YEREVAN (CoinChapter.com) — Almost all tokens listed on Binance in 2024 have misplaced worth. Information reveals that out of 30 initiatives, just one token recorded a price enhance. The remainder dropped in worth, many by over 70%.

PORTAL, which listed on February 29 with a $2.37 billion valuation, now stands at simply $240 million. AEVO, listed on March 13, fell from $3.2 billion to $320 million. STRK, launched on February 20 with help from Coinbase Ventures and Paradigm, misplaced 81% of its worth. One other token, W, backed by Coinbase Ventures and Multicoin Capital, dropped by 86.5%.

The general image is obvious. Almost 89% of tokens listed on Binance in 2024 and 2025 delivered destructive returns. Many had sturdy backers, however that didn’t shield them from losses. The decline in token costs has added to person frustration and raised issues concerning the credibility of Binance token listings.

ACT Coin Crash Fuels Extra Doubts

The scenario intensified after ACT, a meme coin listed on Binance, dropped sharply. Earlier this week, market maker Wintermute offered massive quantities of ACT quickly after the itemizing. The sale created sturdy downward strain on the token’s price.

The ACT incident led to extra questions on how Binance approves new tokens. Customers started to marvel if the listings favor massive gamers whereas retail merchants take the losses. Some consider that monetary motives are positioned above challenge high quality.

The sudden sell-off by Wintermute sparked discussions concerning the itemizing course of and timing. Critics requested whether or not some market makers had entry to early info or coordinated trades. The ACT case turned a central instance in arguments for higher Binance transparency.

Even tokens backed by main buyers like a16z, Consensys, DragonFly Capital, and Binance Labs carried out poorly after their listings. ETHFI dropped by 57% after its launch on March 18. ENA, listed in April with backing from Binance Labs, misplaced 65.4%. TNSR, which entered the market on April 8, fell by 82.4%.

JUP is the one token with good points, exhibiting a 21.2% enhance since itemizing on January 31. The remaining 29 tokens listed in 2024 all posted destructive returns.

These numbers mirror rising strain on Binance. The Binance boycott motion has gained consideration, with extra customers voicing issues about insider exercise and weak itemizing controls. The Wintermute ACT sell-off, paired with sharp losses throughout new tokens, has led to extra criticism of Binance token listings and calls for for extra transparency.

Customers Level to Revenue Focus Amid Binance Boycott

Neighborhood members argue that Binance prioritizes itemizing charges over token fundamentals. This has triggered a Binance boycott motion throughout platforms like X. Critics say the change has allowed a number of low-quality tokens to listing.

Though Binance launched a neighborhood voting system for listings, customers say it hasn’t restored belief. The Wintermute ACT sell-off incident turned a reference level in lots of complaints. Critics known as for extra oversight and larger Binance transparency in how tokens are chosen.

Customers Blame Binance for Failing to Shield Merchants

Social media customers are turning in opposition to Binance, accusing the change of serving to massive gamers profit whereas retail customers lose cash. The hashtag #BoycottBinance is spreading throughout a number of platforms, with customers sharing screenshots, graphs, and direct accusations.

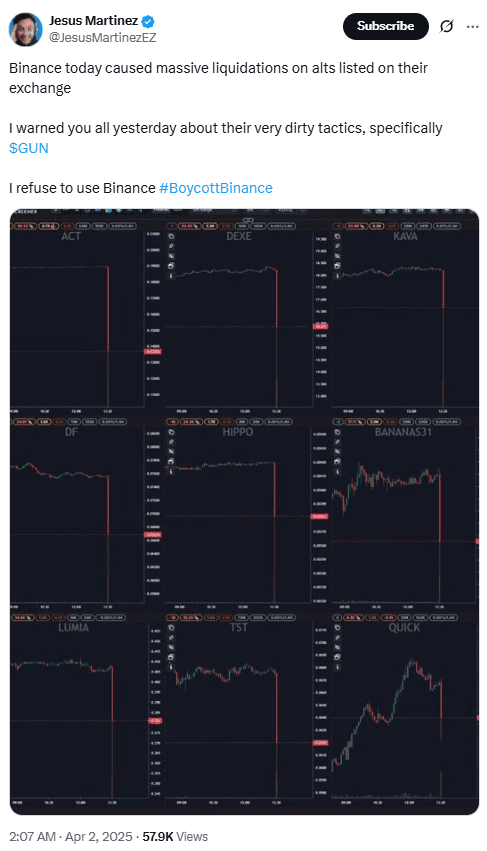

In a single submit, person Jesus Martinez, posted charts exhibiting sudden price crashes for a number of tokens. He mentioned,

“Binance today caused massive liquidations on alts… I warned you yesterday about their very dirty tactics.”

He named token GUN and mentioned he would not use the platform.

FDUSD Depeg Sparks Panic and Extra Criticism

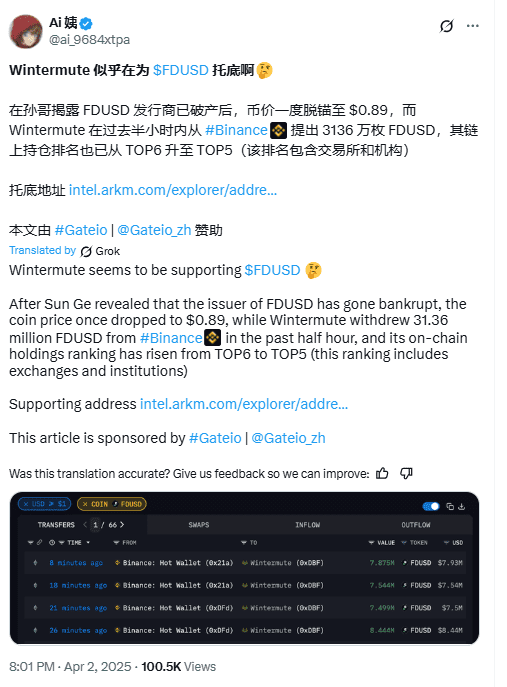

A serious level of concern is the FDUSD stablecoin, which misplaced its greenback peg and dropped to $0.89. The depeg occurred after unconfirmed reviews mentioned the issuer of FDUSD went bankrupt. Binance, as one of many foremost platforms for FDUSD, turned the focus.

Based on blockchain knowledge, at 11:15 AM UTC, market maker Wintermute withdrew 31.36 million FDUSD from Binance. This occurred proper earlier than the stablecoin dropped additional. Merchants mentioned the timing of the withdrawal elevated panic available in the market.

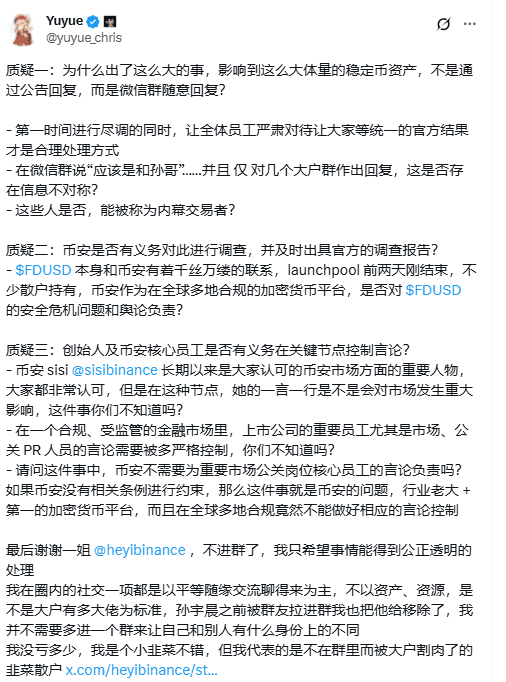

Later, neighborhood members claimed that Binance staff could have leaked personal info to whale teams earlier than the depeg was public. These teams could have had time to behave early, whereas common customers had been caught off guard.

Chinese language analyst @yuyue_chris questioned the position of Binance workers in an in depth submit, asking if the corporate had accomplished any inner investigation into the leak. The submit raised issues about how a lot info had been shared with personal customers and whether or not public customers had been left uninformed.

Transparency Points Gasoline Binance Boycott

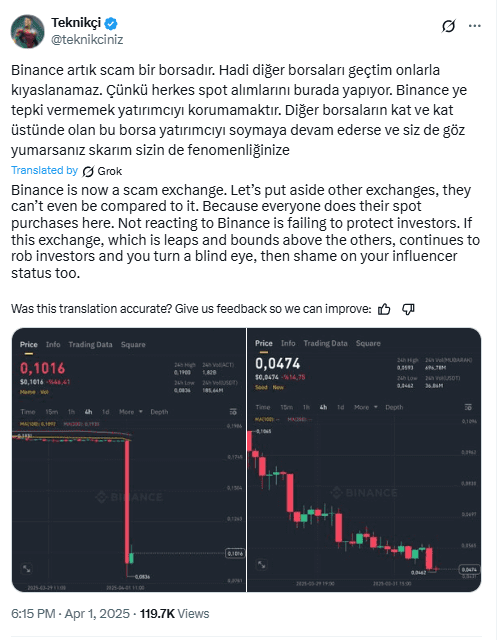

One other person, @teknikciniz known as Binance a rip-off platform and mentioned it continues to hurt buyers whereas different exchanges don’t present the identical sample.

Binance is now a rip-off change. Let’s put apart different exchanges, they’ll’t even be in comparison with it. As a result of everybody does their spot purchases right here. Not reacting to Binance is failing to guard buyers. If this change, which is leaps and bounds above the others, continues to rob buyers and also you flip a blind eye, then disgrace in your influencer standing too.

In the meantime, Binance has not launched an in depth public response to the claims. The corporate stays below strain as extra merchants share screenshots and query its operations.

In the meantime, Binance has not launched any detailed public response addressing the rising listing of accusations. The change has remained silent on key occasions, together with the FDUSD depeg, insider leak allegations, and sudden altcoin crashes.

Merchants proceed sharing screenshots, blockchain knowledge, and price charts that counsel market manipulation or unfair practices.