Picture supply: Getty Pictures

The previous 5 years haven’t been type to the UK inventory market and particularly, actual property funding trusts (REITs). These tax-beneficial funding autos are very delicate to rate of interest hikes, which ramp up borrowing prices and scare off buyers.

That’s why lots of them suffered losses via 2023 and 2024. However I feel their excessive dividend yields and dedication to shareholder returns make them nice additions to think about for passive revenue portfolios.

Now, with the business exhibiting indicators of enchancment, it might be time to think about some high UK REITs.

Listed below are two that caught my consideration just lately.

Please be aware that tax therapy will depend on the person circumstances of every consumer and could also be topic to vary in future. The content material on this article is offered for info functions solely. It’s not meant to be, neither does it represent, any type of tax recommendation.

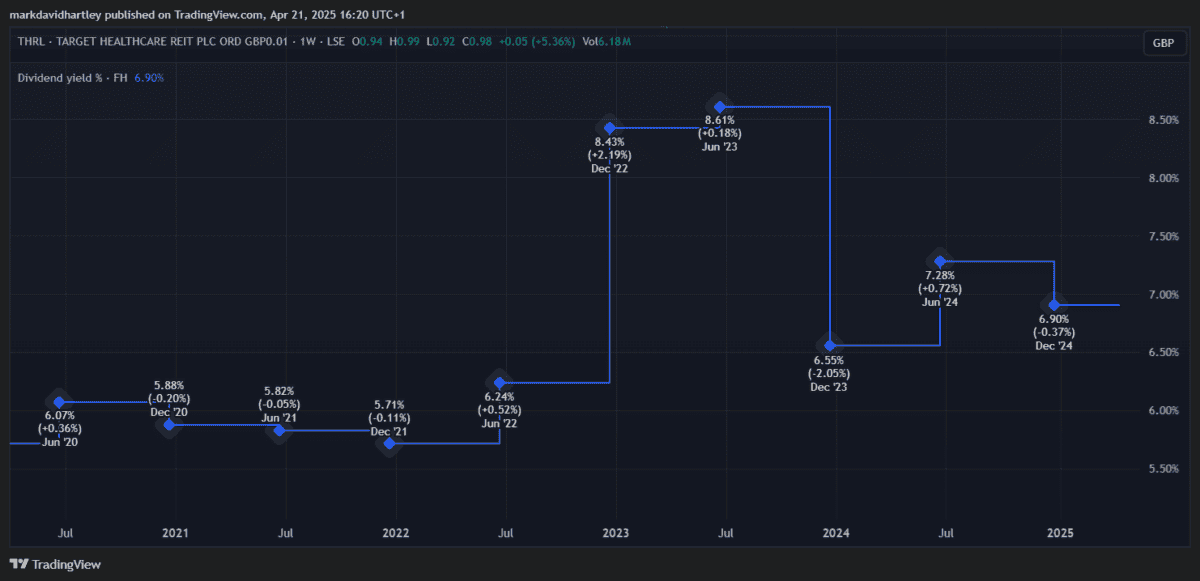

Goal Healthcare REIT

Actual property funding trusts (REITs) are scorching once more, with many having fun with notable consideration this yr. Considered one of my favourites, Main Well being Properties, is up virtually 10%, whereas sustaining a juicy 6.9% yield.

However now I’ve my eye on a possible competitor — Goal Healthcare REIT (LSE: THRL). The inventory boasts a 5.9% yield and is up a powerful 16.7% this yr already. But regardless of this, its price-to-earnings (P/E) ratio stays low, at 8.45. This implies it nonetheless has lots of room to develop.

And I’m not shocked — at 98p per share, it’s nonetheless 20% beneath its five-year excessive set in July 2021.

Nevertheless, the chance of a return to excessive rates of interest is ever-present, to not point out regulatory and coverage adjustments in healthcare or housing. Each these elements can damage the share price, compounded by any further bills from rising supplies prices, upkeep points or environmental disasters.

It’s value nothing that REITs are likely to get pleasure from restricted capital progress however make up for it with robust and dependable dividends.

What actually caught my eye about Goal was the corporate’s market cap relative to income, measured by its price-to-sales (P/S) ratio. At 8.48, it suggests buyers are prepared to pay a excessive price for the inventory. This, mixed with a low P/E ratio, suggests robust progress potential.

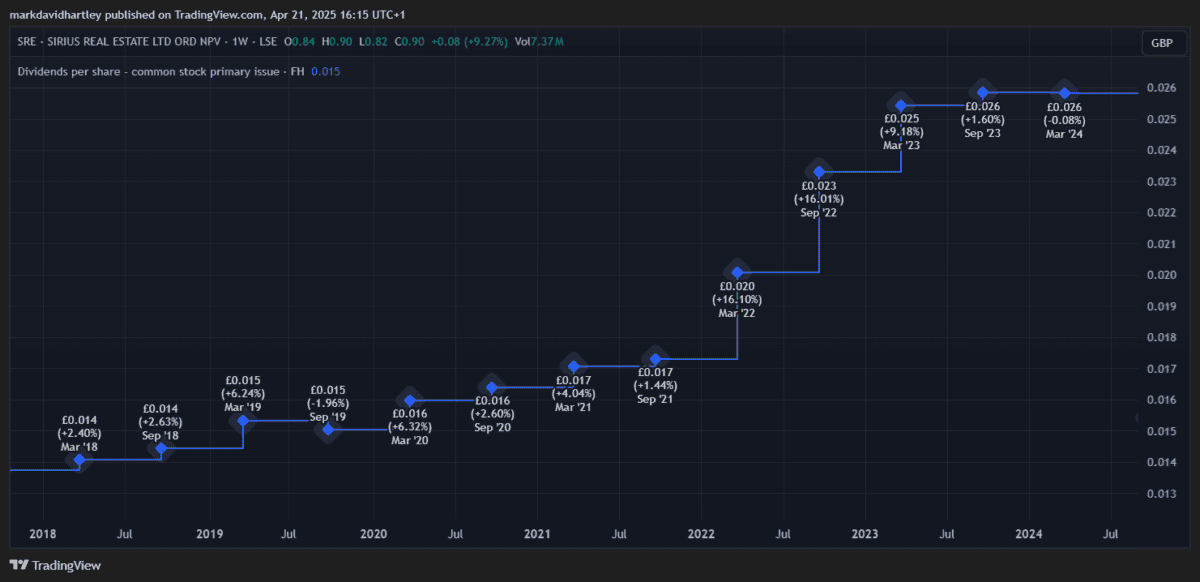

Sirius Actual Property

Sirius Actual Property (LSE: SRE) is a property firm centered on proudly owning and managing enterprise parks, versatile places of work and industrial areas in Germany and the UK. It has established a repute for producing steady rental revenue from small and medium-sized enterprises (SMEs), benefitting from robust operational effectivity and regional diversification.

One of many fundamental points of interest of the REIT is its strong income progress, which rose 7.2% year-to-date (YTD), reflecting excessive tenant demand and efficient asset administration. The corporate has a good dividend yield of 5.6%, interesting to income-focused buyers, and its P/E ratio of 10.8 suggests the inventory is at the moment undervalued relative to earnings.

Nevertheless, there are dangers. Like Goal Healthcare, Sirius is affected by macroeconomic points like excessive inflation and rates of interest. This places strain on tenant affordability and might result in diminished property valuations. The corporate additionally has publicity to foreign money fluctuations between the euro and the pound, doubtlessly affecting reported outcomes. Furthermore, future rental revenue progress could gradual if SMEs face financial pressure.

With a 1.38bn market cap, it’s bigger and extra well-established than Goal. This makes it a extra defensive play, including stability however limiting its progress potential.

Are they the very best? Saying so may be very subjective and will depend on an investor’s particular person standards. However collectively, I feel the 2 are value contemplating as a part of an revenue portfolio aimed toward reaching long-term dividend returns.