The cryptocurrency market continues to captivate buyers worldwide, with a complete market capitalization of roughly $3.51 trillion as of Could 12, 2025. Bitcoin (BTC), Ethereum (ETH), and XRP stay on the forefront of investor consideration, alongside different large-cap cryptocurrencies.

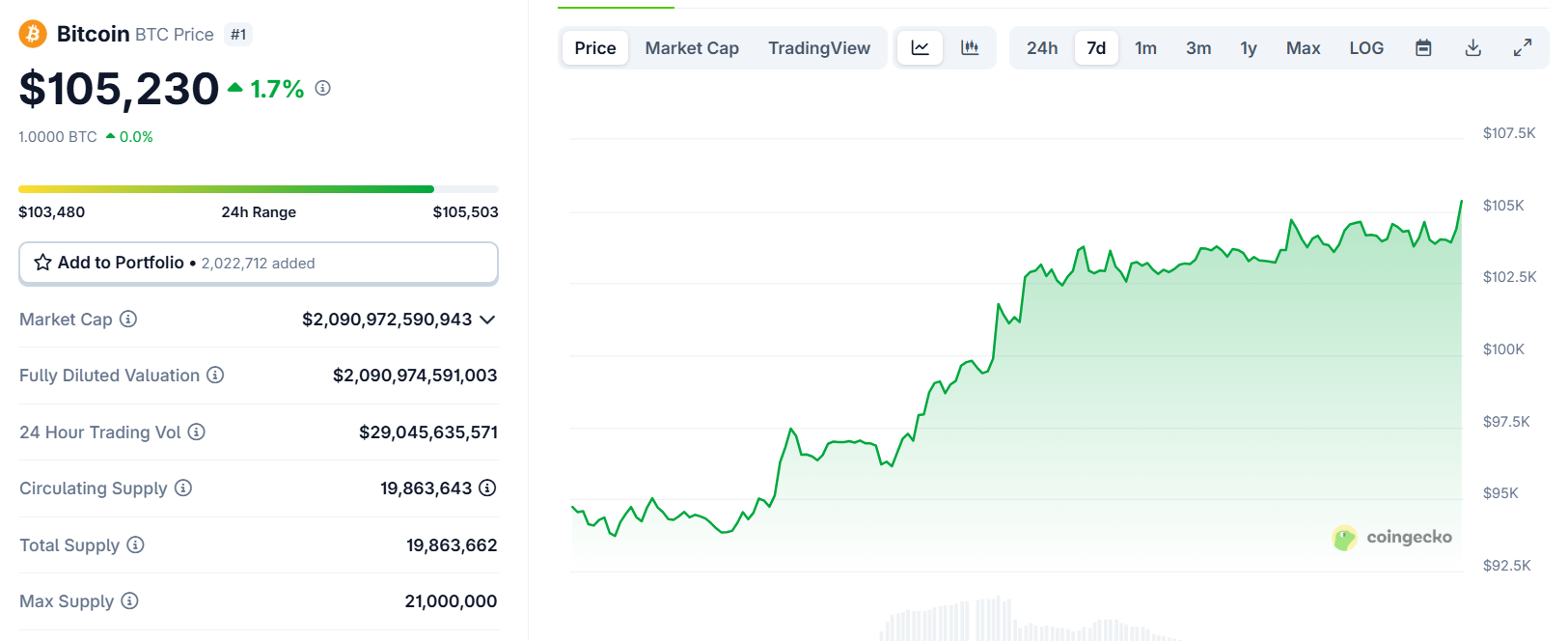

Bitcoin Stays Secure Close to $105k

Bitcoin, the flagship cryptocurrency, is buying and selling at round $106,000, up 2% on the day. Its market dominance stands at 59.6%, underscoring its pivotal position in dictating market sentiment. The momentum is pushed by optimism round macroeconomic developments and U.S. coverage shifts, together with discussions of a strategic Bitcoin reserve.

Supply: CoinGecko

Nonetheless, Bitcoin has since pulled again, with analysts noting low volatility—a 563-day low—suggesting a possible cooling-off section. The fast resistance lies at $97,000, with the psychological $100,000 barrier looming massive. If bullish momentum resumes, analysts mission a push towards $107,000, whereas assist holds agency at $85,645.

Learn extra: CryptoQuant CEO: “A New Era for Bitcoin has Begun”

Market sentiment stays cautiously optimistic, bolstered by institutional adoption and ETF inflows, although issues about macroeconomic uncertainties, comparable to U.S. commerce insurance policies, might introduce volatility.

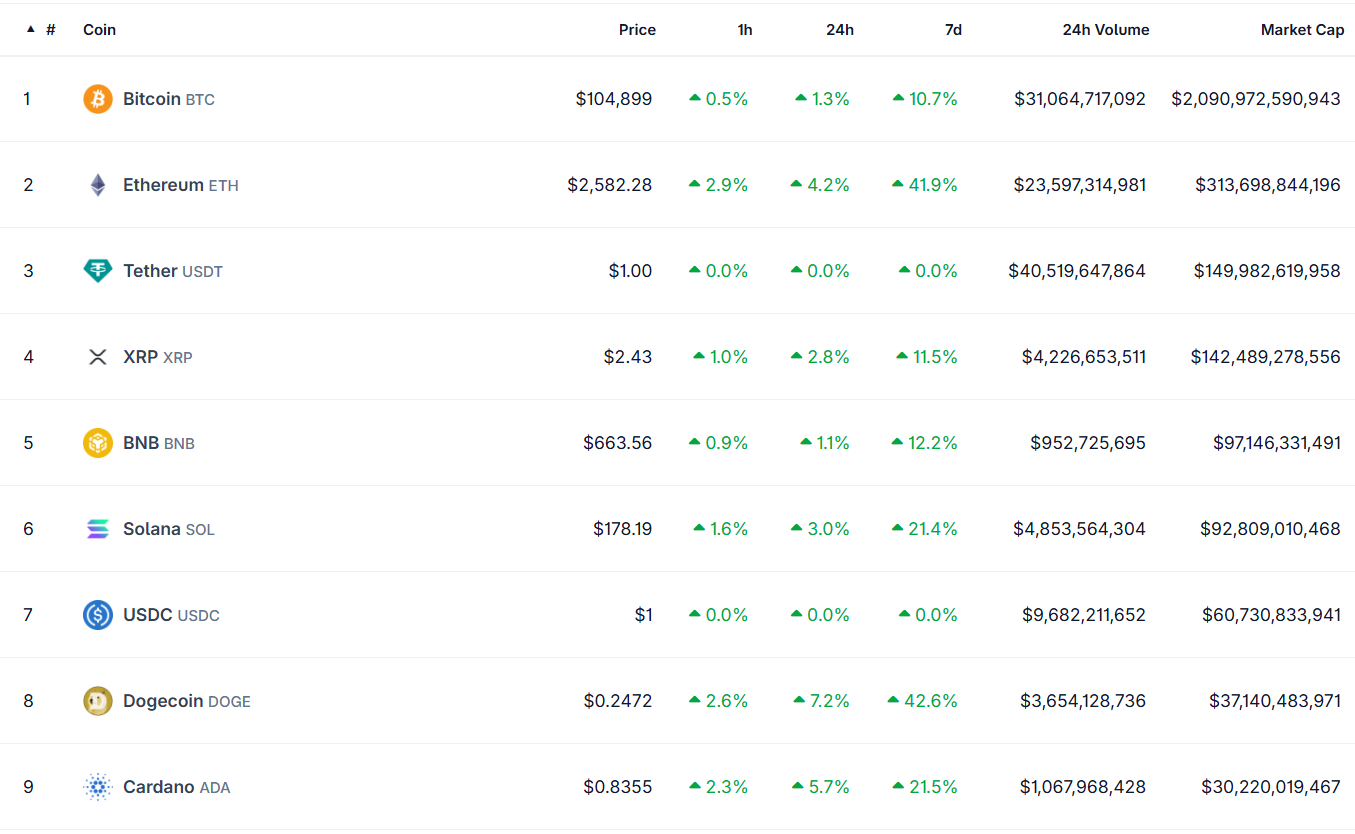

Ethereum’s Market Capitalization Surpasses Coca-Cola

Ethereum, the second-largest cryptocurrency by market cap, is priced at roughly $2,500, reflecting a sturdy 40% weekly acquire and a day by day improve of 4%. With a market cap of $311 billion, ETH has surpassed Coca-Cola’s market worth, rating fortieth within the prime international asset market capitalization.

Supply: CoinGecko

The latest rally is partly attributed to anticipation for the Pectra improve and constructive market sentiment following Bitcoin’s upward motion.

$ETH‘s market cap has surpassed Novo Nordisk and is looking at Coca-Cola, Alibaba and BOA.$ETH is currently the 36th largest asset in the world. pic.twitter.com/bCYdWzAIja

— CW (@CW8900) May 12, 2025

Technical indicators suggest Ethereum is testing resistance around $2,500, with potential to reclaim its multi-month high of $2,600 if bullish momentum persists. However, analysts warn of possible pullbacks to $1,500 if liquidity issues arise.

Vitalik Buterin’s latest feedback on bettering rollup safety have highlighted ongoing growth efforts, reinforcing long-term confidence in Ethereum’s ecosystem. Regardless of occasional underperformance in comparison with Bitcoin, ETH’s position as a sensible contract platform continues to drive institutional curiosity, with ETF outflows not too long ago stabilizing.

Learn extra: BlackRock Proposes Ethereum ETF Staking, Boosting ETH Value

All Eyes on Altcoin Season

Different large-cap cryptocurrencies, comparable to XRP, Solana (SOL), Binance Coin (BNB), exhibit diverse efficiency. Solana is buying and selling at $179, up barely however struggling to regain its $200 highs from earlier in 2025. Analysts forecast a variety for SOL in 2025, from $122 to $490, contingent on continued scalability enhancements. BNB maintains stability, with market caps corresponding to XRP, although they lack the identical upward momentum.

Supply: CoinGecko

The broader altcoin market is displaying indicators of life, with lowering USDT dominance indicating buyers are shifting funds from stablecoins to riskier belongings like ETH and XRP. Nonetheless, an “Altcoin Season” stays elusive, as Bitcoin’s dominance continues to suppress smaller rallies. Meme cash like Dogecoin (DOGE) and Shiba Inu (SHIB) are additionally gaining traction, pushed by social media buzz, however their volatility makes them much less dependable for sustained positive factors.

The crypto market is navigating a fancy panorama formed by macroeconomic components, regulatory developments, and technical developments. The Concern & Greed Index is impartial at 51, reflecting uncertainty amongst buyers. U.S. insurance policies beneath the Trump administration, together with a proposed strategic crypto reserve that includes BTC, ETH, XRP, and SOL, have sparked each optimism and debate. In the meantime, international commerce tensions and potential tariff wars might dampen bullish sentiment, as seen in March 2025 when BTC dropped beneath $83,000.