Cardano will quickly assist Chainlink’s oracle community by a self-serve integration library, based on CEO Charles Hoskinson. He confirmed the event on June 20, 2025, stating that he maintains shut communication with the Chainlink staff and receives common updates.

Chainlink Integration to Enhance Cardano’s dApp Potential

The mixing will permit builders on Cardano to entry off-chain knowledge immediately by Chainlink’s decentralized oracle feeds. This marks a serious step for functions that depend on real-world inputs—comparable to decentralized finance (DeFi), insurance coverage, and gaming platforms.

Oracles play a crucial position in connecting blockchain good contracts with exterior knowledge like alternate charges, climate metrics, and market statistics. With out them, good contracts stay remoted and lack responsiveness to real-world occasions. Chainlink solves this hole by offering a decentralized system that delivers correct, tamper-resistant knowledge to blockchain networks.

With Cardano increasing its good contract infrastructure, the Chainlink integration will give builders new instruments to create extra advanced and helpful functions. A self-serve library simplifies the method, eradicating the necessity for personalized setups or middleman options.

Chainlink Secures Main Monetary Companions

On June 19, 2025, Chainlink revealed a number of high-profile partnerships that anchor its CCIP technique. UBS Asset Administration and Swift launched a pilot program for tokenized fund settlements. This system ran beneath Singapore’s Mission Guardian and demonstrated seamless integration between conventional infrastructure and blockchain techniques. It additionally confirmed decreased prices and quicker settlements throughout the $63 trillion mutual fund sector.

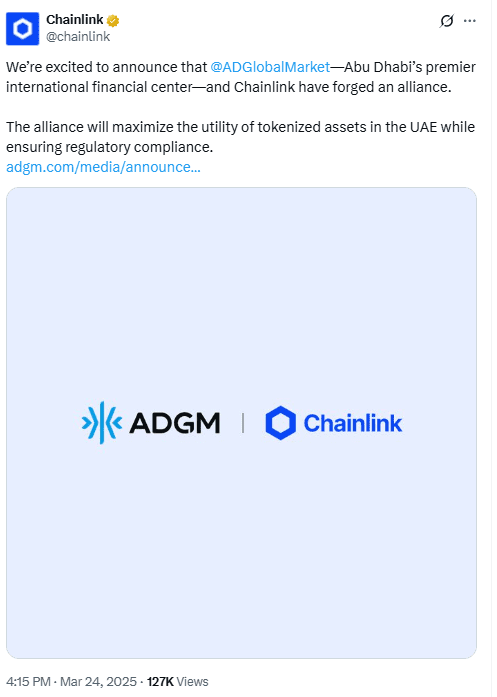

Individually, Chainlink signed a long-term settlement with Abu Dhabi World Market (ADGM) to develop blockchain compliance requirements. ADGM’s Registration Authority will use Chainlink’s technical companies to handle tokenized property inside a regulated framework. This ensures that new tokenization pilots meet the authorized and operational requirements anticipated by institutional gamers.

Chainlink Evolves Into Tokenization Infrastructure

Chainlink is not simply an oracle supplier. By way of CCIP and institutional-grade infrastructure, it now hyperlinks conventional finance to blockchain ecosystems. It permits fund managers, banks, and regulators to maneuver from pilot experiments to full-scale manufacturing fashions.

Latest integration into World Liberty Monetary’s DeFi ecosystem additional demonstrates Chainlink’s rising position in bridging real-world property and decentralized platforms. Every integration contributes to a broader community impact, the place profitable implementations encourage quicker adoption.

Replicable Mannequin for World Enlargement

The UBS-Swift pilot beneath Mission Guardian now serves as a replicable mannequin for different monetary corporations exploring asset tokenization. Chainlink’s technical stack proved efficient in decreasing friction throughout conventional and digital asset rails. Following this, different asset managers have begun evaluating comparable fashions for deployment.

The ADGM partnership additionally gives a framework for compliant tokenization beneath strict regulatory requirements. It presents a ready-made blueprint for jurisdictions trying to entice blockchain innovation with out sacrificing oversight.

Collectively, these partnerships cut back institutional resistance and sign that blockchain integration is not experimental—it’s actionable.

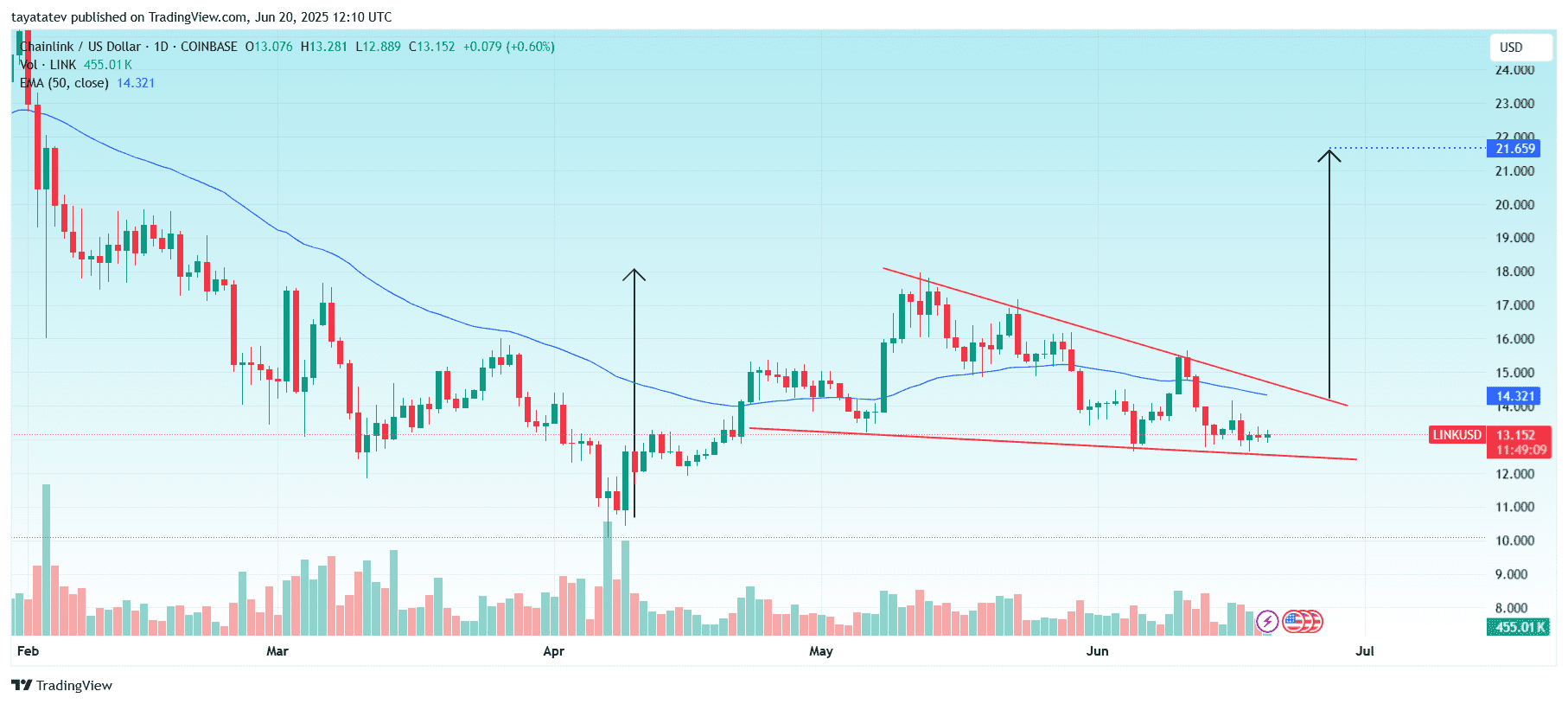

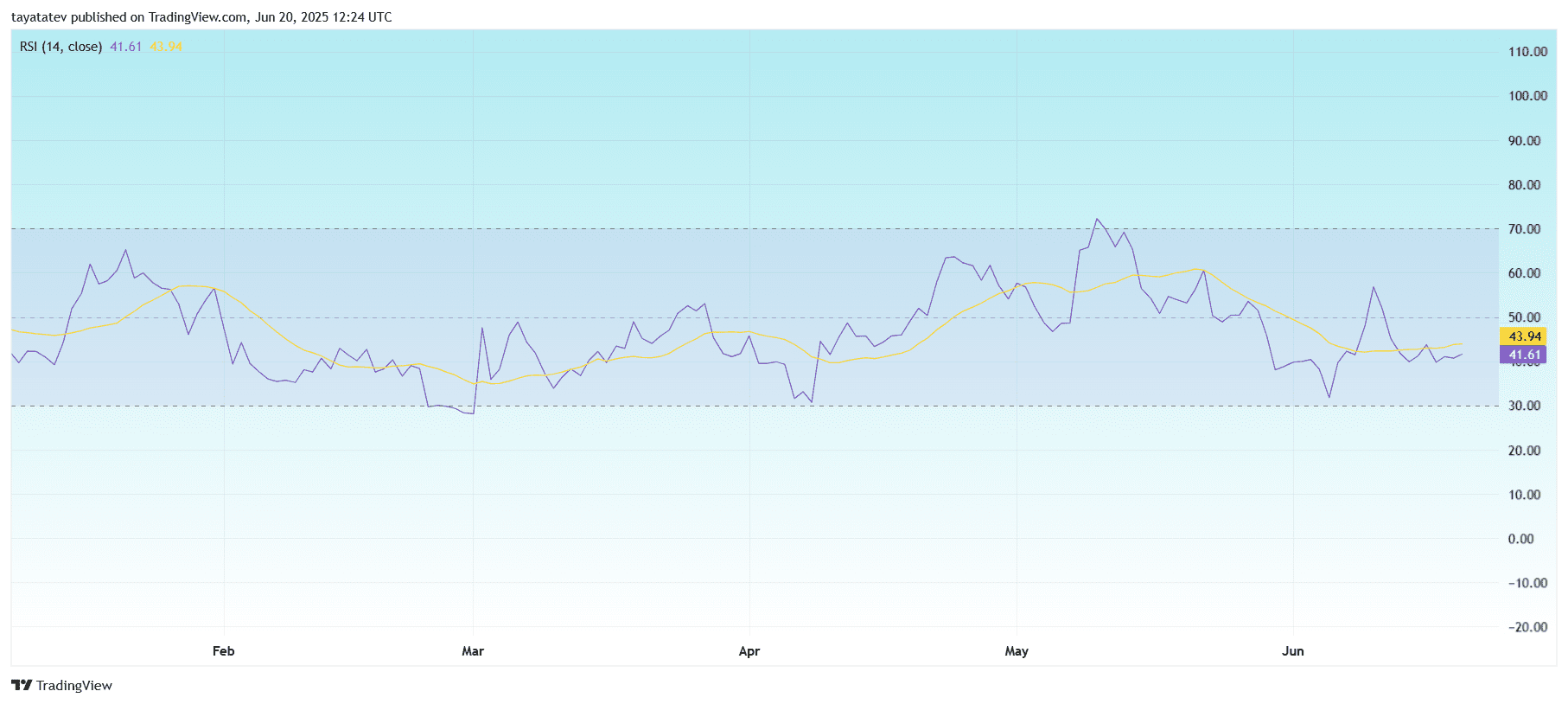

LINK Value Outlook Tied to CCIP Adoption

As Chainlink strikes deeper into real-world finance, LINK’s worth proposition grows. If CCIP adoption continues to broaden, analysts see room for LINK to reclaim the $30 zone. Institutional use instances present not solely liquidity but in addition long-term demand for the protocol’s companies.

By embedding itself in regulatory frameworks and monetary infrastructure, Chainlink is constructing greater than partnerships—it’s constructing the technical rails for tokenizing the worldwide financial system.