Market analyst Peter Brandt has steered that Bitcoin might be repeating a historic sample that led to a pointy price decline in 2022. In a chart shared publicly, Brandt pointed to a attainable double-top formation in Bitcoin’s present price motion. He in contrast it to an identical setup that preceded a 75% drop three years in the past.

Brandt additionally referenced a longer-term sample he calls “Exponential Decay,” which exhibits that Bitcoin’s features throughout every bull cycle have decreased over time. In accordance with his knowledge, the 2009–2011 cycle noticed features of over 3,000 occasions. The 2018–2021 cycle noticed a 22-fold improve. Within the present cycle, Brandt estimates the rise is about 4.5 occasions from the 2022 low of $15,473 to the 2024 excessive of $72,723.

Brandt estimates a 25% probability that the market already topped in March 2024 and warned that, if the sample continues, Bitcoin might fall again to the mid-$30,000 vary. He emphasised that whereas every halving occasion has beforehand led to robust rallies, the dimensions of these rallies has weakened over time.

BlackRock’s Bitcoin ETF Hits $71.9 Billion, Turns into Quickest Ever to Attain Milestone

Whereas some merchants concentrate on technical dangers, institutional curiosity in Bitcoin continues to develop. BlackRock’s iShares Bitcoin Belief (IBIT) has grow to be the quickest exchange-traded fund in historical past to surpass $70 billion in belongings underneath administration. It achieved this milestone in simply 341 buying and selling days. That is greater than 80% quicker than the SPDR Gold Shares ETF (GLD), which took 1,691 days to succeed in the identical stage.

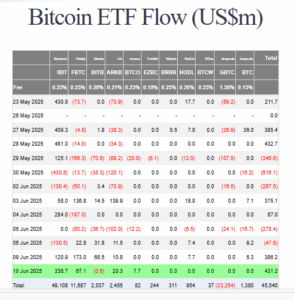

IBIT now holds round 661,457 BTC. This makes BlackRock the biggest institutional holder of Bitcoin and places it forward of Binance and MicroStrategy in whole holdings. The fund did expertise a serious $430.8 million outflow on Might 30. This ended a 31-day streak of inflows, but it surely shortly recovered. On June 10, the fund noticed $336.7 million in web inflows, with whole spot Bitcoin ETF inflows reaching $431.2 million that day, based on Farside Buyers.

ETF analyst Eric Balchunas famous that, at its present tempo, IBIT might surpass the estimated Bitcoin holdings of Satoshi Nakamoto by the top of subsequent summer time. Nakamoto’s wallets are believed to comprise about 1.1 million BTC. That is roughly 5.2% of the whole provide.

You Might Additionally Like: BTC Worth Might Hits $250K By 2025, Says Analyst Who Referred to as $100K

GameStop Provides 4,710 BTC to Treasury Technique

Public firms are additionally increasing their direct publicity to Bitcoin. GameStop disclosed that it bought 4,710 BTC between Might 3 and June 10 utilizing company money reserves. Based mostly on current market costs, the acquisition is valued at over $516 million.

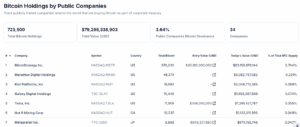

This transfer brings GameStop right into a rising group of publicly listed companies holding Bitcoin as a part of their treasury technique. 34 public firms now maintain a mixed 723,500 BTC, valued at round $79 billion. These holdings account for 3.64% of Bitcoin’s whole provide of 21 million cash.

Different massive holders embrace MicroStrategy, Tesla, Coinbase, Marathon Digital, Block Inc., and Galaxy Digital. With its current buy, GameStop ranks slightly below Tesla by way of whole Bitcoin holdings amongst public firms.