Commonplace Chartered reviews rising sovereign Bitcoin publicity by MicroStrategy holdings, backing a $500,000 price goal by 2029, amid rising institutional curiosity as of Might 2025.

SEC DATA BACKS BITCOIN $500K TARGET BY 2028: STANDARD CHARTERED

Commonplace Chartered’s Geoff Kendrick says current SEC 13F filings help a potential rise in Bitcoin to $500,000 by end-2028. Whereas direct ETF holdings dipped in Q1, authorities entities boosted stakes in Technique…

— *Walter Bloomberg (@DeItaone) Might 20, 2025

Commonplace Chartered: Sovereign Wealth Funds Enhance Bitcoin Publicity through MicroStrategy

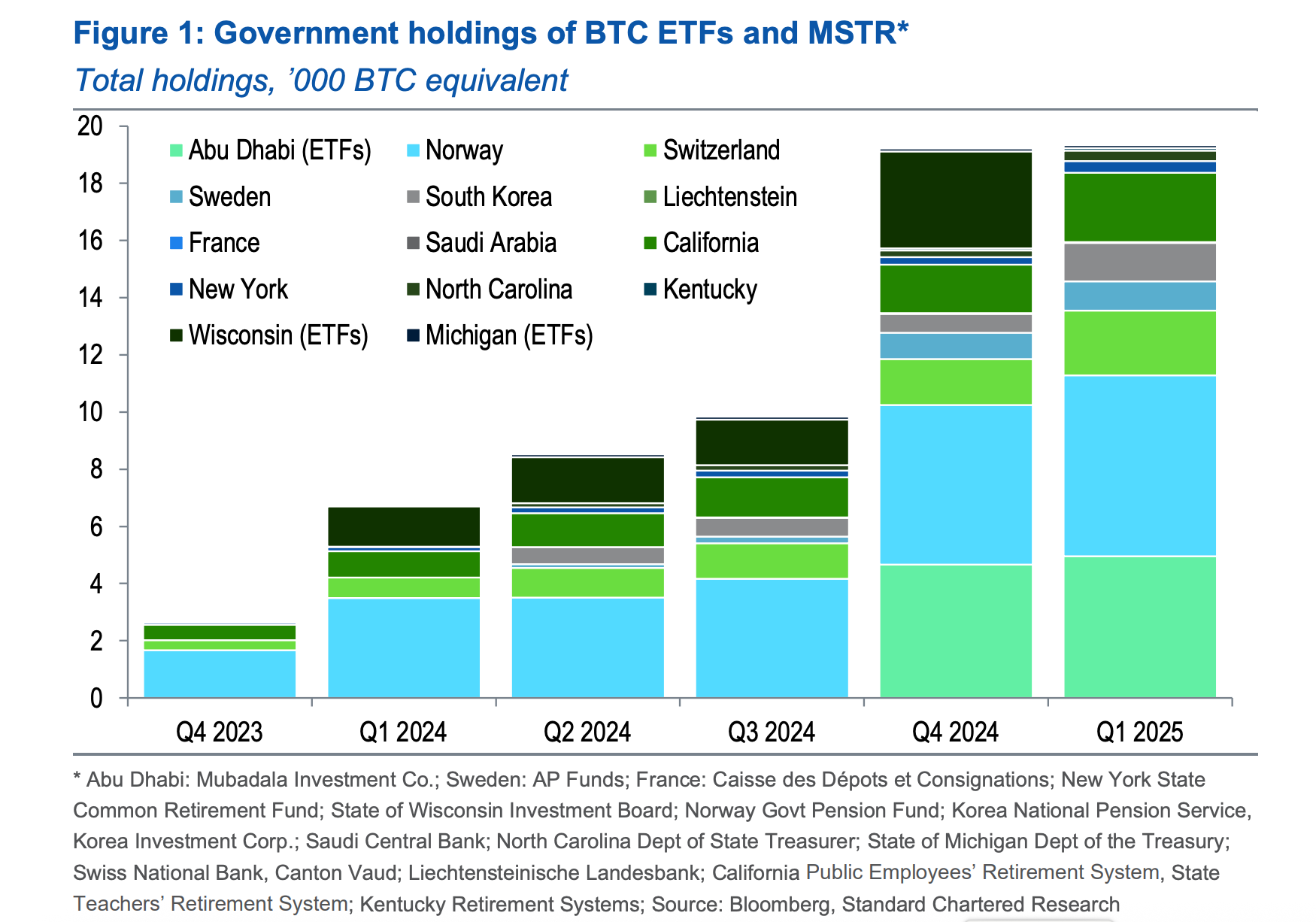

Commonplace Chartered’s report, primarily based on Q1 2025 SEC 13F filings, reveals that sovereign wealth funds and authorities entities have considerably elevated their holdings in MicroStrategy, an organization recognized for its substantial Bitcoin investments.

Supply: Commonplace Chartered

Norway’s Authorities Pension Fund, the Swiss Nationwide Financial institution, and South Korea’s pension our bodies every added the equal of 700 BTC by MSTR shares, whereas U.S. state retirement funds in California, New York, North Carolina, and Kentucky collectively added 1,000 BTC equal. First-time patrons like Saudi Arabia and France additionally entered the area with smaller positions, signaling increasing international curiosity.

MicroStrategy itself holds 576,230 BTC valued at roughly $61,4 billion at Bitcoin’s present price.

Supply: Saylor Tracker

This oblique publicity aligns with a broader pattern of institutional adoption. Commonplace Chartered’s head of digital property, Geoffrey Kendrick, emphasised that this pattern helps the financial institution’s $500,000 Bitcoin BTC price goal by 2029, coinciding with the top of President Donald Trump’s time period.

Nevertheless, the report additionally famous a decline in direct Bitcoin ETF possession, with Wisconsin offloading its 3,400 BTC-equivalent place in BlackRock’s IBIT ETF, indicating a strategic shift towards oblique publicity through MSTR.

Institutional Momentum Accelerates Bitcoin’s International Ascent

The rising sovereign curiosity in Bitcoin through MicroStrategy underscores its growing acceptance as a retailer of worth amongst conventional monetary entities. MicroStrategy’s technique of utilizing debt to amass Bitcoin—including $42.6 billion to company treasuries since 2021, per River’s Might 2025 report—has made it a proxy for Bitcoin publicity, particularly for entities cautious about direct crypto investments. This pattern might drive Bitcoin’s price greater, as elevated demand from sovereign funds could scale back accessible provide.

Learn extra: JPMorgan Shifts Stance, Alerts Institutional Embrace of Bitcoin

Nevertheless, challenges stay. The focus of Bitcoin publicity in MicroStrategy raises considerations about centralization dangers when MSTR’s holdings expose main funds like BlackRock to Bitcoin volatility.

Regardless of this, the institutional momentum, coupled with Bitcoin’s halving in 2024, which decreased issuance to 450 BTC per day (per Blockchain.com), helps a bullish outlook, doubtlessly pushing Bitcoin towards $150,000 by the top of 2025 if institutional inflows proceed.