Bitcoin (BTC) failed to carry above $105,000 this week regardless of sturdy momentum earlier in Might. After tapping $105,706 on Might 13, the price retraced sharply and now trades close to $103,200, marking a rejection from key resistance. The rejection comes after BTC posted two sturdy weeks of good points, largely pushed by quick squeezes and improved danger sentiment. Nevertheless, the rally seems to be shedding steam just under crucial psychological ranges.

The broader crypto market displays this cooling. Ethereum (ETH) trades close to $2,552, whereas Solana (SOL) hovers round $169. BNB has slipped to $652, and XRP has fallen to $2.47. Most large-cap property are in gentle decline, suggesting a broader pause in bullish momentum.

Macroeconomic stress can be returning. Merchants are actually watching U.S. inflation information anticipated later this week, which may reset expectations for Federal Reserve fee cuts. Whereas a brief easing of U.S.–China tariffs final week supported danger property, the aid proved short-lived as equities and crypto did not maintain upward momentum.

BTC’s incapability to carry $105,000, coupled with fading macro tailwinds, paints a cautious image within the quick time period. Momentum merchants now face a key query — whether or not BTC can reclaim its highs or if distribution is already underway.

Bitcoin Value May Face Bother Forward

Analysts throughout a number of platforms highlighted rising draw back danger for Bitcoin, regardless of its short-term breakout above $100,000. The predictions depend on each on-chain and technical cues. A dealer posted a chart on Tradingview, which outlined a transparent Elliott Wave construction pointing to a ultimate push towards $122,000 earlier than a pointy correction to $60,000 in 2026.

The transfer suits inside a rising wedge, with Bitcoin presently in Wave 3 of the ultimate leg.

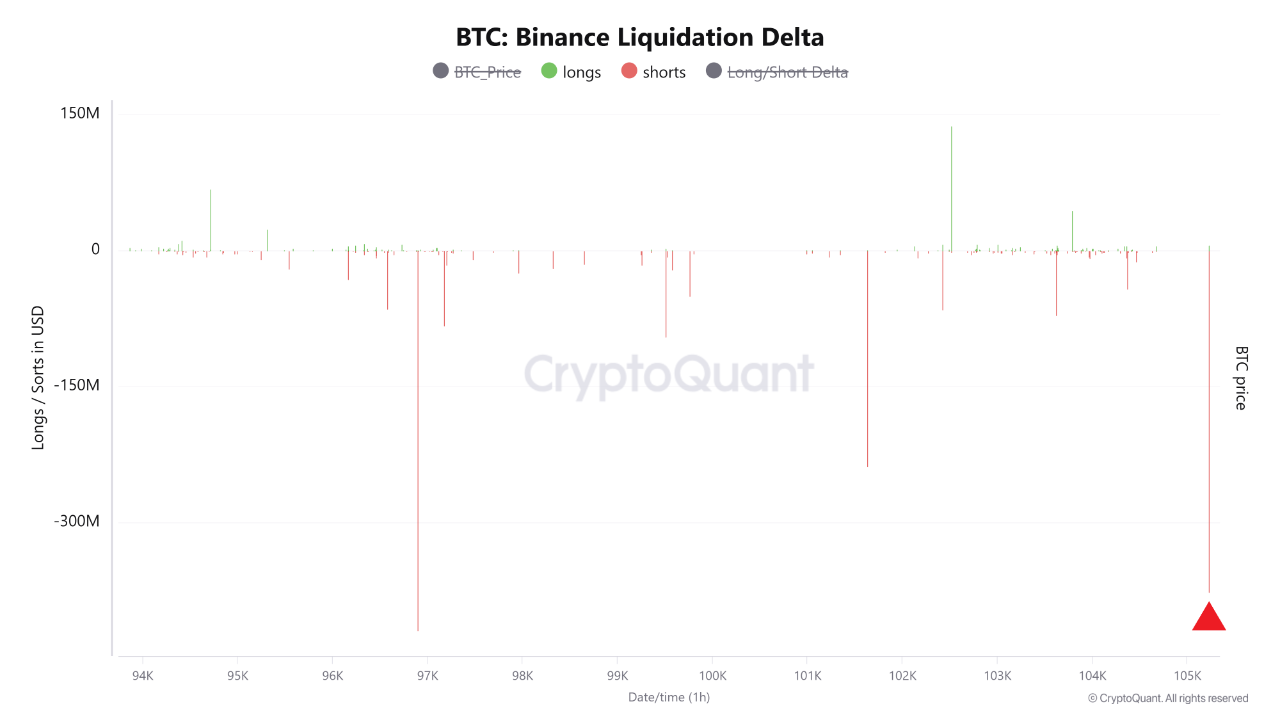

Furthermore, Amr Taha, an analyst on CryptoQuant, shared one other warning, with this one coming from Binance liquidation information. Bitcoin has registered two liquidation spikes above $300 million inside seven days. Each had been quick liquidations, with the newest occurring close to $105,000. These should not natural rallies.

As an alternative, they had been pressured buy-ins triggered by margin calls on quick positions. When crypto exchanges auto-close shorts, they generate aggressive upside strikes, however the gas is finite. Value briefly pierced $105K earlier than retracing, confirming that reactive shopping for, not spot demand, drove the transfer.

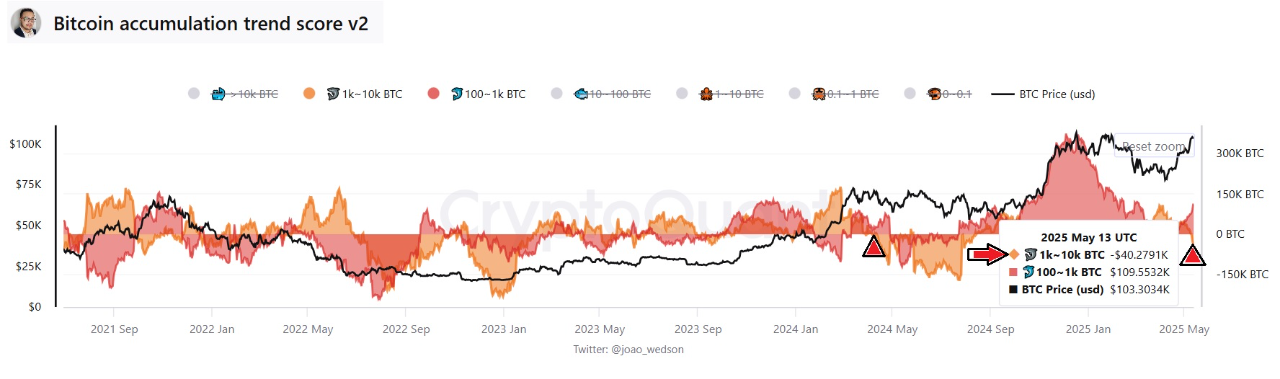

The second sign entails on-chain exercise from wallets holding 100 to 1,000 BTC. On Might 13, this cohort moved from accumulation to distribution, shedding over 40,000 BTC. The dump was their first internet adverse pattern since April 2024. This group tends to behave early, usually distributing into energy earlier than broader sentiment shifts.

Their determination to exit whereas the Bitcoin price rallied suggests tactical promoting into retail-driven euphoria. This cohort is thought for precisely timing cycle mid-tops and late-stage rallies.

The third sign is technical. A weekly honest worth hole between $73,624 and $74,420 stays unfilled. This inefficiency fashioned throughout a vertical transfer in early April and has not been retested. Such gaps usually appeal to price later within the cycle, particularly if the pattern exhausts. With BTC over 28% above the zone, a return would suggest a deep correction, however it stays a related magnet.

Collectively, these alerts mirror distribution, not energy. With out recent inflows or a decisive breakout above $105K, the subsequent main transfer may favor draw back reversion.

Bulls’ Final Hope Would possibly Take Some Time To Notice

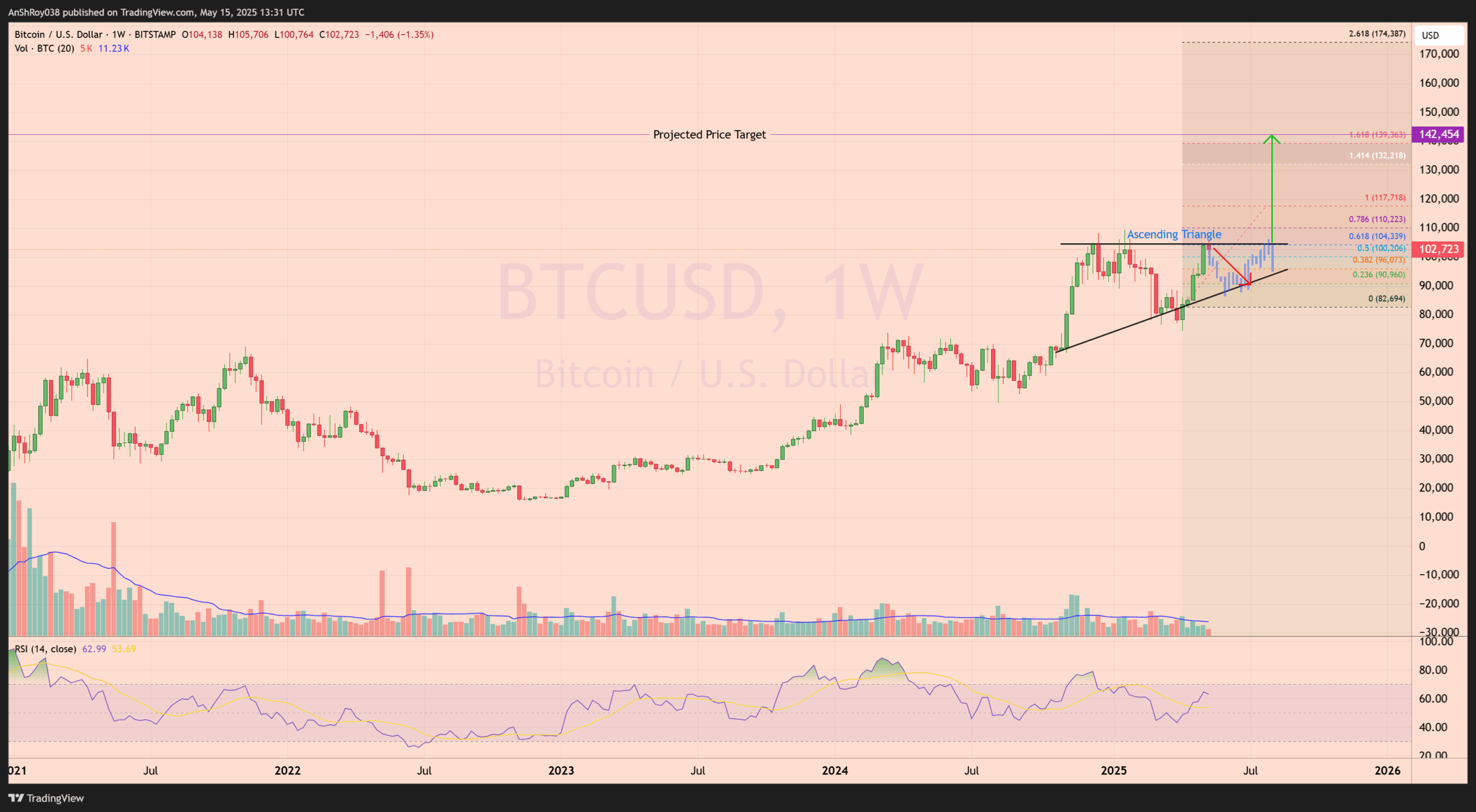

The BTC USD pair has fashioned a bullish technical setup referred to as the ascending triangle. A horizontal resistance line and rising assist trendline assist characterize the sample. This construction means that consumers are regularly gaining management, compressing price towards an outlined ceiling.

Merchants measure the projected price goal for this sample by first calculating the vertical top between the bottom of the triangle and the horizontal resistance. Then, they undertaking the space upward from the breakout level. Per this technique, Bitcoin price may rally practically 39% to succeed in the sample’s theoretical price goal close to $142,450.

Nevertheless, affirmation stays absent. BTC should put up a clear breakout above the horizontal resistance to validate this setup. Till then, the chance of rejection lingers. A failed breakout try may push BTC again towards the ascending trendline assist close to the $90,000 zone, invalidating short-term bullish momentum.

Including warning to the outlook, the quantity pattern is declining, a situation that always precedes false breakouts. With out rising quantity to again a breakout transfer, the market dangers slipping right into a fakeout—the place price breaks above resistance quickly however lacks conviction to maintain the rally.

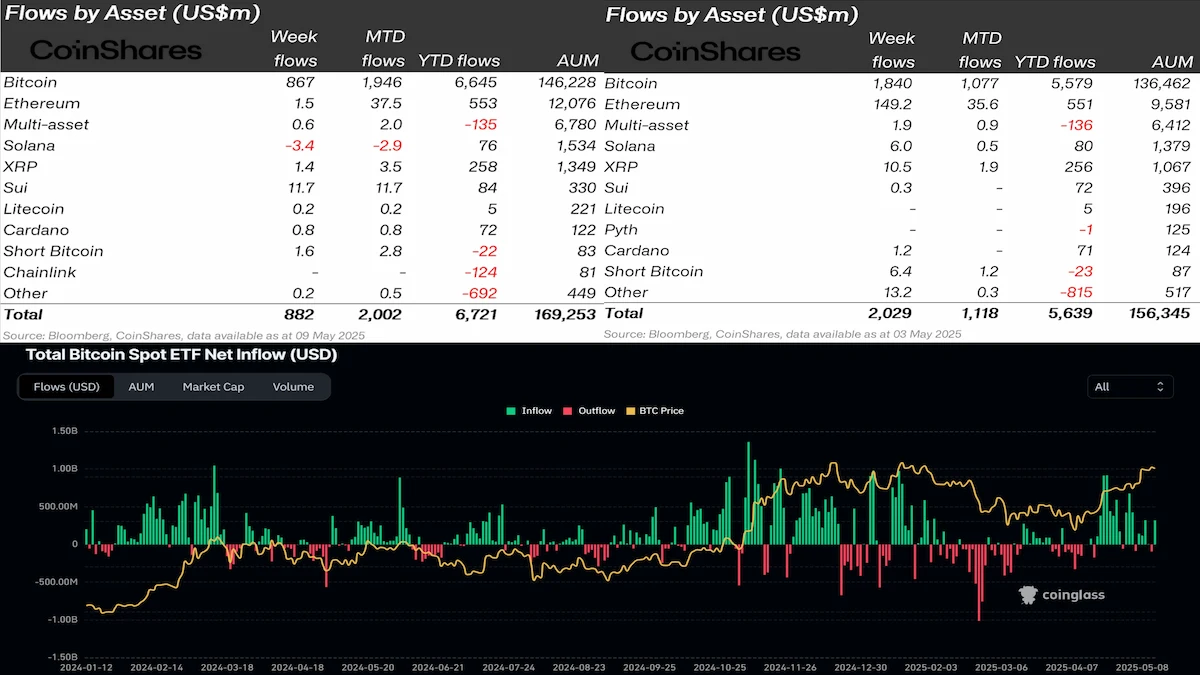

Institutional sentiment can be displaying indicators of exhaustion. CoinShares’ newest digital asset fund flows report famous $867 million in BTC inflows, sharply decrease than the earlier week’s $1.84 billion, signaling fading demand. Complementing this, Coinglass information reveals a visual drop in internet spot ETF inflows since April, at the same time as BTC exams historic highs.

Nonetheless, a robust and sustained breakout would override all bearish expectations, together with distribution and ETF slowdown considerations.