Picture supply: Getty Photographs

The most effective time to purchase shares is when different traders are trying elsewhere. And it’s honest to say that uncertainty round US commerce coverage has triggered a shift within the inventory market.

Because the begin of the yr, the FTSE 100 is up 6% whereas the S&P 500 is roughly the place it was at the beginning of January. So does that imply it’s time for traders to take a look at shopping for US shares?

The S&P 500 doesn’t look low-cost

The MSCI US Index has underperformed the MSCI World Index for the reason that begin of the yr. However the S&P 500 as an entire posted earnings development of round 18% within the fourth quarter of 2024.

That’s very spectacular and better earnings do make valuations extra enticing. Nonetheless, within the grand scheme of issues, the distinction is pretty marginal.

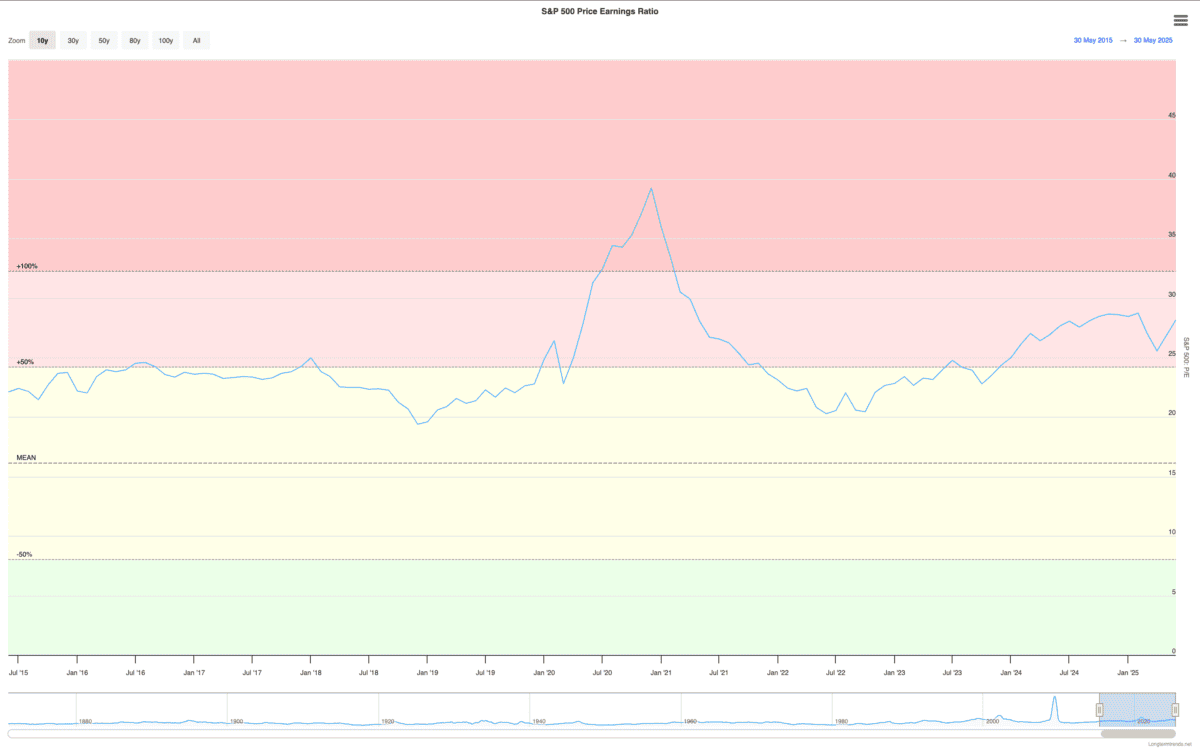

The present price-to-earnings (P/E) ratio of the S&P 500 is in direction of the upper finish of the place it has been during the last 10 years. And historical past tells us that returns from these ranges are usually underwhelming.

After all, the long run doesn’t all the time resemble the previous. However I feel there are alternatives in particular person shares that look rather more enticing.

Not all shares are identical

The S&P 500 is in constructive territory for the reason that begin of the yr, however not each inventory has carried out the identical. Thus far, one of many worst-performing sectors in 2025 has been power.

General, power shares are down round 3.5% and a few particular person shares have fared a lot worse. However that is the sort of shift that I feel can generate alternatives for traders.

A sector falling out of favour with the inventory market may give traders an opportunity to purchase the perfect shares at unusually good costs. Proper now, I feel ConocoPhillips (NYSE:COP) may be a great instance.

The inventory is down nearly 14% for the reason that begin of the yr, however the firm’s long-term benefits stay intact. And it has bold plans for shareholder returns.

A possible power alternative

In 2024, ConocoPhillips generated simply over $8.25bn in free money and it has bold plans to develop this by $6bn between now and 2029. If it could possibly do that, the present share price appears very low-cost.

The agency’s said goal includes the corporate producing nearly 15% of its present market worth in free money annually from 2029. However rather a lot is determined by what occurs to grease costs within the subsequent few years.

That is the largest threat with ConocoPhillips shares. Its future ambitions are primarily based on a median oil price of $70 per barrel and it’s value noting the price of WTI crude is at present 10% under this.

Traders due to this fact shouldn’t depend their chickens prematurely. However with a major quantity of untapped stock accessible at lower than $40 per barrel, there may nonetheless be good returns on the best way.

Grasping when others are fearful

US shares as an entire don’t appear like an apparent shopping for alternative to me in the meanwhile. Nevertheless it’s a special story with the out-of-fashion power sector and ConocoPhillips is an effective instance.

The agency is at present set to return nearly 100% of its market worth to shareholders over the subsequent 10 years. And with bold development plans forward, I feel it’s value contemplating at as we speak’s costs.