The cryptocurrency market is experiencing a outstanding rally, with Bitcoin ATH at $111,000 for the primary time on Might 22, 2025, a date that marks the fifteenth anniversary of Bitcoin Pizza Day. This milestone and rising institutional curiosity have ignited bullish sentiment throughout main cryptocurrencies, together with Ethereum, Solana, and XRP.

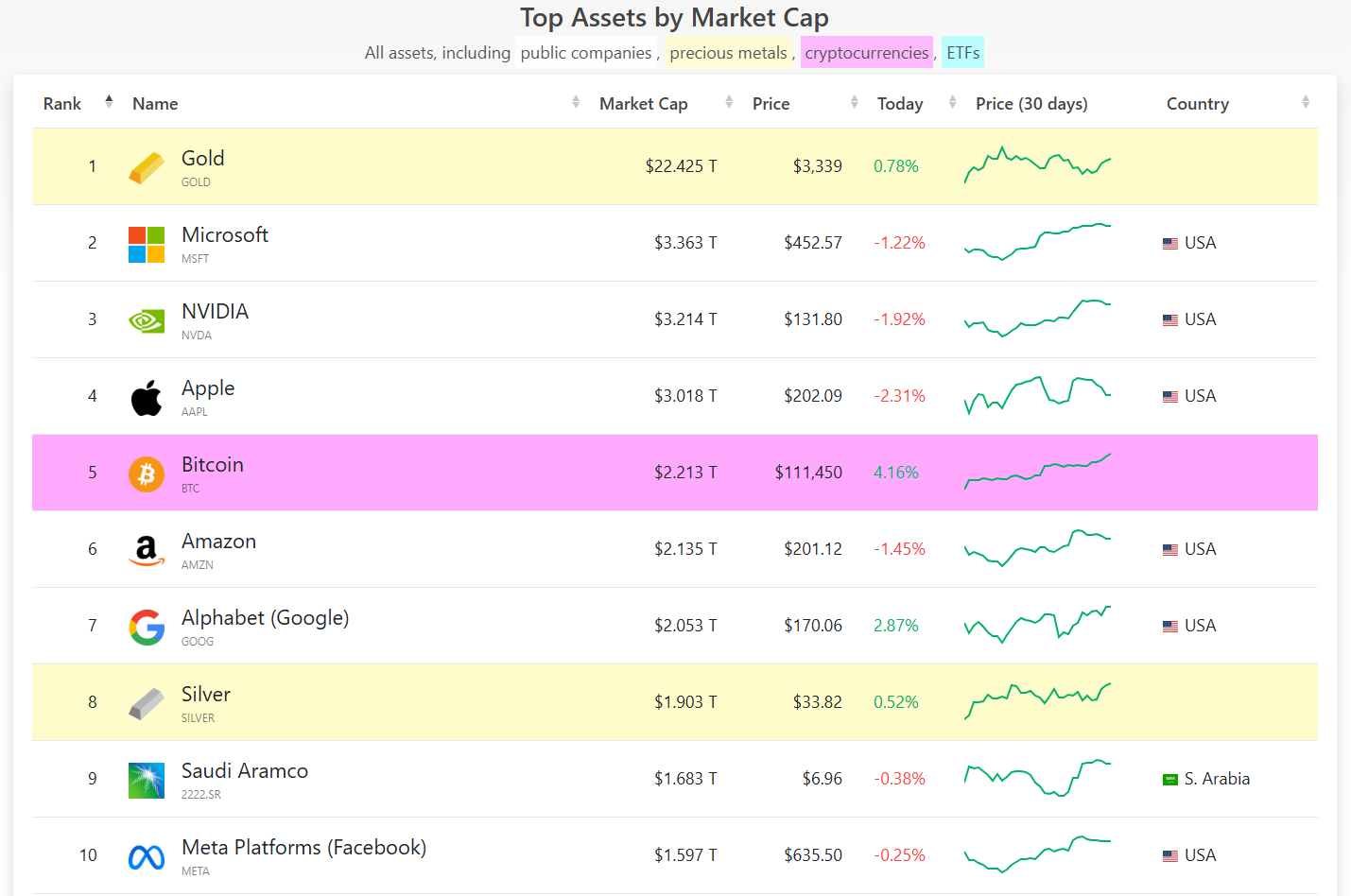

Bitcoin Outranks Amazon, Turns into fifth Largest International Asset by Market Cap

On Might 22, 2025, Bitcoin BTC achieved a historic milestone, surpassing $111,000 to set a brand new all-time excessive. This surge coincides with Bitcoin Pizza Day, commemorating the primary real-world Bitcoin transaction in 2010, when 10,000 BTC have been exchanged for 2 pizzas. The symbolic date has amplified market enthusiasm, with Bitcoin gaining 7.3% over the previous 7 days.

Supply: TradingView

The entire cryptocurrency market capitalization reached $3.6 trillion, with Bitcoin’s dominance at 61.1%, underscoring its central function in driving market sentiment.

Ethereum ETH additionally posted beneficial properties, buying and selling at $2,600, up 40.7% over the previous 14 days. Ethereum’s DeFi ecosystem is prospering, with platforms like Uniswap and Aave experiencing elevated exercise as a consequence of decrease fuel charges, enhancing accessibility. This development is fueling renewed curiosity in Ethereum-based decentralized functions, bolstering their market resilience and progress potential.

Solana SOL rose to $175, a 16.5% enhance over 14 days, pushed by pleasure surrounding the upcoming second-generation Seeker machine, which has secured over $67.5 million in pre-orders. The Solana group is eagerly anticipating the Alpenglow proposal, a game-changing improve anticipated to reinforce community efficiency and scalability, additional boosting investor confidence and sustaining Solana’s robust market momentum.

XRP, a prime performer, climbed 10.7% over the previous 14 days to $2.40. The current launch of XRP futures has sparked optimism for a possible spot XRP ETF, which might enhance liquidity and appeal to institutional buyers, additional propelling XRP’s upward trajectory.

Study extra: Is XRP a Good Funding in 2025? A Complete Information for Traders

Different main cryptocurrencies, together with BNB, Cardano, and Dogecoin, additionally recorded strong beneficial properties, reflecting broad market optimism.

Supply: Coin360

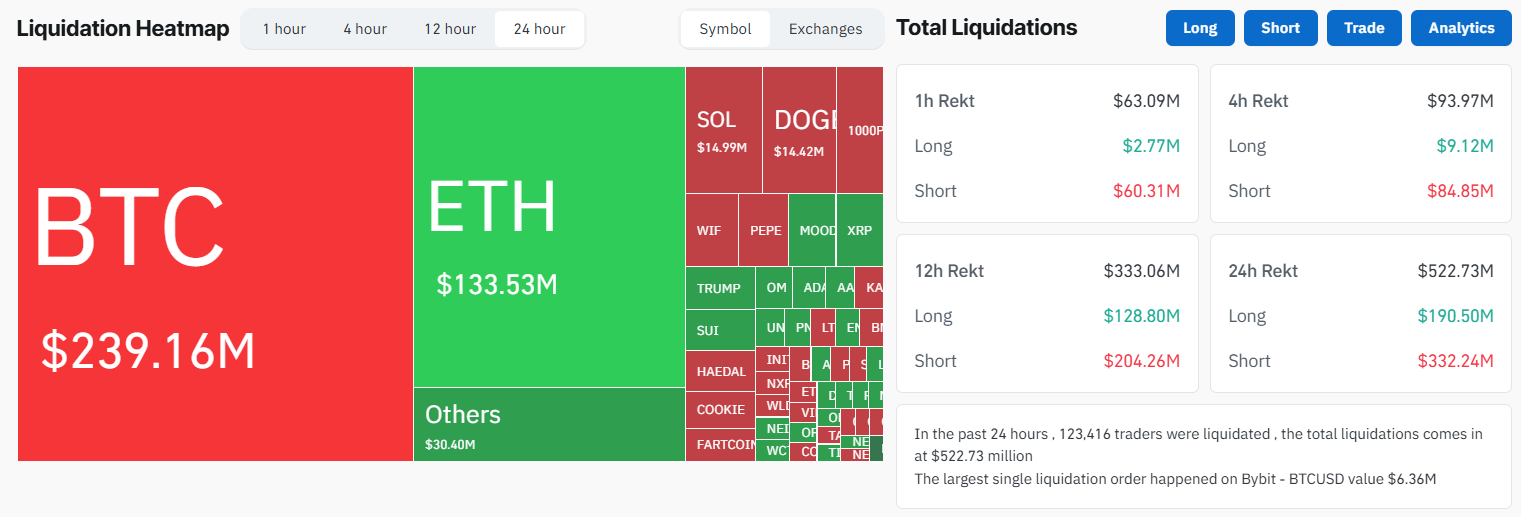

Within the final 24 hours, over $522 million value of leveraged positions have been liquidated, 63% of that are in brief. The biggest single liquidation order occurred on Bybit with the BTCUSDT pair, worth of $6.36 million.

Supply: CoinGlass

Bitcoin’s historic ATH marks a major milestone, because it overtakes Amazon to develop into the fifth largest asset globally by market capitalization. With a market cap of $2.17 trillion, Bitcoin surpasses Amazon’s $2.07 trillion valuation, cementing its standing as a world monetary powerhouse.

Supply: Corporations Marketcap

Robust Bets by Establishments and Whales Push Bitcoin to All-Time Excessive

Bitcoin ATH at $111,000 seems pushed by strategic strikes from institutional buyers and huge crypto whales, who appear to have anticipated favorable market developments.

Spot Bitcoin ETFs have seen document inflows of almost $7 billion since April, reflecting sturdy institutional confidence in Bitcoin as a long-term retailer of worth. This surge in ETF investments, significantly by way of automobiles like BlackRock’s iShares Bitcoin Belief (IBIT), which manages over $56 billion in property, underscores Bitcoin’s rising legitimacy amongst conventional finance gamers.

Moreover, JPMorgan’s shift in stance, with a $1.7 billion funding in Bitcoin ETFs, alerts a broader institutional embrace, additional fueling bullish sentiment.

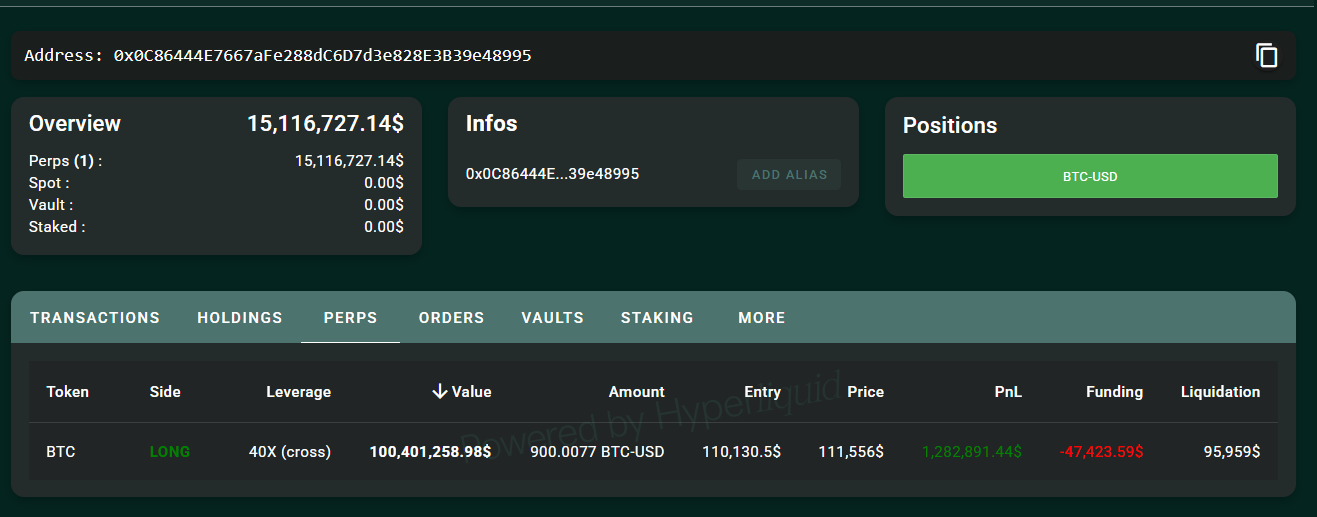

In the meantime, three Hyperliquid whales positioned $1 billion in 40x leveraged lengthy positions on Bitcoin, a daring wager highlighting their robust perception in an imminent price breakout, doubtlessly pushed by insider data or market traits.

Furthermore, one other whale has joined the betting membership, entered a 900 BTC ($99.67 million) place at $110,130.5, has an unrealized revenue of roughly $1.3 million, with a liquidation price of $95,959.

Supply: Hyperliquid