NAIROBI (CoinChapter.com)— Bitcoin (BTC), Hedera (HBAR), and DogWifHat (WIF) are at crucial factors this week. Bitcoin’s drop beneath $94,000 has shaken confidence, HBAR is consolidating and gearing up for a attainable breakout, and WIF is clinging to assist at $1.50. Right here’s what’s taking place and what may come subsequent.

Bitcoin’s Rally Above $100K Stalls Amid DOJ Bitcoin Sale Issues

Bitcoin surged previous $100,000 earlier this week however confronted intense promoting strain, dropping to $92,500 and shaking market confidence. Issues over the USA Division of Justice’s (DOJ) impending sale of 69,370 Bitcoin, price $6.4 billion, have added to the bearish sentiment. These cash, seized in a historic Silk Street-related hack, had been recovered in 2020 and licensed on the market by a court docket ruling.

Market analyst Axel Adler recognized crucial demand zones between $86,800 and $89,700, representing the short-term holders’ realized price. These ranges may function accumulation zones if the promoting strain eases.

The sale may disrupt the pro-crypto coverage plans of President-elect Donald Trump, who has proposed establishing U.S. crypto reserves. With Bitcoin already retracing from its $108,000 all-time excessive in Dec. 2024, the upcoming liquidation provides to fears of additional draw back.

Nevertheless, Bitcoin’s spot ETFs reported outflows of $568 million on Jan 8, signaling diminished institutional demand. Binance’s stablecoin reserves additionally declined sharply, reflecting weakening shopping for curiosity.

For BTC to get well, reclaiming the $95,000 stage is essential. Failure to carry above $92,000 may expose it to a deeper correction towards the $86,000 vary. Moreover, Donald Trump’s inauguration may influence its trajectory.

HBAR Poised for a Breakout as Merchants Eye Key Ranges

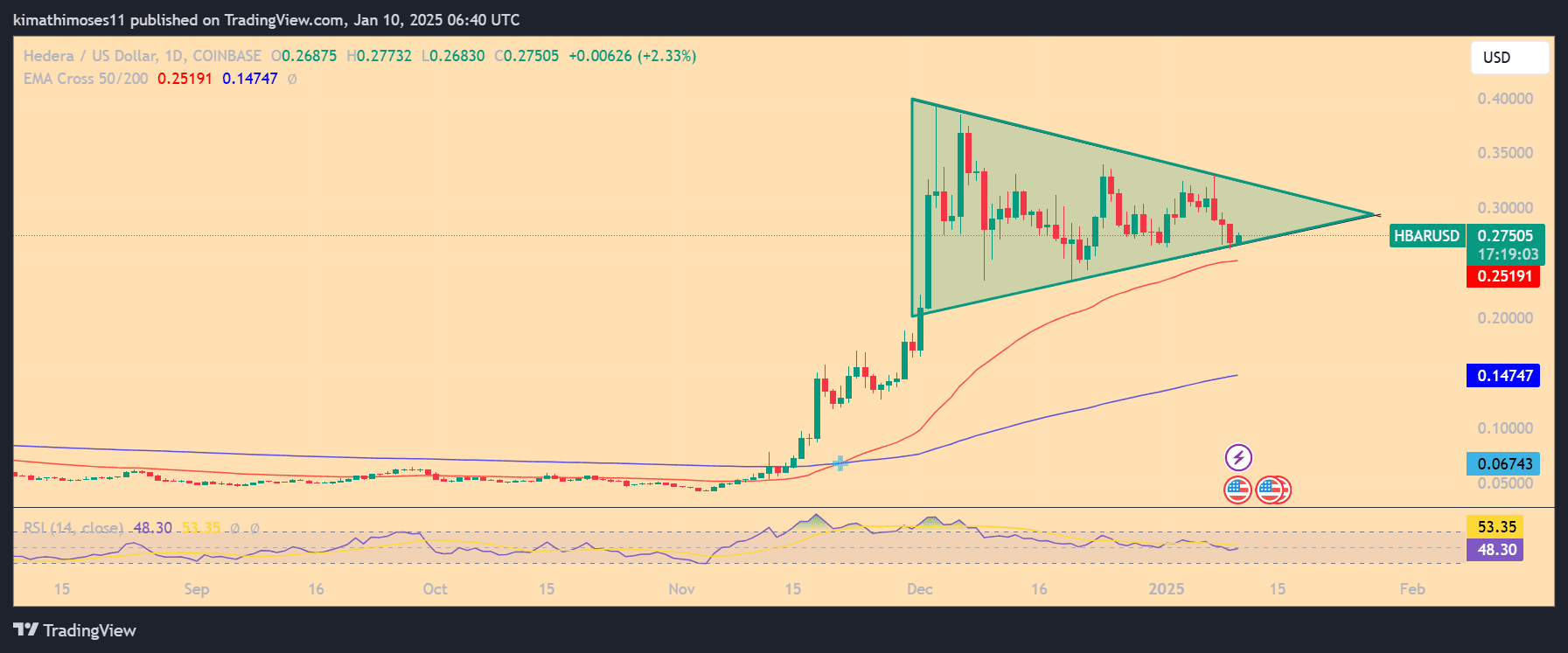

Hedera (HBAR) has been locked in a decent consolidation vary between $0.25 and $0.33, with its symmetrical triangle sample signaling a possible breakout.

The 50-day EMA at $0.25 is appearing as sturdy assist, aligning with the triangle’s decrease boundary. A breakdown beneath this stage may push HBAR towards $0.20, intensifying promoting strain.

Conversely, a breakout above the triangle’s higher boundary close to $0.30 may ignite a rally concentrating on $0.33 and better. The Relative Energy Index (RSI) at 53.35 suggests impartial momentum, leaving room for a major transfer in both path.

HBAR’s price additionally stays influenced by Bitcoin’s broader market actions, with a correlation of 0.65 highlighting its dependency on the crypto chief.

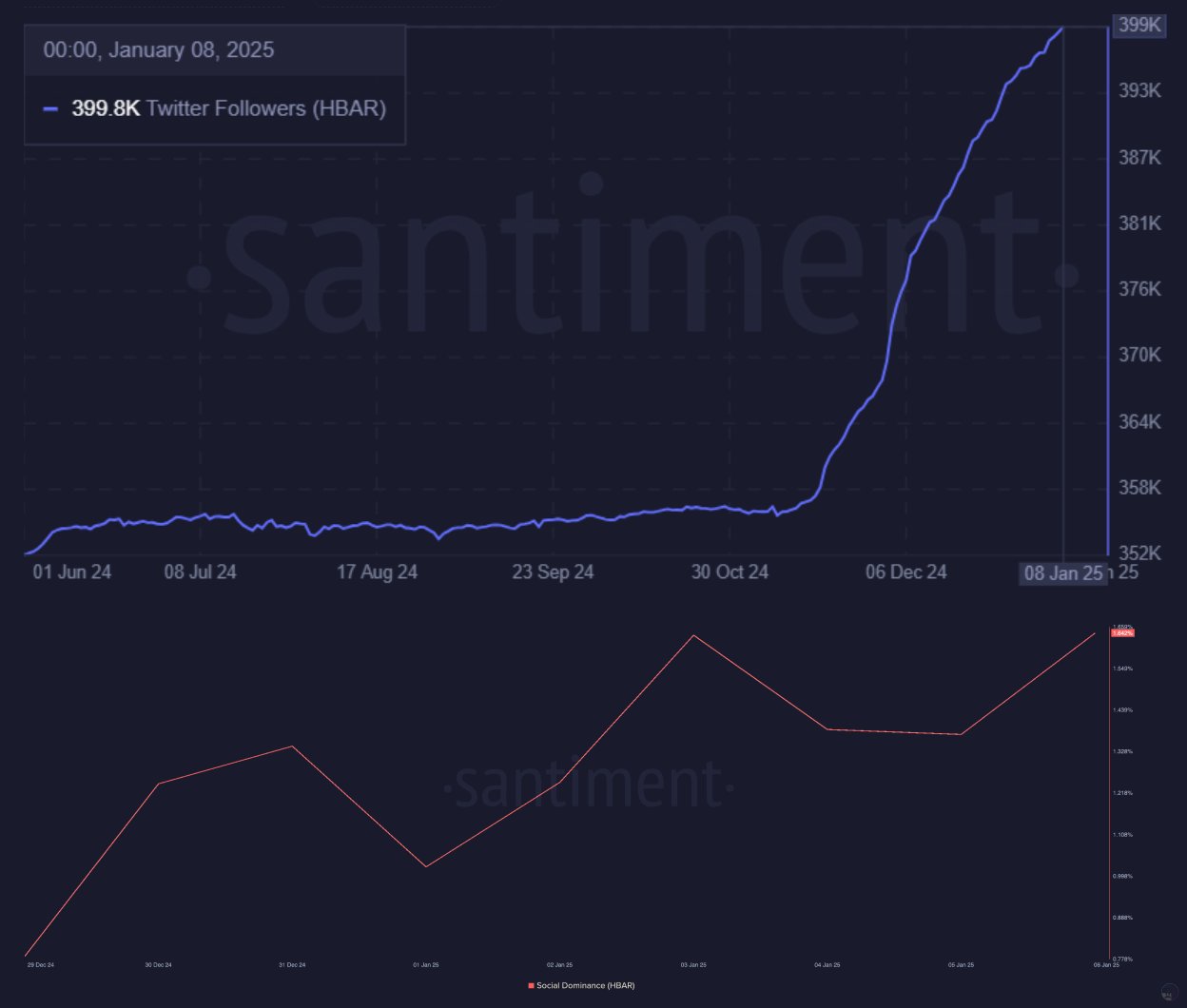

Regardless of market uncertainty, HBAR has drawn elevated consideration on account of its partnerships with NVIDIA and Intel, which place it as a key participant in AI governance options.

Social metrics are additionally surging, with its Twitter followers rising by 50,000 in simply 60 days, signaling rising neighborhood curiosity.

Whereas these developments present a bullish backdrop, merchants are carefully watching the triangle’s breakout path for affirmation. A sustained transfer above $0.30 may pave the best way for vital positive factors, whereas a drop beneath $0.25 dangers additional losses.

DogWifHat (WIF) Eyes Key Reversal as Bears Take a look at $1.50 Help

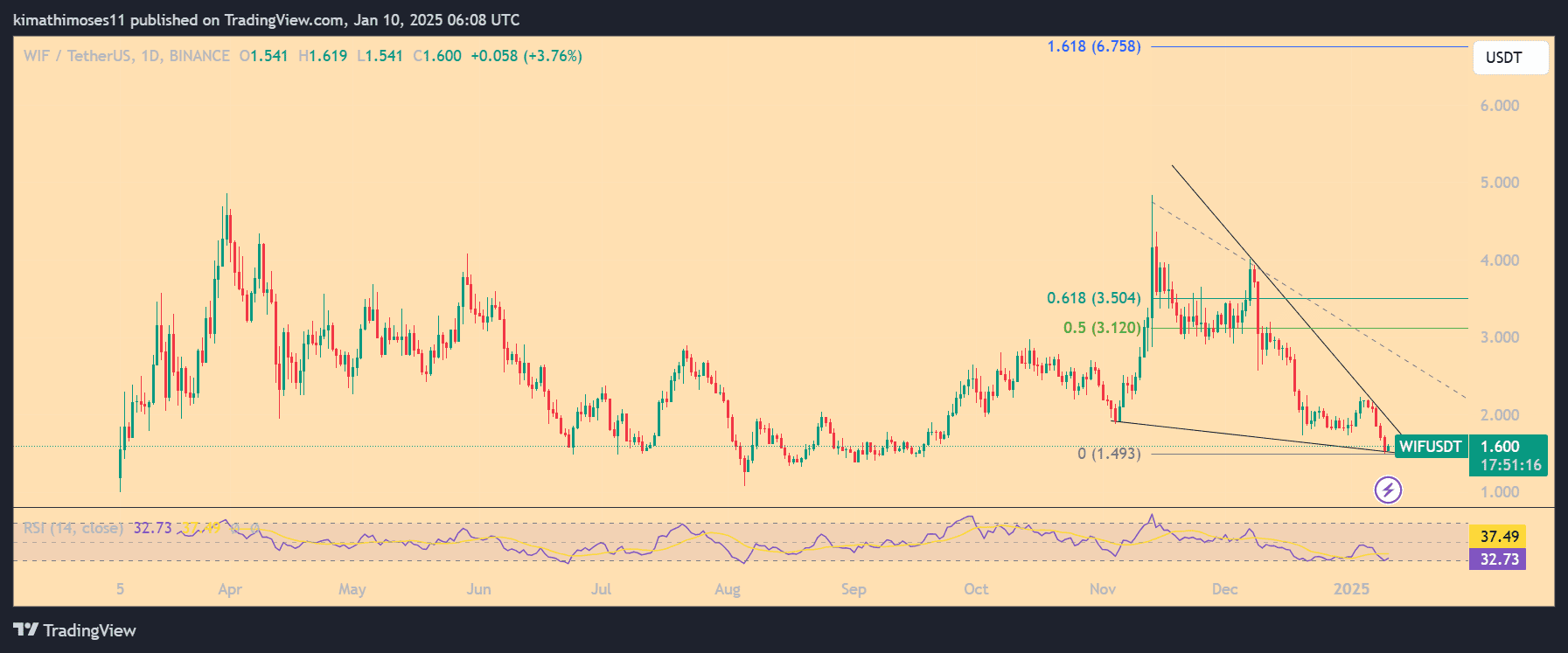

DogWifHat (WIF), a distinguished meme coin, is navigating an important juncture after sliding from its $3 peak to $1.60. The bearish sentiment is underpinned by a double-top formation and a descending trendline, with crucial Fibonacci ranges including to the drama. Presently, the token is testing the 0.786 retracement stage at $1.50, a make-or-break zone for a possible reversal.

The RSI at 37.49 signifies oversold situations, which may entice consumers at these ranges.

Analyst @greenytrades on X has flagged $1.50 as a main re-entry zone, citing favorable risk-reward dynamics. Nevertheless, a failure to carry this assist dangers a plunge towards $1.25, intensifying bearish momentum.

On the flip aspect, reclaiming $2.44 (the 0.5 Fibonacci stage) may spark a rally, concentrating on $3.50 as the following main resistance.

Market sentiment stays shaky, with WIF closely influenced by BTC’s price actions.

General, BTC, HBAR, and WIF face distinctive challenges, with Bitcoin’s assist ranges shaping broader market traits. HBAR’s potential is tied to Bitcoin’s efficiency, whereas WIF’s speculative nature makes it reliant on market sentiment.