Picture supply: Getty Photos

Raspberry Pi (LSE:RPI) shares proved to be a candy addition to the London Inventory Change in final week’s preliminary public providing (IPO).

Contemporary UK inventory market listings have slumped to a 10-year low, however this tech firm has attracted vital investor curiosity. In its first day of buying and selling, the Raspberry Pi share price skyrocketed as a lot as 40%.

So, ought to buyers take into account grabbing a slice of this new inventory at present?

Right here’s my take.

New child on the block

Regardless of the identify, Raspberry Pi has nothing to do with edible treats.

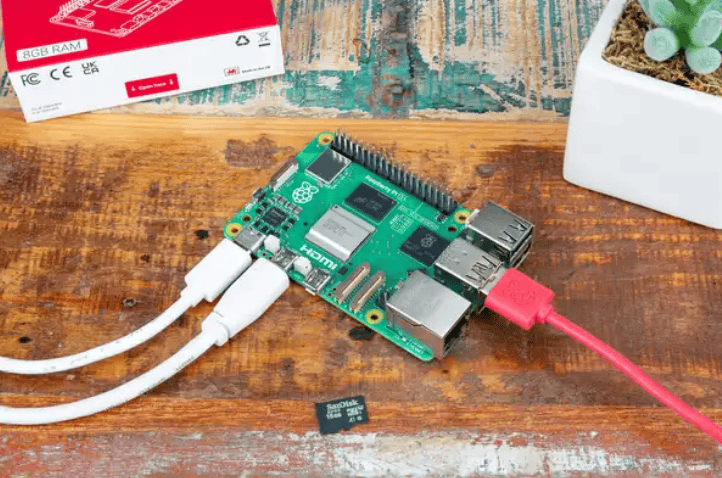

The Cambridge-based enterprise began life because the business arm of a charity to advertise pc science schooling. It’s now best-known for designing and manufacturing miniature single-board computer systems with costs beginning at simply $35.

Since its inception, Raspberry Pi’s offered a powerful 60m items. At this time, industrial prospects account for 72% of gross sales. The rest come from tech fanatics and educators.

Industrial functions for its computer systems embrace sensible dwelling units, seismometers, synthesisers, cardiology system screens, and rather more.

Development credentials

Unusually for a tech startup, Raspberry Pi’s already a worthwhile enterprise with zero debt. Final 12 months, pre-tax revenue rose 90% to succeed in $38.2m.

It’s additionally backed by main gamers, together with the likes of Sony and ARM. These strategic partnerships are essential for the fledgling firm and add weight to the funding case.

As well as, the group already has a horny diploma of geographic diversification. Europe’s the biggest market, representing 38% of shipped items, adopted by North America (29%), and Asia (26%). The remainder of the world accounts for 7%.

So as to add a cherry on prime, the potential market alternative is big and rising. Presently, Raspberry Pi estimates its mixed goal market is price round $21bn.

All good to date, then.

Issues might flip bitter

Nonetheless, I’ve some considerations about investing within the shares. Three main dangers spring to thoughts, though it’s removed from an exhaustive checklist.

First, the valuation. As I write, Raspberry Pi shares commerce at a price-to-earnings (P/E) ratio round 29. The corporate has a £720m market cap.

Whereas it’s commonplace for tech shares to draw greater multiples, that places the agency in the identical ballpark as Alphabet, Apple, and Meta.

Whether or not a inventory market minnow with lots to show deserves to commerce for the same P/E ratio as established US tech titans is a moot level. Briefly, it doesn’t seem like a very low-cost purchase to me.

Second, there are notable competitors dangers. Raspberry Pi doesn’t seem to have a large moat. Arguably, there’s little stopping different firms from consuming into its market share with decrease costs or higher merchandise.

Third, whereas the enterprise has admirable non-profit roots, I’m involved that its loyal neighborhood of fanatics could also be dismayed by the choice to go public. Balancing shareholder pursuits with an ethically-conscious fanbase received’t be simple.

A uncommon probability to get wealthy?

General, I believe Raspberry Pi is an enchanting firm and I hope it does effectively. That mentioned, I’ve too many doubts in regards to the challenges it faces to speculate at present.

I believe there are higher alternatives to spend money on wealth-creating shares elsewhere, however courageous buyers who disagree with me is likely to be handsomely rewarded for taking over the dangers.