NAIROBI (CoinChapter.com)— Bitcoin change reserves have dropped to 2.35 million BTC, marking their lowest degree since 2018. This tightening provide alerts potential market shifts, in line with CryptoQuant knowledge.

This marked a stark distinction to Bitcoin’s valuation in June 2018, when the cryptocurrency traded simply above $7,000.

Hedge Funds Purchase the Dip

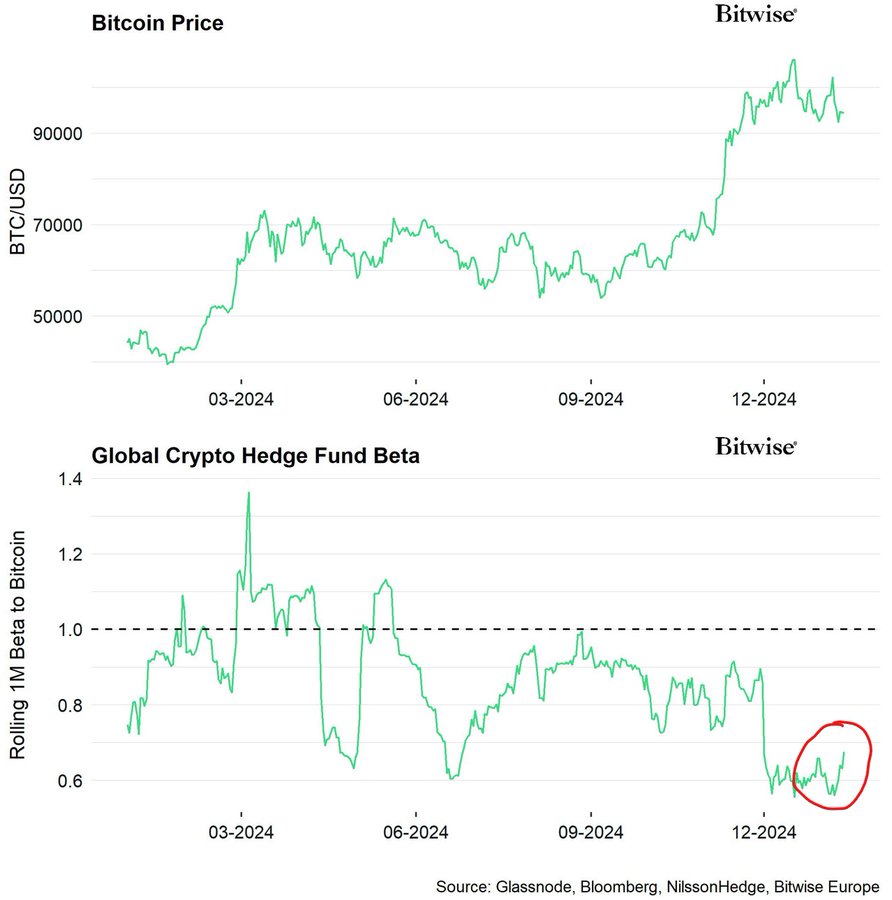

The declining change reserves replicate a surge in institutional curiosity, as hedge funds transfer to capitalize on Bitcoin’s current dip. André Dragosch, head of research at Bitwise, highlighted this pattern, citing a rise in hedge fund publicity to crypto belongings.

In a Jan. 13 publish on X, Dragosch identified that the correlation between hedge fund efficiency and Bitcoin costs had strengthened considerably, indicating sustained market engagement. This accumulation may very well be getting ready the stage for a “supply shock”—a phenomenon the place rising demand clashes with diminishing provide, traditionally pushing costs greater.

Nonetheless, the bullish narrative is tempered by an absence of buying and selling exercise. Analysts argue that whereas provide constraints are constructing, buying and selling momentum stays inadequate to maintain a breakout above the essential $100,000 mark.

Skinny Trading Quantity Stalls Rally Prospects

Bitcoin’s low buying and selling quantity is casting doubts on its potential to interrupt via resistance ranges within the brief time period. Ryan Lee, chief analyst at Bitget Analysis, emphasised the hole between market sentiment and tangible buying and selling exercise.

“While the market shows signs of stabilization, daily volume trends indicate a lack of the momentum needed for a decisive move upward,” Lee instructed Cointelegraph. He added that decreased promoting strain suggests consolidation, although sustained buying and selling curiosity stays a lacking piece.

Knowledge from Santiment revealed that buying and selling volumes for main cryptocurrencies have dipped to ranges final seen earlier than the U.S. elections in Nov. 2024. The continued “trading paralysis,” as described by Santiment, has stalled market enthusiasm however might pave the way in which for rebounds as soon as fear-driven promoting subsides.

Lengthy-Time period Optimism Persists

Regardless of near-term hurdles, Bitcoin’s trajectory for the approaching years stays promising. Analysts predict that by late 2025, Bitcoin might surpass $150,000, pushed by macroeconomic developments corresponding to a projected $20 trillion growth within the world cash provide. If realized, this liquidity increase might channel up to $2 trillion into Bitcoin investments, considerably lifting its valuation.

Institutional demand continues to help Bitcoin’s price. In Dec. 2024, U.S. spot Bitcoin exchange-traded funds (ETFs) bought round 42,000 BTC, 3 times the month-to-month mining output.