Bitcoin {{BTC}} has plunged 15% over the previous month, with many market observers inserting the blame on promoting stress from bitcoin mining operators, Mt. Gox refunds and, most not too long ago, the German state of Saxony.

The case for the above catalysts as behind the foremost price decline has been overstated, stated Greg Cipolaro, research head at NYDIG, in a Wednesday be aware.

“While emotions and psychology may rule over the short-term, our analysis suggests that the price impact from potential selling may be overblown,” he wrote.

“We aren’t oblivious to the fact that other factors may be at play here, but it is reasonable to think that the rational investor may find this an interesting opportunity created by irrational fears,” he added.

Over the previous weeks, traders have been fixated on transfers associated to Bitcoin addresses linked to the property of defunct alternate Mt. Gox, the U.S. authorities and the German state of Saxony, sparking fears about imminent gross sales of the over $20 billion price of stash these three entities held mixed.

Learn extra: It is Not Germany Promoting Bitcoin. It is Considered one of Its States and It Has No Alternative.

Even when all three have been promoting all their belongings – roughly 375,000BTC as of June 9 – without delay, Cipolaro discovered that BTC’s price decline over the previous weeks was deeper than it will have been for shares based mostly on Bloomberg’s transaction value analysis (TCA) – a well-followed indicator lengthy utilized in conventional markets for estimating the price affect of block gross sales of widespread shares.

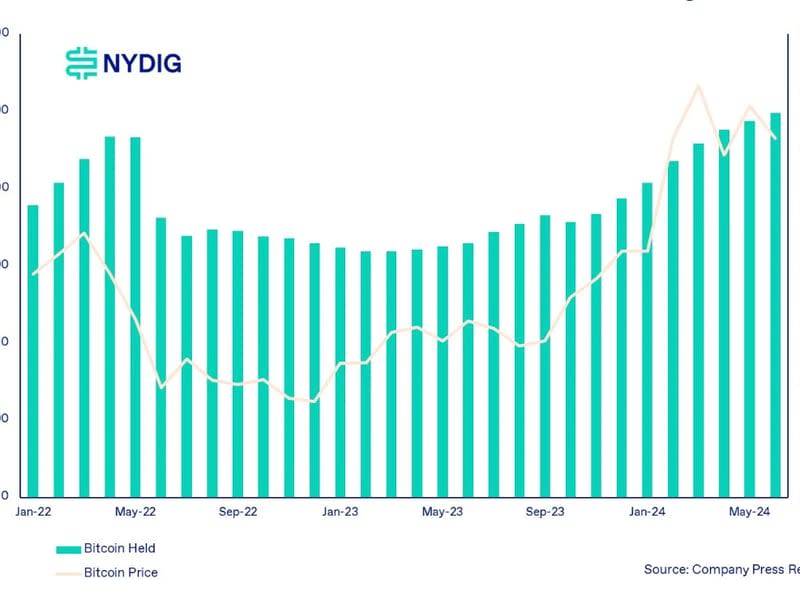

Cipolaro additionally argued that current stories about miners capitulating and promoting their BTC stash en masse after this yr’s halving occasion has not simply been overstated, however in some instances wholly inaccurate.

NYDIG’s information confirmed that publicly listed mining firms really elevated their bitcoin holdings in June. And whereas the quantity of BTC offered picked up barely final month, it was nonetheless properly beneath ranges seen earlier this yr and final yr.

Cipolaro suggested in opposition to counting on blockchain information about miners shifting belongings with out understanding the character of these transactions. “Identifying that bitcoins move to an exchange or OTC desk, even if done correctly, only tells us that coins moved. That’s it,” he argued. “They could’ve been posted as collateral or lent out, not necessarily sold.”