YEREVAN (CoinChapter.com) — Canary Capital’s newest ETF submitting outlines plans to carry spot TRX tokens and stake a portion of them to generate yield. This makes the appliance stand out from most U.S. crypto ETF filings, which normally search staking rights solely after securing preliminary approval.

The ETF would enable traders to achieve publicity to each TRX’s market price and its staking rewards, which common round 4.5% yearly, in line with StakingRewards.com.

Tron’s Community and Founder Underneath Authorized Strain

The ETF facilities on the Tron blockchain, a proof-of-stake community launched by entrepreneur Justin Solar. He additionally owns Rainberry, the corporate behind BitTorrent. In March 2023, the SEC sued Solar for allegedly manipulating the costs of TRX and BitTorrent’s BTT token. In February 2025, each events requested the courtroom to pause the case to start settlement talks. Regardless of the authorized points, Tron’s market cap has stayed above $22 billion.

Whereas a number of Ethereum ETFs have already listed or are underneath overview, their issuers didn’t initially request staking rights. As a substitute, they waited till after launch to hunt approval for staking. Canary Capital’s TRX submitting contains this characteristic from the start, probably accelerating investor returns if permitted. This transfer may sign a shift in how future crypto ETFs are structured.

A part of a Broader Push for Altcoin ETFs

Canary’s submitting follows a surge in ETF proposals for various cryptocurrencies. Since January 2025, when Donald Trump took workplace, the SEC has acquired dozens of filings tied to non-core tokens. These embrace Solana (SOL), the Trump-themed Official Trump (TRUMP) coin, and several other others.

Canary has additionally submitted purposes for ETFs targeted on Litecoin (LTC), XRP, Hedera (HBAR), Axelar (AXL), Pengu (PENGU), and Sui (SUI). It just lately grew to become the primary to file for a Sui ETF within the U.S.

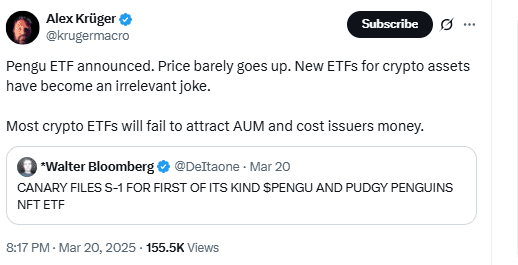

Regardless of the uptick in filings, some business observers stay cautious. Crypto researcher Alex Krüger famous in a March submit on X that the majority altcoin ETFs could wrestle to draw belongings underneath administration (AUM) and will finish up being unprofitable for issuers.

Regulatory selections on many of those purposes, together with Canary’s staked TRX ETF, are nonetheless pending.