On Might 20, 2025, Bitcoin price crossed the $105,000 mark once more. Throughout the intraday session, Bitcoin (BTC) reached $107,108 earlier than closing above the $105,000 threshold. This price transfer triggered elevated capital influx into Bitcoin ETFs.

In response to SosoValue, spot Bitcoin ETFs listed within the U.S. recorded a complete day by day web influx of $667.44 million. This was the biggest single-day influx since Might 2 and marked the fourth consecutive day of optimistic ETF inflows.

As of the most recent information, Bitcoin trades at $105,543. Its 3% day by day enhance aligned with rising institutional exercise, which stays seen throughout ETF and derivatives markets.

BlackRock IBIT Tops Bitcoin ETF Inflows

BlackRock IBIT led the influx chart on Might 20. The ETF attracted $305.92 million in someday, elevating its whole web inflows to $45.86 billion. This was the best amongst all spot Bitcoin ETFs that day.

Constancy FBTC adopted with $188.08 million in web inflows. Its cumulative web inflows have now reached $11.78 billion. These two ETFs—BlackRock IBIT and Constancy FBTC—accounted for almost all of capital motion in the course of the session.

Different ETFs contributed smaller quantities to the general $667 million influx whole. The information confirms continued institutional curiosity in Bitcoin ETFs, particularly on days with sturdy price ranges.

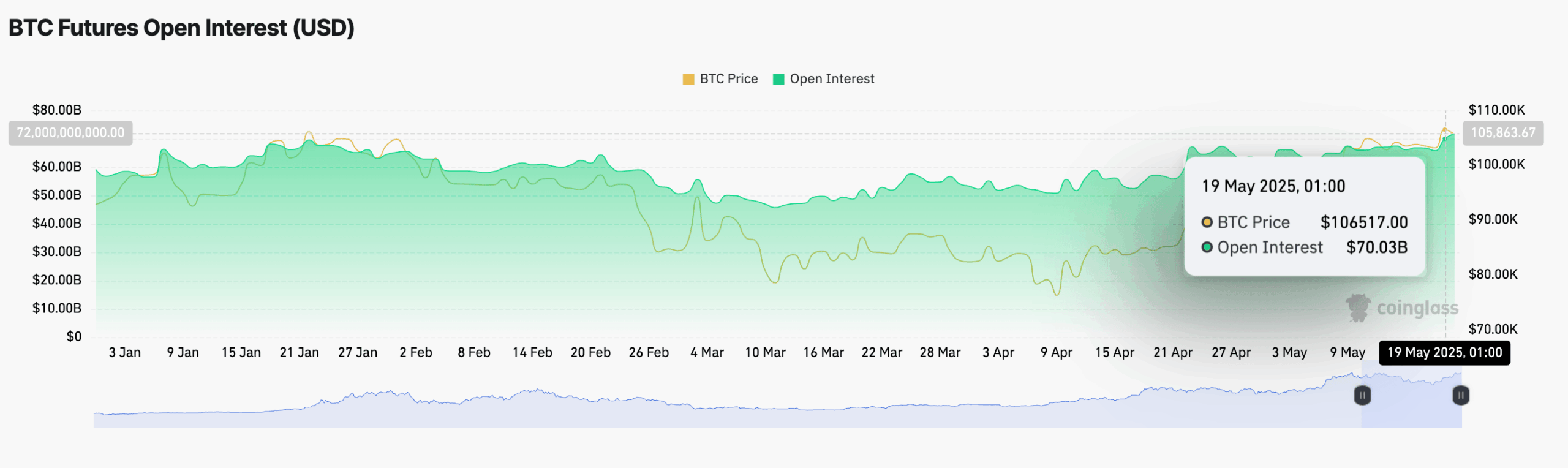

BTC Futures Open Curiosity Reaches 2025 Peak

Open curiosity in BTC futures additionally elevated. Coinglass studies that futures open curiosity rose to greater than $70 billion on Might 20. This was the best worth in 2025. It mirrored a 1% rise during the last 24 hours.

When each price and open curiosity climb collectively, it often signifies new capital coming into the market. The rise in BTC futures open curiosity reveals that merchants are opening new contracts as Bitcoin price good points momentum.

Quantity remained steady throughout main derivatives platforms. The regular buying and selling exercise in futures helps the development noticed within the spot Bitcoin ETF house.

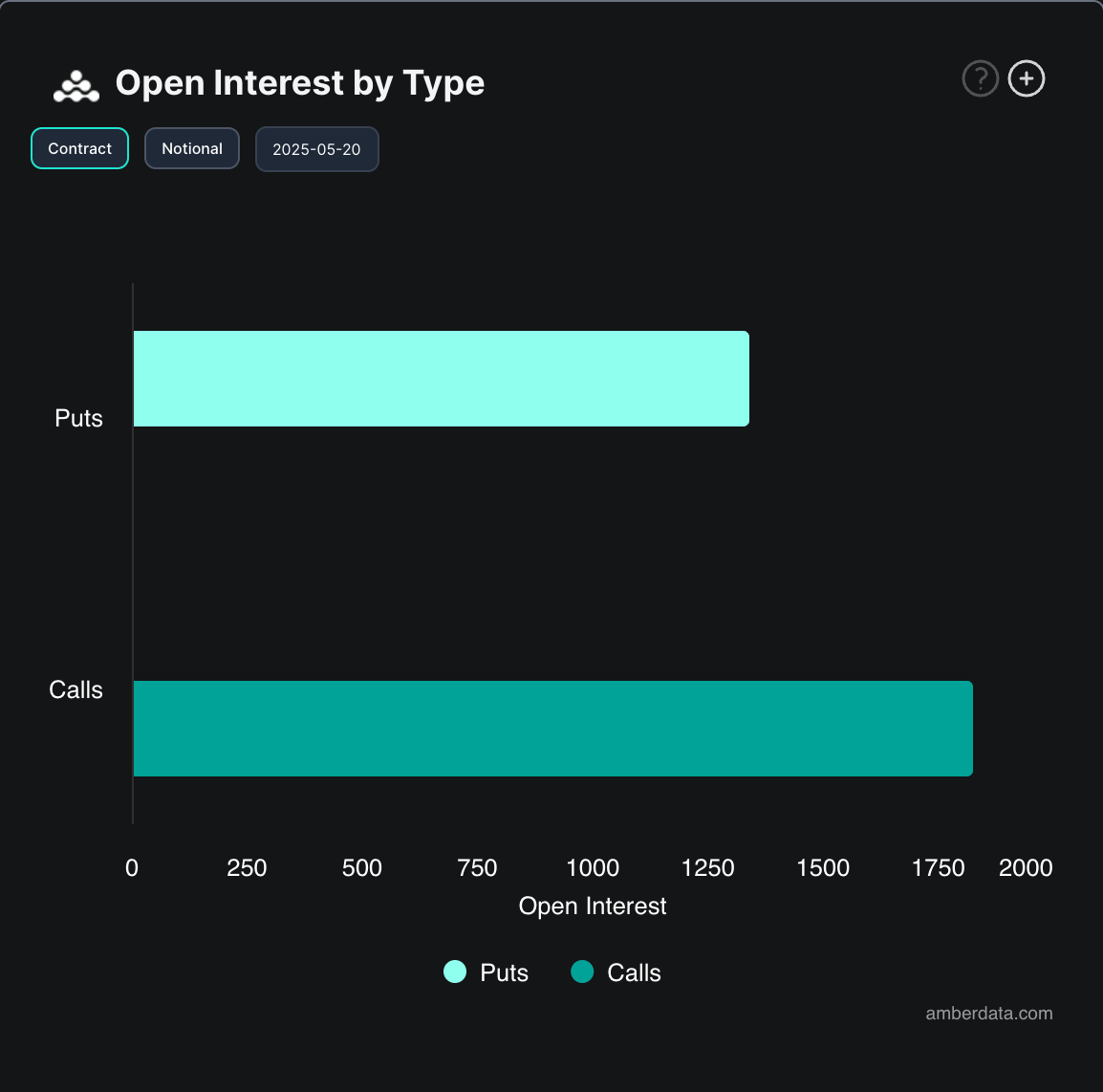

BTC Name Choices Demand Rises in Derivatives Market

BTC name choices additionally noticed elevated demand. In response to Deribit, open curiosity in BTC name choices rose on Might 20. Name choices give merchants the fitting to purchase Bitcoin at a selected price inside a set time-frame.

This enhance in name choices exercise occurred alongside price motion and ETF inflows. The derivatives market responded to Bitcoin’s restoration of the $105,000 stage with renewed positioning.

Along with spot and futures information, the rise in BTC name choices provides to the image of expanded market participation. These modifications in choices quantity got here on the identical day as main ETF inflows, suggesting related curiosity throughout markets.