Picture supply: Getty Photographs

Since 24 February 2022, the share price of BAE Programs (LSE:BA.), the FTSE 100 defence contractor, has greater than doubled. That was the day Russia invaded Ukraine and reignited the controversy over whether or not governments are spending sufficient on their militaries.

Defence of the realm

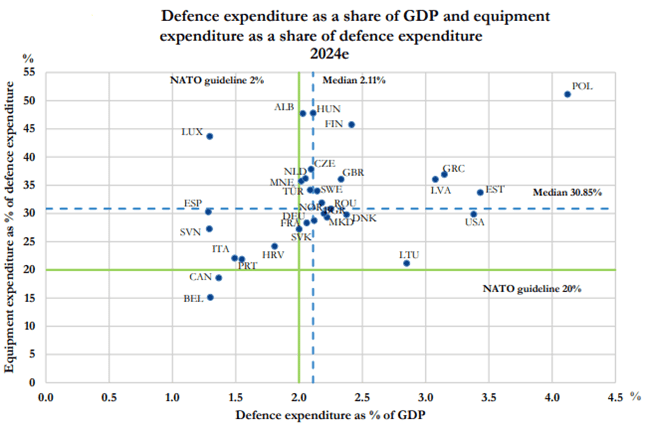

NATO encourages its members to spend not less than 2% of their gross home product on defence. The determine for the UK is at the moment 2.3%. However in the course of the current common election marketing campaign, each principal political events pledged to extend this to 2.5%.

The newly-elected Labour authorities hasn’t given a timescale for assembly this dedication. It has additionally cautioned that it’s going to solely attain the goal if the financial system grows.

However on 10 July, talking on Occasions Radio, Luke Pollard, the Armed Forces Minister, reiterated the federal government’s intention to succeed in 2.5%. He additionally mentioned it was vital that any elevated defence spending was “directed at British industry”.

This will solely be excellent news for BAE Programs. Extra expenditure of 0.2% is equal to £23bn a 12 months.

To place this in context, the UK’s largest defence contractor’s gross sales in the course of the 12 months ended 31 December 2023 (FY23) have been £25.3bn.

| Monetary 12 months | Gross sales (£bn) | Underlying earnings earlier than curiosity and tax (£bn) | Underlying earnings per share (pence) | Order ebook (£bn) |

|---|---|---|---|---|

| 2021 | 21.3 | 2.2 | 50.7 | 35.5 |

| 2022 | 23.3 | 2.5 | 55.5 | 48.9 |

| 2023 | 25.3 | 2.7 | 63.2 | 58.0 |

In fact, it’s extremely unlikely that the entire additional spending would go to BAE Programs. I’m positive Rolls-Royce Holdings, Serco Group, Babcock Worldwide, and QinetiQ would all get their fair proportion. To not point out quite a few unlisted firms.

However even when BAE Programs acquired a small proportion, it might probably rework its monetary efficiency and drive its share price larger.

Timing

At any time when a inventory has been on a superb run, it’s typically simple to assume that it’s too late to speculate.

However a high quality firm will proceed to ship. Warren Buffett didn’t put money into Apple till after the launch of the ninth model of the iPhone. Sure, he ‘missed out’ on a six-fold enhance within the inventory price. Nevertheless, it’s grown greater than seven occasions since he first invested.

The BAE Programs share price has fallen 9% in six weeks. This may very well be a great alternative to take a stake.

The shares at the moment commerce on a historic price-to-earnings (P/E) ratio of 20 — twice the FTSE 100 common — so it will possibly’t be described as a discount. Nevertheless, this does evaluate favourably with (say) Rolls-Royce, which trades on a a number of of 28 occasions earnings.

And the 75 largest US defence contractors have a mixed P/E ratio of 47. Though shares on the opposite aspect of the Atlantic entice larger multiples in most industries.

Sadly, we stay in a harmful world. The Doomsday Clock has by no means been nearer to midnight and there are at the moment practically 50 armed conflicts on the earth. Due to this fact, the expansion prospects for the defence sector look like good.

Nevertheless, there’s the difficulty of ethics that must be addressed. Some received’t go close to the sector. However in my view, the first obligation of a authorities it to maintain its residents protected so I wouldn’t rule out investing on grounds of morality.

However I’d rule out investing in BAE Programs because of the miserly dividend.

The corporate paid 30p in FY23, which means a present yield of two.4%. There are numerous FTSE 100 shares providing a much better return.

For that reason alone, I don’t wish to take a place.