- Bitcoin spot ETFs obtained the second consecutive day of inflows this week on Tuesday.

- On June 5 and 6, 35,486 BTC outflowed from BitMEX, marking the second-largest BTC outflow within the alternate.

- Regardless of FUD from Mt. Gox and the German authorities, on-chain knowledge reveals traders quietly accumulating BTC.

- Technical analysis reveals that BTC has fashioned a bullish divergence on a momentum indicator.

Bitcoin (BTC) has encountered resistance close to the $58,375 weekly degree through the previous few days, making an attempt to interrupt and hovering simply above it at $58,865 on the time of writing on Wednesday. Concurrently, on-chain knowledge reveals quiet BTC accumulation, alongside a notable outflow of 35,486 BTC from exchanges on June 5 and 6, marking BitMEX’s second-largest outflow in historical past. As well as, Bitcoin spot ETFs obtained $216.4 million in inflows on Tuesday, marking the second consecutive day of constructive netflows this week. Technical analysis additionally signifies a bullish divergence on a momentum indicator, suggesting a possible rally forward.

Every day digest market movers: Bitcoin has recorded the second-largest Bitcoin outflow in BitMEX historical past

- In keeping with on-chain market intelligence and analytics platform CryptoQuant, Bitcoin Alternate Netflow knowledge from BitMEX has recorded the second-largest Bitcoin outflow in historical past. Traditionally, the Alternate Netflow indicator on BitMEX has proven a robust inverse correlation with Bitcoin price actions.

- When this indicator turns extremely detrimental, indicating vital BTC outflows from exchanges, Bitcoin’s price rises. Giant BTC outflows from BitMEX counsel that main traders withdraw their holdings, presumably for chilly storage or strategic gross sales on different platforms. This habits reduces speedy promoting stress on the alternate, stabilizing or probably growing Bitcoin’s price.

- Lately, an outflow of 35,486 BTC occurred, marking the second-largest BTC outflow in BitMEX’s historical past.

Bitcoin Alternate Netflow (Whole) – BitMex chart

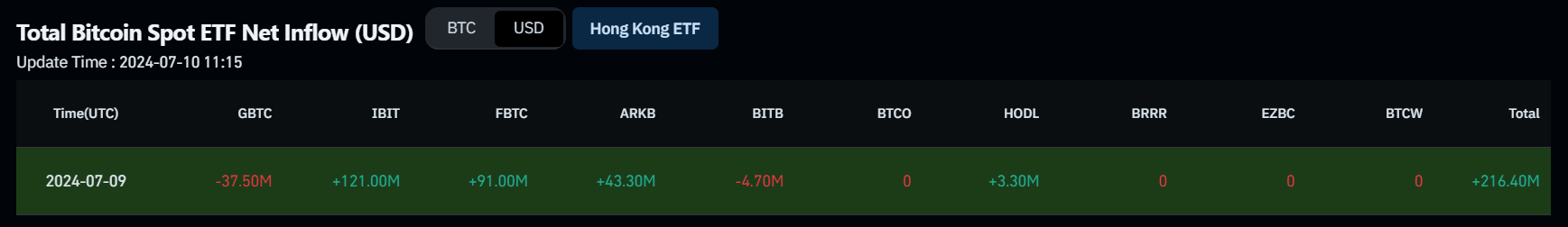

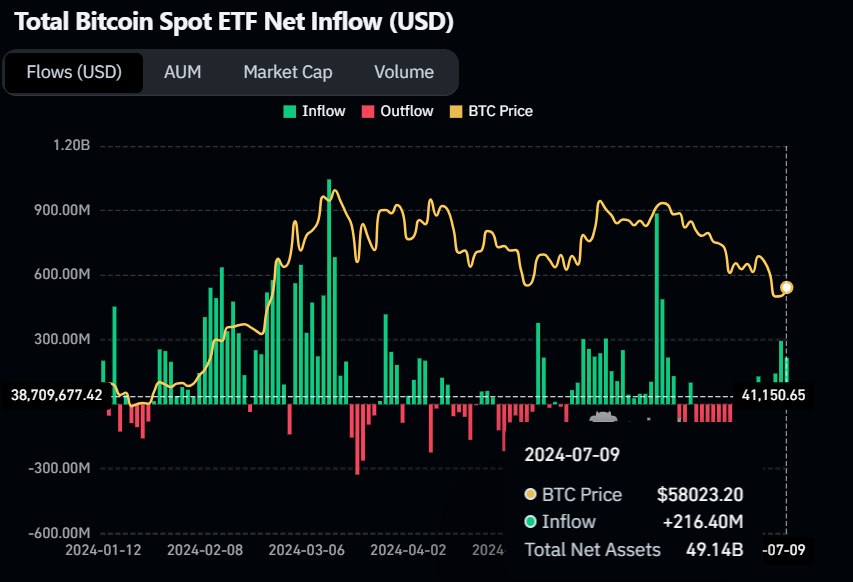

- On Tuesday, US spot Bitcoin ETFs recorded their second consecutive day of inflows this week of $216.4 million. This surge signifies growing investor confidence, suggesting a possible short-term uptick in Bitcoin’s price. Monitoring internet influx knowledge from these ETFs is significant for assessing investor sentiment and comprehending market tendencies. Collectively, the 11 US spot Bitcoin ETFs presently maintain reserves amounting to $49.14 billion in Bitcoin.

Bitcoin Spot ETF Internet Influx chart

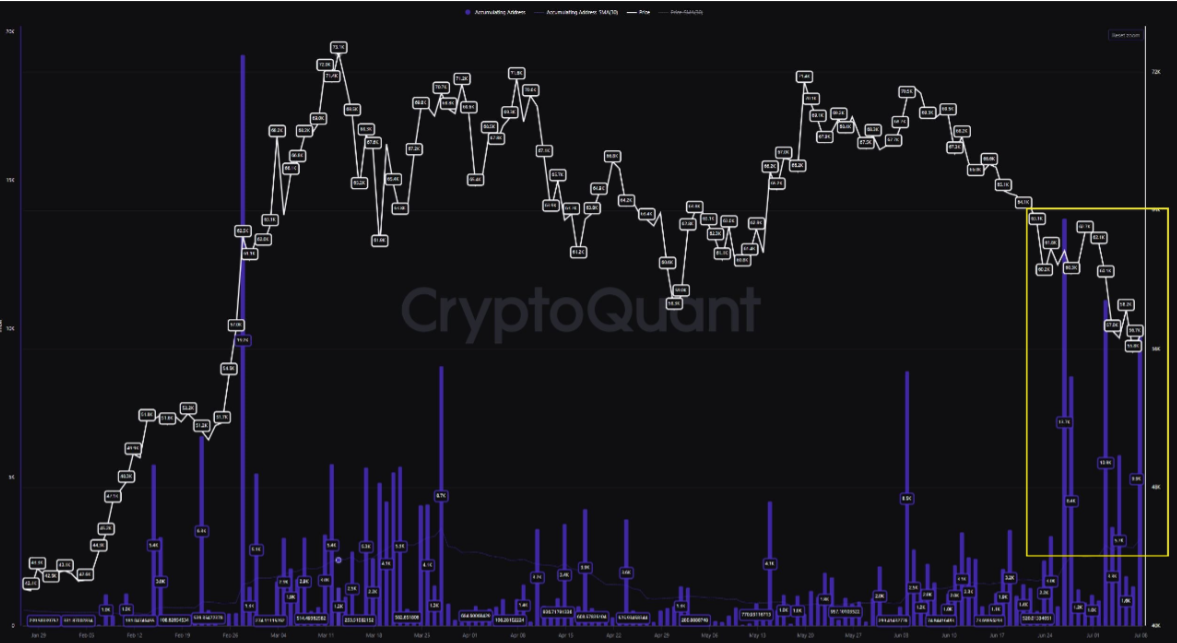

- Moreover, knowledge from CryptoQuant reveals that amid the FUD (Worry, Uncertainty, Doubt) triggered by Mt. Gox’s and the German authorities’s fund transfers on exchanges over the previous weeks, sure traders are discreetly accumulating BTC, as proven within the chart beneath.

Bitcoin Accumulation chart

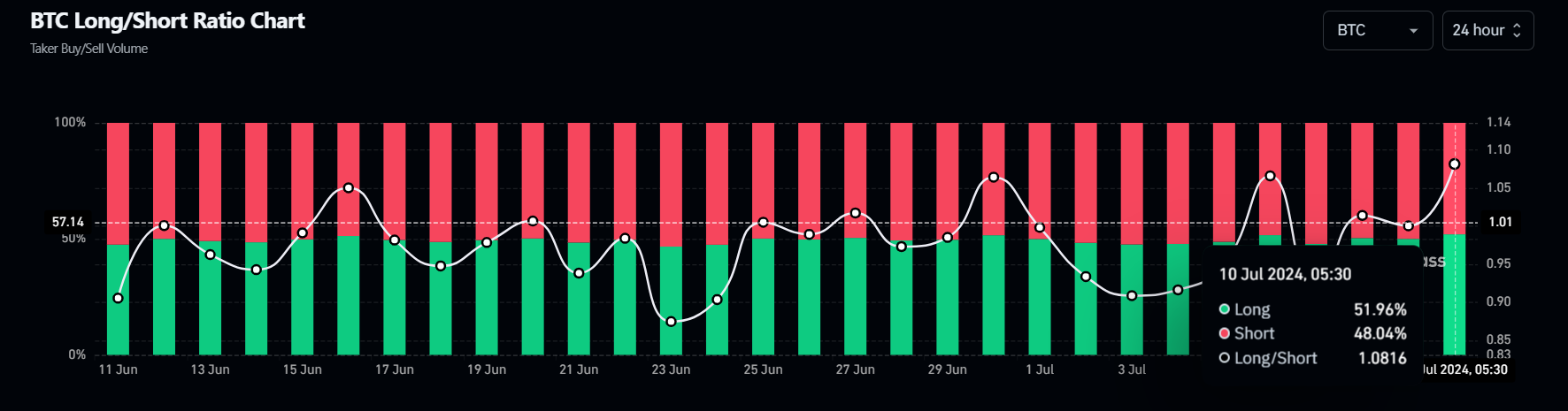

- Coinglass Bitcoin Lengthy/Brief Ratio offers perception into market sentiment amongst merchants and traders relating to Bitcoin’s price path. A excessive lengthy/quick ratio usually suggests bullish sentiment, indicating that extra merchants are betting on growing Bitcoin’s price. Conversely, a low ratio might point out bearish sentiment, suggesting extra merchants count on Bitcoin’s price to lower.

- In BTC’s case, the long-to-short ratio was 1.081, which means there are 1.081 instances as many lengthy positions as quick positions, additional bolstering BTC’s bullish outlook.

Bitcoin Lengthy/Brief Ratio chart

Technical analysis: BTC momentum indicators present bullish divergence

Bitcoin price has confronted resistance close to the weekly degree of $58,375 over the past 4 days. BTC/USDT is testing that degree and hovers simply above $58,865, marking a 1.3% improve on Wednesday.

Moreover, the formation of a decrease low within the day by day chart on July 5 contrasts with the Relative Power Index’s (RSI) larger excessive throughout the identical interval. This growth is termed a bullish divergence and infrequently results in the reversal of the pattern or a short-term rally.

If BTC’s day by day candlestick closes above the $58,375 weekly resistance degree, it may rise 9% to revisit the day by day resistance at $63,956.

BTC/USDT day by day chart

Then again, if BTC closes beneath the $52,266 day by day help degree and varieties a decrease low within the day by day time-frame, it may point out that bearish sentiment persists. Such a growth might set off a 4% decline in Bitcoin’s price to revisit its day by day low of $50,521 from February 23.

Cryptocurrency metrics FAQs

The developer or creator of every cryptocurrency decides on the entire variety of tokens that may be minted or issued. Solely a sure variety of these property could be minted by mining, staking or different mechanisms. That is outlined by the algorithm of the underlying blockchain know-how. Since its inception, a complete of 19,445,656 BTCs have been mined, which is the circulating provide of Bitcoin. Then again, circulating provide will also be decreased through actions corresponding to burning tokens, or mistakenly sending property to addresses of different incompatible blockchains.

Market capitalization is the results of multiplying the circulating provide of a sure asset by the asset’s present market worth. For Bitcoin, the market capitalization at the start of August 2023 is above $570 billion, which is the results of the greater than 19 million BTC in circulation multiplied by the Bitcoin price round $29,600.

Trading quantity refers back to the complete variety of tokens for a particular asset that has been transacted or exchanged between patrons and sellers inside set buying and selling hours, for instance, 24 hours. It’s used to gauge market sentiment, this metric combines all volumes on centralized exchanges and decentralized exchanges. Growing buying and selling quantity usually denotes the demand for a sure asset as extra individuals are shopping for and promoting the cryptocurrency.

Funding charges are an idea designed to encourage merchants to take positions and guarantee perpetual contract costs match spot markets. It defines a mechanism by exchanges to make sure that future costs and index costs periodic funds repeatedly converge. When the funding price is constructive, the price of the perpetual contract is larger than the mark price. This implies merchants who’re bullish and have opened lengthy positions pay merchants who’re in brief positions. Then again, a detrimental funding price means perpetual costs are beneath the mark price, and therefore merchants with quick positions pay merchants who’ve opened lengthy positions.