Cardano (ADA) is now supported on Courageous Pockets, introducing the blockchain to a possible person base of 88 million month-to-month customers. The combination allows Cardano holders to handle property, signal transactions, and entry decentralized options instantly inside the Courageous browser. Nevertheless, regardless of this publicity enhance, ADA’s price continues to say no.

Courageous Pockets Provides Cardano Mainnet Assist

The Courageous Pockets now helps Cardano’s mainnet alongside different main chains like Solana, Ethereum, and Bitcoin. This integration might increase Cardano’s utility by introducing it to tens of millions of privacy-focused customers. With BAT token holders receiving a associated airdrop and Cardano now a visual a part of Courageous’s supported networks, the visibility of ADA in retail-facing platforms has elevated.

Nevertheless, the itemizing has not but triggered a market response. ADA is buying and selling round $0.60, dealing with a continuation of promoting strain seen all through the week.

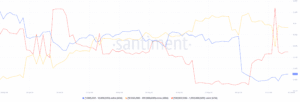

On-chain information exhibits that whales acquired 230 million ADA earlier within the week however reversed course by midweek, offloading the identical quantity. This implies an absence of conviction amongst giant holders, probably influenced by macro uncertainty or doubts surrounding near-term ADA efficiency. Their complete holdings stay shut to three.18 billion ADA.

In the meantime, wallets with greater than 1 billion ADA added 180 million cash in June, exhibiting blended sentiment throughout whale classes.

You Might Additionally Like: Charles Hoskinson Faces $600M ADA Accusations Whereas Cardano Charts Sign 31% Crash Danger

ADA Slides Beneath Key EMAs as RSI Nears Oversold Territory

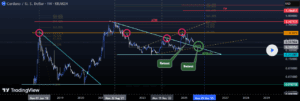

Cardano trades round $0.60 on the time of writing, remaining under all main exponential shifting averages—20, 50, 100, and 200-day. These EMAs now type stacked resistance between $0.65 and $0.70.

The Relative Power Index (RSI) is close to 36, suggesting continued bearish momentum and potential oversold circumstances. Worth is hovering close to short-term assist between $0.59 and $0.62. A breakdown under this zone might open the trail towards $0.50, a stage not revisited since late 2023.

This technical setup aligns with the current lack of whale assist and declining buying and selling quantity, indicating towards the danger of additional draw back within the close to time period.

Lengthy-Time period Chart Nonetheless Reveals Structural Retest

Regardless of the short-term weak point, ADA stays inside a multi-year wedge construction, first damaged in late 2023. The present price motion seems to be a retest of that breakout zone. Historic retests of comparable patterns in 2020 and 2023 preceded main price expansions.

The broader assist zone between $0.21 and $0.30 stays vital. So long as ADA stays above this vary, the long-term bullish setup stays legitimate. Resistance above $1.26 and Fibonacci extensions close to $3.14 define potential targets if momentum returns later within the cycle.