Onchain Highlights

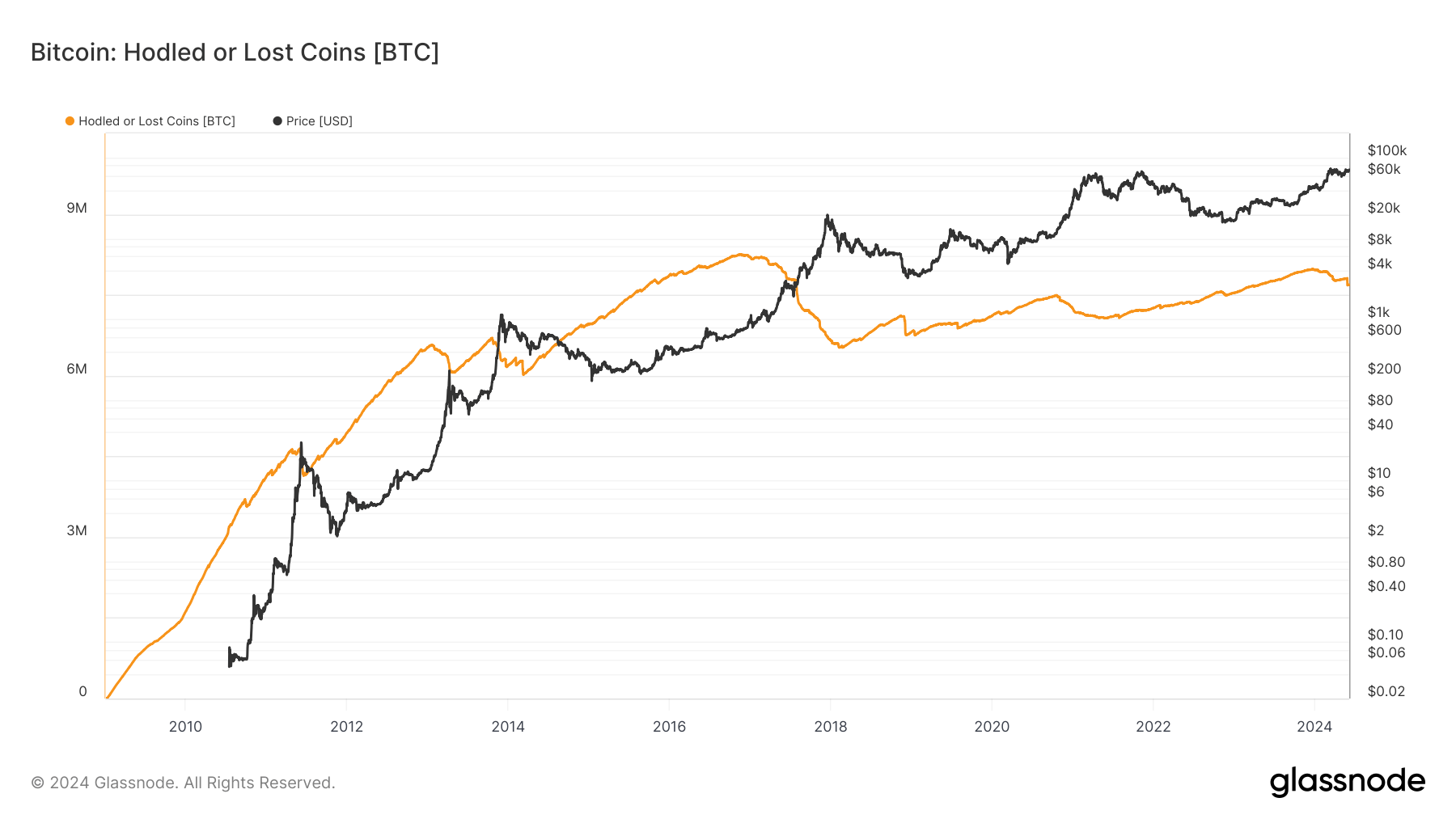

DEFINITION: Misplaced or HODLed Bitcoins point out strikes of enormous and outdated stashes. They’re calculated by subtracting Liveliness from 1 and multiplying the consequence by the circulating provide.

Bitcoin’s “Hodled or Lost Coins” metric, as tracked by Glassnode, has reached notable ranges, reflecting long-term tendencies in investor habits. Glassnode estimates roughly 7.7 million BTC are both hodled or misplaced, considerably impacting the circulating provide and market forces.

In current months, the metric has proven a lower in hodled or misplaced cash, significantly in 2024. This shift suggests a potential reallocation of Bitcoin holdings as traders reply to market situations post-halving. The final important decline was in Could, coinciding with Mt. Gox shifting Bitcoin to a brand new pockets. Since January, there has additionally been a gradual decline, correlating with promoting strain from Grayscale, which held Bitcoin which will have been thought of ‘hodled.’

Glassnode’s knowledge highlights that intervals of elevated hodling sometimes correlate with diminished promote strain, probably resulting in bullish price motion. For instance, throughout earlier bear markets, elevated hodling usually preceded important price recoveries.

Per CryptoSlate’s analysis, the present development could replicate strategic selections by long-term holders to retain or consolidate their positions in anticipation of future market actions (CryptoSlate). This habits emphasizes the significance of monitoring on-chain metrics to grasp broader market sentiments and investor methods.