CoinDCX has quickly emerged as considered one of India’s main cryptocurrency exchanges since its founding in 2018 by Sumit Gupta and Neeraj Khandelwal. What started as an effort to bridge the hole in India’s nascent crypto market has developed right into a complete digital asset ecosystem. This evaluation delves into CoinDCX’s choices, its modern enterprise mannequin, safety measures, and general market influence, offering an in‐depth have a look at why it stands out within the aggressive world of crypto buying and selling.

A Gateway for Indian Crypto Lovers

CoinDCX was conceived at a time when dependable and consumer‐pleasant platforms had been scarce in India. The founders’ imaginative and prescient was to democratize entry to digital property by creating an interface that caters to each inexperienced persons and skilled merchants. Right now, CoinDCX boasts a sturdy suite of options starting from spot buying and selling to superior instruments like margin and futures buying and selling, staking, and lending companies. By aggregating liquidity from high world exchanges, it presents Indian merchants a seamless entry into the crypto world with the convenience of native fiat integration (viz., Indian Rupees).

Complete Trading Suite

At its core, CoinDCX gives a various array of buying and selling choices:

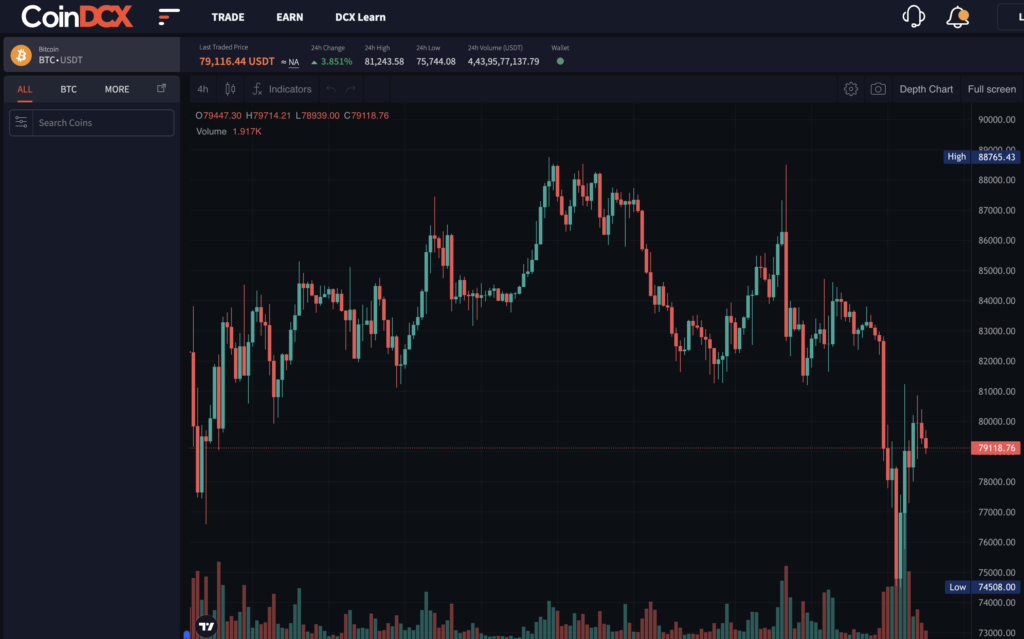

- Spot Trading: The platform presents actual‑time buying and selling of fashionable cryptocurrencies like Bitcoin, Ethereum, Ripple, and several other altcoins. The user-friendly dashboard, enhanced with TradingView’s charting capabilities, makes it easy to trace market actions and execute trades effectively.

- Margin & Futures Trading: For extra seasoned merchants, CoinDCX allows margin buying and selling with up to 6x leverage and futures buying and selling up to 15x. Whereas these leverage limits may appear modest in comparison with some world rivals, they’re designed to stability threat and reward in a market that’s nonetheless evolving inside India.

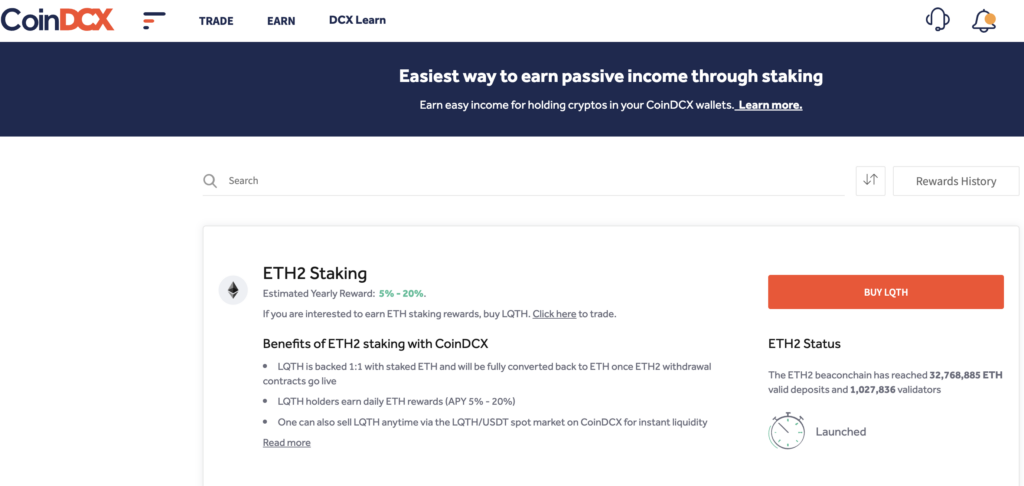

- Staking & Lending: CoinDCX additionally permits customers to stake their crypto property to earn rewards or lend them for extra curiosity earnings. These options not solely enhance the utility of the platform but in addition present avenues for passive earnings, encouraging long-term funding.

This multifaceted strategy makes CoinDCX a one-stop store for cryptocurrency fans, whether or not they’re merely seeking to make investments or interact in subtle buying and selling methods.

Safety as a Cornerstone

Some of the important considerations in cryptocurrency buying and selling is safety. CoinDCX addresses this head-on by implementing industry-leading safety protocols. The platform makes use of multi-signature wallets via partnerships with BitGo and integrates Ledger {hardware} pockets assist for an added layer of security. With two-factor authentication, withdrawal whitelists, and common safety audits, CoinDCX ensures that consumer funds stay safe, at the same time as cyber threats proceed to evolve. Their current transparency report—revealed in March 2025—highlights strong reserve metrics and the expansion of its insurance coverage safety fund (CIPF), reinforcing the platform’s dedication to belief and resilience.

Modern Enterprise Mannequin

CoinDCX’s enterprise mannequin is constructed totally on a buying and selling payment construction, with charges sometimes starting from 0.1% to 0.3% per transaction. This mannequin not solely drives income but in addition permits the platform to reinvest in expertise and safety enhancements. Furthermore, as India’s first hybrid liquidity aggregator, CoinDCX advantages from sourcing liquidity from main world exchanges similar to Binance, HitBTC, and Huobi International, guaranteeing aggressive pricing and minimal market slippage.

The corporate’s income streams lengthen past mere buying and selling charges. With further earnings from premium companies, sponsored promotions, and modern options like referral bonuses and airdrop campaigns, CoinDCX has created a vibrant ecosystem. This numerous income mannequin has performed a big function in its rise to unicorn standing, a uncommon achievement amongst startups in India’s aggressive monetary companies sector.

Person-Centric Method and Instructional Outreach

CoinDCX has not solely constructed a strong buying and selling engine but in addition centered on making cryptocurrency accessible to a broad viewers. Their suite of academic instruments—together with blogs, tutorials, webinars, and stay assist—helps demystify crypto buying and selling for newcomers. Initiatives like “CoinDCX Go” are particularly tailor-made for inexperienced persons, enabling them to grasp market dynamics with out feeling overwhelmed by technical jargon.

The emphasis on consumer schooling has been pivotal in driving crypto adoption in India. As reported in {industry} surveys, this dedication has helped cut back entry boundaries, permitting even first-time buyers to take part confidently within the crypto market. This user-centric strategy underlines CoinDCX’s mission to democratize finance and foster a tradition of knowledgeable investing.

Market Affect and Strategic Positioning

CoinDCX has managed to carve a distinct segment for itself in a extremely aggressive market. With over 16 million registered customers and a good portion of India’s rising crypto neighborhood counting on its companies, CoinDCX has proved its mettle. The platform’s potential to draw a various consumer base—from retail buyers in metropolitan areas to budding merchants in tier‑II cities like Jaipur, Lucknow, and Patna—speaks volumes about its widespread attraction.

Strategic partnerships and strong funding from notable buyers similar to Bain Capital, Polychain Capital, and Coinbase Ventures have additional bolstered CoinDCX’s market place. These partnerships not solely improve the platform’s technological capabilities but in addition be sure that it stays agile in an {industry} marked by fast regulatory and market adjustments. By aligning itself with world crypto leaders whereas specializing in the distinctive wants of Indian buyers, CoinDCX has efficiently positioned itself as a trailblazer within the digital asset area.

Balancing Innovation with Warning

Regardless of its many strengths, CoinDCX isn’t with out its challenges. Some customers have raised considerations relating to the restricted variety of listed cash in comparison with different world exchanges, and occasional points with withdrawal processing have been reported. Whereas these considerations are vital, they replicate the rising pains typical of quickly increasing platforms in a still-maturing market. CoinDCX seems to be addressing these points via steady updates, buyer assist enhancements, and increasing its coin listings steadily to fulfill market demand.

Furthermore, the leverage provided on margin and futures buying and selling, whereas safer for threat administration, may not fulfill merchants searching for aggressive high-leverage alternatives. Nonetheless, this conservative strategy has doubtless contributed to the platform’s strong safety document and long-term sustainability, guaranteeing that consumer funds stay protected in risky market circumstances.

Transparency and Belief

Transparency has turn out to be a key differentiator for CoinDCX. The discharge of normal transparency studies—such because the February 2025 report—exhibits its dedication to openness about reserves, insurance coverage funds, and general monetary well being. These studies not solely construct consumer belief but in addition set a benchmark for accountability in an {industry} that has seen its share of scams and safety breaches.

This dedication to transparency reassures customers that CoinDCX is not only about revenue but in addition about safeguarding the pursuits of its neighborhood. In an atmosphere the place belief is paramount, such initiatives play a important function in retaining and attracting buyers.

Future Outlook

Wanting forward, CoinDCX is poised for additional enlargement and innovation. The corporate continues to discover new product choices, similar to superior DeFi options and enhanced lending/borrowing options. There are additionally plans to broaden its geographical footprint past India, tapping into rising markets the place crypto adoption is on the rise.

Investments in expertise, regulatory compliance, and strategic partnerships might be essential for sustaining its development trajectory. Because the cryptocurrency panorama evolves, CoinDCX’s potential to adapt to regulatory adjustments and market calls for will decide its long-term success. With a give attention to each innovation and consumer safety, CoinDCX seems well-equipped to navigate future challenges whereas sustaining its management in India’s digital asset revolution.

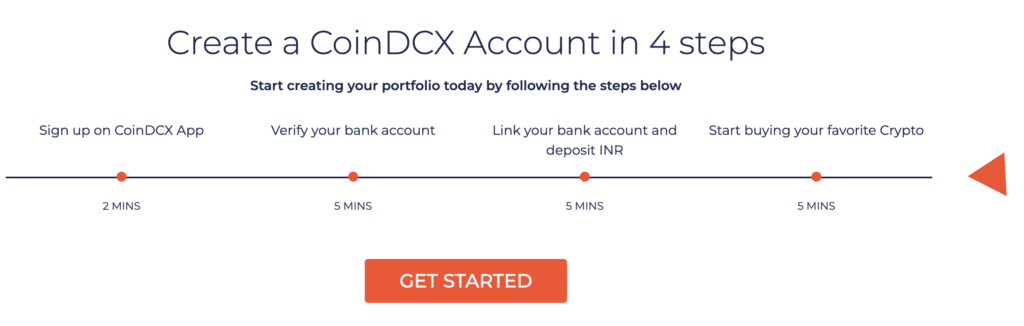

With robust backing from world buyers and a transparent strategic imaginative and prescient, CoinDCX is well-positioned to guide the subsequent section of India’s crypto revolution. For anybody seeking to enter the world of cryptocurrency—whether or not as a newbie or an skilled dealer—CoinDCX presents a safe, user-friendly, and dynamic platform that not solely simplifies digital asset buying and selling but in addition paves the way in which for broader monetary inclusion.

Continuously Requested Questions

What’s CoinDCX and why is it fashionable in India?

CoinDCX is considered one of India’s main cryptocurrency exchanges, providing a full suite of companies together with spot, margin, and futures buying and selling, in addition to staking and lending. Its user-friendly interface, INR integration, and robust safety make it a go-to platform for each inexperienced persons and skilled crypto merchants in India.

Is CoinDCX secure to make use of?

Sure. CoinDCX employs top-tier safety measures together with multi-signature wallets (through BitGo), Ledger {hardware} pockets integration, two-factor authentication (2FA), and common audits. The platform additionally publishes transparency studies and maintains an insurance coverage safety fund to safeguard consumer property.

What buying and selling choices can be found on CoinDCX?

Customers can interact in spot buying and selling, margin buying and selling with up to 6x leverage, and futures buying and selling up to 15x. CoinDCX additionally presents staking and crypto lending for customers looking for passive earnings alternatives.

What are the charges on CoinDCX?

Trading charges on CoinDCX sometimes vary from 0.1% to 0.3% per transaction. These aggressive charges are supported by deep liquidity sourced from world exchanges like Binance and Huobi, which helps cut back slippage.

Does CoinDCX assist inexperienced persons?

Completely. CoinDCX presents beginner-friendly instruments like CoinDCX Go, academic assets, and tutorials. The platform focuses on monetary literacy and goals to simplify the crypto expertise for Indian customers simply getting began.