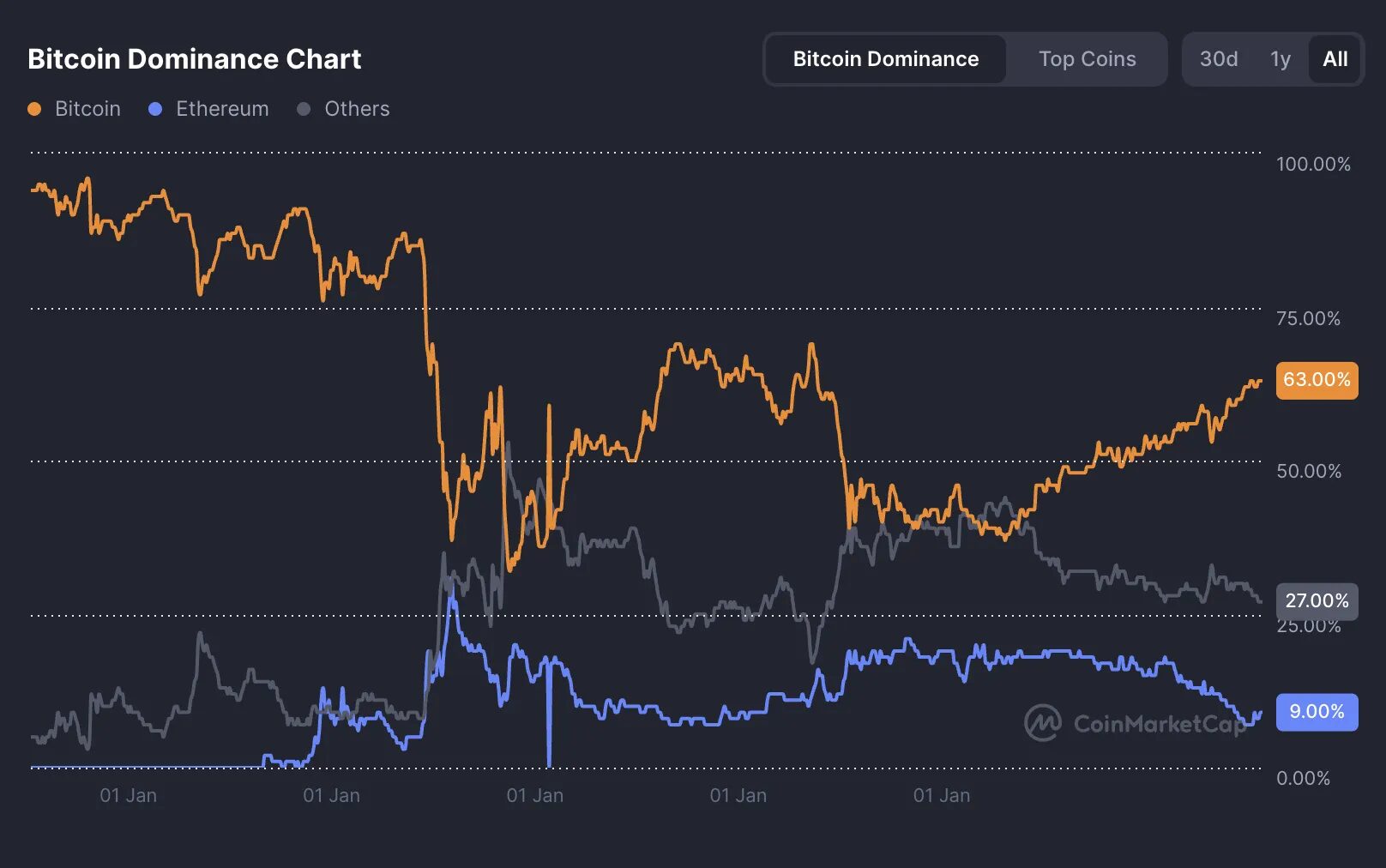

Bitcoin’s share of the cryptocurrency market has surged to ranges not seen in 4 years, approaching the psychologically important 75% threshold.

Regardless of Bitcoin itself buying and selling barely under its Might 22 all-time excessive of $111,970, its dominance (BTC.D) has continued to climb, signaling an imbalanced restoration that closely favors BTC over different digital property.

What Is BTC Dominance (BTC.D)?

Bitcoin Dominance, abbreviated as BTC.D, measures Bitcoin’s share of the whole cryptocurrency market capitalization. It displays the proportion of capital allotted to Bitcoin relative to all different digital property. A rising BTC.D sometimes signifies that capital is consolidating in Bitcoin on the expense of altcoins, usually signaling risk-off sentiment or institutional desire for BTC’s liquidity and regulatory readability.

Conversely, a declining BTC.D suggests rising curiosity in altcoins and the potential for broader market hypothesis.

Bitcoin’s Market Share Nears 4-12 months Highs

Bitcoin dominance surpassed 64% in early Might, reaching its highest level since January 2021. Latest knowledge from TradingView exhibits BTC.D oscillating between 64% and 65%, marking a sustained interval of outperformance in opposition to altcoins.

Supply: TradingView

Notably, this rise has occurred at the same time as Bitcoin costs hover just under new report highs, suggesting capital is rotating towards BTC while not having recent all-time peaks.

Coingecko experiences Bitcoin’s market capitalization now sits at $2.18 trillion, comprising 61% of the $3.54 trillion crypto market. When excluding BTC and ETH (TOTAL3), the altcoin sector remains to be battling to reclaim April’s $1.17 trillion resistance – a struggle it’s presently shedding.

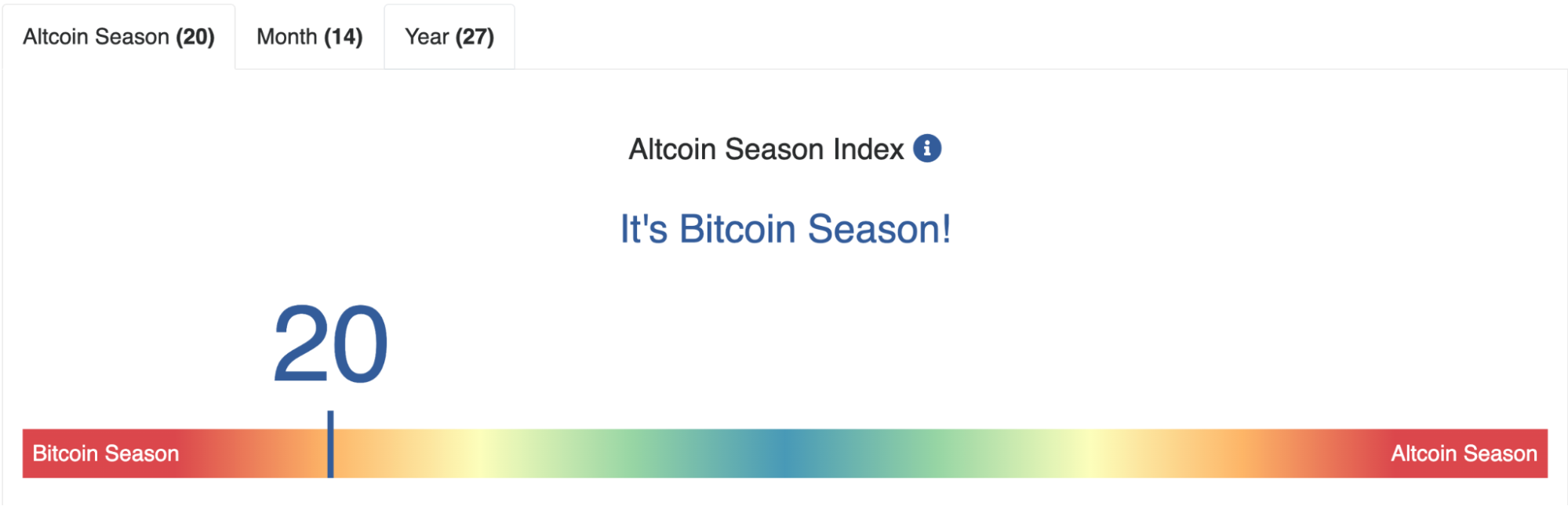

The BlockchainCenter Altcoin Season Index, which indicators altcoin power when 75% of the highest 50 cash outperform BTC over 90 days, presently stands at 22 – deep in “Bitcoin Season” territory. The continued altcoin bear section has now stretched over 1,200 days, the longest within the business’s historical past.

Supply: BlockchainCenter

Main altcoins are nonetheless properly off their all-time highs. Ether stays 64% under its November 2021 peak, whereas Solana remains to be down 36%. In the meantime, TOTAL3 continues to be rejected at key resistance ranges, casting doubt on a near-term rotation.

Capital Retains Flowing Into Bitcoin

Because the U.S. Securities and Trade Fee accepted spot Bitcoin ETFs in early 2024, institutional capital has poured into these merchandise at a scale beforehand unseen in crypto markets. Over $1 billion in internet inflows have entered BTC-focused ETFs, reflecting a brand new wave {of professional} investor participation. Registered funding advisers and wealth managers now dominate ETF shareholder registries, in line with CoinDesk’s 13F filings.

In distinction, Ethereum ETFs recorded $228 million in internet outflows in Q1 2025. Analysts interpret the disparity as a transparent sign that establishments desire Bitcoin as a “first exposure” asset attributable to its longer observe report, perceived regulatory security, and better liquidity profile.

Supply: CoinDesk

Bitcoin continues to profit from its de facto regulatory readability. It’s broadly labeled as a commodity by U.S. companies just like the CFTC, not like many altcoins nonetheless entangled in authorized grey areas or enforcement actions. Monetary Information London experiences that hedge funds similar to Millennium Administration and Brevan Howard have considerably expanded positions in Bitcoin ETFs since their approval.

In the meantime, the absence of regulatory approval for crypto basket ETFs, those who embody altcoins, has restricted broader institutional diversification, reinforcing Bitcoin’s primacy in regulated portfolios.

Bitcoin’s deep liquidity stays certainly one of its most compelling attributes, particularly throughout unsure macroeconomic environments.

Macro dangers like renewed tariff conflicts, Fed coverage ambiguity, and geopolitical flare-ups have prompted portfolio managers to hunt refuge in probably the most liquid crypto asset out there. Mitrade’s cross-exchange knowledge confirms that in sharp market drawdowns, BTC.D truly will increase, exhibiting that merchants offload altcoins first.

This sample has develop into self-reinforcing: the extra Bitcoin dominates liquidity flows, the extra cautious capital it attracts, additional marginalizing altcoins throughout volatility spikes.

Learn extra: Trading with Free Crypto Alerts in Night Dealer Channel

Can Altcoin Season Break Free?

U.S. spot Ethereum ETFs have entered a robust influx streak – 15 consecutive days with roughly $837.5 million added since mid‑Might, bringing cumulative 2025 inflows to over $3.3 billion. With BlackRock’s ETHA main (~$600M), a profitable U.S. itemizing may reorient institutional funds towards ETH and away from BTC.

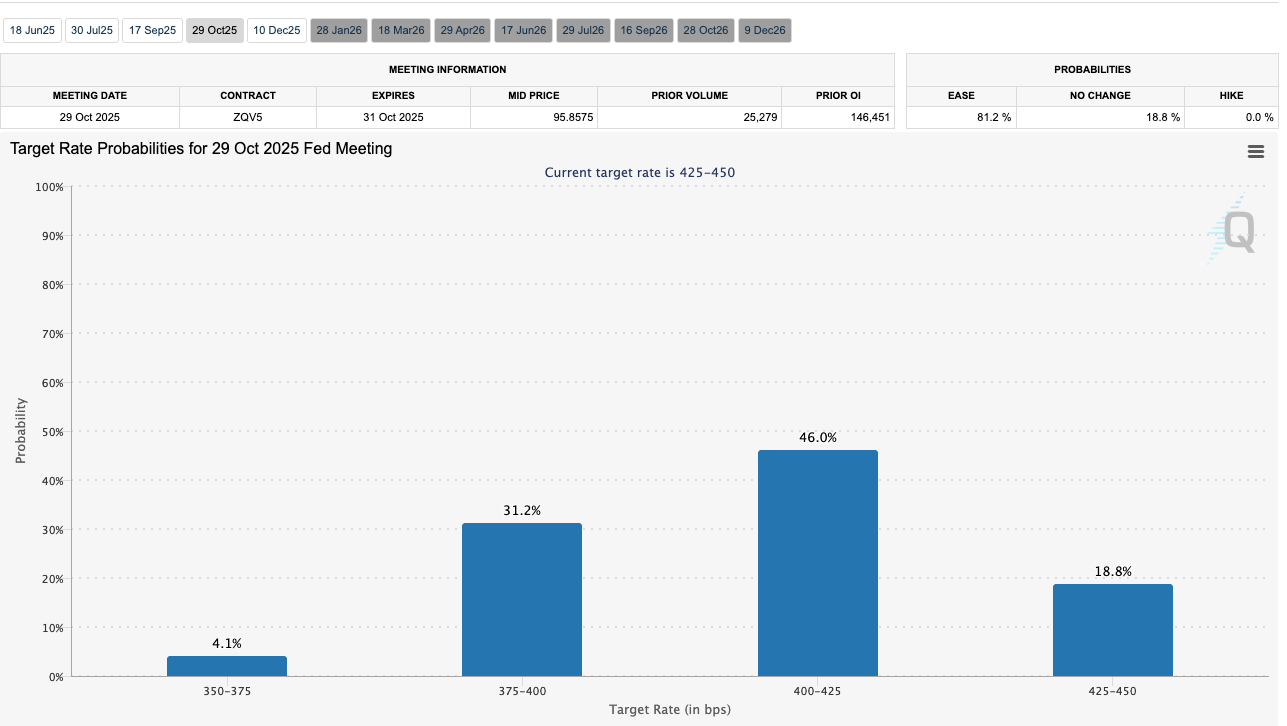

On‑chain danger fashions from AInvest present a 90% likelihood that easing Fed coverage may set off an altcoin rally. The CME FedWatch Device nonetheless assigns a couple of 4.6% probability of a charge lower in early June, but when cuts materialize later, historic patterns recommend smaller‐cap cryptos may rally in tandem.

Supply: CME Group

Furthermore, new thematic bets, like AI-linked tokens, actual‑world‐asset performs, or business‐particular protocols, might briefly decouple from BTC‑dominated traits. Nevertheless, these sectors presently lack ETF channels or strong institutional publicity, making any breakout weak with out broader adoption drivers.

Nonetheless, word that even bullish technical indicators like a golden cross on the TOTAL3 chart require new capital inflows to be significant, capital that continues to be concentrated in Bitcoin.

Structural benefits regulatory, liquidity, and institutional presently favor BTC. Until a type of levers shifts, or a disruptive catalyst breaks the dominance development, altcoin buyers might proceed to face powerful headwinds as Bitcoin consolidates its function as crypto’s liquidity king.

Learn extra: When Will Altcoin Season Start?