The cryptocurrency market confronted a turbulent begin to the week, with Bitcoin (BTC) main a broad sell-off that worn out $700 million in lengthy positions and despatched main altcoins like Dogecoin (DOGE) and Cardano (ADA) tumbling by as a lot as 7%.

The downturn, reported by CoinDesk on Might 13, 2025, displays a cooling of threat urge for food amongst merchants, pushed by macroeconomic uncertainty and shifting capital flows. Right here’s a deep dive into right now’s market dynamics, price actions, and the forces shaping the crypto panorama.

Promote the information motion hit bitcoin right now, which pulled again under $102K after difficult $106K hours in the past. Additional underperformance may very well be within the playing cards as tariff worries disappear.https://t.co/tkDjsyxFNA

— CoinDesk (@CoinDesk) Might 12, 2025

Bitcoin Drops to $100k and Liquidation Cascade

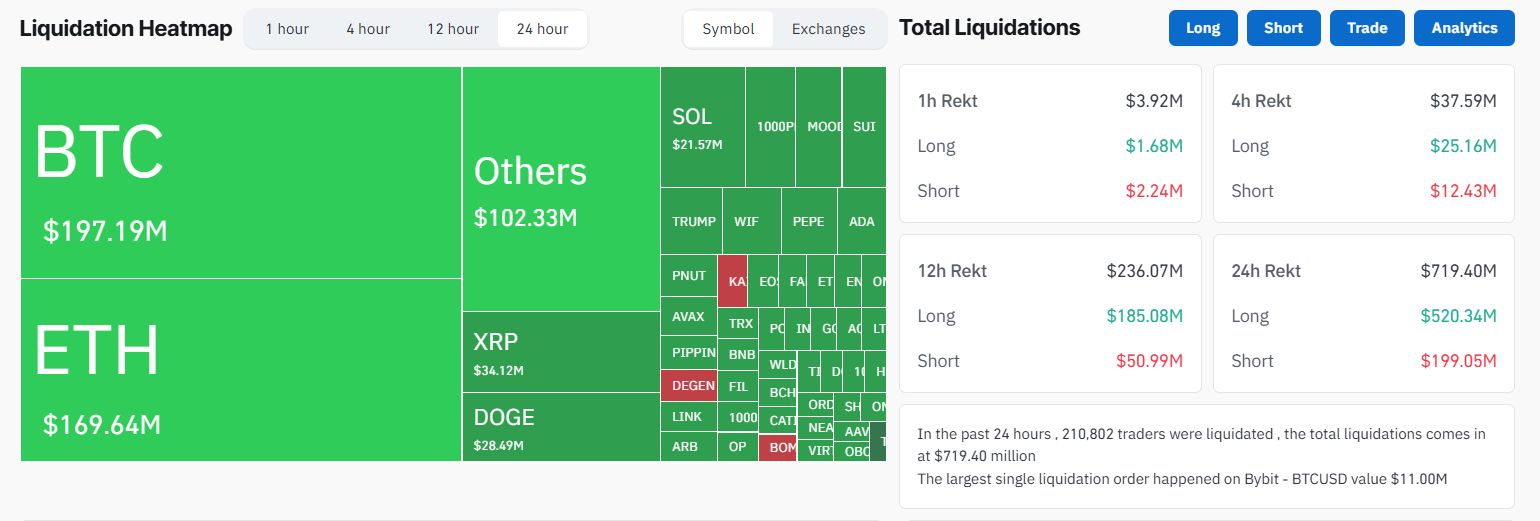

Bitcoin BTC, the market’s bellwether, dropped 2% to hover round $101,000, erasing beneficial properties made earlier within the week when it briefly crossed $105,000. This pullback triggered an enormous $700 million in lengthy liquidations, as leveraged merchants betting on increased costs have been caught off guard.

Supply: TradingView

Liquidations happen when exchanges forcibly shut leveraged positions because of inadequate margin, usually amplifying price swings in risky markets like crypto. The most important single liquidation was a BTCUSDT futures commerce on Bybit, valued at $11 million.

Supply: CoinGlass

The sell-off was partly attributed to profit-taking after Bitcoin’s latest rally, coupled with broader market warning. Posts on X highlighted a “soft” Asia buying and selling session, with complete market capitalization shedding $15.5 billion and capital flowing into stablecoins as buyers sought security. Different indicators together with the Crypto Worry & Greed Index, a sentiment gauge, stays in “fear” territory, suggesting potential for a near-term backside but additionally reflecting persistent unease.

Ethereum, XRP, and Solana Beneath Stress

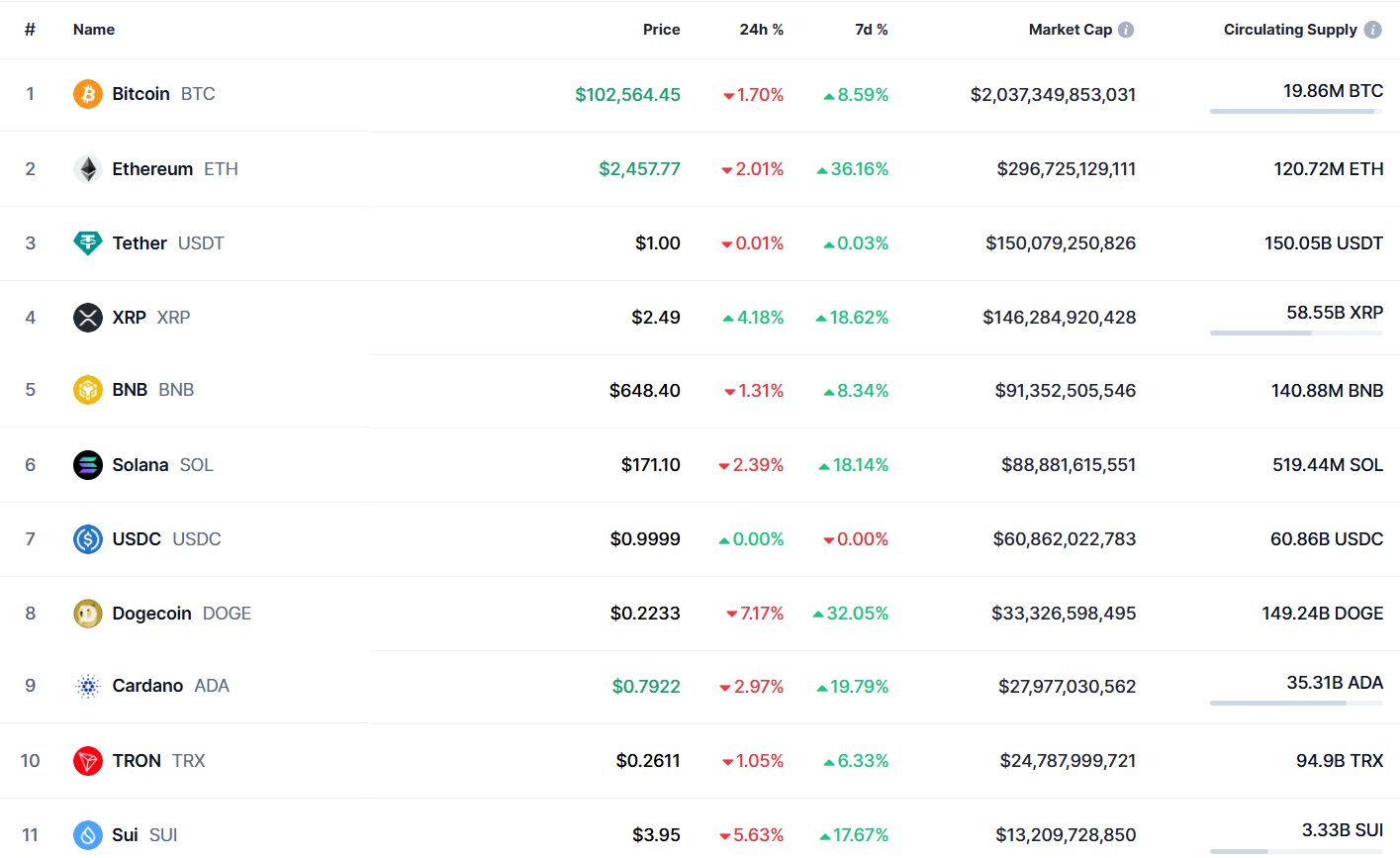

Ethereum ETH fell 2.2%, buying and selling close to $2,450. The decline follows a 36% surge final week, fueled by optimism round Ethereum’s Pectra improve and a U.S.-UK commerce deal. Nonetheless, right now’s risk-off sentiment reversed these beneficial properties, with ETH futures contributing considerably to the liquidation tally.

Learn extra: ETH Value Prediction after Pectra Improve in Might

Supply: TradingView

XRP, usually a darling of retail merchants, beneficial properties 4%, buying and selling at $2.5.

Learn extra: Wellgistics Adopts $50M XRP: A Catalyst for Value Progress?

Supply: TradingView

Solana SOL, a high-performance blockchain token, additionally dropped 2.5%, buying and selling at $170.

Supply: TradingView

Giant-cap altcoins like DOGE and ADA led losses, every down 7%. DOGE, buying and selling at $0.2, has struggled to keep up momentum regardless of hypothesis round a possible ETF and Elon Musk’s affect.

Supply: CoinGecko

Macro Components and Outlook

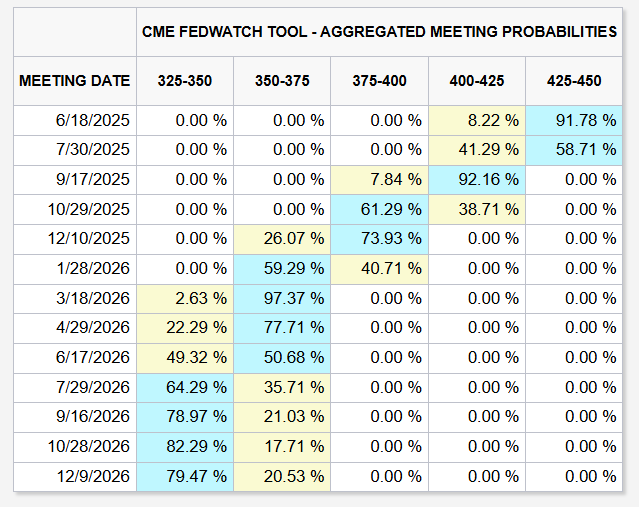

As we speak’s downturn aligns with macroeconomic headwinds, together with uncertainty over Federal Reserve price cuts and fears of stagflation. The CME FedWatch Instrument signifies a 41.29% likelihood of a price lower to 4.00%-4.25% by July, however merchants stay cautious of inflationary pressures from potential U.S. tariffs. Bitcoin’s position as a hedge towards volatility continues to draw inflows into spot BTC ETFs, with BlackRock’s IBIT seeing $4.3 billion in month-to-month inflows.

Supply: CME Group

Whereas the market stays in a “holding pattern,” as famous by CoinDesk, Bitcoin’s dominance at 59% suggests capital is consolidating into safer belongings. For now, merchants are eyeing key assist ranges—$96,000 for BTC, $2,300 for ETH, and $2.20 for XRP – as potential inflection factors. With volatility more likely to persist, cautious positioning and strong threat administration are vital in navigating this dynamic market.