Circle Web Monetary, the issuer of USD Coin (USDC), is getting ready to checklist on the New York Inventory Change beneath the ticker CRCL. In response to investor Chamath Palihapitiya, the corporate’s preliminary public providing (IPO) has drawn demand that’s 25 occasions higher than the out there provide of shares.

Circle to Elevate $1.05 Billion at $31 Per Share

Circle will promote 34 million shares at $31 every, above its beforehand marketed vary of $27–$28. This pricing values the corporate at roughly $6.9 billion, primarily based on 220 million excellent shares. The corporate additionally gave underwriters a 30-day possibility to purchase up to five.1 million further shares.

Circle plans to make use of the proceeds to pay tax obligations, develop new merchandise, and increase its operations, in line with filings submitted to the U.S. Securities and Change Fee (SEC).

This IPO is Circle’s third try to go public. It canceled a 2021 SPAC merger due to regulatory delays and market instability. In April 2025, it paused one other IPO plan after U.S. tariffs disrupted international markets.

Chamath Palihapitiya mentioned buying Circle may benefit corporations like Ripple or Coinbase because of the firm’s place within the stablecoin market. He added that buying Circle for $12–13 billion may show favorable over a long-term horizon.

“If someone can buy it for even $12–13 billion, that’s a steal, imo, for what this business could be worth in 20 years,” he wrote.

Palihapitiya additionally talked about that corporations comparable to Stripe, Block (previously Sq.), Ripple, and Coinbase may compete for management in stablecoin infrastructure. He acknowledged that corporations providing environment friendly, low-cost options might achieve probably the most market share in the long term.

Ripple’s Alleged Bids for Circle Could Now Require Increased Valuation

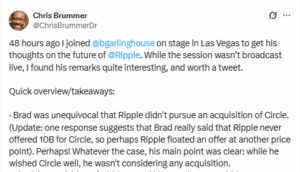

Ripple Labs reportedly supplied $5 billion to amass Circle, however Circle rejected the bid. Later, Ripple allegedly elevated its provide to between $9 billion and $11 billion. Ripple’s CEO denied submitting a $10 billion provide however didn’t rule out the potential of discussions.

Circle has denied coming into acquisition talks with both Ripple or Coinbase.

Now that Circle’s IPO is closely oversubscribed, the corporate has gained stronger leverage. It might select to proceed independently until future bids come at a considerably increased valuation.

Oversubscription Factors to Robust Demand

Zero Hedge reported that Circle’s IPO is 25 occasions oversubscribed. This means that buyers need way more shares than the corporate is providing. With 34 million shares out there, demand has exceeded 850 million shares’ price.

Main buyers have proven curiosity. ARK Make investments, led by Cathie Wooden, plans to take a position $150 million. BlackRock reportedly goals to amass not less than 10% of the corporate when it lists.

Market analysts say this stage of demand reveals the assumption that Circle’s IPO pricing doesn’t totally mirror its share of the stablecoin sector.

As of June 2025, Circle oversees $62 billion in USD Coin (USDC) circulation, accounting for roughly 27% of the worldwide stablecoin market.

In 2024, the corporate generated $1.68 billion in income. The web earnings declined by roughly 42% year-over-year, falling from $267.5 million in 2023 to $155.7 million. The corporate acknowledged in its filings that it intends to reinvest its earnings and doesn’t plan to situation dividends right now.