2023 has been a extremely unstable yr for Bitcoin and your entire crypto market. Beginning the yr on a bullish rally like a tracer bullet to being on a collision course, pulling again for your entire Summer time, and at last recovering and forming a brand new 52W excessive in 2023.

Catalyzing the numerous price actions within the crypto markets, the current developments on the earth market have led to a domino impact in Bitcoin. Happily, it ends on a bullish be aware in 2023.

The volatility within the International markets because of ongoing conflicts around the globe, the failing banking techniques, the U.S. economic system on excessive alert driving sharp modifications in rates of interest, and the rising curiosity of huge shot Funding Establishments into Bitcoin and hoping for a Bitcoin Spot ETF have been the driving power behind this yr’s price motion.

Now that we all know the driving elements for this yr’s Crypto market let’s take a look at it intimately to know the upcoming price motion. Cracking the code with earlier price actions, let’s discover out if Bitcoin can hit the $100,000 mark in 2024. And what it’s best to anticipate within the crypto market within the coming months.

Bitcoin’s Journey in 2023

On the finish of 2023, the crypto market has proven indicators of stabilization and progress. Bitcoin, specifically, has skilled important price actions all year long.

Beginning the yr at round $16,000 lowest price level since November 2020, Bitcoin’s price surged to almost $24,000 in January, dropped to round $20,000 in mid-year, and skilled fluctuations in response to varied market stimuli, together with regulatory information and world financial developments.

Nevertheless, the rising anticipations of Bitcoin spot ETF approval and the hopes of a bull run in 2024 as a result of Bitcoin Halving occasion hold the consumers keen and able to pay the additional premium. Fueled by some additional bullish sentiments just like the upcoming Bitcoin halving 2024 occasion, the potential fee cuts in 2024, and extra, the bull run is gaining momentum.

By the tip of the yr, Bitcoin’s price motion mirrored a extra mature and resilient market, with the Uptober rally prolonging the uptrend to succeed in cross $40,000, to type the 52W excessive at $44,729, a major restoration inside a yr.

However earlier than coming to the current bull run in Bitcoin, allow us to take a look at your entire yr.

A Bullish Stint for Cryptocurrencies

Commencing 2023 on a bullish be aware, Bitcoin, the main cryptocurrency, noticed a outstanding rise within the first quarter. Beginning the yr at $16,508, the BTC price pattern saved an general optimistic month-to-month progress, resulting in 4-consecutive bullish candles within the month-to-month chart. The bullish progress over the 4-month section accounts for a rise of 78%.

Ethereum, the second-largest cryptocurrency by market capitalization, additionally witnessed substantial progress. Making six consecutive bullish candles, the ETH price jumped from $1,195 to $1,945, a 62% enhance within the first half of 2023.

This optimistic pattern was primarily attributed to easing macroeconomic pressures and shifting investor sentiment. Analysts pointed to the Federal Reserve’s potential slowdown in fee hikes as a key driver of this optimism, fostering a bullish sentiment amongst traders and contributing to the market’s upward trajectory.

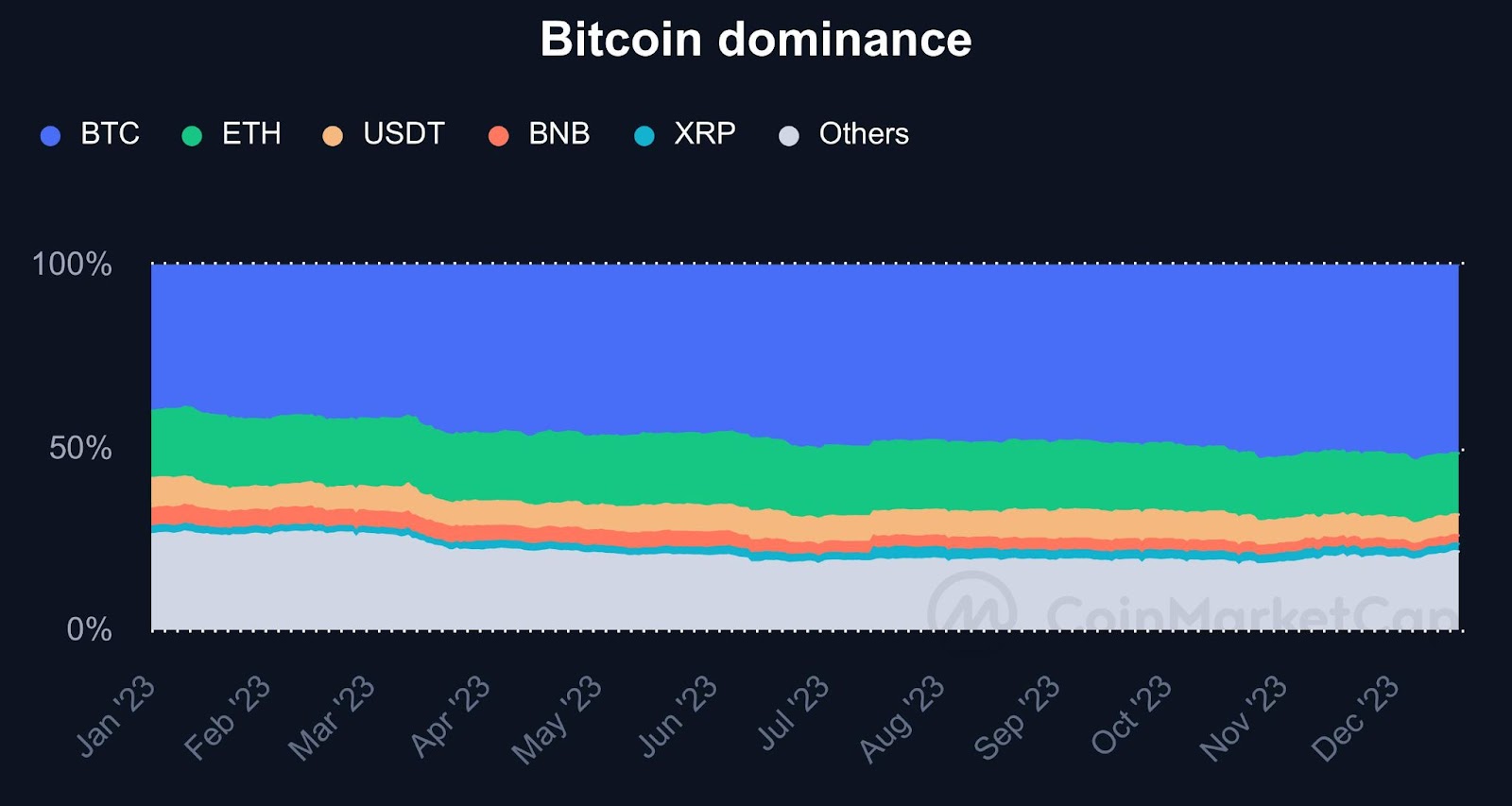

Moreover, Bitcoin’s dominance within the crypto market strengthened. From a commanding 40% share on the yr’s daybreak, Bitcoin surged previous the 50% mark, ending the yr with a 51.68% share. Ethereum’s slice contracted to 16.77%, whereas USDT noticed a discount to five.71%.

Additionally Learn: Crypto & Blockchain Funding 2023: In-Depth Report on Investments in Web3

Market Sentiments and Metrics

On the emotional barometer of the market—the Crypto Concern and Greed Index—we’ve ridden a wave from a impartial 59% to the depths of worry at 31.83% in September. However now, we’re browsing within the greed zone at a bullish 69.79%, an indication that optimism is again with a vengeance.

Within the derivatives enviornment, open curiosity has been a rollercoaster. The futures market has soared from $1.28 billion to $2.30 billion, whereas perpetuals have seen a steep climb from $109 billion to $139 billion regardless of extreme ups and downs.

BRC-20 Tokens: A New Period for Bitcoin

In 2023, the BRC-20 token normal, constructed on the Bitcoin blockchain leveraging the Ordinals protocol, marked a pivotal shift in using Bitcoin. This new class of fungible tokens allowed for functionalities akin to the ERC-20 normal on Ethereum however with the safety and widespread adoption of Bitcoin.

The rise of BRC-20 tokens on the Bitcoin blockchain has sparked numerous social sentiments paying homage to final yr’s DeFi token frenzy. Buyers are exhibiting speculative curiosity, eyeing BRC-20 tokens for potential positive aspects, but cautious of their volatility and unproven long-term worth. Therefore, the excessive enthusiasm amongst traders is drawn to the potential purposes of those tokens.

The crypto neighborhood stays divided: some view BRC-20 as a useful innovation for Bitcoin, enhancing its utility past mere transactions. In the meantime, others see it as a deviation from Bitcoin’s unique intent, doubtlessly resulting in elevated transaction charges and community congestion.

Key Highlights of BRC-20 in 2023:

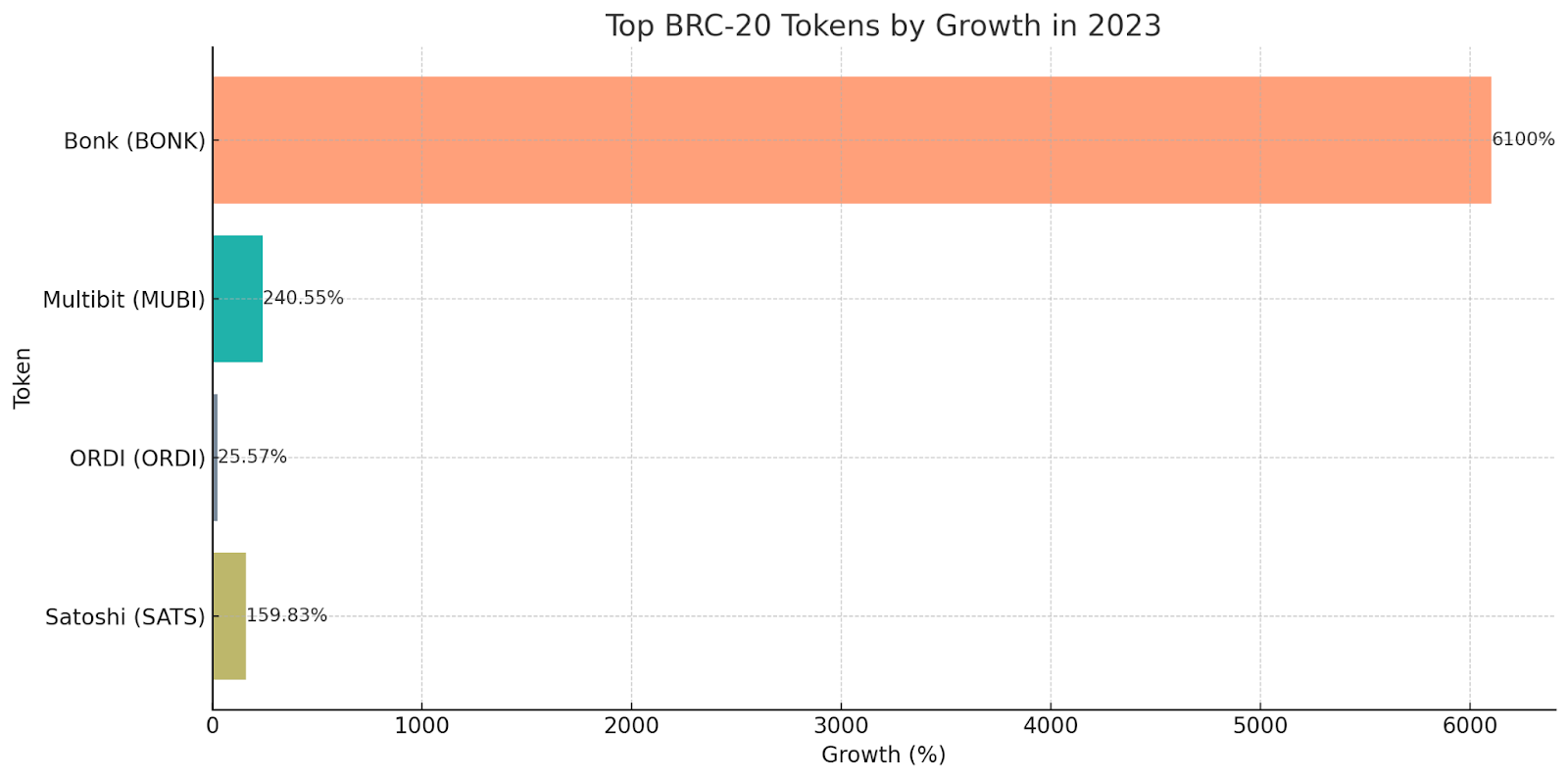

- Excessive Returns: BRC-20 tokens skilled substantial progress, with some tokens like Bonk (BONK) seeing a meteoric rise of over 6,100% inside a yr. This surge mirrored the market’s urge for food for revolutionary makes use of of the Bitcoin blockchain.

- Modern Protocol Use: The usage of the Ordinals protocol by BRC-20 showcased a novel utility of Bitcoin’s infrastructure, going past NFTs and tapping into the demand for fungible property on this major blockchain.

- Future Points: BRC-20’s potential extends into DeFi, governance, and crowdfunding on the Bitcoin blockchain. The concentrate on leveraging Bitcoin’s strong safety and person base may redefine the blockchain’s function within the broader cryptocurrency ecosystem.

High Blockchain Efficiency in 2023

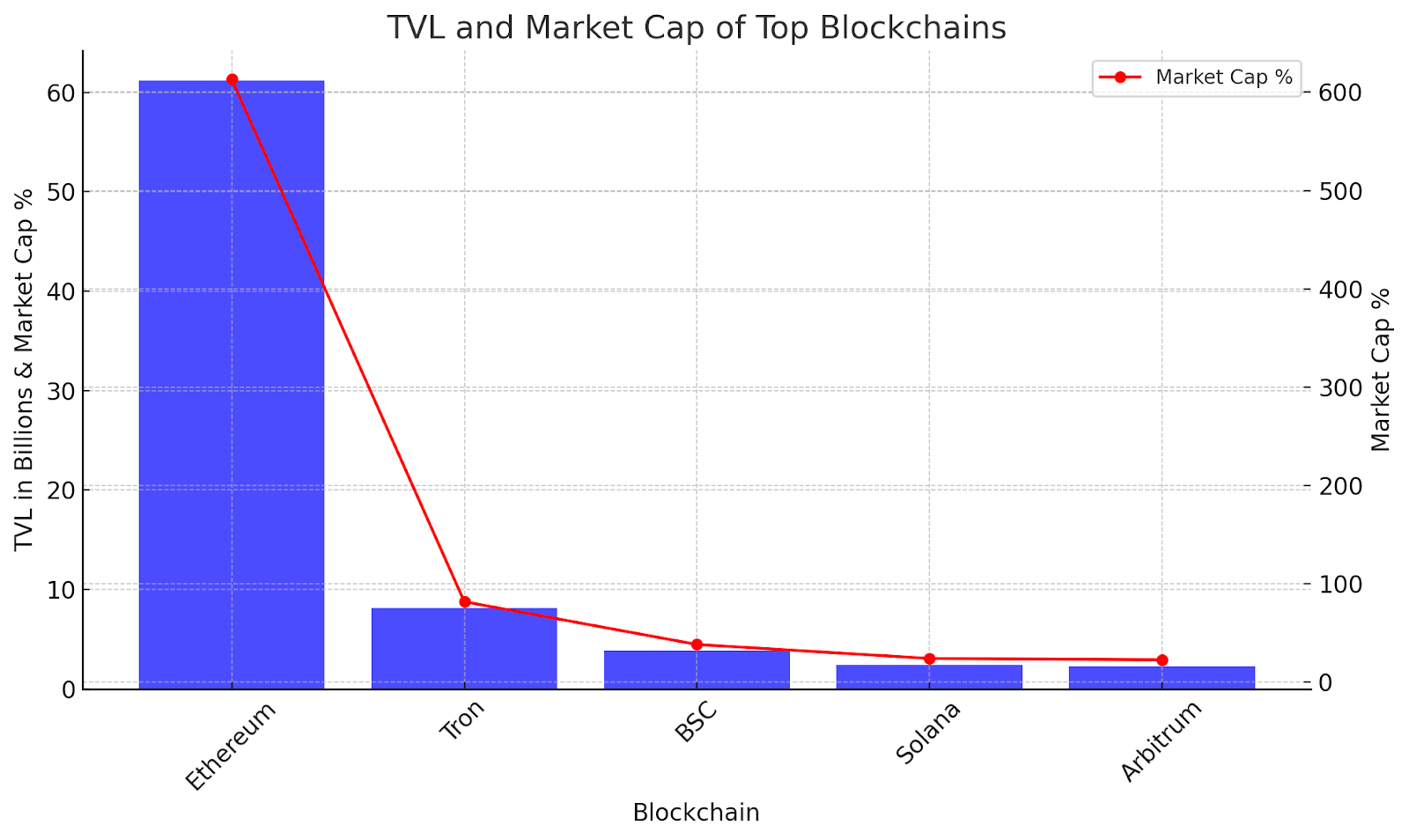

2023 has been a wild journey within the blockchain universe! The full worth locked (TVL) out there skyrocketed from $56.99 Billion on the yr’s begin to a powerful $93.2 Billion. That’s an enormous soar! What does this imply? It signifies rising belief and funding in blockchain applied sciences—an indication that the crypto world is increasing its affect!

Additionally Learn: Blockchain Trade Report 2023 : Development, Developments, and Projections

Comparability of Ecosystems

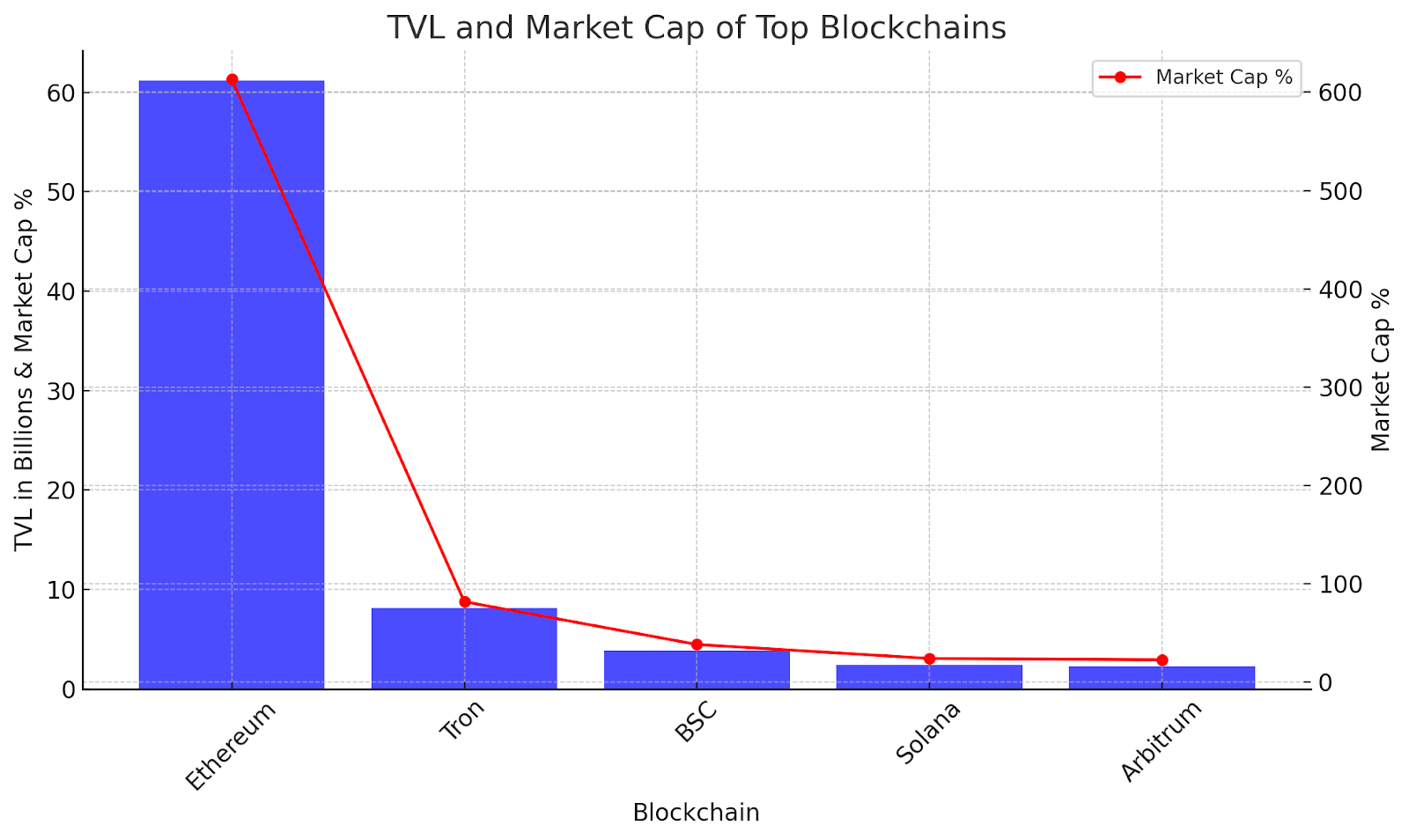

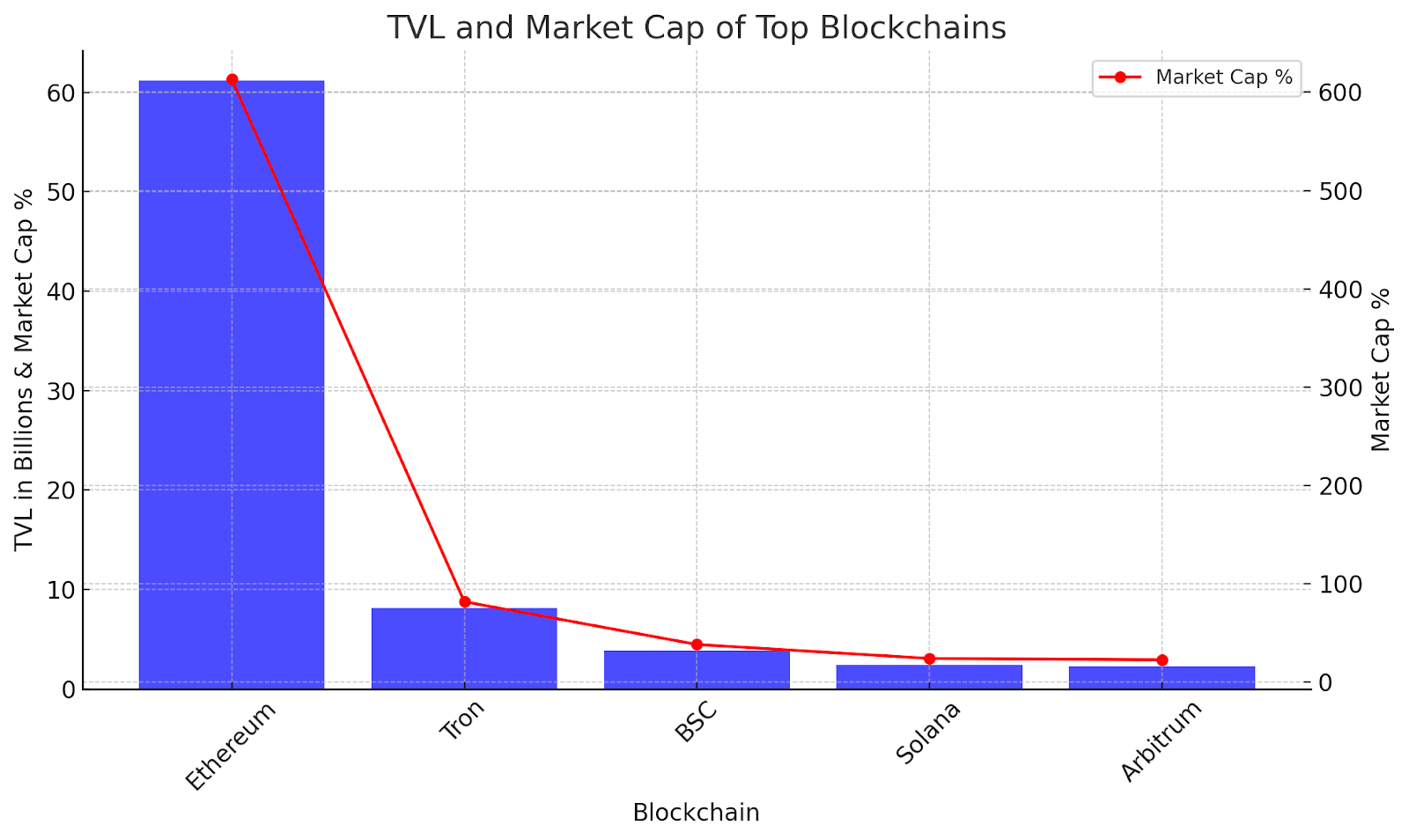

Ecosystem Leaders: A Breakdown

- Ethereum: Holding a dominant 69.75% share, Ethereum boasts a TVL of $61.18 billion and a market cap that represents 613.03% of the full.

- Tron: With 8.75% dominance, Tron captures a TVL of $8.17 billion and 81.86% of the market cap.

- BSC (Binance Good Chain): Sustaining its stance, BSC data 4.14% dominance, a TVL of $3.83 billion, and contributes 38.38% to the full market cap.

- Solana & Arbitrum: Each platforms maintain important shares with Solana at 2.70% dominance and Arbitrum carefully behind at 2.96%, reflecting their rising affect within the blockchain realm.

DeFi Market

Liquid Staking Tops The Sectoral Development

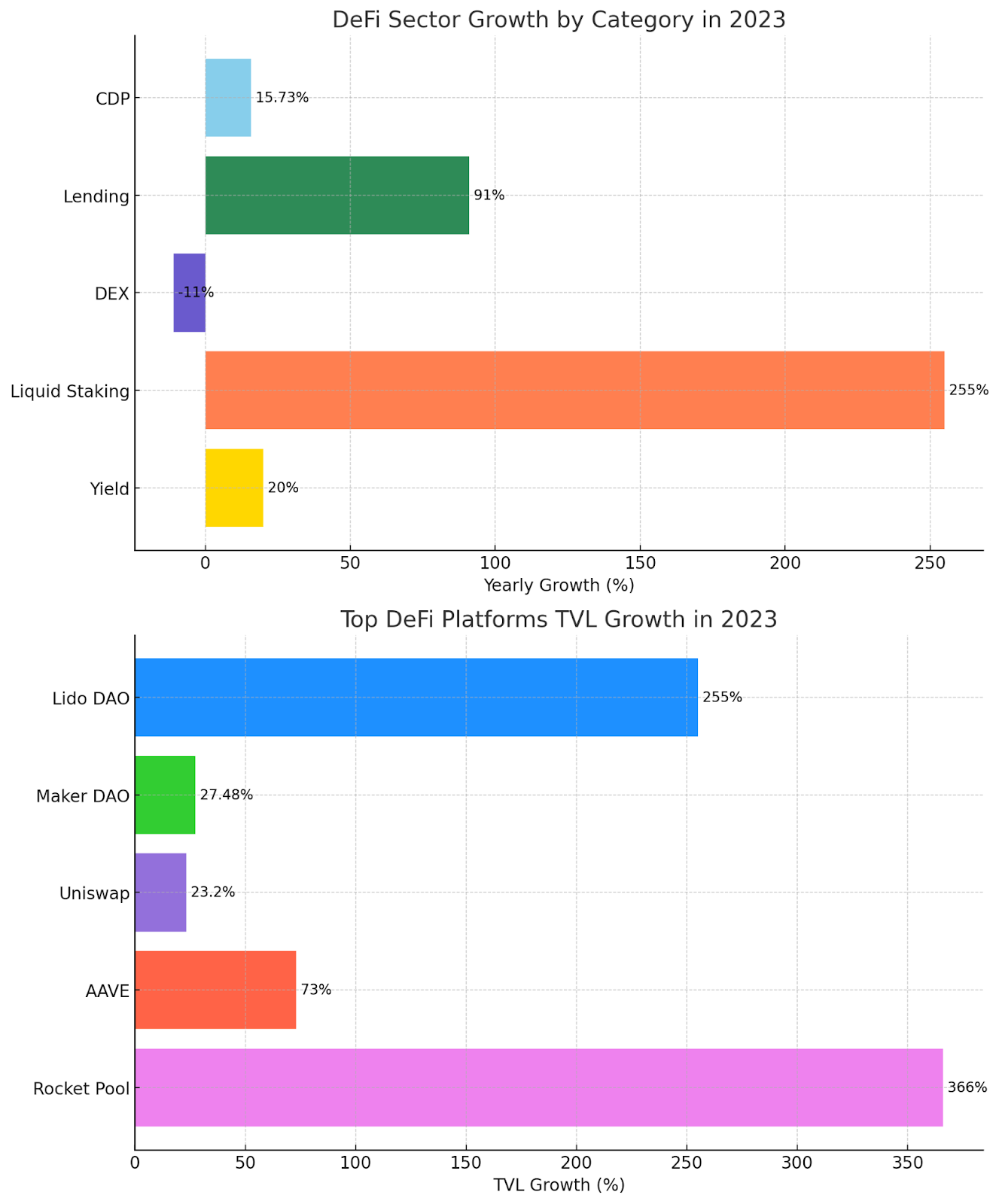

The DeFi sector 2023 has showcased important progress, with a 32% year-over-year enhance, pushing the market cap past $50 billion. DeFi’s numerous ecosystem noticed assorted performances throughout its sub-sectors:

- Collateralized Debt Positions (CDPs) elevated by 15.73%, indicating a gentle belief in blockchain-based collateral administration.

- Lending, an important DeFi operate, jumped by 91%, reflecting a surge in decentralized borrowing and lending actions.

- Nevertheless, decentralized Exchanges (DEXs) skilled an 11% decline, suggesting a shift within the liquidity provision panorama.

- Liquid Staking dominated, capturing 28% of the full worth locked (TVL) with a putting 255% progress, spearheaded by Lido DAO.

- Yield farming additionally noticed a secure rise of 20%, with Convex Finance contributing considerably to this sector’s worth.

High DeFi platforms like Rocket Pool and Lido DAO stood out with TVL growths of 366% and 255%, respectively. Regardless of some fluctuations, the general momentum of DeFi is optimistic, with platforms like AAVE and Maker DAO exhibiting stable progress and resilience in 2023.

Efficiency Of High DeFi Tokens by Market Cap

- Avalanche (AVAX): 274.28% return

- Chainlink (LINK/USD): 12.63% return

- Injective Protocol (INJ/USD): 453.36% return

- Web Laptop (ICP/USD): 16.77% return

- Uniswap (UNI/USD): -4.68% return

The Injective Protocol token (INJ/USD) has the very best return among the many group, exceeding 450%, which may point out a major improvement within the venture or a considerable enhance in adoption and demand. Avalanche (AVAX) additionally exhibits robust efficiency, with greater than a 270% return, suggesting strong progress and key ecosystem developments. In distinction, Uniswap (UNI/USD) skilled a slight decline in 2023.

Within the fascinating realm of the metaverse, 2023 has been a yr of dynamic progress and growth. The full market capitalization is a outstanding $12.29 billion, with an energetic 24-hour buying and selling quantity of $1.25 billion. The trailblazing tokens are on the forefront of this vibrant sector: SAND from Sandbox, MANA from Decentraland, and AXS from Axie Infinity.

SAND has made a stable mark with a year-to-date progress of 21.44%, showcasing its rising affect within the metaverse panorama. MANA, to not be outdone, has soared even increased, registering a powerful 51.49% progress, reflecting its strong place out there. In the meantime, AXS from Axie Infinity has charted a extra modest course, with a progress of three.19%.

These tokens are extra than simply digital property; they characterize the burgeoning potential of the metaverse – a digital universe the place creativity, economic system, and know-how converge. The expansion figures of those tokens are a transparent indicator of the sector’s momentum and the rising curiosity of traders and customers alike.

Additionally Learn: Centralized Exchanges Report 2023: Insights and Detailed Evaluation of Crypto Trade

Stablecoins: Consolidation and Evolution

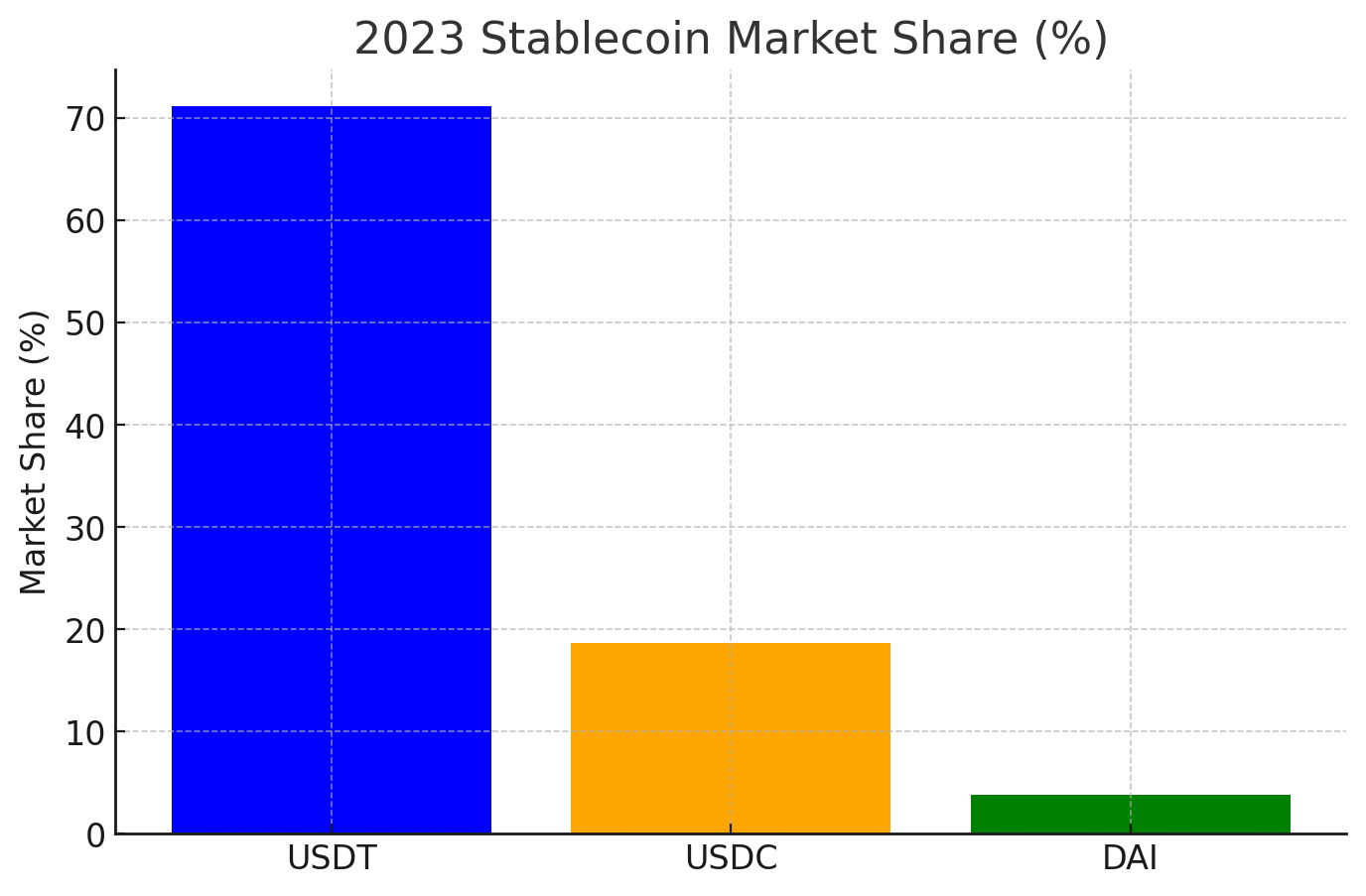

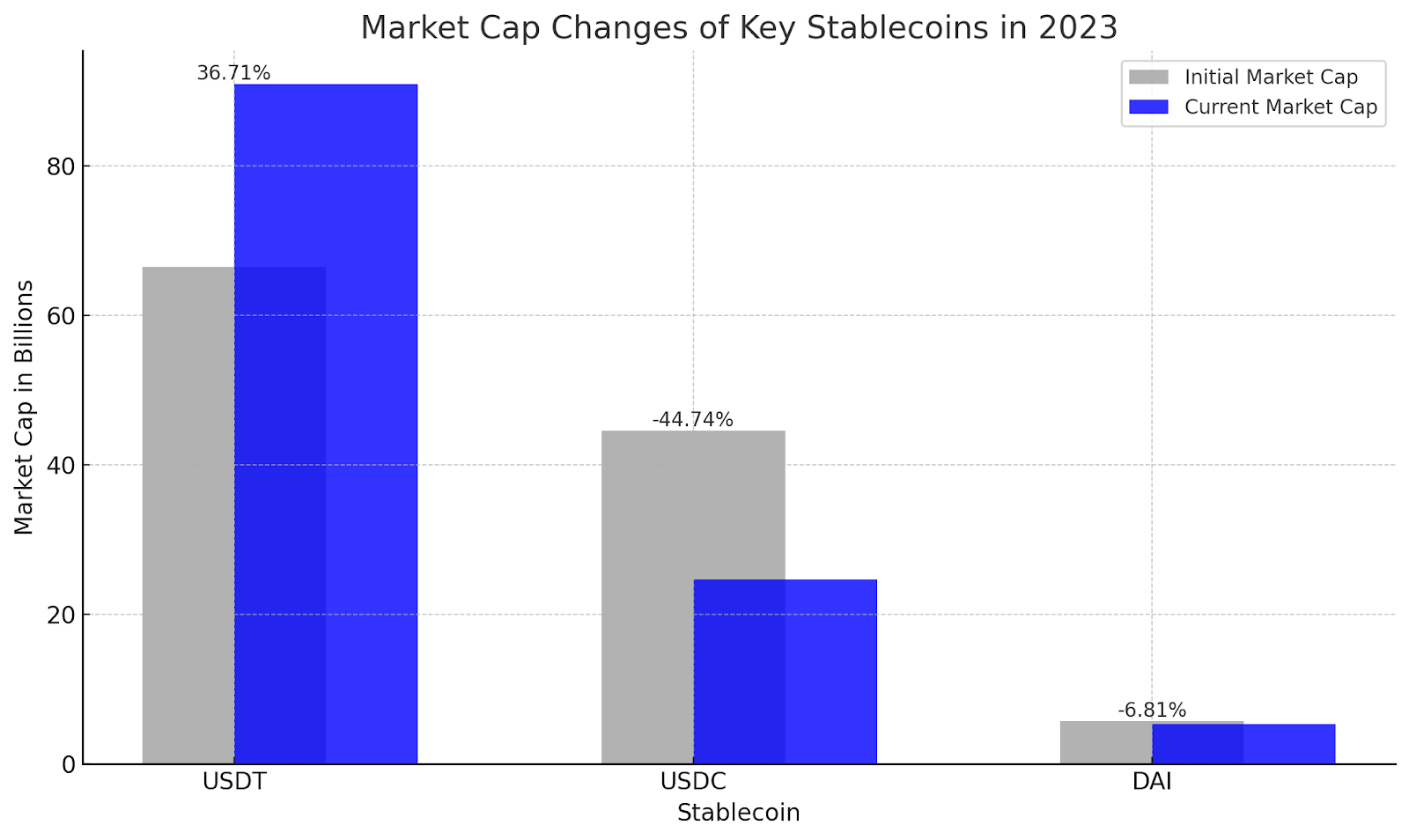

USDT regained and expanded its dominance, commanding 71.17% of the market with a market cap of $97.5 billion. USDC held 18.69%, and DAI captured 3.86%. This exhibits a extra substantial market consolidation round these high gamers, notably USDT.

Let’s take a better take a look at the market cap of those stablecoins.

- USDT (Tether): Beginning the yr at $66.47 billion, USDT noticed a rise to $90.87 billion, marking a major progress of 36.71%. This upsurge underscores its increasing affect within the stablecoin market.

- USDC: In distinction, USDC skilled a lower, falling from $44.55 billion in the beginning of the yr to $24.62 billion. This represents a substantial decline of 44.74%, reflecting a major shift in its market place.

- DAI: DAI confirmed comparatively minor modifications, beginning at $5.73 billion and barely reducing to $5.34 billion, amounting to a 6.81% lower.

NFT

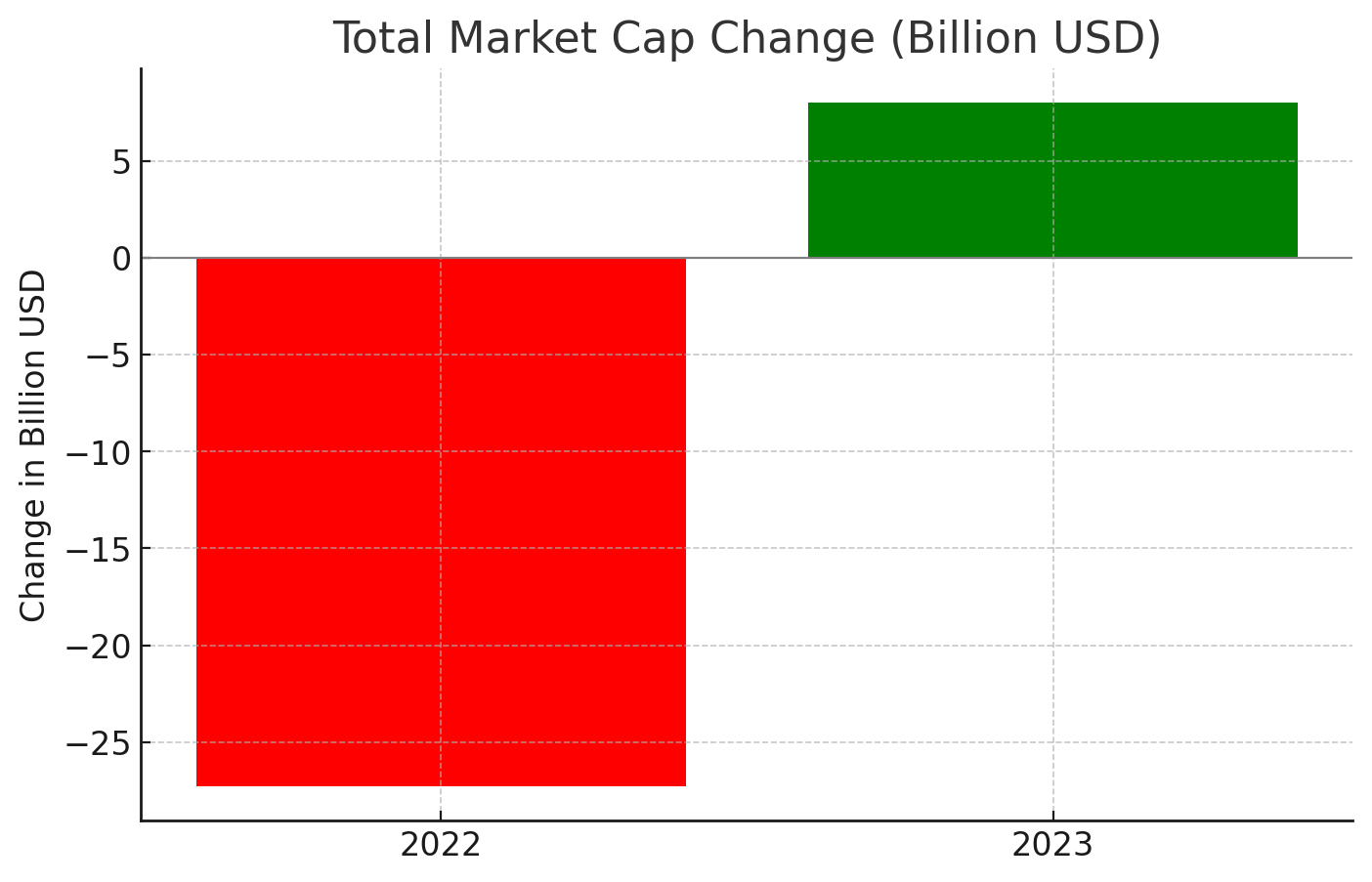

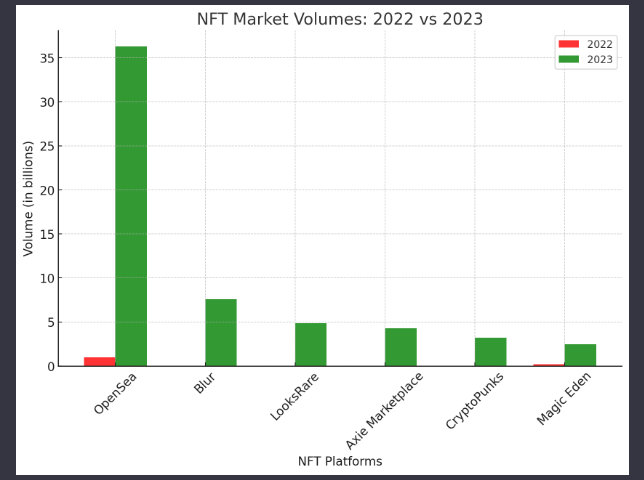

A Unstable 12 months For NFTs Marks A Bittersweet Finish

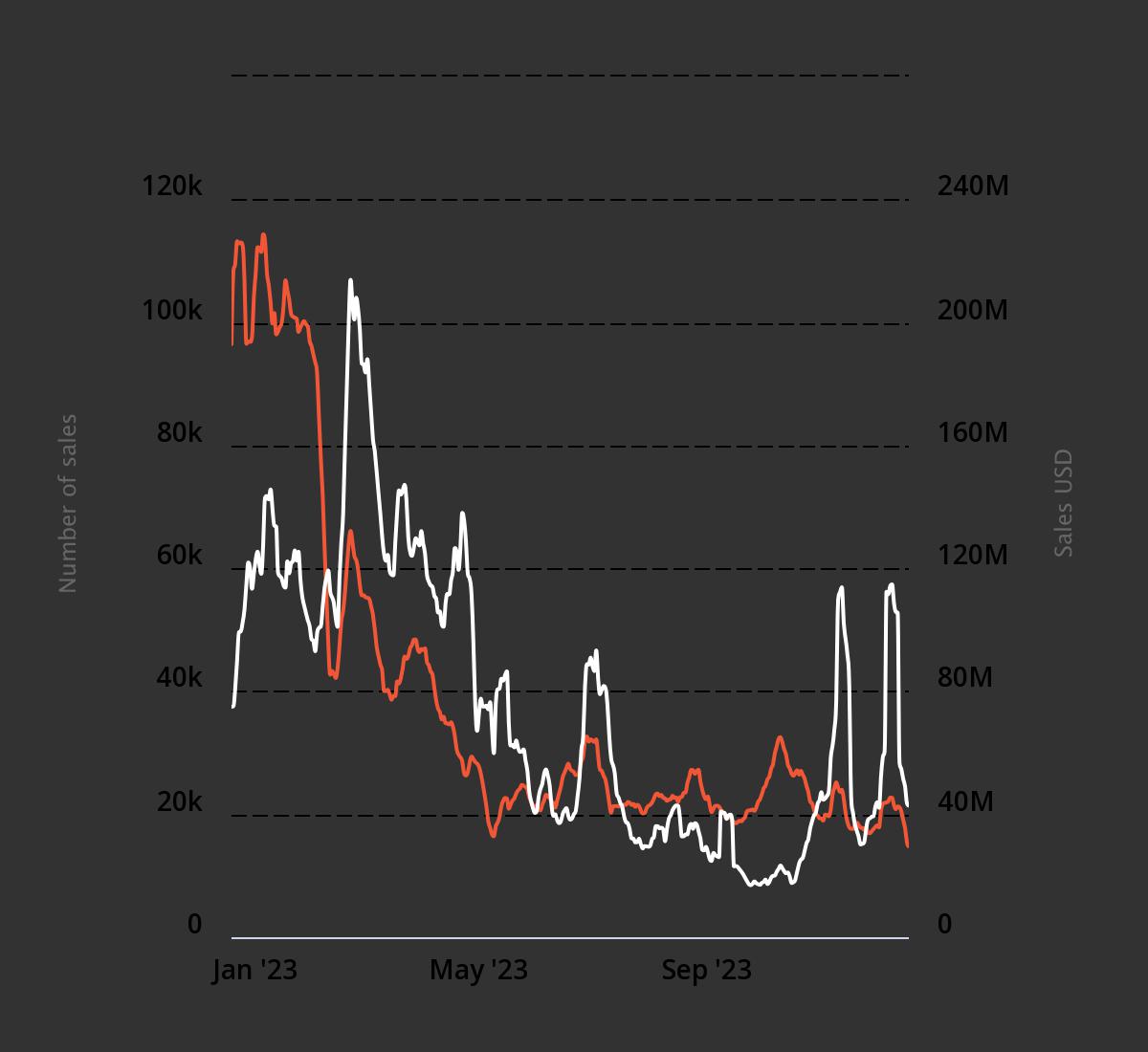

The NFT market in 2023, valued at a staggering $22 billion, has skilled important fluctuations. Initially, the trade noticed a 220-fold progress since 2021, regardless of a 90% gross sales drop from its September 2021 peak, showcasing resilience. Month-to-month gross sales common $1.8 billion, with half of those transactions beneath $200, indicating a market of broad attain and accessibility.

Mid-year, the market declined, with gross sales dipping to beneath 4,000 and volumes round $1.5 million. Nevertheless, there was a notable resurgence on December sixth, with gross sales hitting 2,364 and volumes reaching $56 million.

This peak was transient, as gross sales dipped to round 2,000 once more, with volumes falling to roughly $4.42 million. Regardless of these ups and downs, the NFT market is predicted to rebound, with predictions of reaching $80 billion by 2025. This optimism is underscored by record-breaking gross sales, reminiscent of a set promoting for $91.8 million.

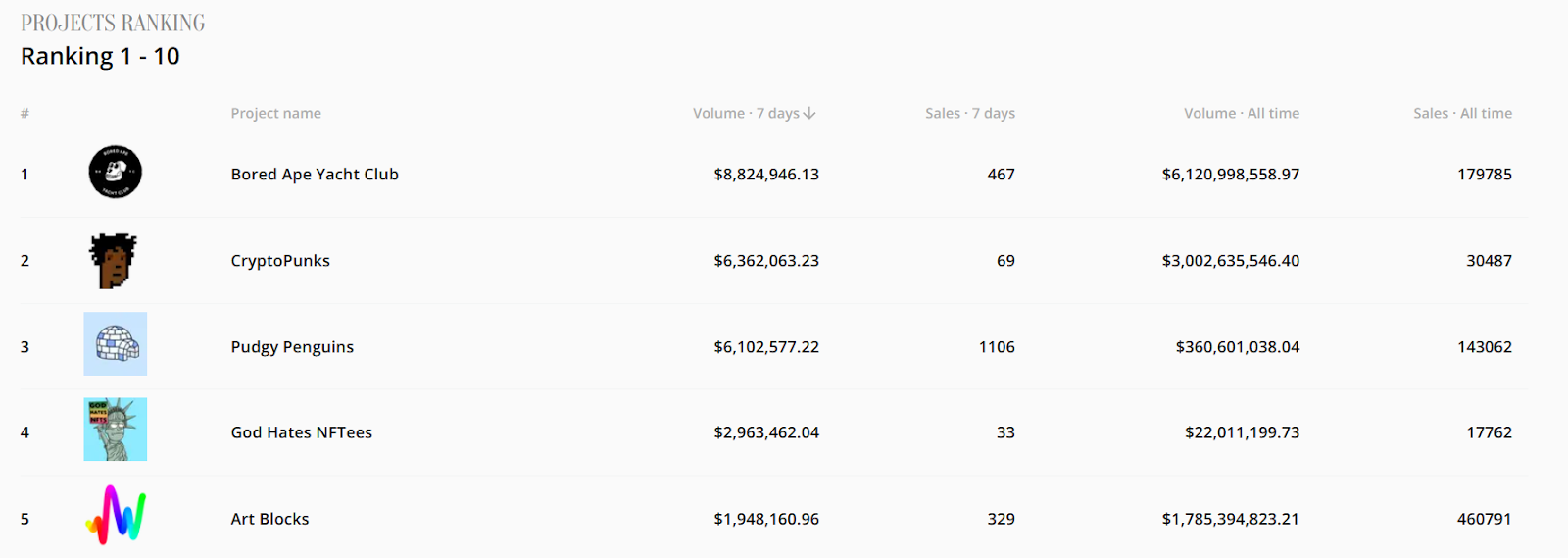

Within the dynamic NFT market of 2023, Bored Ape Yacht Membership tops the leaderboard with $8.8 million in quantity, carefully adopted by CryptoPunks at $6.36 million and Pudgy Penguins at $6.10 million. God Hates NFTees and ART Blocks full the highest 5, every reflecting their distinct positions out there by means of their respective volumes and gross sales.

Additionally Learn: Decentralized Trade (DEX) Market Report 2023 : Analysing Market Shifts & Future Potentials

Crypto Market Dynamics: ROI Tokens and Market Capitalizations

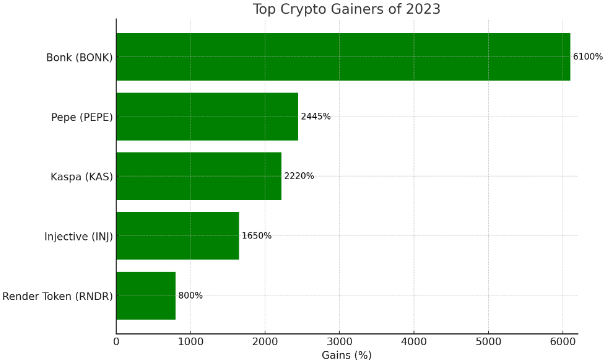

The yr 2023 has been dynamic for cryptocurrencies, with important actions at each ends of the spectrum. The highest gainer’s chart showcases a powerful lineup led by Bonk (BONK) with a staggering 6100% enhance, highlighting its dominance because the yr’s high performer.

Pepe (PEPE) and Kaspa (KAS) adopted go well with with substantial positive aspects of 2445% and 2220%, respectively. Injective (INJ) and Render Token (RNDR) rounded out the highest 5 with spectacular positive aspects of 1650% and 800%.

Crypto vs Different Belongings

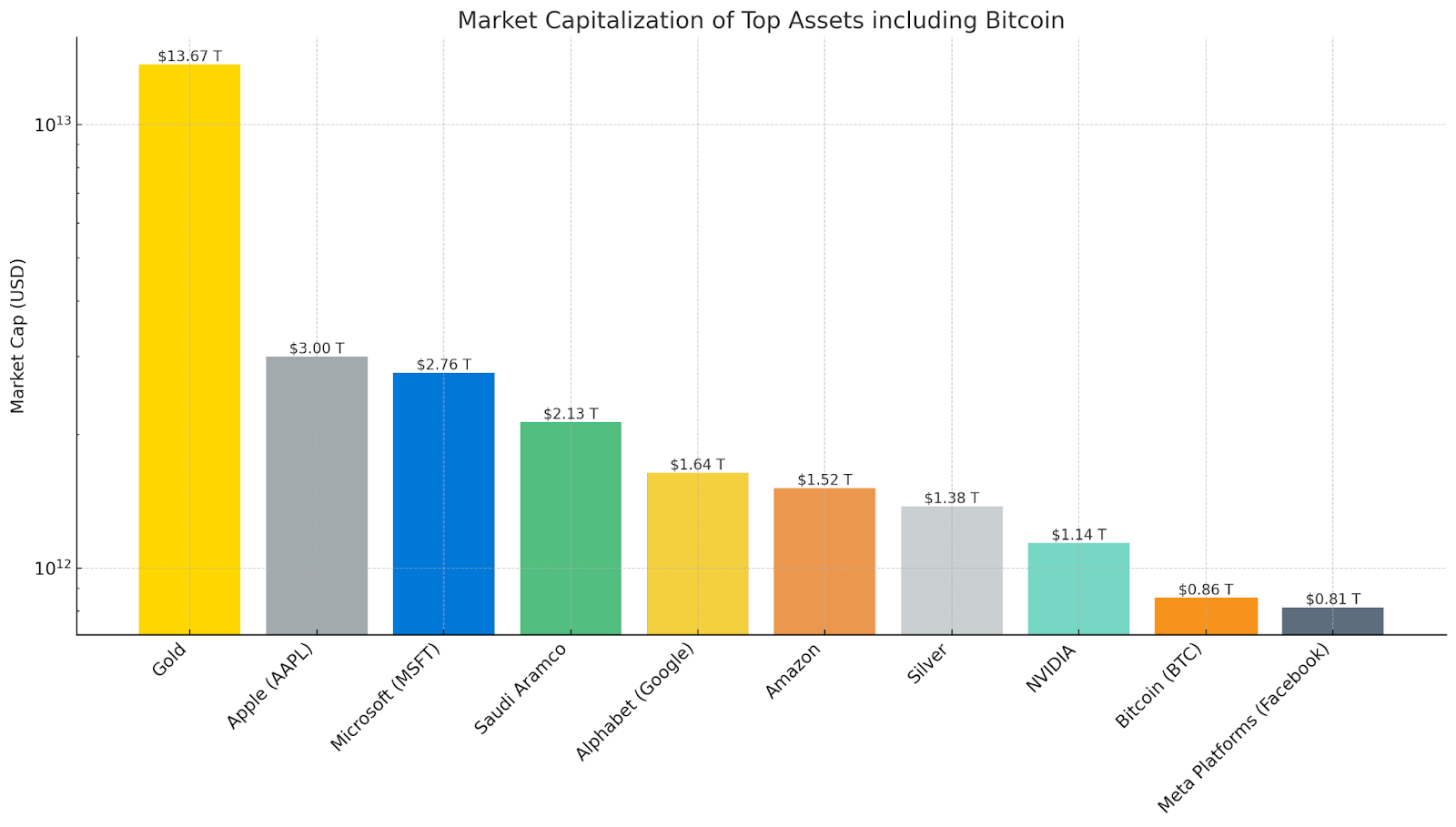

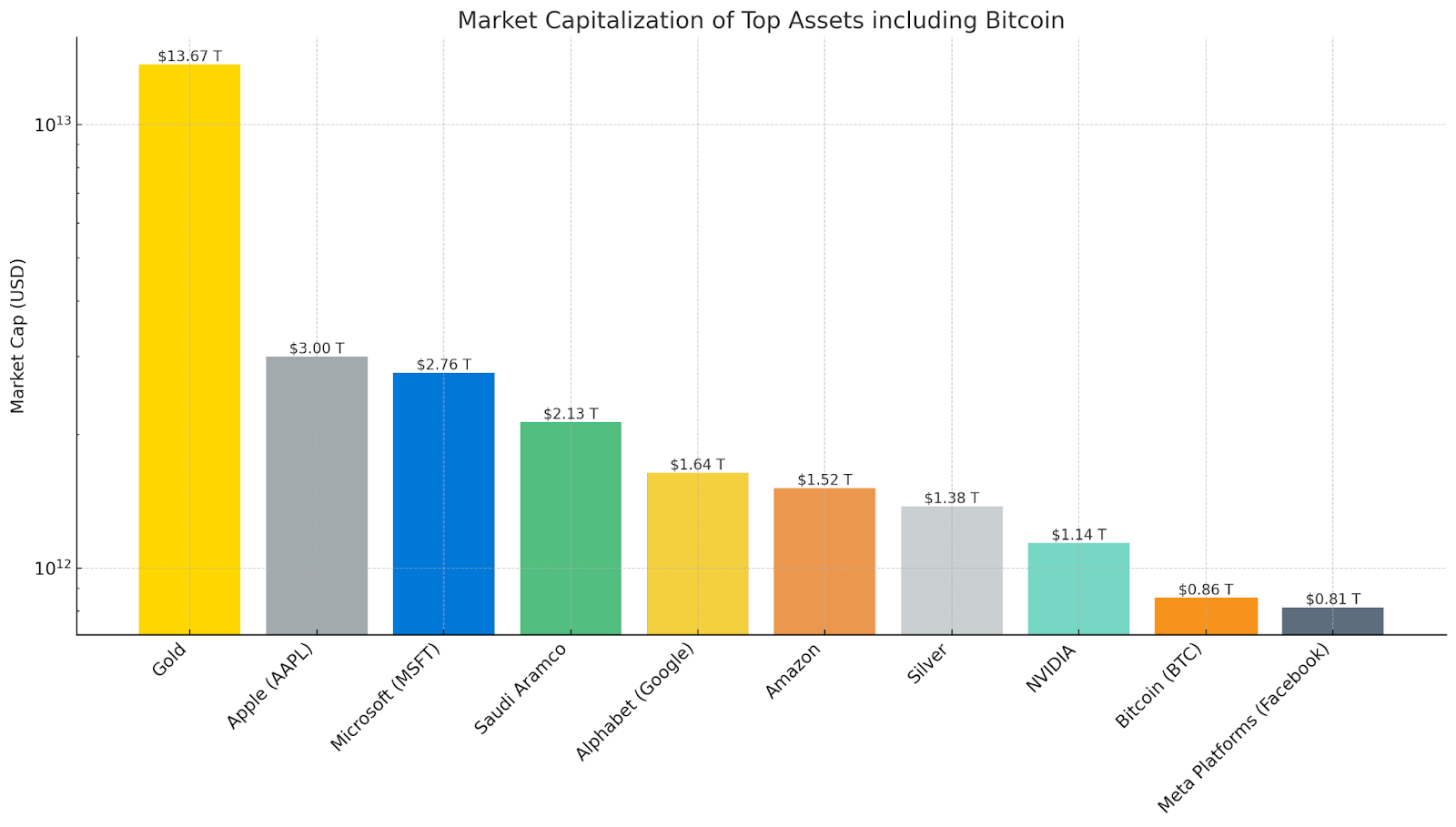

The bar chart above illustrates the market capitalizations of assorted high property, highlighting Bitcoin’s (BTC) important standing. With a market cap of roughly $855.97 billion, BTC overtakes giants like Meta Platforms (previously Fb) and positions itself prominently among the many world’s most respected property.

The chart underscores Bitcoin’s spectacular market progress and potential as a digital retailer of worth, usually in comparison with gold, which retains the highest spot with a market cap of $13.67 trillion.

The crypto market’s efficiency in 2023 outshined conventional property, with the full market cap experiencing an distinctive enhance of 104.42%. In stark distinction, the S&P 500 noticed a modest rise of 13.82%, whereas treasured metals like gold remained secure, and silver declined by 9.83%. Regardless of its volatility, this disparity illustrates the crypto market’s excessive progress potential and positions it as a major participant amongst world asset lessons.

Bitcoin Spot ETF Purposes: A Glimmer of Regulatory Hope

The U.S. Securities and Trade Fee (SEC) has pushed the timeline for its choice on a number of high-profile Bitcoin spot ETF purposes into 2024. Notable candidates like BlackRock, WisdomTree, and Valkyrie Digital Belongings at the moment are set to await the SEC’s rulings till mid-January 2024.

The continuing purposes for Bitcoin Spot ETFs have been a major space of curiosity in 2023. These ETFs, if accredited, may considerably increase the market by providing traders a regulated technique to acquire publicity to Bitcoin.

The SEC’s deferral of Bitcoin Spot ETF choices to 2024 has saved the crypto neighborhood on edge. Amid this ready interval, the historic impression of Gold ETFs on gold costs within the early 2000s gives a glimpse into Bitcoin’s future.

Introducing Gold ETFs led to a 350% surge in gold’s market price, underscoring the profound affect ETFs can have. An identical upswing could possibly be in retailer for Bitcoin with the approval of its ETFs, doubtlessly unlocking a brand new wave of mainstream funding.

Additionally Learn: Non-Fungible Tokens (NFT) Market Report 2023 : Insights, Market Dynamics and Future Developments

Bitcoin at $100K in 2024?!

As we draw the curtains on the exhilarating journey of the crypto market in 2023, we stand on the cusp of a brand new potential breakout rally. The market has weathered its fair proportion of storms, from banking collapses to regulatory headwinds, but it has demonstrated outstanding resilience and an upward trajectory.

There’s a palpable sense of bullish anticipation amongst traders, merchants, and market lovers. A number of elements fan these bullish flames:

- Bitcoin Spot ETF Hopes: The approval of a Bitcoin Spot ETF could possibly be the domino that units off a cascading impact of bullish momentum, replicating the historic impression of Gold ETFs.

- Potential Charge Cuts: The anticipation of fee cuts in 2024 may shift the monetary panorama, doubtlessly rising the attractiveness of non-traditional property like Bitcoin.

- Bitcoin Halving 2024: The upcoming halving occasion has traditionally been a precursor to important price will increase, and the following one may set the stage for an additional main rally.

- Santa Rally: The top-of-year surge in market exercise, sometimes called the Santa Rally, may lengthen its goodwill into the crypto house, stirring a surge in Bitcoin’s worth.

- New 12 months Rally Anticipation: The brand new yr usually comes with renewed optimism and funding fervor, which may additional cement the inspiration for Bitcoin’s ascent.

Subsequently, the winds of change recommend that Bitcoin may not simply take a look at new highs however may soar to the coveted $100,000 mark in 2024.