YEREVAN (CoinChapter.com) — Spot Solana ETFs will formally launch in Canada on April 16, in line with Bloomberg analyst Eric Balchunas’s X put up. Within the put up, he cited a non-public consumer word from TD Financial institution, which confirmed that the Ontario Securities Fee (OSC) accredited 4 issuers.

Consequently, Objective, Evolve, CI, and 3iQ will every checklist a Solana ETF in Canada. These funds will maintain Solana (SOL) and in addition embody SOL staking. The funds can earn further yield by locking SOL on the community by means of staking. With this transfer, the spot Solana ETF launch brings Canada into the nations providing regulated altcoin funding automobiles. Not like the U.S., Canada at the moment permits each spot ETF buildings and staking options beneath its provincial regulatory framework.

Ontario Securities Fee Approves Solana ETF Canada Plans

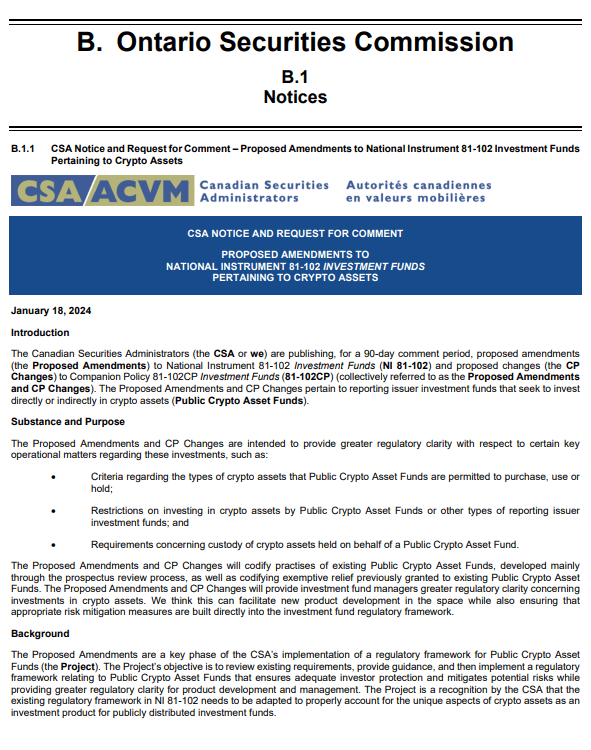

The Ontario Securities Fee mentioned the Solana ETF Canada launch follows rule modifications launched in January 2024. These modifications revised the authorized framework for publicly traded crypto funds in Ontario.

In line with the OSC, every Solana ETF should observe the up to date guidelines to supply staking and on-chain publicity. Nevertheless, the assertion didn’t specify the precise staking share allowed. Nonetheless, regulatory oversight stays in place for all issuers. In Ontario, the OSC oversees monetary markets, together with Toronto’s trade. Since Canada lacks a single federal securities company, every province applies its rules.

In the meantime, Eric Balchunas referred to the upcoming ETFs as “our first look at the alt coin race.” His X put up included a screenshot from a TD Financial institution consumer memo that outlined key particulars in regards to the Solana ETF Canada launch.

U.S. Nonetheless Blocks Spot Solana ETFs and Staking

The U.S. Securities and Change Fee (SEC) has not accredited any spot Solana ETFs thus far. At current, solely Bitcoin and Ether spot ETFs are permitted. Though a number of functions exist for altcoin-based ETFs, none have acquired regulatory clearance.

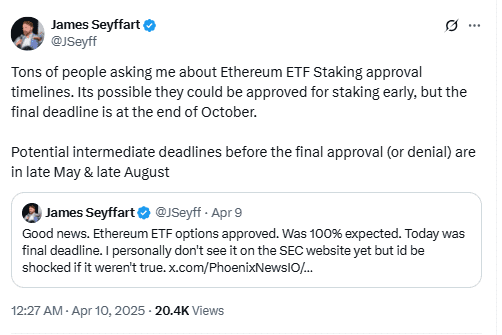

Moreover, staking stays prohibited for all U.S.-based crypto ETFs. Bloomberg analyst James Seyffart talked about that Ether ETFs may obtain staking approval by Might. Nevertheless, the method remains to be ongoing, and no confirmed timeline exists.

Consequently, the U.S. continues to lag behind Canada in approving each spot Solana ETFs and staking. This case highlights the regulatory variations between markets in North America.

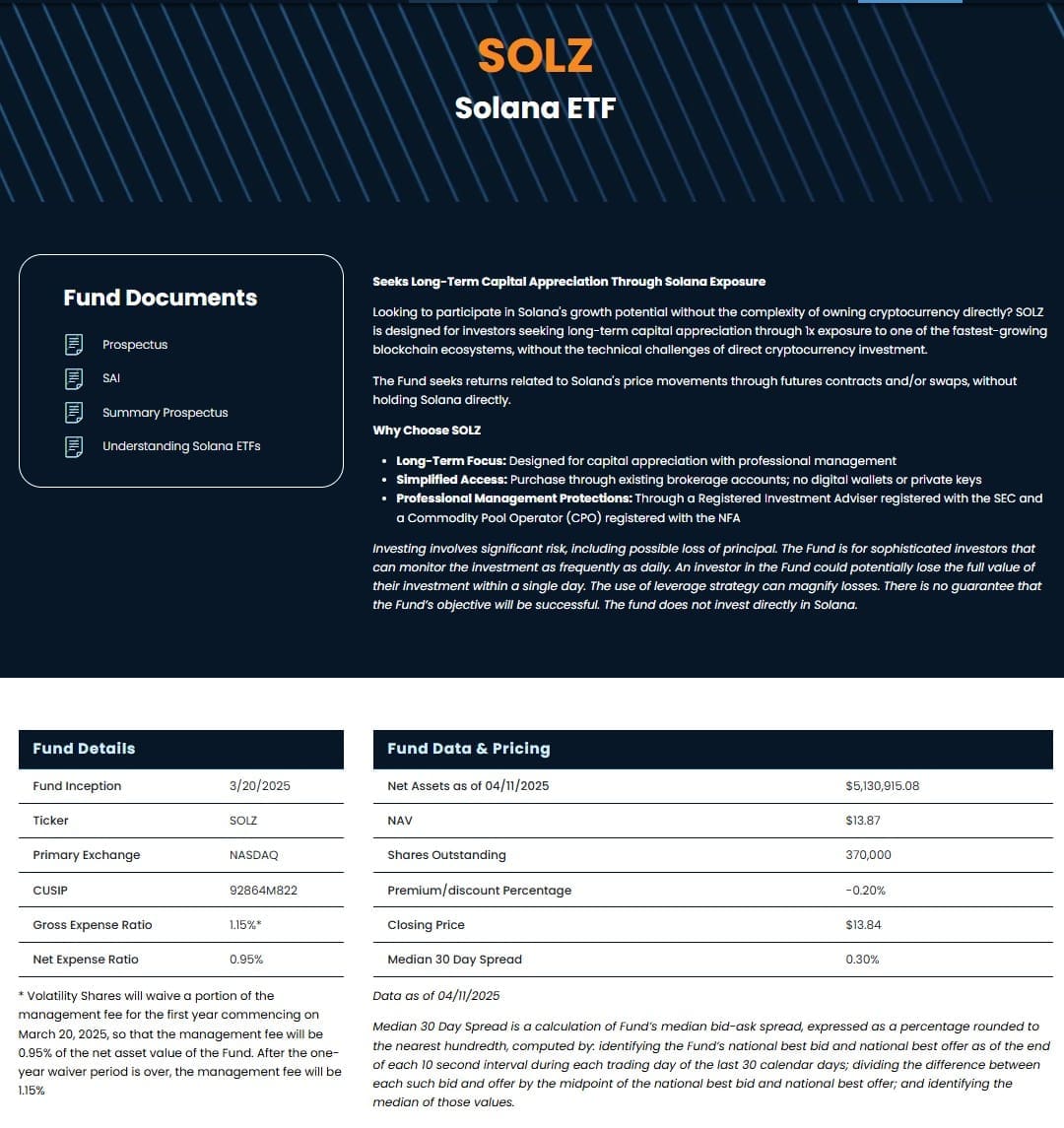

In the meantime, U.S. asset supervisor Volatility Shares launched the primary Solana futures ETF in March 2025. The product, named SOLZ, tracks Solana’s price utilizing monetary derivatives. In line with Volatility Shares’ web site, it held round $5 million in internet property as of April 14.

In response, Eric Balchunas famous the underperformance of Solana futures ETFs within the U.S. He identified that each Solana futures merchandise had low complete property beneath administration. In distinction, the 2x XRP ETF attracted extra funds regardless of launching after the Solana merchandise.

“FWIW, the 2 Solana ETFs in US (which track futures so not a perfect guinea pig) haven’t done much,”

Balchunas posted.

“Very little in AUM.”

He clarified that this efficiency shouldn’t be used to foretell the way forward for spot Solana ETFs in Canada. The product construction and market circumstances are completely different.