As Q2 2024 concludes, the Web3 ecosystem navigates a consistently altering safety setting. This quarter has witnessed a big shift in assault vectors. Centralized exchanges (CEX) have borne the brunt of main incidents, whereas decentralized finance (DeFi) protocols have proven improved resilience.

A report from blockchain safety agency Cyvers gives an in depth analysis of safety incidents. The report highlights their influence on varied segments, adjustments in hacker techniques, and the financial repercussions of those incidents.

Rising Cyber Threats Drive Crypto Losses to New Heights in 2024

The Cyvers Web3 Safety Report for Q2 and H1 2024 reveals a dramatic improve in crypto losses as a result of cyberattacks. The report notes notable occasions, shifting assault methods, and monetary and operational results on the Web3 ecosystem. Regardless of the rise in assaults, restoration efforts and incident response methods have proven enchancment, exhibiting the necessity for steady vigilance and powerful safety measures.

Q2 2024 witnessed $629.68 million in crypto losses throughout varied 49 incidents, bringing the year-to-date complete to a staggering $1.38 billion as of H1 2024. This determine exhibits a notable rise in comparison with the identical interval in 2023, due to this fact highlighting the continued and altering character of threats within the Web3 setting.

Learn extra: 15 Most Widespread Crypto Scams To Look Out For

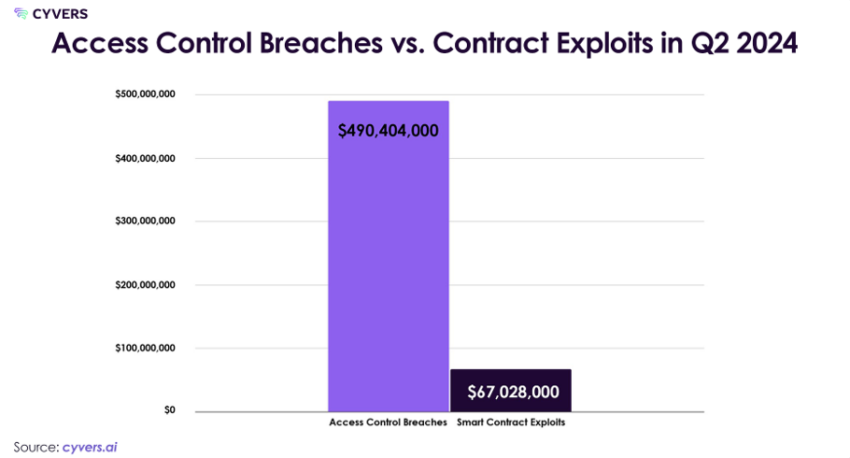

Sensible contract exploits accounted for $67,378,000 from 20 incidents, whereas entry management breaches resulted in losses of $491,311,000 from 26 incidents. Moreover, tackle poisoning accounted for $71,475,000 of the 361 incidents. The year-over-year loss improve exhibits an over 100% rise from Q2 2023.

“It’s worth noting that the amount of funds recovered rose by almost 42%, from $138,900,000 in Q2 2023 to $197,000,000 in Q2 2024. This notable increase highlights the value of solid response techniques and improved recovery efforts,” the Cyvers crew instructed BeInCrypto.

Crypto Hacks Impression in Q2: Regulatory Scrutiny and Rising Prices

Nevertheless, the losses transcend numbers. The safety issues in Q2 had a large and vital impact on the economic system.

The high-profile CEX hacks have intensified regulatory scrutiny, doubtlessly leading to stricter compliance necessities and elevated operational prices for exchanges. As troubled firms pursue authorized motion in opposition to the offenders, these occasions have additionally significantly tarnished their reputations and elevated authorized bills.

Moreover, including to the working bills of Web3 tasks are the frequency and scale of assaults, which have sharply raised crypto insurance coverage charges. Frequent safety lapses may undermine consumer belief, reducing Web3 house adoption charges and funding.

The quarterly report from the Cyvers crew additionally identified geographical developments in Web3 cybersecurity threats. Jap Europe noticed a surge in exercise, whereas Asia-Pacific centralized exchanges confronted focused assaults as a result of regulatory gaps and weaker cybersecurity legal guidelines. However, North American DeFi protocols confirmed elevated resilience, doubtless as a result of stringent safety and compliance measures.

DeFi vs. CeFi: Evaluating the Impression of Latest Crypto Assaults

In Q2 2024, there was a notable shift in safety breaches in the direction of entry management incidents, notably focusing on centralized exchanges. This marked a transfer away from exploiting good contract vulnerabilities in DeFi protocols. Entry management exploits elevated by 35%, whereas good contract exploits decreased by 83% in comparison with H1 2023.

The dramatic 900% improve in CeFi losses in comparison with Q2 2023 alerts a big shift in attacker focus. This pattern could also be attributed to the focus of belongings in centralized platforms and doubtlessly lax safety measures in some exchanges.

The Cyvers crew takes DMM Bitcoin’s incident for instance. The Japan-based centralized change suffered a big hack in Might 2024, leading to $305 million in losses. This occasion marked the most important blockchain hack since December 2022 and the third-largest in crypto historical past.

The hack concerned transferring 4502.9 BTC (over $308 million) to a number of addresses, complicating restoration efforts. Initially, the character of the switch was unclear. Nevertheless, DMM Bitcoin confirmed it as a safety breach and initiated an investigation.

It additionally assured clients that their deposits remained safe. Potential causes included compromised scorching pockets keys permitting unauthorized transactions, attackers tricking customers into signing malicious transactions, or seeding transaction histories with lookalike addresses to mislead customers.

In the meantime, within the DeFi sectors, the Cyvers crew reported that decentralized exchanges (DEX) witnessed vital incidents. Nevertheless, these have been much less extreme than these affecting their centralized counterparts.

Lending protocols skilled reasonable impacts, with notable incidents involving Sonne Finance and UwU Lending. The Cyvers crew examined Sonne Finance’s exploitation, taking it as a case examine.

“The $20 million exploit of Sonne Finance involved a complex oracle manipulation tactic. Attackers exploited a vulnerability in the protocol’s price feed mechanism, momentarily inflating the value of a lesser-known token. This allowed them to borrow against the inflated collateral and drain the protocol’s liquidity pools before the price could be corrected,” they defined.

Bridges emerged as an rising goal, with incidents like XBridge. Wallets and custodians additionally confronted vital losses, with notable incidents like Coinstats.

From Deal with Poisoning to Oracle Manipulation: The Developments in Q2

The rise of tackle poisoning demonstrates attackers’ rising crafty and highlights the necessity for enhanced safety measures. Deal with poisoning may cause vital monetary losses as a result of customers’ belief in acquainted addresses.

Different notable developments in Q2 2024 included flash mortgage assaults exploiting short-term vulnerabilities in liquidity protocols, oracle manipulation assaults exploiting price feeds for arbitrage alternatives, and cross-chain assaults leveraging weaknesses in bridge protocols to siphon funds throughout chains.

The quarter additionally noticed evolving sophistication in post-attack cash laundering strategies. Attackers more and more used cross-chain bridges to maneuver stolen funds throughout a number of blockchains, complicating monitoring efforts.

New DeFi protocols providing privacy-enhancing options have been exploited for cash laundering functions. AI algorithms are being employed to automate and optimize the motion of stolen funds, rendering conventional monitoring strategies much less efficient. There was an elevated use of privateness cash, decentralized mixers, and complex strategies to obscure transaction trails, together with cross-chain swaps and layer 2 options.

Fast Response Mitigates DeFi Losses in Q2 2024

Efficient incident response methods noticed in Q2 2024 included fast motion to freeze susceptible contracts and reduce losses in a number of DeFi incidents. Cyvers famous that some DeFi protocols efficiently carried out decentralized safety groups that might rapidly reply to and mitigate threats.

As an illustration, improved coordination between exchanges, blockchain analytics corporations, and regulation enforcement led to the restoration of $22 million from the Gala Video games hack. Moreover, pump.enjoyable, the meme coin creation platform on Solana, demonstrated speedy response after their safety breach, together with instantly pausing the contract, partaking with the hacker by way of on-chain messages, and providing a bounty. Their proactive measures resulted in 80% of the stolen funds being returned inside 24 hours.

Cyvers Predicts Rising Assaults on Layer 2 Options and Gaming Platforms

Primarily based on Q2 developments, the Cyvers crew predicts a number of threats to emerge sooner or later. These embrace a continued rise in refined contract exploits, the mixing of AI in assault vectors, elevated danger to present cryptographic requirements as quantum computing advances, elevated focusing on of Layer 2 options with their rising adoption, and the potential for assaults that exploit vulnerabilities throughout a number of chains. Moreover, there’s a chance of extra assaults on gaming platforms and NFTs.

Because the ecosystem turns into extra interconnected, safety audits must be thought of for improved cross-chain interactions. Leveraging AI for real-time risk detection and response, fostering better data sharing and collaborative protection mechanisms throughout the trade, and adopting multi-layered safety protocols are important.

Learn extra: Prime 5 Flaws in Crypto Safety and How To Keep away from Them

Consumer conduct continues to play an important position in safety incidents. Phishing and social engineering stay vital components in safety breaches. Weak passwords and password reuse proceed to be exploited in assaults. Customers granting pointless permissions to good contracts stay a big vulnerability.

Common safety consciousness campaigns, greatest practices for personal key administration and multi-factor authentication, wallets and DApps implementing real-time warnings for suspicious transactions, and peer-to-peer education schemes inside crypto communities have successfully raised safety consciousness.

Disclaimer

Following the Belief Undertaking tips, this characteristic article presents opinions and views from trade specialists or people. BeInCrypto is devoted to clear reporting, however the views expressed on this article don’t essentially mirror these of BeInCrypto or its workers. Readers ought to confirm data independently and seek the advice of with an expert earlier than making choices primarily based on this content material. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.