Bitcoin (BTC) faces a technical and macro crossroads as merchants weigh the possibilities of a rally towards $130,000. Regardless of indicators of energy, price motion stays capped beneath $92,000. Analysts now warn {that a} failure to shut above that stage might stall the continued uptrend.

BTC traded at $88,350 as of March 24, rising 3% over the weekend however nonetheless removed from its all-time excessive over $108,000.

Resistance at $92K Stays the Line within the Sand

Crypto dealer Pentoshi flagged the $90,000–$92,000 vary as a key resistance space. “Needs a 3d or 1W close above for a reclaim,” he wrote in a March 24 X put up.

Open curiosity (OI) knowledge from Velo revealed a $1.5 billion improve in excellent BTC futures contracts over the previous 24 hours. However IT Tech PL, an nameless analyst on X, warned that top OI mixed with speedy price will increase might set off liquidation cascades.

“High OI + Rapid Price Increase = Risk of Liquidation Cascades,” the put up learn.

On-Chain Indicators Counsel Market Not Overheated But

Whereas decrease time frames level to overheated alerts, others see the present transfer as a part of a wholesome consolidation.

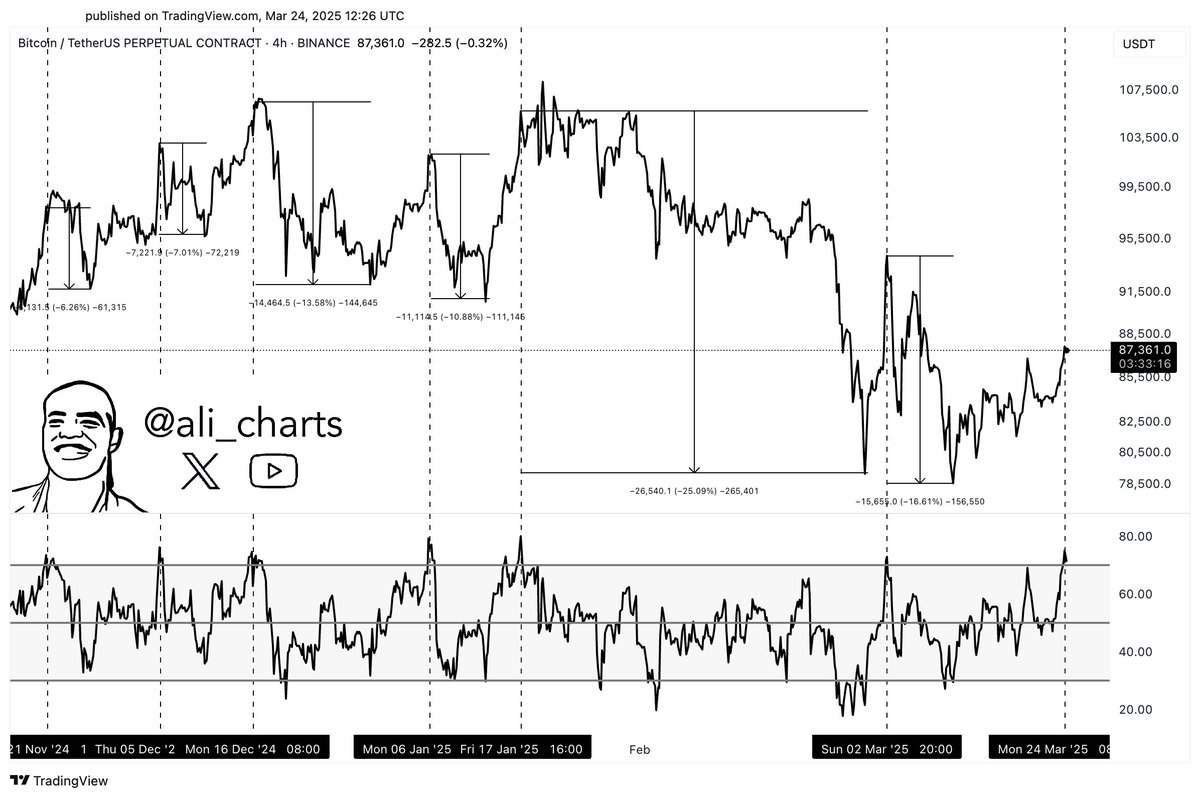

Ali Martinez shared that Bitcoin’s relative energy index (RSI) has just lately hit overbought territory on the 4-hour chart. Nonetheless, Bitcoin researcher Axel Adler Jr. argued that broader on-chain metrics don’t point out overheating.

Adler’s Substack article highlighted that BTC stays in a “growth stage” primarily based on cumulative worth days destroyed (CVDD), a metric that tracks promoting by long-term holders. He famous that BTC solely triggered one promote sign throughout this cycle—again in March 2024.

The researcher expects Bitcoin to succeed in $130,000 inside 90 days, citing CVDD and the investor price mannequin, which beforehand flashed two promote alerts in 2021.

Gold Close to ATH, However BTC Lags Behind

Bitcoin’s 3% weekend rally got here as gold traded simply 1% beneath its report excessive of $3,057.

Whereas BTC good points assist from a number of macro tendencies, some merchants query why the price struggles to carry above $92,000. Based on Keith Alan, co-founder of Materials Indicators, information of the U.S. authorities probably promoting gold reserves to purchase Bitcoin “gave speculators some hopium.”

“With gold in ATH territory, and BTC in a correction, this would be an opportune time,” Alan wrote on March 24.

In the meantime, the S&P 500 rose 1.5% after reviews emerged that President Donald Trump may soften the influence of upcoming commerce tariffs. The Kobeissi Letter mentioned that as a substitute of blanket guidelines, “sector-specific tariffs” might take impact from April 2.

Technique Provides $584M in BTC, However Is It Sufficient?

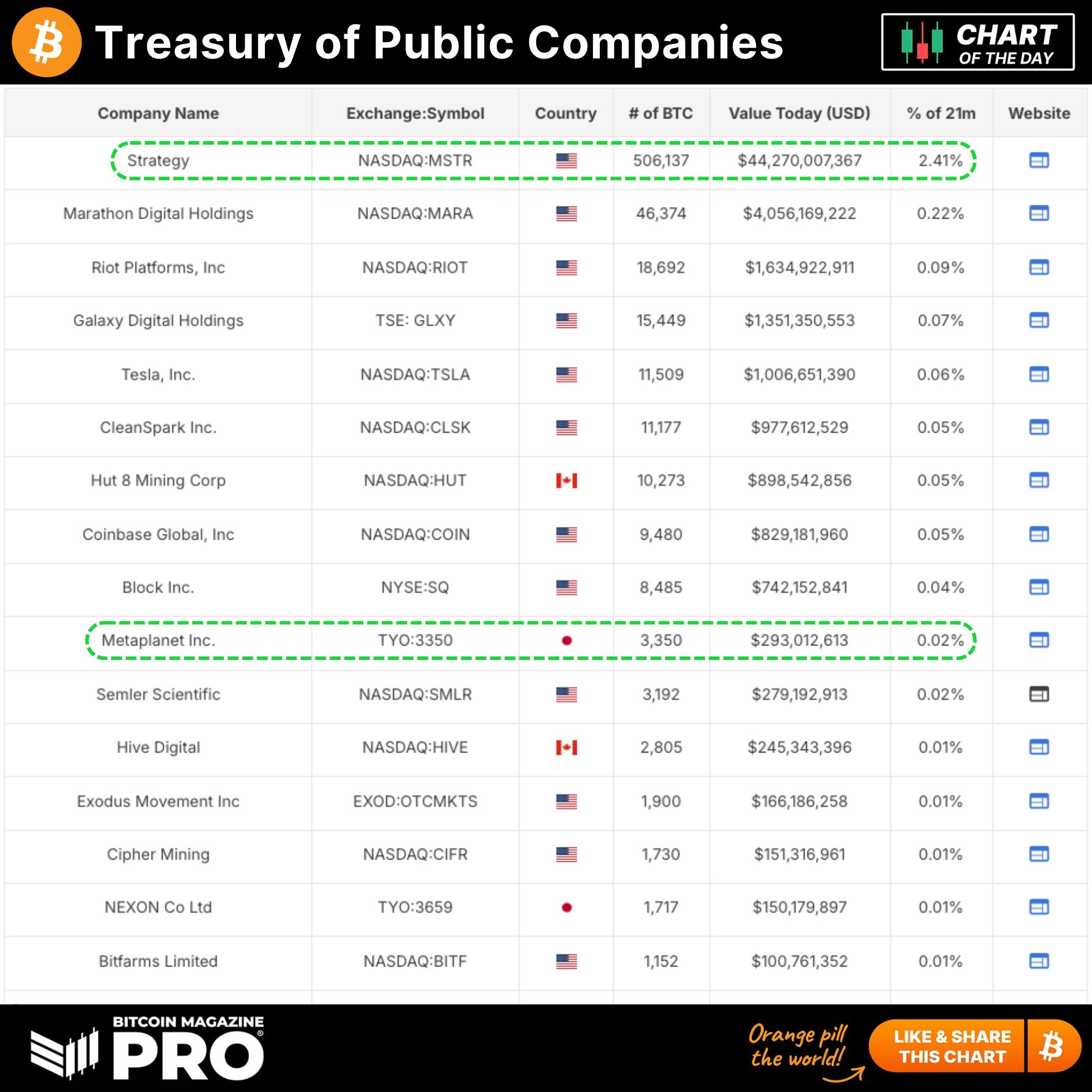

On the company entrance, Technique disclosed a $584 million BTC buy on March 24, elevating its holdings to 506,137 BTC. The agency used funds from the sale of 1.97 million shares and a broader $21 billion inventory issuance program.

Whereas the acquisition provided short-term assist, critics argue the corporate’s aggressive shopping for might backfire if its funding dries up. Nonetheless, the broader pattern stays constructive. Between March 14 and March 21, Bitcoin spot exchange-traded funds (ETFs) recorded $786 million in internet inflows.

Macro Dangers Nonetheless Cloud the Path to $130K

Whereas Adler’s $130,000 prediction highlights bullish potential, merchants stay cautious. The market stays reactive to macro alerts, from U.S. tariff coverage shifts to the Federal Reserve’s financial stance.

Though easing inflation expectations and speculative ETF flows assist Bitcoin’s trajectory, the trail stays unsure except BTC reclaims $92,000 on the weekly shut.