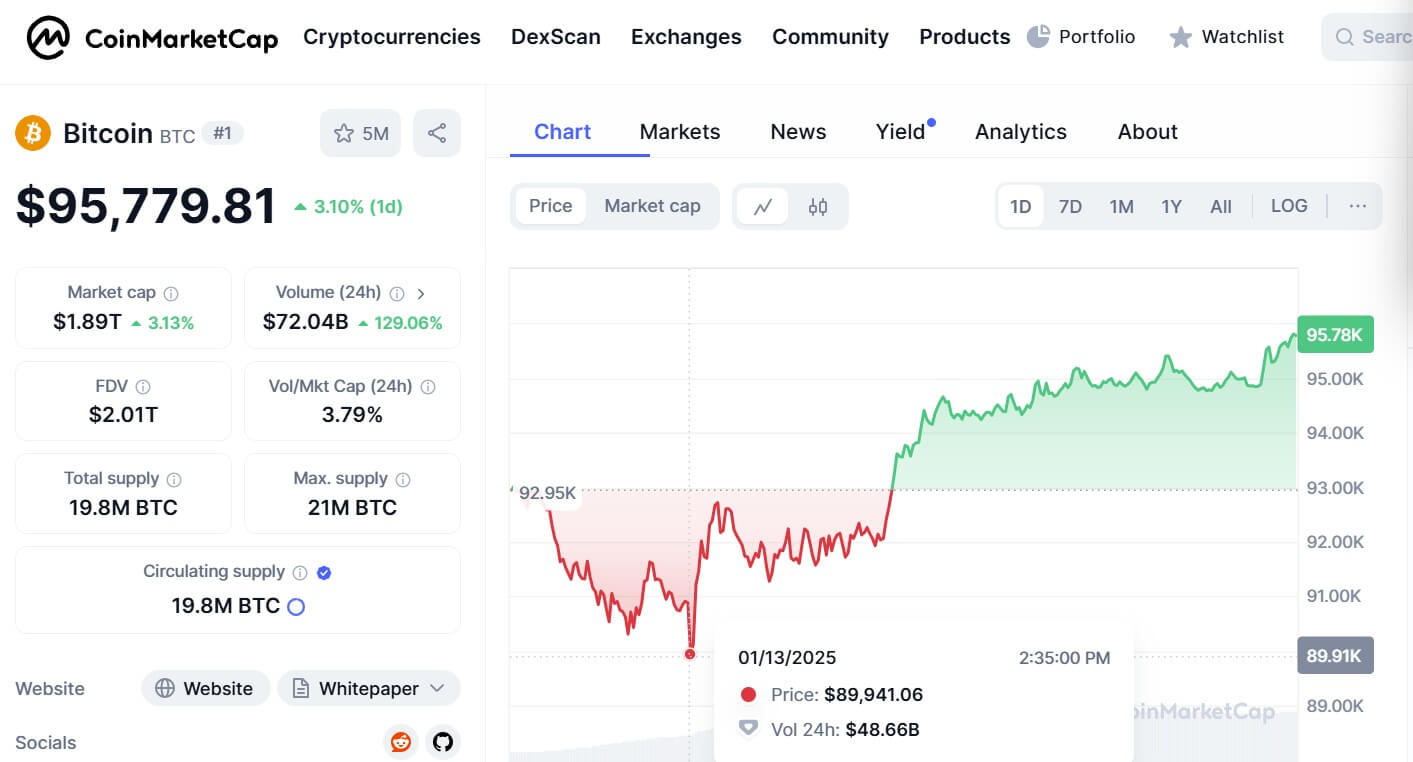

- Bitcoin dropped to $89,900 on January 13, its lowest decline in two months

- James Toledano, COO at Unity Pockets, mentioned one of many causes for the drop is profit-taking after Bitcoin hit $108,000 in mid-December

- The inauguration of President-elect Donald Trump may spark renewed shopping for curiosity, Toledano mentioned

Bitcoin fell under $90,000 for the primary time in two months, dropping 3.6% in 24 hours because the market skilled promoting stress.

Information from CoinMarketCap reveals that Bitcoin’s price dropped to round $89,900 on January 13. Nevertheless, on the time of publication, it’s buying and selling over $95,000.

In accordance with James Toledano, COO at Unity Pockets, there are a number of the explanation why Bitcoin’s price fell.

“The first is profit-taking, after hitting a peak of around $108,300 in mid-December, the market has seen a massive amount of it, particularly following the election of pro-crypto President-elect Donald Trump,” he mentioned to CoinJournal, including:

“Secondly, while institutional buying has continued contributing to Bitcoin reserves on exchanges hitting a seven-year low, trading volume remains subdued and this could simply be down to a seasonal slow-down.”

Macroeconomics weigh available on the market

Latest analysis means that bleak financial expectations drive this bearish sentiment. This contains Trump’s tariff plans, the US Federal Reserve’s cautious strategy to rate of interest cuts, and a powerful greenback.

Zach Pandl, head of research at Grayscale Investments, mentioned to CNBC that:

“I would attribute the drawdown in the last two days largely to the market starting to appreciate that not every aspect of the Trump policy agenda is going to be positive for Bitcoin – and tariffs do introduce some new uncertainty.”

As questions encompass Trump’s forthcoming insurance policies, it could have dampened enthusiasm, which might “lead to short-term volatility for an already highly volatile asset,” mentioned Toledano.

Some analysts consider Bitcoin can attain between $140,000 and $200,000 by mid-2025, so the present price motion might seem regarding. But, it doesn’t essentially sign the top of the bull run.

“The inauguration of President-elect Trump is just seven days away and could be a pivotal moment, with markets anticipating announcements of pro-crypto policies that might spark renewed buying interest,” mentioned Toledano. “Institutional accumulation, as reflected in falling exchange reserves also supports the view that demand remains strong despite low trading volumes.”