Fast Take

As the top of the month approaches, vital choices expiries for each Bitcoin and Ethereum are set for Could 31. Bitcoin trades round $68,500 with a put/name ratio of 0.58, indicating a bullish sentiment amongst merchants. The overall open curiosity is roughly 68,000 BTC, translating to a considerable notional worth of $4.7 billion. The max ache price is $65,000, suggesting that this stage might act as a gravitational pull for Bitcoin’s price as expiration nears as a result of hedging actions.

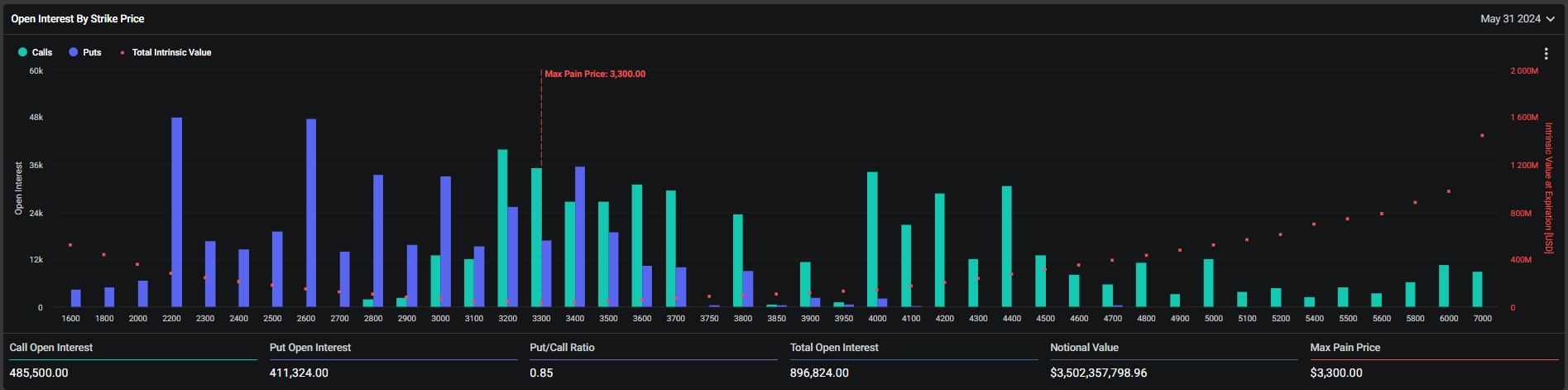

Ethereum, in distinction, is buying and selling under $4,000 with a put/name ratio of 0.85, reflecting a extra balanced sentiment between bullish and bearish positions. The notional worth is decrease in comparison with Bitcoin at $3.5 billion, however the whole open curiosity for Ethereum choices is at 897,238 ETH. The max ache price for Ethereum is about at $3,300, probably influencing price actions because the expiration date approaches.

Whereas Ethereum’s open curiosity is important across the $2,200 and $2,600 strike costs, there’s additionally notable exercise at greater strike costs. Many Ethereum name choices are positioned at these elevated ranges, reflecting combined sentiment.

In distinction, Bitcoin demonstrates a extra pronounced bullish sentiment, evidenced by its decrease put/name ratio and concentrated open curiosity at greater strike costs. This means merchants are extra optimistic about Bitcoin’s price prospects in comparison with Ethereum.