Fast Take

The primary half of 2024 has witnessed important developments within the digital property market, significantly for Bitcoin and Ethereum, as highlighted in a complete report compiled by Glassnode and CME. The report delves into the insights and evolution of the market following the launch of the US Bitcoin ETFs on Jan. 11 and the impact on derivatives markets.

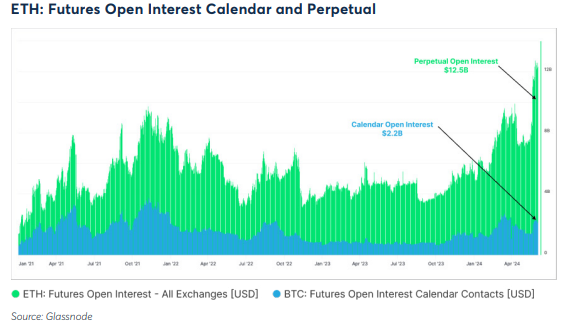

Within the crypto trade, two major futures devices are utilized: the perpetual swap and the standard calendar-expiring contract. In response to the report, perpetual open curiosity is at present at roughly $16.6 billion, whereas calendar open curiosity stands at $12.6 billion. Traditionally, perpetual open curiosity dominated till 2023. Nevertheless, 2024 has seen a notable enhance in calendar expiring futures, attributed to a surge in curiosity from institutional buyers, with a big quantity traded by way of CME Group Devices.

The report exhibits that this shift just isn’t mirrored in Ethereum, the place perpetual open curiosity stays the dominant selection, with $12.5 billion in comparison with $2.2 billion in calendar open curiosity. The upcoming ETF launch in July raises questions on whether or not this dynamic may shift in Ethereum’s market.

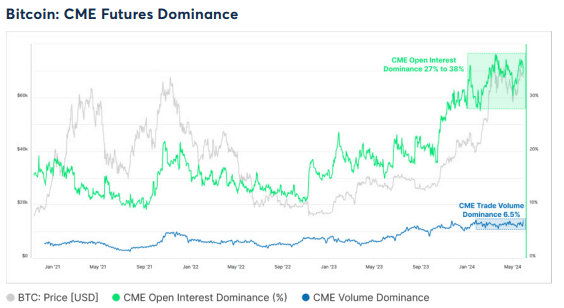

Supporting this development, Bitcoin CME Futures have proven exceptional dominance, representing over one-third of all open futures contracts positions in Bitcoin. Moreover, in keeping with the report, CME’s commerce quantity continues to realize market share, at present at 6.5%, which is at a multi-year excessive.

This report illustrates the rising affect of institutional buyers in shaping the futures market, primarily by means of CME Group’s choices, and alerts potential shifts in market forces with forthcoming developments such because the Ethereum ETF launch.