Cardano (ADA), Solana (SOL), and Hyperliquid (HYPE) every posted modest recoveries following final week’s marketwide drawdown. Nonetheless, momentum exhaustion has began rising throughout all three tokens.

ADA price rebounded from a key help zone close to $0.55, earlier than the restoration rally began bleeding good points. On June 27, ADA price was up once more, with a modest 2% spike to $0.56. SOL costs climbed above $147 after the marketwide drawdown compelled the Solana token to greet its help stage close to $130.

HYPE one way or the other managed to buck the downtrend, beginning its restoration a day sooner than almost many of the wider market. Nonetheless, the token stalled close to native resistance. Regardless of the preliminary upside, not one of the tokens have confirmed sustained breakouts, and short-term constructions now counsel weakening shopping for strain.

With spot volumes thinning and key resistance ranges nonetheless intact, merchants seem cautious because the broader crypto market enters a consolidation part.

ADA Analysts Map Rebound Situations

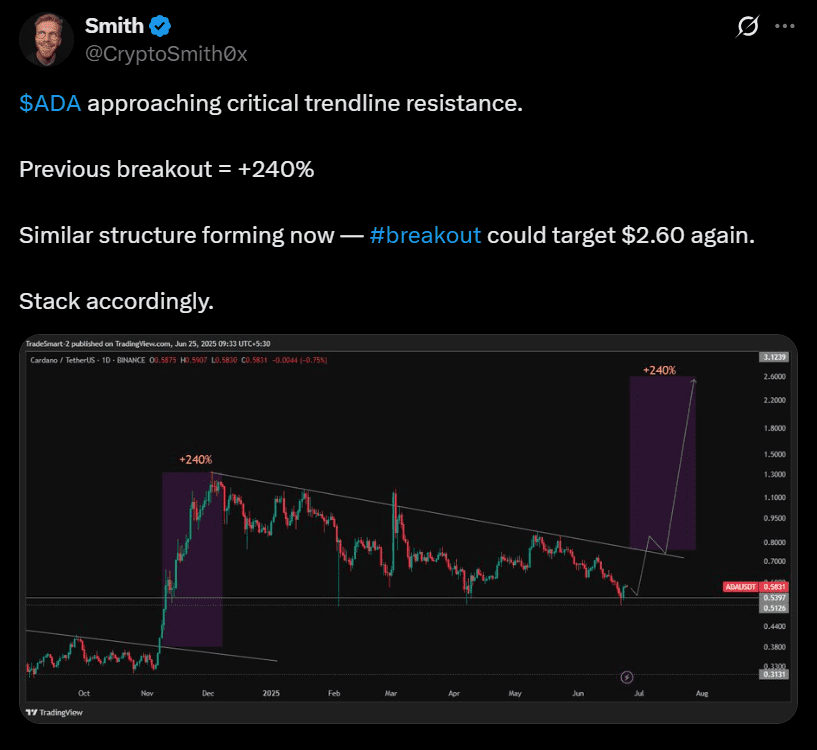

The Cardano (ADA) price has been in a downtrend since late Could 2025, and the current market crash didn’t assist. Many analysts took to X to focus on potential reversal setups after the crash.

In keeping with a dealer, Smith, ADA is forming a construction much like its late 2024 breakout, when the token surged over 240% after clearing a descending trendline. He famous that the identical trendline is now in play once more, with a projected upside goal of $2.60 if the Cardano token price breaks out.

One other X-based analysis account, Most Offended Bull, targeted on the horizontal help zone close to $0.58, pointing to prior range-bound exercise between $0.58 and $0.70. He flagged this space as a essential check for bulls, suggesting {that a} profitable protection might set off a transfer again above resistance.

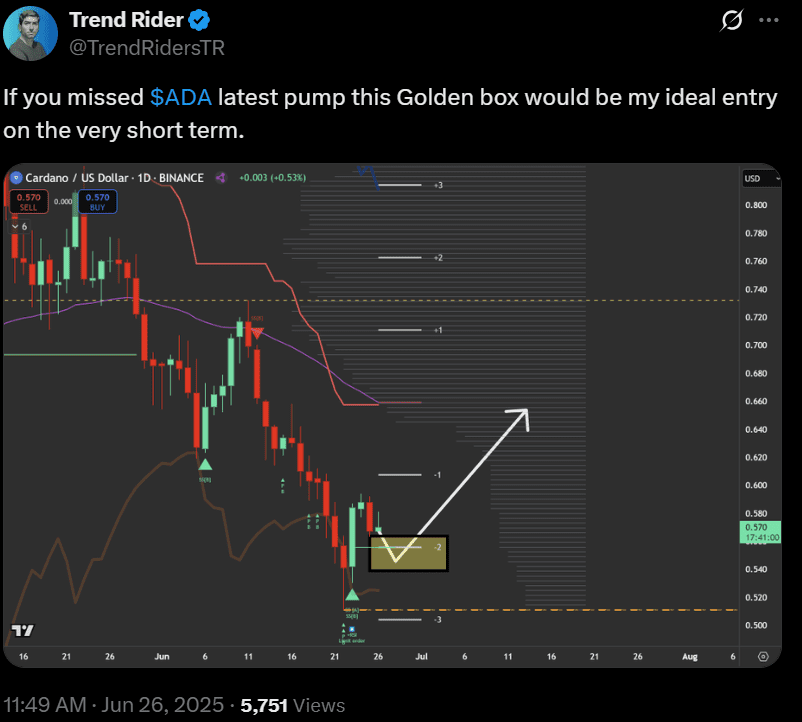

The 2 analysts’ predictions do assist set up the $0.54-$0.58 vary as a key help zone for the ADA USD pair. Furthermore, one other analyst, with the username Development Rider on X, confirmed this.

Rider recognized a time period demand zone—known as a “golden box”—between $0.54 and $0.58. He marked this area as a possible entry space for intraday trades, citing historic help and quantity profile alignment.

Analysts haven’t confirmed a breakout, however short-term reversal expectations stay lively as price consolidates close to accumulation ranges.

SOL Worth Holds Above Key Assist

Solana (SOL) is buying and selling above a key help zone close to $139, with technical analysts pointing to an incomplete wave construction that would decide the token’s subsequent directional transfer. Since final week’s crash, SOL has painted a near-identical price chart to ADA.

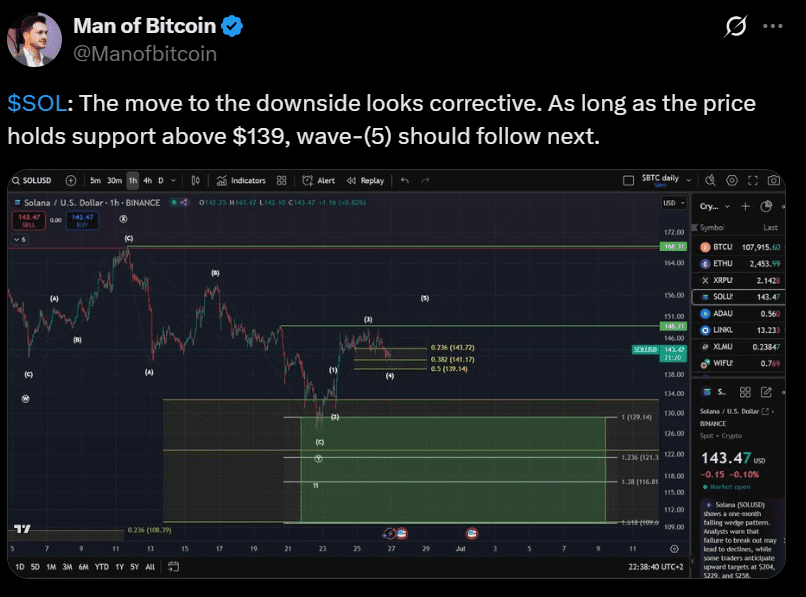

A publish by analyst Man of Bitcoin shared a chart displaying that the SOL price wanted a remaining excessive in wave (5) of the Elliott Wave sample to verify {that a} backside has shaped.

The 1-hour construction indicated consolidation between $143 and $141, with Fibonacci retracement ranges plotted at 0.236 ($143.72), 0.382 ($141.17), and 0.5 ($139.14). If the retracement is maintained, SOL price might purpose on the $148–$149 area.

Nonetheless, failure to interrupt above the native excessive might expose SOL price to prolonged draw back targets. A transfer under $139 would shift focus to decrease ranges close to $129, $122, and $116.80.

The broader construction stays technically incomplete, and confirming pattern reversal would require a clear breakout above the wave-3 prime. Till then, price motion stays inside a corrective framework.

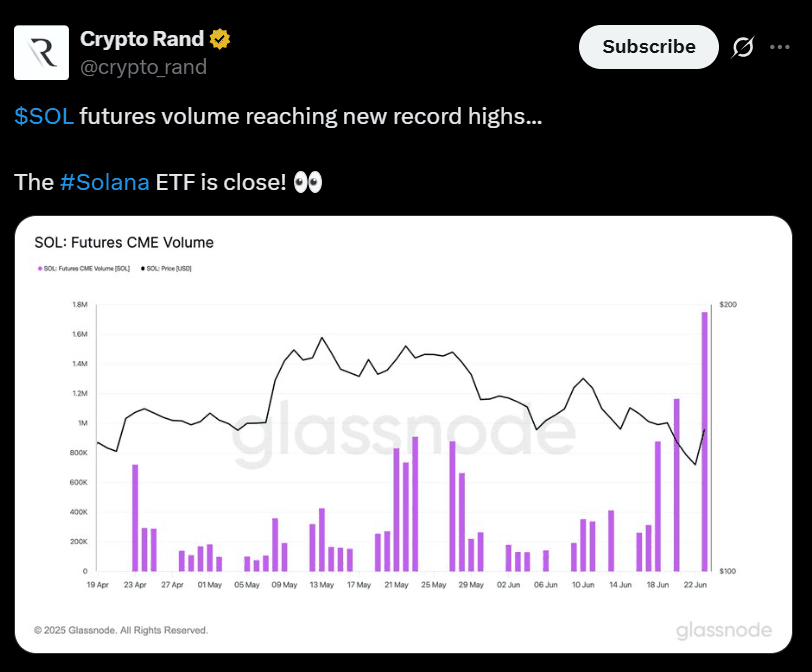

In the meantime, analyst Crypto Rand famous that Solana’s CME futures quantity has reached new file highs. The rise in institutional curiosity has renewed hypothesis a few spot Solana ETF, following a submitting by Invesco and Galaxy in search of SEC approval.

Individually, one other analyst, Koroush AK, highlighted a variety construction between $127 and $180.58, with the present price holding close to the decrease sure. Koroush predicted that bulls stay weak until SOL reclaims the $157–$180 zone, the place prior distribution occurred.

HYPE Merchants Debate $32–$45 Vary

Hyperliquid (HYPE) has pulled again from current highs and is now consolidating within the $36–$38 area, which merchants appear to deal with as a essential help zone.

Analyst CryptosBatman highlighted that the token beforehand broke out of a long-term downtrend and rallied strongly, however is now retesting the $36–$38 stage. Batman said {that a} transfer towards $45 or increased stays potential if this zone holds.

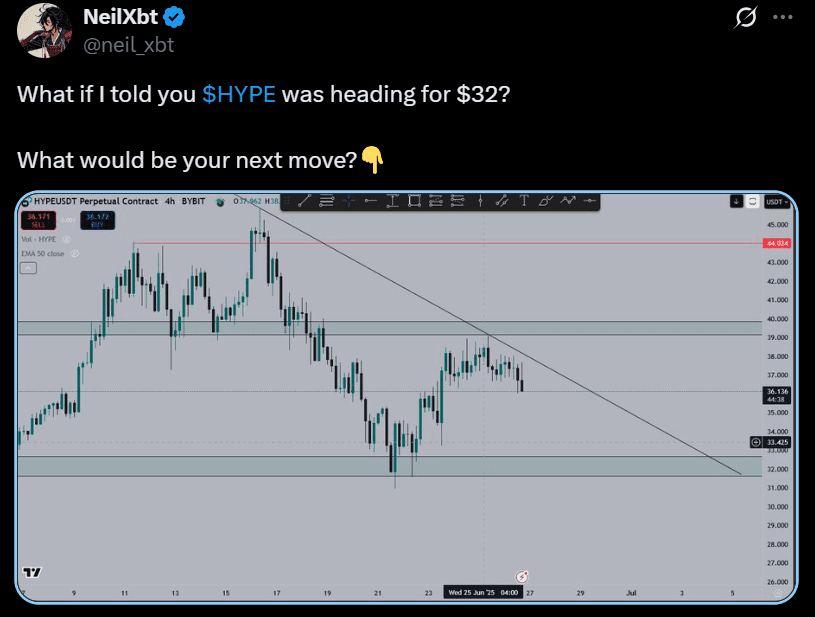

Dealer Neilxbt shared a descending resistance trendline on the 4-hour chart, projecting a possible short-term drop towards $32 if the price exceeds the present vary.

His help area aligns with a beforehand examined accumulation zone, indicating the $32–$33.50 space may very well be the subsequent draw back goal if weak point persists.

In the meantime, blockchain information posted by X-based dealer Alex highlighted massive spot purchases by Galaxy Digital. In keeping with the publish, the agency reportedly collected $1 million in HYPE and will have $19 million in USDC left to deploy. The trades appeared concentrated across the $36.10–$36.16 vary.

Nonetheless, till a decisive reclaim of the $39–$40 vary happens with increased quantity, the short-term bias stays range-bound and weak to additional dips.

It appears ADA, SOL, and HYPE would wish sturdy bullish cues to interrupt out of the bearish rut that the tokens have entered.