Bitcoin’s potential to hit $100,000 stays a subject of eager curiosity amongst buyers. Numerous market dynamics and financial indicators counsel that this formidable goal continues to be inside attain.

Consultants share insights on what it should take for Bitcoin to attain this milestone.

The Path to a $100,0000 Bitcoin

Felix Mohr, co-founder of MohrWolfe, informed BeInCrypto about Bitcoin’s potential, emphasizing the rising demand and rising Open Curiosity (OI). Just lately, Bitcoin futures OI surged by $2.02 billion in simply three days.

“This increased buying interest in Bitcoin is no coincidence. Investors have made it clear they anticipate two US Federal Reserve rate cuts by the end of the year,” Mohr defined.

Certainly, investor sentiment is considerably influenced by speculations surrounding the Federal Reserve’s financial coverage. A Reuters ballot signifies a possible price lower in September, though there’s a threat of fewer cuts or none in any respect.

“Nearly two-thirds of economists, 74 of 116, in the May 31-June 5 Reuters poll predicted the first cut in the Fed funds rate to a 5.00%-5.25% range would come in September. That was the same conclusion as last month’s poll, with a similar majority,” reads the Reuters report.

Traditionally, Bitcoin advantages from a bullish inventory market, which might be invigorated by Fed price cuts. Nevertheless, Federal Reserve Chair Jerome Powell stays cautious and financial indicators additional complicate the image.

The Client Worth Index (CPI) elevated by 3.4% over the previous 12 months, whereas Core CPI rose by 3.9%. The Producer Worth Index (PPI) additionally exceeded expectations, climbing 2.2% yearly. These figures counsel persistent inflation, which can deter the Fed from aggressive price cuts.

“Amid the flurry of subpar economic data, the SP500 is at a record high, indicating a potential for reversal. Bitcoin and traditional markets have historically moved in tandem. A correction in traditional markets could collapse the Bitcoin price,” Mohr informed BeInCrypto.

Learn extra: Methods to Shield Your self From Inflation Utilizing Cryptocurrency

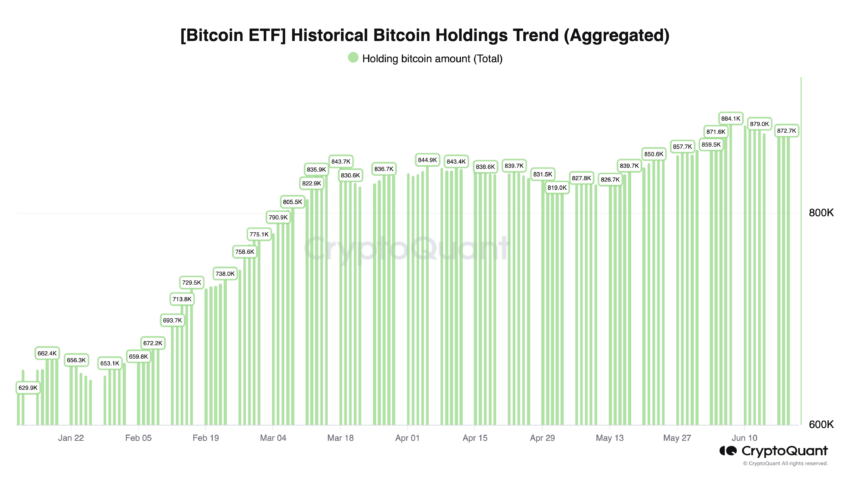

Nonetheless, Bitcoin’s trajectory can also be influenced by institutional curiosity. The approval of Bitcoin exchange-traded funds (ETFs) by the SEC has been a major catalyst.

The anticipation of Ethereum ETF approvals by main monetary establishments later this 12 months may additionally drive substantial price will increase.

“Bitcoin has surpassed that all-time high to establish a new high of nearly $74,000 set in mid-March. The march towards $100,000 by year’s end begins again if indeed, the Fed cuts rates twice,” Mohr concluded.

Such an optimistic state of affairs is supported by Bernstein Analysis. The agency tasks Bitcoin to achieve $200,000 by 2025, $500,000 by 2029, and $1 million by 2033.

Bernstein’s analysts argue that Bitcoin ETFs, which have seen preliminary retail-driven allocations, are poised for broader adoption as main wirehouses and personal banks put together to supply these funding merchandise.

Learn extra: Bitcoin (BTC) Worth Prediction 2024 / 2025 / 2030

This institutional foundation commerce, they contend, acts as a “trojan horse” for wider adoption, probably reworking Bitcoin right into a mainstream asset class. Due to this fact, Bitcoin’s path to $100,000 and past stays achievable, contingent on favorable financial insurance policies and continued institutional curiosity.

Disclaimer

In adherence to the Belief Challenge pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.