Eoneren

In June, In search of Alpha’s podcast host, Rena Sherbill, had me on to debate the continued crypto bull market. In that episode, I mentioned the significance of the $50,600 assist for Bitcoin (BTC-USD). Ideally, it holds. Structurally, it has a great probability of holding. And, though there aren’t any ensures in buying and selling and investing, we’ve got reached a great level in Bitcoin’s construction to take a low-risk commerce.

Irritating the Bulls

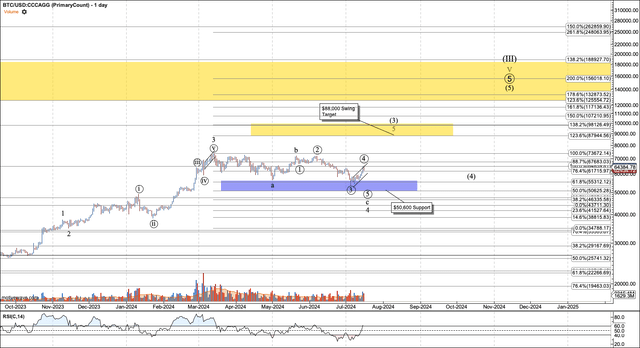

In late March, Bitcoin dropped right into a corrective sample from its all-time excessive of $73K+. That drop commenced a irritating four-month slog of sideways motion. As is typical throughout such durations, crypto podcasts flashed titles asking whether or not this bullish cycle was over. But, such durations are a key a part of bull markets.

And the correction that began in March continues to be shy of the five-month sideways correction Bitcoin went by way of from April to September 2023. That correction preceded the vertical transfer that broke Bitcoin’s all-time excessive set in 2021. This correction is unlikely to precede the identical return on a percentile foundation, however so long as it’s over $50,600, I count on new all-time highs within the coming months, probably earlier than the 12 months’s finish.

Why $50,600?

Why is the extent $50,600 so vital? That stage is the log 50% retrace of wave three that peaked in March at ~$73K. The fourth wave of impulsive rallies holds the 50% retrace of its third wave, and extra typically holds the 38.6% retrace. The 38.6% retrace in Bitcoin is $55,300 and has already been breached, so $50,600 is the following stage to look at.

It isn’t as if a break of $50,600 commences a bear market, although it’d. On the very least, it will enhance the choppiness of this bull market and open the door to a for much longer correction. And for sensible and tactical functions, it will lead me to promote all my extra speculative altcoin positions and lower my Bitcoin publicity down. Thus far, that’s not a priority. Nevertheless, I at all times think about essentially the most opposed eventualities.

Bitcoin, day by day chart (MotiveWave software program)

A Stunning Reversal

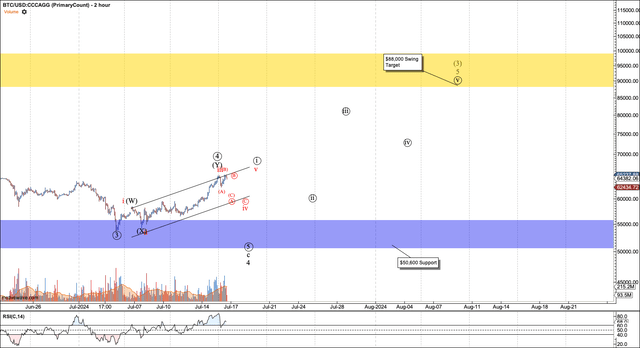

I supposed to publish this text final week, however I used to be not capable of end it earlier than a deliberate weekend away demanded my preparation. Once I got here again on Sunday evening, my jaw dropped as I famous Bitcoin made a push by way of resistance. And as of the time of writing, it has stretched nicely previous a standard wave 4, as indicated by my label of black circle-4.

This C wave of this wave-4 was already evident as a diagonal when it was dropping under $60K. Which means this wave 4 isn’t invalid till it breaks circle-2 $72K. That mentioned, this wave 4 has breached norms, and I now presume the underside is in and Bitcoin is headed to my subsequent goal of $88K, with the slim risk of extension to $97K.

Nevertheless, Elliotticians search for 5 waves by way of resistance off a low to verify {that a} correction has ended. Resistance was at $62K and so has fallen. Nevertheless, this transfer continues to be three waves in construction. As of writing, the third wave has hit $64,800.

This rally additionally has a corrective construction indicating that if this reversal is indicative that the underside is in, it’s a diagonal. Ideally, the fourth wave holds the channel as drawn, which is at the moment within the $60,100 area. This diagonal invalidates with a break under $54K.

Bitcoin, two hour chart (MotiveWave software program)

Sound Techniques

How will we commerce such motion as we watch for Bitcoin to verify a backside? Whereas we watch for the proper sample, the market can get away from us. Nevertheless, if we commerce earlier than affirmation, we are able to expertise a drop to $50,600 (roughly 20%) earlier than stopping out or slicing our place.

First, this isn’t meant to be construed as private recommendation. It’s meant that will help you think about methods of managing this motion.

As I at all times say with such questions, “It depends on what you start with.” For those who nonetheless haven’t participated on this bull market, you may think about what quantity of Bitcoin you’re comfy proudly owning whether or not or not it broke $50,600, and that you’d add to if a bear market like that of 2018 and 2022 began. I nonetheless have Bitcoin in my possession that I purchased within the $3000 area on the 2018 low after which held by way of the 2022 bull. These tranches of Bitcoin weren’t a part of my swing portfolio. What has stopped you from holding some Bitcoin long run and slowly accumulating in bear markets?

In case you are extra concerned about growing a swing place, this isn’t the kind of rally to chase, until you retain the scale comfy for a cease loss at $50,600. Nevertheless, if Bitcoin kinds a transparent 5 waves as proven in crimson, that might full black circle-i early. Black circle-ii is a superb place so as to add. The cease for that commerce strikes up to $53,600. And circle-ii typically breaks fairly deep, up to a 764% retrace of circle-i. Till circle-i completes, I can’t be particular about ranges for circle-ii. Nevertheless, we might be able to make extra purchases within the $56K–$58K area.

Conclusion

Bitcoin has gone sideways for 4 months, inflicting many to surprise if the bull market is over. Whereas nobody can predict the longer term, thus far, this motion is a run-of-the-mill bullish consolidation that gives the launch pad for Bitcoin’s subsequent transfer larger. Whereas positioning after this correction requires care and persistence, we’re beginning to come right into a zone the place danger to reward is extra advantageous than it has been for the reason that September 2023 backside.

Lastly, I’ll remind you that I don’t have a crystal ball. My ranges do break at occasions. Nevertheless, the correct use of those ranges entails not contemplating them predictive. They’re tactical ranges from which to measure your danger and resize your place accordingly. Due to this fact, mark my phrases. If by probability $50,600 breaks, it is going to change my view and derisk my very own portfolio. That’s vital with such a unstable asset class.