As of Could 16, 2025, Cardano (ADA) seems to have fashioned a bearish flag sample on its each day chart. A bearish flag sample is a continuation setup that usually types after a pointy downward transfer, adopted by a short upward or sideways consolidation inside parallel trendlines earlier than breaking down additional.

This construction started forming in early April 2025, following a backside close to $0.58. ADA then entered an upward-sloping consolidation channel bounded by two parallel pink trendlines. Nevertheless, current candles present rejection on the higher boundary close to $0.82 and a pullback towards the midrange.

If the bearish flag confirms with a breakdown beneath the decrease trendline—at the moment intersecting close to the $0.72 mark—ADA could proceed its downtrend. The measured goal for the breakdown implies a 35% drop from the breakdown level, which units a possible price goal close to $0.51. This goal aligns with a earlier assist stage and is marked on the chart with a downward arrow.

In the meantime, the 50-day exponential shifting common (EMA), at the moment at $0.7203, acts as an instantaneous assist. An in depth beneath this line would additional validate bearish continuation.

On the similar time, the Relative Energy Index (RSI) sits at 57.61, just under its 14-day common of 59.35. This neutral-to-bearish positioning exhibits fading bullish momentum with out but reaching oversold territory.

If ADA closes beneath the flag’s decrease trendline and fails to reclaim the 50-day EMA rapidly, the bearish flag breakdown will possible play out. A fall towards the $0.51 goal zone might comply with in that case, particularly if promoting quantity will increase.

Cardano ETF Approval Odds Hit 55%, Community Exercise Surges

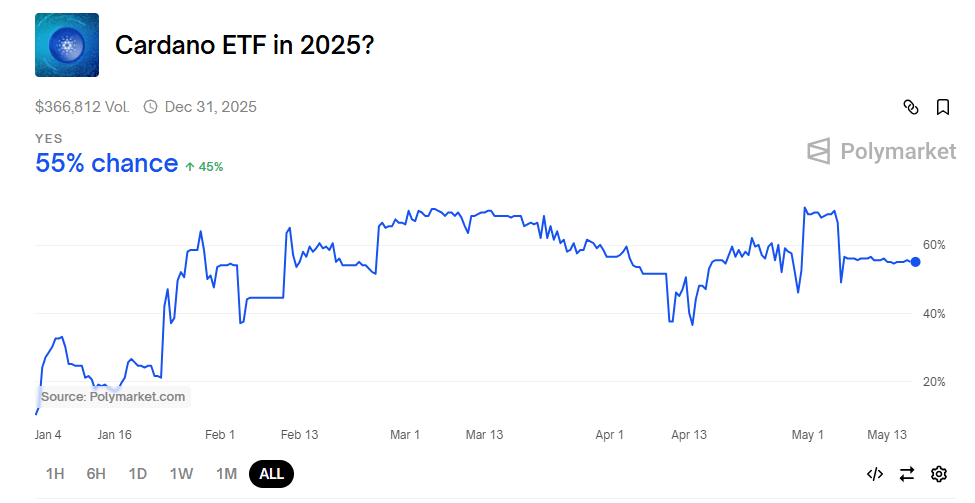

In the meantime, merchants on Polymarket now place a 55% probability on Cardano (ADA) receiving spot exchange-traded fund (ETF) approval by the top of 2025. This marks a forty five% enhance from earlier within the 12 months, reflecting rising optimism throughout the cryptocurrency sector. The rise in confidence follows the profitable approvals of spot Bitcoin and Ethereum ETFs in the USA.

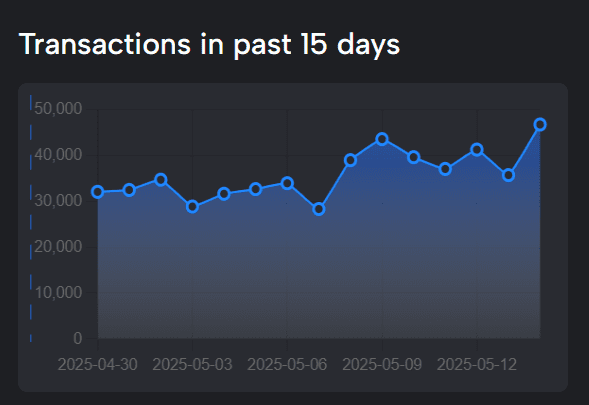

This shift has sparked renewed curiosity in Cardano’s on-chain efficiency. Between April 30 and Could 6, Cardanoscan information exhibits each day transactions ranged from 30,000 to 35,000. Exercise rose sharply starting Could 7, repeatedly topping 40,000 and reaching almost 50,000 on Could 15. These ranges counsel regular engagement with Cardano past market hypothesis.

Analysts attribute this optimistic sentiment to a number of components. Cardano’s proof-of-stake blockchain, ongoing ecosystem growth, and energy-efficient construction proceed to enchantment to institutional traders. The ETF hypothesis has not solely pushed price dialogue but additionally underlined Cardano’s operational stability.

Though the optimism on Polymarket has held agency since January, closing selections stay within the arms of regulators who’re weighing market maturity, compliance frameworks, and investor safety issues.

For now, the mixed enhance in ETF odds and transaction volumes indicators strengthened perception in Cardano’s broader position in institutional crypto adoption.

Hoskinson Rejects VCs, Launches Midnight Airdrop for 37 Million Wallets

On the similar time, Cardano co-founder Charles Hoskinson unveiled a brand new cross-chain airdrop throughout his keynote at Consensus 2025 in Toronto, focusing on 37 million wallets throughout eight main blockchains. The initiative, named the Glacier Drop, will distribute two tokens — NIGHT, a governance token, and DUST, designed for personal transactions. Hoskinson confirmed that your entire distribution will go to retail customers, excluding enterprise capitalists and early insiders.

“I had no f-ing time for your Ponzi,”

he stated, dismissing VC presents and reinforcing his determination to create a community-first launch mannequin.

Hoskinson described the present state of crypto as fractured by what he referred to as “tribal warfare,” the place tasks compete fairly than collaborate. He criticized the recurring cycle of token launches that foster division as an alternative of unity. To counter this, he constructed Midnight — a privacy-first sidechain of Cardano — to assist cooperative economics. Midnight stays in testnet, with a mainnet launch anticipated later in 2025.

The mission permits builders from Ethereum, Solana, and Bitcoin to construct decentralized purposes (dApps) utilizing Midnight whereas nonetheless paying charges of their respective native tokens like ETH, SOL, and BTC. Validators from completely different chains may assist safe the Midnight community and share rewards, creating an incentive to collaborate throughout ecosystems.

Hoskinson emphasised that the Glacier Drop arms full management to recipients. Customers can commerce, maintain, or ignore their tokens with out lockups or restrictions.

“You already have it, congratulations. It’s yours. It’s your property,”

he informed the viewers. He stated the objective is to redefine how crypto distributes worth — shifting away from closed insider offers towards broader, extra inclusive entry.

Calling it essentially the most pleasurable mission he’s labored on, Hoskinson framed Midnight and its unorthodox token technique as a blueprint for the trade’s future. He believes as conventional tech giants and billions of customers enter the crypto area, rules like privateness, equity, and cooperation shall be important to long-term success.