YEREVAN (CoinChapter.com) — Oregon Legal professional Common Dan Rayfield filed a lawsuit towards Coinbase on April 18, accusing the platform of providing XRP and 30 different tokens as unregistered securities. The Oregon Division of Justice acknowledged that Coinbase violated the state’s securities regulation by making these crypto belongings accessible for buying and selling with out correct registration.

The division mentioned in its official launch that state motion is required to fill the regulatory hole left by federal authorities:

“States must fill enforcement vacuum being left by federal regulators who are abandoning these cases under Trump administration.”

This authorized motion is a part of a wider development the place U.S. states are rising oversight of crypto platforms as federal enforcement slows down.

Coinbase XRP Case Provides Extra Authorized Strain

Coinbase, a U.S.-based publicly traded crypto alternate, now faces scrutiny over its therapy of XRP and different main tokens. The lawsuit mentions Aave (AAVE) at $151.68, Avalanche (AVAX) at $21.61, Uniswap (UNI) at $5.60, and Close to Protocol (NEAR) at $2.29.

Additionally listed is wrapped LUNA (wLUNA), a model of the failed Terra (LUNA) undertaking. Nonetheless, the grievance excludes LUNA, with out explaining the rationale for this omission.

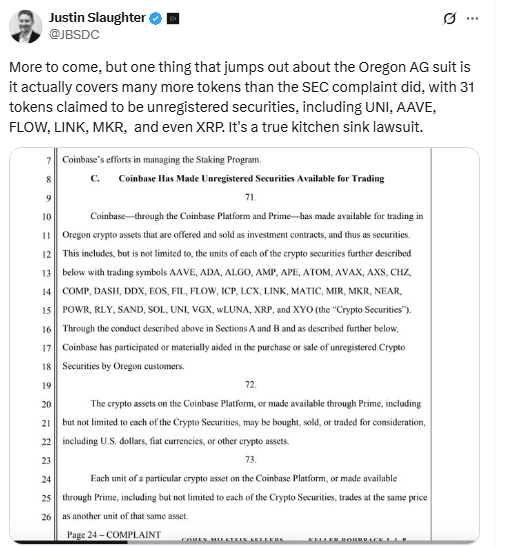

Justin Slaughter, Paradigm’s Vice President of Regulatory Affairs, described the lawsuit as a “kitchen sink” case due to the broad variety of belongings concerned. The grievance targets buying and selling via each Coinbase Platform and Coinbase Prime.

The lawsuit says:

“Coinbase—through the Coinbase Platform and Prime—has made available for trading in Oregon crypto assets that are offered and sold as investment contracts, and thus as securities.”

Oregon’s XRP Motion Follows Ripple SEC Case

XRP was already a part of a high-profile case introduced by the U.S. Securities and Trade Fee (SEC) in December 2020. The SEC accused Ripple Labs of elevating $1.3 billion via an unregistered securities providing.

That case resulted in March 2025, when the SEC dropped its claims towards Ripple executives. Nonetheless, the top of that lawsuit didn’t deliver clear solutions about XRP’s authorized classification. Now, Oregon’s motion places XRP again underneath authorized assessment.

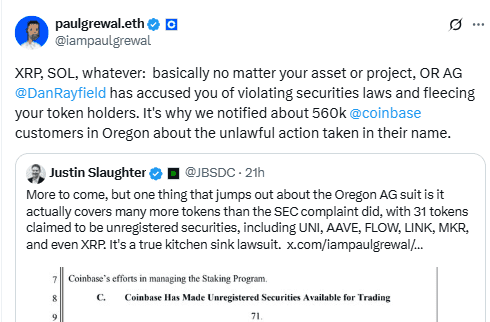

Paul Grewal, Coinbase’s Chief Authorized Officer, responded on April 21 in a publish on X, expressing concern in regards to the authorized technique. Coinbase had added XRP futures to its derivatives platform simply days earlier on April 21.

Wrapped Property Elevate Extra Authorized Questions

The grievance’s inclusion of wrapped tokens akin to wLUNA, and the exclusion of core tokens like LUNA, introduces authorized uncertainty. The submitting doesn’t present a technical or regulatory rationalization for the alternatives.

This selective inclusion may have an effect on how courts and regulators assess spinoff tokens, particularly when coping with collapsed initiatives or tokens tied to exterior chains.

The lawsuit didn’t clarify why some crypto belongings had been named whereas others had been overlooked. The case is anticipated to look at whether or not these digital belongings qualify as funding contracts, which underneath state regulation would label them as securities.

This lawsuit represents certainly one of a number of latest state-led efforts to implement securities guidelines within the crypto sector. It displays rising concern amongst state officers about diminished federal enforcement, particularly from the SEC.

Whereas the courtroom has not but set a trial date, the case may form how states interpret crypto laws independently. Coinbase and different platforms might face elevated scrutiny if extra states observe Oregon’s authorized strategy.