YEREVAN (CoinChapter.com) — The Superior Court docket of Justice in Brazil approved judges to grab cryptocurrencies for debt assortment. The Third Panel of the court docket voted unanimously to let judges inform crypto exchanges concerning the determination and freeze property when debtors fail to pay.

In keeping with the court docket’s memo, crypto doesn’t qualify as authorized tender. Nonetheless, it nonetheless capabilities as a retailer of worth and a type of fee. That classification now places crypto property below the identical authorized instruments already used to grab conventional financial institution accounts.

The assertion from the court docket learn:

“Although they are not legal tender, crypto assets can be used as a form of payment and as a store of value.”

The choice applies to any case the place a creditor brings a legitimate declare. As soon as a ruling is made, courts can instruct crypto brokers to freeze or switch property with out notifying the account holder prematurely.

Brazilian legislation already permits judges to freeze financial institution accounts or withdraw funds with out warning when a debt is confirmed. The brand new ruling now locations crypto below the identical authority. Judges might deal with digital property like different monetary holdings when dealing with unpaid money owed.

Minister Ricardo Villas Bôas Cueva, one among 5 panel members, famous that Brazil lacks a full authorized framework for digital property. Nonetheless, some payments already outline cryptocurrencies as “a digital representation of value,” making a foundation for enforcement.

This determination offers courts further instruments to implement rulings and get well cash owed. The Brazil crypto seizure ruling displays a broader sample of together with digital property in monetary authorized constructions.

Brazil Crypto Regulation Nonetheless Ongoing

Brazil doesn’t but have full guidelines for digital property. The central financial institution is engaged on laws in a number of phases, however no unified legislation covers the sector.

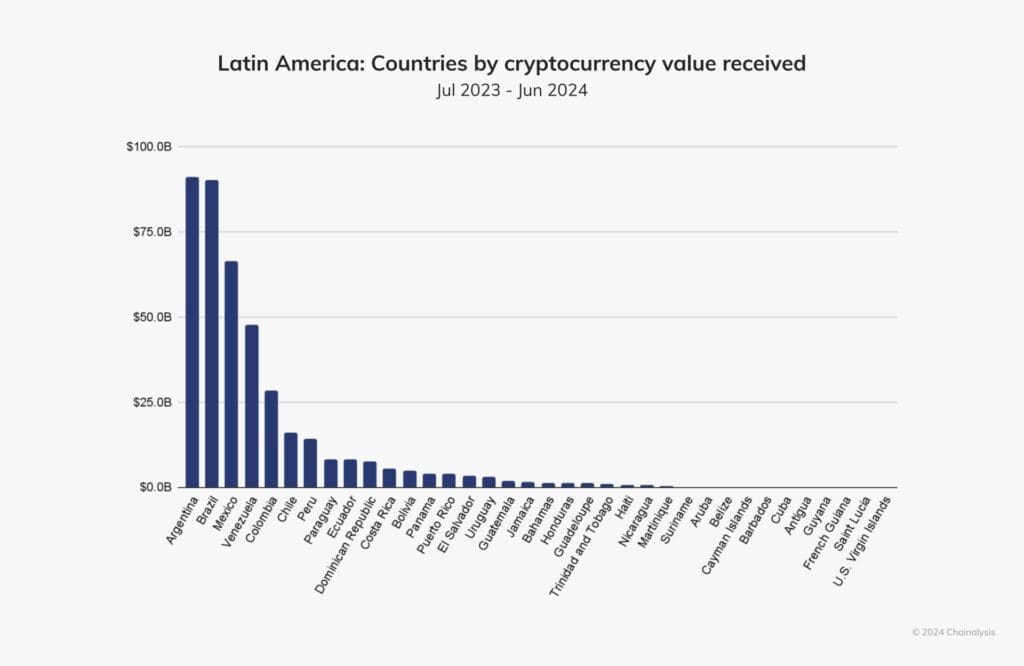

Regardless of this, Brazil ranks second in Latin America for crypto worth acquired, in response to an October report by Chainalysis. The report exhibits Brazil trails solely Argentina on this metric as of June 2024.

This progress in utilization continues at the same time as regulators transfer slowly. Binance Brazil acquired official approval to function earlier this yr after shopping for a São Paulo funding agency. A Binance spokesperson informed Cointelegraph that the nation is advancing towards a regulatory framework, with expectations for a full plan “by mid-year.”

Stablecoin Brazil Proposal Faces Trade Criticism

In December 2023, Brazil’s central financial institution proposed banning stablecoin transactions in self-custodial wallets. The transfer got here as many Brazilians turned to dollar-linked tokens to protect in opposition to the falling worth of the true.

Trade individuals responded to the proposal. Lucien Bourdon, analyst at Trezor, stated:

“Governments can regulate centralized exchanges, but P2P transactions and decentralized platforms are much harder to control, which means the ban would likely only affect part of the ecosystem.”

Whereas this proposed rule isn’t but enforced, it exhibits a break up in Brazil crypto regulation. Centralized exchanges stay inside authorities management, whereas peer-to-peer transactions and decentralized finance are tougher to observe.

This displays the bigger problem of imposing crypto-related legal guidelines in a decentralized system. The Brazil crypto seizure ruling applies solely to property held on registered platforms.