Picture supply: Getty Photos

I’m scouring the London inventory marketplace for the most effective dividend shares and exchange-traded funds (ETFs) to purchase at this time. And I believe I’ve discovered a few distinctive candidates for a long-term passive revenue.

Not solely do the next have FTSE 100-beating dividend yields proper now. I anticipate them to supply a big and rising dividend over time.

Right here’s why I’d purchase them if I had spare £20,000 prepared to speculate. Primarily based on present dividend yields, they might make me £1,200 in further revenue this 12 months alone if I break up my funding 50-50.

An inexpensive ETF

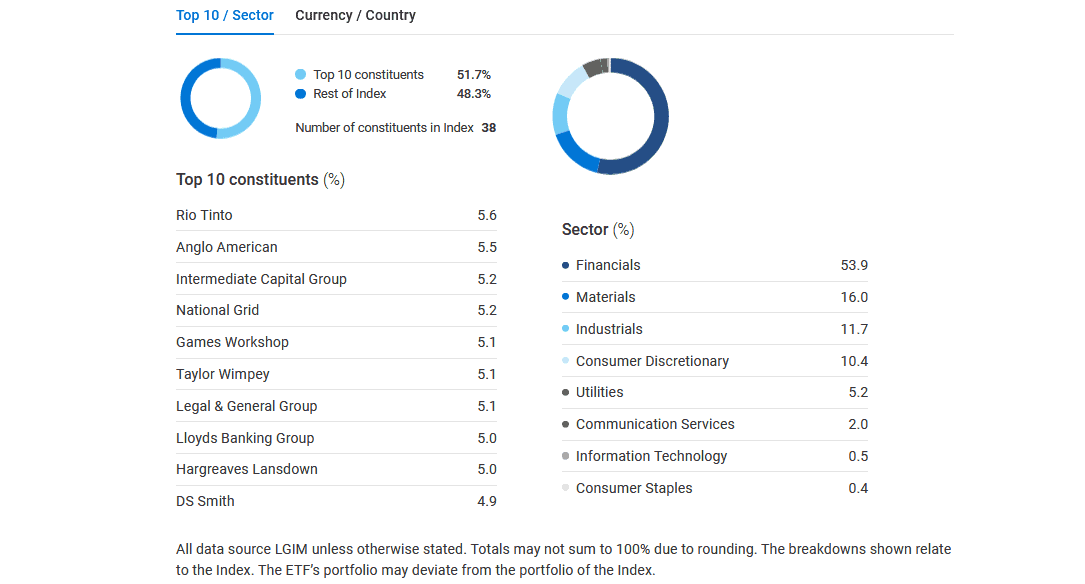

As its identify implies, the L&G High quality Fairness Dividends ESG Exclusions UK ETF (LSE:LDUK) focuses on British corporations with robust data from an environmental, social and governance (ESG) standpoint.

It invests in a basket of shares — 38 on the final rely — excluding people who have “essentially poor stability sheet, revenue assertion and/or ESG traits“. Whereas dividends are by no means assured, the primary two could make the fund a reliable supply of passive revenue.

Main holdings right here embrace miners Rio Tinto and Anglo American, monetary companies suppliers Lloyds and ICG, and utilities enterprise Nationwide Grid. This broad diversification will help it to supply a clean return over time.

One downside with this fund is its low liquidity in comparison with different ETFs. This could make it trickier and extra expensive for traders to enter and exit positions.

That mentioned, I nonetheless suppose it’s value a detailed look proper now. Its dividend yield’s at the moment 4.5%, round a proportion level increased than the broader Footsie common.

A FTSE 100 dip purchase

Insurance coverage big Aviva (LSE:AV.) is a FTSE 100 share I already personal in my portfolio. I’m contemplating upping my stake after I subsequent have money to speculate too, owing to its good worth.

You see, Aviva’s share price has fallen sharply from above 500p previously six weeks. I believe this represents a pretty dip-buying alternative.

Because the chart beneath reveals, its dividend yield is double the FTSE 100 common of three.6%. And it rises steadily over the next two years amid Metropolis predictions of dividend hikes.

| Yr | Dividend per share | Dividend progress | Dividend yield |

|---|---|---|---|

| 2024 | 35.43p | 6% | 7.4% |

| 2025 | 38.11p | 8% | 7.9% |

| 2026 | 40.83p | 7% | 8.3% |

On high of this, Aviva shares commerce on an undemanding ahead price-to-earnings (P/E) ratio of 10.5 occasions. And its price-to-earnings progress (PEG) a number of sits beneath the worth watermark of 1, at simply 0.5.

The monetary companies agency generates big quantities of money, which makes it a pretty goal for dividend traders. With a robust Solvency II ratio (205% as of June), it appears to be like in fine condition to fulfill the payout forecasts proven above.

I anticipate Aviva to ship a big and rising dividend over time as a rising aged inhabitants drives demand for retirement and safety merchandise. Having mentioned that, intense competitors in its markets might influence the agency’s capacity to capitalise on this. However I prefer it all the identical.