DeFi Improvement Corp. (DFDV), a Nasdaq-listed agency previously often known as Janover, has made headlines with its aggressive pivot into the cryptocurrency house, significantly by its substantial funding in Solana SOL.

Deep Give attention to Solana

On Might 12, 2025, DeFi Improvement introduced a $23.6 million buy of 172,670 SOL tokens at a mean price of $136.81, pushing its complete Solana holdings to 595,988 tokens, valued at practically $105 million.

1/ We simply made our BIGGEST $SOL buy but! 🚀

Right this moment, we announce that DeFi Dev Corp. has bought one other 172,670 $SOL ($23.6M) as a part of our crypto-forward treasury technique.

Complete treasury holdings have formally surpassed $100M and stand at

595,988 $SOL. 🤯 pic.twitter.com/qKzHIBHkqE— DeFi Dev Corp. (@defidevcorp) Might 12, 2025

This strategic transfer, the biggest since its crypto-focused shift final month, has solidified DeFi Improvement’s place as a serious institutional participant within the Solana ecosystem.

The Florida-based firm, initially an actual property tech platform, has undergone a dramatic transformation below new management from former Kraken executives, together with CEO Joseph Onorati. This acquisition aligns with a broader pattern amongst public firms adopting cryptocurrencies as treasury property, impressed by Michael Saylor’s Bitcoin technique with MicroStrategy.

Not like many corporations specializing in Bitcoin, DeFi Improvement has chosen Solana, citing its high-speed blockchain, low transaction charges, and strong decentralized finance (DeFi) ecosystem as key drivers. The corporate plans to carry these tokens long-term and stake them with validators, together with its personal, to generate yield, additional embedding itself in Solana’s infrastructure.

Supply: Nasdaq

Bullish Sentiment on Solana’s Future

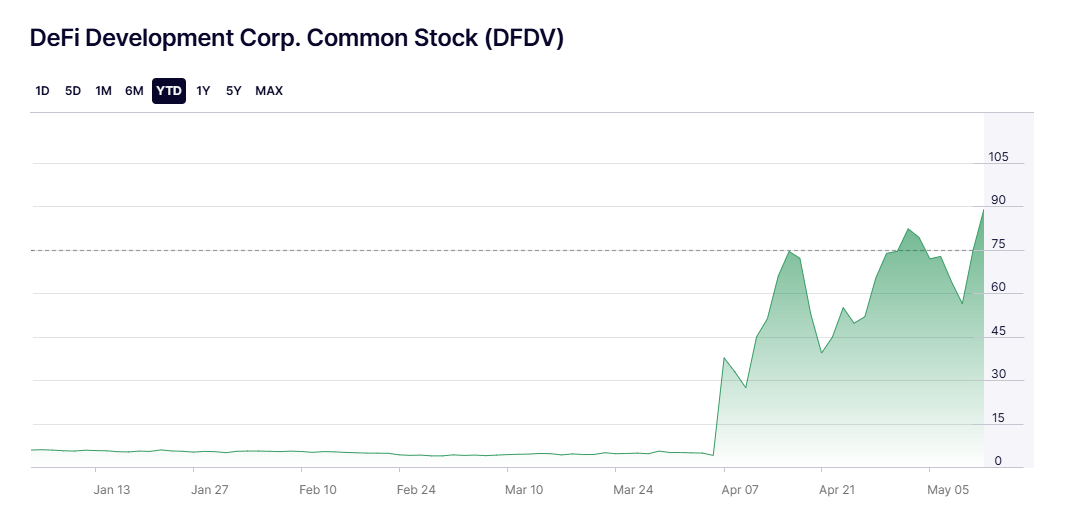

The market responded enthusiastically, with DeFi Improvement’s shares hovering 20% to $90 in early buying and selling on Might 12, following a 30% acquire the earlier Friday amid a broader crypto rally. This surge displays investor confidence within the agency’s Solana-centric treasury technique, which now equates to 0.293 SOL per share, or roughly $50.42. The corporate’s earlier acquisition of a Solana validator with 500,000 SOL staked ($72.5M) and plans to lift $1 billion by a securities providing underscore its ambition to deepen its Solana publicity.

Learn extra: Technique Bolsters Bitcoin Holdings with $1.34 Billion Buy

Solana itself has seen robust efficiency, with SOL climbing over 20% up to now week to $180, pushed by elevated community exercise and institutional curiosity.

Supply: TradingView

DeFi Improvement’s daring guess on Solana highlights the rising convergence of conventional finance and blockchain. Because the agency continues to scale its crypto treasury, it gives buyers a singular avenue to realize publicity to Solana’s progress, doubtlessly reshaping perceptions of company crypto adoption.