The Crypto Worry & Greed Index stayed within the Greed territory with a rating of 60 on June 9, regardless of rising army exercise between Israel and Iran. The index dropped from 71 on Thursday, when explosions had been reported in Tehran at 22:50 UTC.

Israel claimed duty for the airstrikes. Iran responded on Friday evening with “dozens of ballistic missiles.” The Crypto Worry & Greed Index, which tracks market sentiment, remained above 50, indicating continued optimism within the crypto market.

In an identical scenario final 12 months, the index fell from a excessive Greed rating to 43 (Worry) in beneath three weeks, following Iran’s April 2024 strike on Israel.

Bitcoin Worth Drops 2.8% However Stays Above $100,000

Bitcoin (BTC) dropped 2.8% to $103,000 on Friday, then recovered to $105,670 by Sunday, in line with CoinMarketCap. The chart reveals BTC holding above the $105,000 degree however buying and selling under the 50-period EMA, at present close to $106,312, on the 4-hour timeframe.

This decline adopted a failed try and retest the all-time excessive of $111,970, set on Might 22. Since that peak, Bitcoin has fashioned a sequence of decrease highs and struggled to maintain momentum above $108,000.

The chart additionally highlights elevated promoting quantity throughout the drop under $106,000, whereas latest candles present smaller our bodies and decrease quantity, signaling diminished volatility.

If Bitcoin fails to reclaim the EMA 50, additional draw back towards the $102,000–$100,000 zone stays potential, the place main lengthy liquidations might happen, in line with CoinGlass.

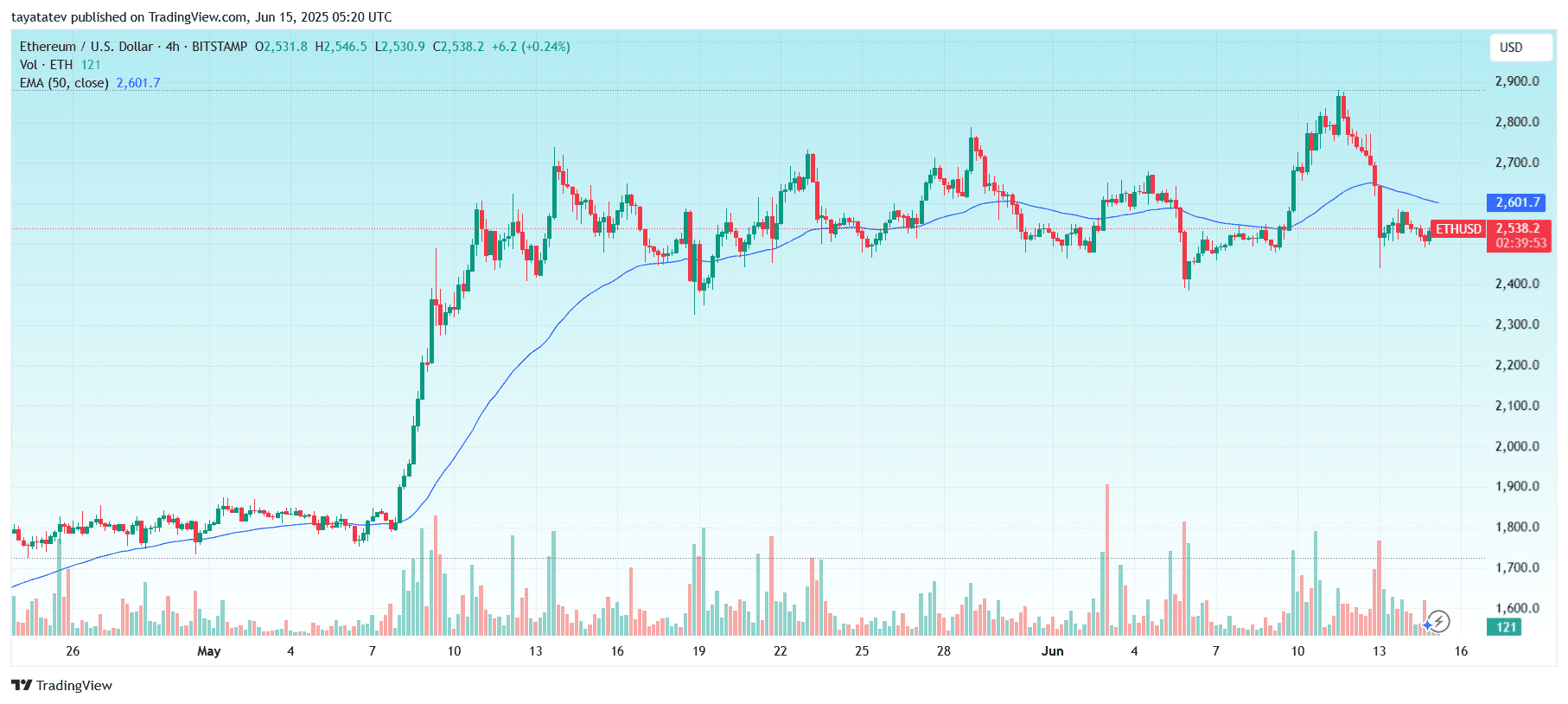

Ether Drops 10.79% in One Week as ETF Inflows Cease

Ether (ETH) dropped 10.79% throughout the week, reaching a low of $2,454 earlier than rebounding barely to $2,538 by publication time. The 4-hour chart reveals ETHUSD buying and selling under its 50-period EMA, at present at $2,601.7, indicating bearish momentum within the brief time period.

After peaking close to $2,870 earlier in June, Ether broke under the shifting common on rising promote quantity. The breakdown adopted a failed try and reclaim the $2,800 degree and coincided with a number of purple candles accompanied by bigger quantity bars.

Worth now hovers across the $2,530–$2,540 vary with weak restoration quantity. If ETH fails to get well the EMA 50, the following assist zones lie close to $2,400 and $2,300, based mostly on earlier consolidation zones seen in mid-Might. Till Ether reclaims $2,600, upside makes an attempt stay capped.

In accordance with Farside Buyers, spot Ether ETFs recorded $2.1 million in internet outflows on Friday, ending a 19-day streak of inflows.

In distinction, spot Bitcoin ETFs registered $1.37 billion in internet inflows over the 5 buying and selling days ending June 7. This marked a full week of optimistic momentum for Bitcoin ETF merchandise, based mostly on the identical information.

The distinction in circulation patterns highlights a stronger demand for Bitcoin ETFs throughout the Israel-Iran battle interval.

Bitcoin Reacted Much less Than It Did to Iran’s April 2024 Strike

Bitcoin’s latest drop of two.8% was smaller than its response to Iran’s April 13, 2024, direct missile assault on Israel, when the price fell 8.4% in in the future.

That occasion adopted the bombing of the Iranian embassy in Damascus by Israeli forces. On that day, the Crypto Worry & Greed Index confirmed 72 however dropped to 43 (Worry) by Might 2.

This time, even with new battle escalation, Bitcoin’s drop remained smaller, and the index stayed inside Greed territory.

Analysts React to Bitcoin Stability Throughout Israel-Iran Battle

Crypto analyst Za commented on X that “Bitcoin does not seem concerned about the Israel and Iran conflict (yet).” The submit was printed on Saturday and identified Bitcoin’s restricted response to geopolitical stress.

Anthony Pompliano, a crypto entrepreneur, additionally posted on Saturday, writing, “Bitcoin is relentless.” Each referred to Bitcoin’s place above the $100,000 degree and its conduct throughout escalating occasions.

Their remarks had been extensively shared by merchants monitoring Bitcoin’s price efficiency alongside geopolitical battle information.