Crypto influencers like @CryptoELITES and @JakeGagain have printed bullish projections on social media. One chart shared by @CryptoELITES outlines a long-term development channel suggesting that PEPE is at the moment at a neighborhood backside, with the following main leg pointing towards a 40x acquire — which might push the price close to the $0.0004 vary.

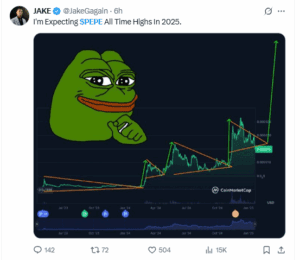

Equally, @JakeGagain posted a chart highlighting a multi-month ascending sample, arguing that PEPE might attain new all-time highs earlier than the tip of 2025.

Each projections depend on historic development channels and chart-based continuation setups. Nevertheless, present market indicators don’t affirm the beginning of a sustained upward transfer.

PEPE Worth Trades Beneath EMAs, RSI Stays Subdued

PEPE is buying and selling at $0.00001041 as of June 19. The chart exhibits a descending wedge sample forming after the early Could rally. This construction suggests potential consolidation, however not but a confirmed breakout. PEPE price is compressing beneath the 20 EMA ($0.00001096), 50 EMA ($0.00001111), 100 EMA ($0.00001134), and 200 EMA ($0.00001141). This alignment exhibits sustained bearish strain throughout all main timeframes.

Robust resistance sits between $0.00001134 and $0.00001200, marked by earlier rejection zones and intersecting EMAs. Worth tried to interrupt into this band in late Could however failed to carry above.

The RSI on the every day chart at the moment reads 40.60, with the sign line at 45.29. Each stay beneath the impartial 50 stage. This means weak momentum. RSI has remained beneath 50 for many of June, aligning with broader development weak spot.

The present falling wedge intently resembles the same construction from June–August 2024, the place PEPE additionally failed to interrupt key resistance after a robust transfer up. In that interval, the token misplaced over 40% from the wedge apex earlier than stabilizing.

The identical setup is now seen, with a decrease excessive forming beneath main resistance. Except PEPE breaks the wedge’s higher boundary and reclaims $0.0000115, the sample dangers repeating.

Whale Exercise and Trade Information Stay Conflicted

Current on-chain knowledge exhibits elevated exercise amongst giant wallets. Whale transactions above $100,000 rose 73% within the final 24 hours. Whole whale transaction quantity reached over $141 million. On the similar time, large-holder web inflows elevated from 81 billion PEPE to 125 billion.

Whale withdrawals from exchanges additionally spiked. On June 18, two wallets withdrew over 1.79 trillion PEPE, valued between $22 million and $27 million. These withdrawals cut back obtainable provide on exchanges, typically interpreted as accumulation.

Nevertheless, not all whale conduct suggests bullish intent. One pockets, recognized as 0x6ea4, despatched 600 billion PEPE again to Binance on June 18. On-chain knowledge exhibits this handle took a $3.5 million loss. Earlier whale deposits to exchanges have additionally preceded short-term price drops. A 609 billion deposit on June 13 triggered a 3.7% decline inside 24 hours.

Open curiosity in PEPE futures stays elevated. Nevertheless, funding charges have turned destructive a number of occasions in June. A destructive funding fee means merchants with lengthy positions are paying funding to brief sellers. This exhibits that the derivatives market continues to lean bearish.

Trading quantity has elevated alongside open curiosity. Regardless of this, price has not damaged resistance. This divergence means that quantity might replicate volatility and never directional conviction.

Technical and on-chain knowledge don’t affirm a rally. Worth stays beneath short-term resistance ranges. Momentum indicators are weak. Funding knowledge exhibits short-side strain. Whale exercise exhibits combined intent, with accumulation and change deposits occurring concurrently.

For bullish momentum to realize assist, PEPE should shut above the 50 EMA at $0.00001094 and reclaim $0.0000114. RSI should additionally transfer above 50. Till these indicators seem, the market construction favors consolidation or draw back continuation.