Fast Take

Based on Newhedge, Bitcoin’s mining problem has decreased by -0.78%. That is the second adverse adjustment within the final 4, following the Bitcoin halving on April 20. The halving led to a delayed hash price drawdown because of sustained excessive charges from Runes, which incentivized some miners to remain on-line.

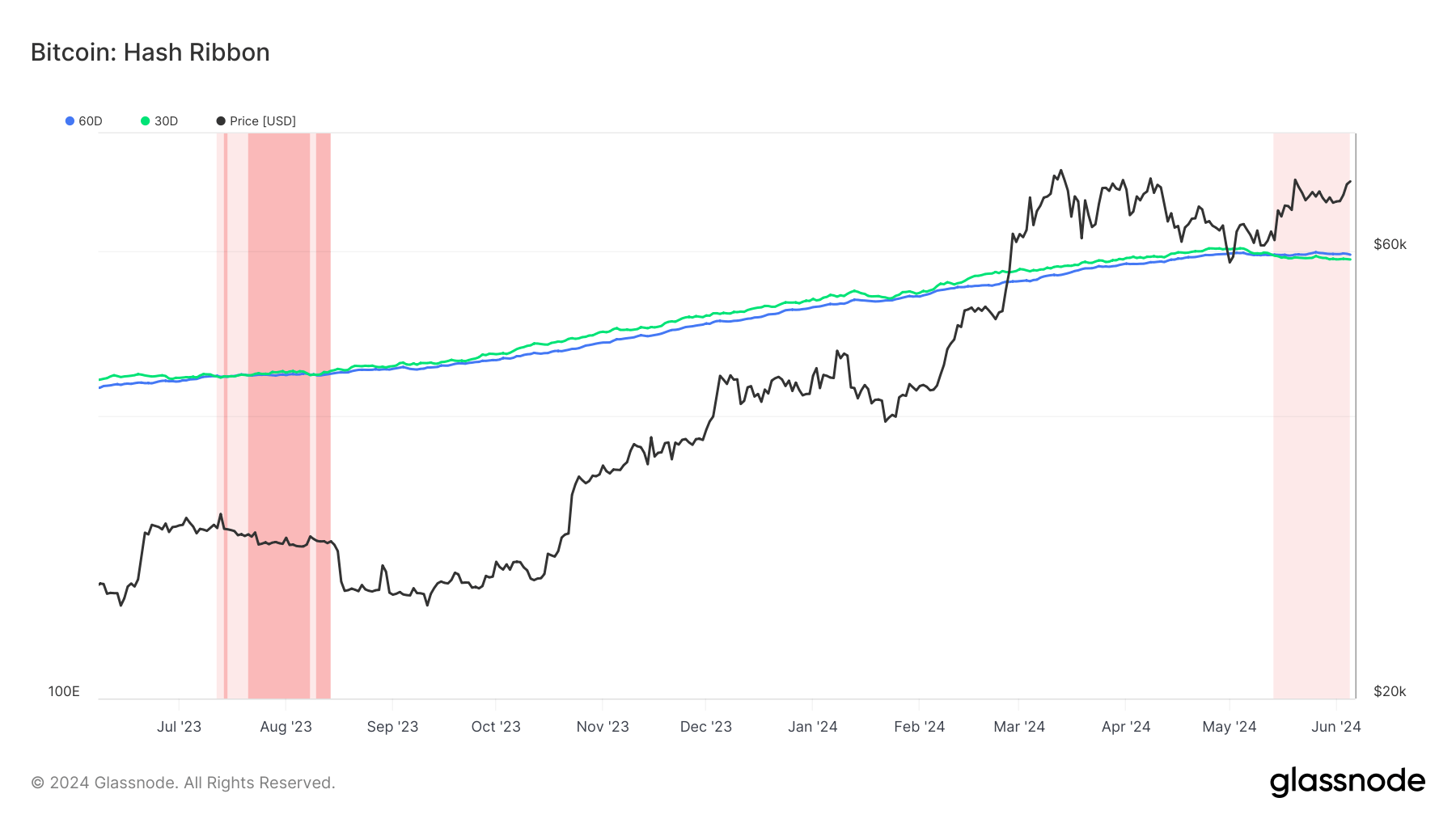

CryptoSlate experiences that the hash price just lately skilled probably the most important seven-day decline since 2021. Though the hash price has risen from its Could 1 lows, it has compressed considerably because the halving. The hash ribbon indicator suggests ongoing miner capitulation, now over three weeks in, with expectations for a number of extra weeks of comparable traits.

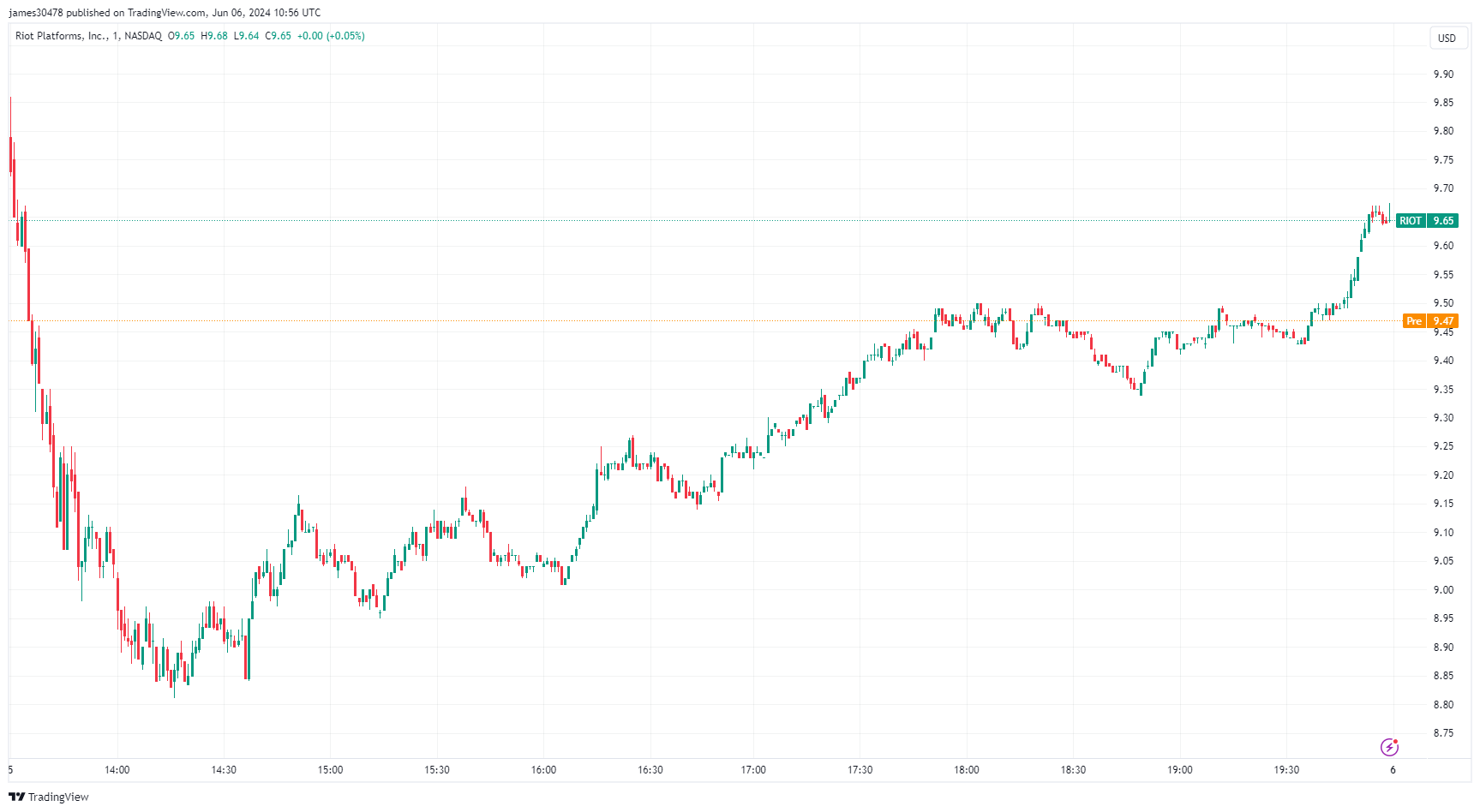

Amid these developments, Kerrisdale Capital has taken a brief place on Riot inventory, criticizing Bitcoin mining. Riot’s shares dropped by as a lot as 10% on June 5 following the announcement however later recovered many of the decline.

These circumstances spotlight the present challenges inside the Bitcoin mining business as miners navigate post-halving changes.