Latest funding choices by main gamers in Hong Kong and Wisconsin reveal contrasting methods relating to BlackRock’s Bitcoin ETF, reflecting divergent views on crypto’s position in institutional portfolios.

The funding panorama for BlackRock’s iShares Bitcoin Belief ETF (IBIT) has lately showcased stark variations between Hong Kong and Wisconsin, highlighting the numerous approaches institutional buyers are taking in direction of Bitcoin. These strikes present perception into the broader traits shaping the adoption of crypto ETFs.

Be taught extra: How and The place to Purchase Bitcoin ETF: A Complete Information

Hong Kong’s Daring Embrace of BlackRock’s Bitcoin ETF

Hong Kong-based Avenir has considerably escalated its funding in BlackRock’s Bitcoin ETF, amassing 14.7 million shares valued at $688 million by March 31, 2025. This represents a 30% enhance within the first quarter alone, as reported by Decrypt.

Avenir’s technique is an element of a bigger initiative, having launched a $500 million Crypto Partnership Program within the fall of 2024, geared toward collaborating with world digital asset-focused quantitative buying and selling groups. This aggressive accumulation displays a robust conviction in Bitcoin’s long-term potential.

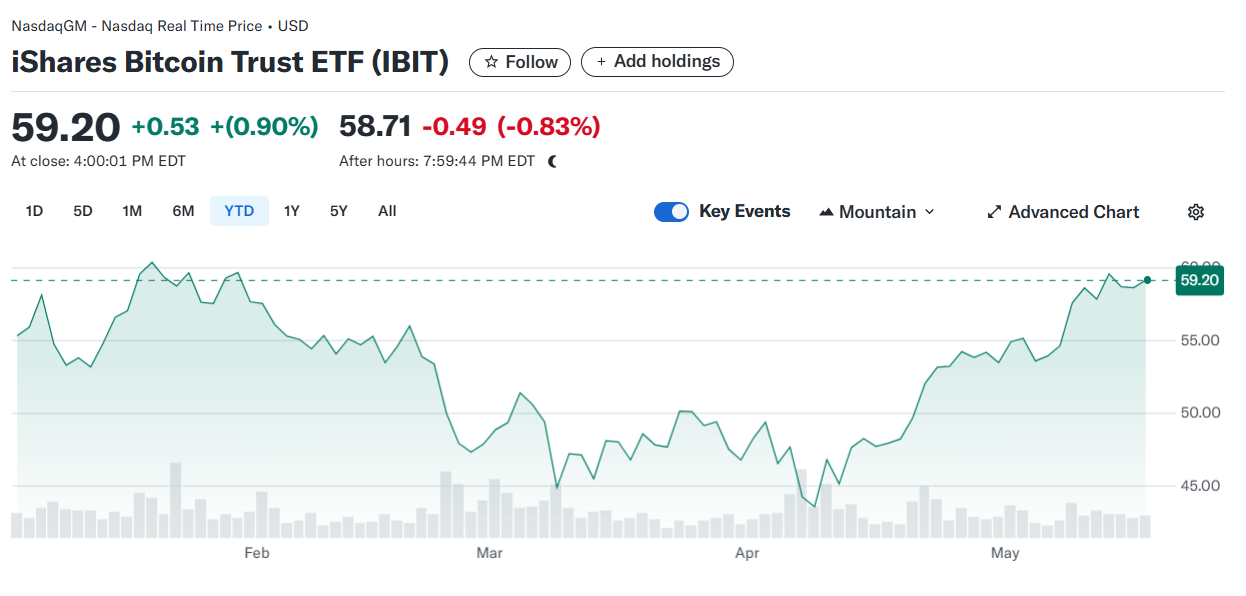

The agency’s determination aligns with the surging curiosity in spot Bitcoin ETFs, which have seen file inflows regardless of a brief dip in buying and selling earlier within the spring of 2025. IBIT was buying and selling at $59.20, indicating sturdy investor curiosity.

Supply: Yahoo Finance

Avenir’s transfer is indicative of a broader development in Asian markets, the place Bitcoin ETFs are more and more considered as a viable avenue for gaining publicity to Bitcoin BTC with out the complexities of direct possession.

Learn extra: Bitcoin ETFs Attain All-Time Excessive with Over $41 Billion in Inflows

Wisconsin Offloads BlackRock’s Bitcoin ETF

In distinction, the State of Wisconsin Funding Board (SWIB) has opted to cut back its publicity to BlackRock’s Bitcoin ETF, unloading over $300 million value of shares.

This determination marks a major downsizing of SWIB’s crypto holdings, which had beforehand included each BlackRock and Grayscale Bitcoin ETFs value $163 million as of late 2024.

SWIB’s exit from IBIT suggests a reassessment of its portfolio, seemingly influenced by market volatility and a strategic shift in direction of extra steady asset lessons. SWIB’s position in managing pension funds and different trusts for Wisconsin’s residents underscores a cautious method to high-risk investments like Bitcoin.

This transfer contrasts sharply with Hong Kong’s aggressive stance, illustrating the various danger appetites amongst institutional buyers.