Blockchain was formally launched in 2009 with the discharge of its first software — the Bitcoin cryptocurrency — however its roots attain again a number of many years. Lots of the applied sciences that type the premise for blockchain immediately have been within the works lengthy earlier than the emergence of Bitcoin.

Nonetheless, blockchain most identifies with Bitcoin — for higher or worse. Within the wild and raucous years that adopted Bitcoin’s debut, blockchain earned a popularity akin to the Wild West. Its decentralized, peer-to-peer (P2P) structure allowed nearly anybody to take part within the course of, making it appear too dangerous for enterprise use. That began to alter in 2016 when a burgeoning open supply group started growing full enterprise platforms.

Since then, the know-how has taken on a lifetime of its personal, with curiosity coming from many quarters, regardless of the generally scary cryptocurrency headlines of late. Governments, companies and different organizations are researching and deploying blockchain know-how to fulfill wants that don’t have anything to do with digital forex. Within the face of proliferating cyberthreats and authorities information privateness laws, blockchain presents safety, immutability, traceability and transparency throughout a distributed community, making it effectively suited to use instances which have change into troublesome to help and shield with conventional infrastructures.

What’s blockchain?

Blockchain is a kind of database that is a public ledger for recording transactions with out the necessity for a 3rd occasion to validate every exercise. It is distributed throughout a P2P community and consists of information blocks linked collectively to type a steady chain of immutable data. Every laptop within the community maintains a replica of the ledger to keep away from a single level of failure. Blocks are added in sequential order, they usually’re everlasting and tamperproof.

A blockchain begins with an preliminary block — also known as the Genesis block — that data the primary transactions. The block can also be assigned an alphanumeric string referred to as a hash, which is predicated on the block’s timestamp. Blocks are added to the chain sequentially. Every block makes use of the hash from the earlier block to create its personal hash, thus linking the blocks collectively.

Blockchain additionally makes use of a computational course of referred to as consensus to validate a block’s authenticity earlier than it may be added to the chain. As a part of this course of, many of the nodes on the blockchain community should agree that the brand new block’s hash has been calculated appropriately. Consensus ensures that each one copies of the distributed ledger are in the identical state.

Initially, blockchain offered a distributed public ledger to help Bitcoin, so transactions might be recorded with out the necessity for a government to ascertain belief in a trustless surroundings. Not solely have been transactions extra environment friendly, however the prices sometimes related to third-party verification have been eradicated. Blockchain additionally offered better transparency, traceability and safety than standard approaches to dealing with distributed transactions.

Blockchain’s historic constructing blocks

Though blockchain as an entity has a comparatively brief historical past, its affect immediately is widespread and its purposes wide-ranging and rising. By means of the many years, blockchain’s improvement and evolution embrace a few of the following notable developments:

- Pioneers like Merkle and his tree, Chaum and digital money, Haber and timestamping, Dwork and proof of labor (PoW), Black and hashcash, Finney and reusable PoW dotted the early years of the pre-blockchain panorama.

- The presumed pseudonym Satoshi Nakamoto was created to introduce the idea of cryptocurrency and blockchain. Shortly thereafter, cryptocurrency was launched and Nakamoto performed the primary bitcoin transaction, a bitcoin trade was established and a programmer paid 10,000 bitcoin for 2 pizzas.

- Bitcoin’s price soared from pennies to tens of hundreds of {dollars}, all of the whereas draped in controversies, shutdowns, crackdowns, bankruptcies, scams, scandals and arrests.

- Blockchain began to considerably divorce itself from Bitcoin when the decentralized blockchain platform Ethereum finally turned one of many greatest purposes of blockchain know-how and opened the door to quite a few enterprise purposes past cryptocurrencies.

- And buoyed by AI, IoT, non-fungible tokens (NFTs), decentralized finance (DeFi) and good contracts, in addition to initiatives by the likes of Walmart and Amazon, blockchain has gained legitimacy as a protected, viable different to conventional strategies of conducting enterprise and particular person transactions.

1979

One of many early pre-blockchain applied sciences is the Merkle tree, named after laptop scientist and mathematician Ralph Merkle. He described an strategy to public key distribution and digital signatures referred to as tree authentication in his Ph.D. thesis for Stanford College. Merkle finally patented this concept as a technique for offering digital signatures. The Merkle tree offers an information construction for verifying particular person data.

1982

In his Ph.D. dissertation for the College of California, Berkeley, David Chaum described a vault system for establishing, sustaining and trusting laptop techniques amongst mutually suspicious teams. The system embodied lots of the components that comprise a blockchain. Chaum can also be credited with inventing digital money, and in 1989, he based the corporate DigiCash.

1991

Stuart Haber and W. Scott Stornetta revealed an article describing how to timestamp digital paperwork to forestall customers from backdating or forward-dating digital paperwork. The aim was to take care of the doc’s full privateness with out requiring record-keeping by a timestamping service. Haber and Stornetta up to date the design to include Merkle timber, which enabled a number of doc certificates to dwell on a single block.

1993

The beginnings of the PoW idea have been revealed in a paper by Cynthia Dwork and Moni Naor to offer “a computational technique for combatting junk mail, in particular, and controlling access to a shared resource, in general.”

1997

Adam Black launched hashcash, a PoW algorithm that offered denial-of-service countermeasures.

1999

Markus Jakobsson and Ari Juels revealed the time period proof of labor. Additionally, the P2P community was popularized by the now defunct peer-to-peer file sharing software Napster. Some argued that Napster was not a real P2P community as a result of it used a centralized server. However the service nonetheless helped breathe life into the P2P community, making it doable to construct a distributed system that might profit from the compute energy and storage capability of hundreds of computer systems.

2000

Stefan Konst launched the idea of cryptographically secured chains in his paper “Secure Log Files Based on Cryptographically Concatenated Entries.” His mannequin, which confirmed that entries within the chain could be traced again from the Genesis block to show authenticity, was the premise for immediately’s blockchain fashions.

2004

Hal Finney launched reusable PoW, a mechanism for receiving a non-exchangeable — or non-fungible — hashcash token in return for an RSA-signed token. The PoW strategy immediately performs an important function in Bitcoin mining. Cryptocurrencies like Bitcoin and Litecoin use PoW, and Ethereum shifted to the proof-of-stake protocol to safe a community utilizing a fraction of the vitality that PoW makes use of.

2008

Satoshi Nakamoto, regarded as a pseudonym utilized by a person — or group of people — revealed a white paper introducing the idea of cryptocurrency and blockchain and helped develop the primary Bitcoin software program. Blockchain infrastructure, in line with the white paper, would help safe, P2P transactions with out the necessity for trusted third events equivalent to banks or governments. Nakamoto’s actual id stays a thriller, however there was no scarcity of theories.

The Bitcoin/blockchain structure was launched and constructed on applied sciences and ideas from the earlier three many years. Nakamoto’s design additionally offered the idea of a “chain of blocks,” making it doable so as to add blocks with out requiring them to be signed by a trusted third occasion. Nakamoto outlined an digital coin as a “chain of digital signatures,” by which every proprietor transfers the coin to the following proprietor by “digitally signing a hash of the previous transaction and the public key of the next owner and adding these to the end of the coin.”

2009

Cryptocurrency was launched throughout the Nice Recession, when the federal government pumped massive quantities of cash into the financial system. Bitcoin was value lower than a penny then. Nakamoto mined the primary Bitcoin block, validating the blockchain idea. The block contained 50 bitcoin and was often called the Genesis block — aka block 0. Nakamoto launched Bitcoin v0.1 to the net service SourceForge as open supply software program. Bitcoin is now on GitHub.

The primary Bitcoin transaction befell when Nakamoto despatched Hal Finney 10 bitcoin in block 170. The Bitcoin-dev channel was created on the text-based prompt messaging system Web Relay Chat for Bitcoin builders. The primary Bitcoin trade — Bitcoin Market — was established, enabling individuals to trade paper cash for bitcoin. Nakamoto launched the Bitcoin Discuss discussion board to share Bitcoin-related information and knowledge.

Within the spirit of cryptocurrency as cash with fastened provide, Nakamoto set up a system to make sure the variety of bitcoin mined will not ever exceed 21 million.

2010

On Might 22, Bitcoin made historical past when a programmer Laszlo Hanyecz paid 10,000 bitcoin for 2 delivered Papa John’s pizzas. The 2 pizzas again then have been valued at about $40, a transaction that might balloon to a price of greater than $260 million at immediately’s bitcoin price stage.

A short while later that 12 months, programmer Jed McCaleb launched Mt. Gox, a Tokyo-based Bitcoin trade. Mt. Gox was brief for Magic: The Gathering On-line eXchange — a carryover from a fantasy card recreation. At its peak, Mt. Gox dealt with greater than 70% of all Bitcoin transactions. However in August, a hacker exploited a bug within the blockchain code and created greater than 184 billion bitcoin in block 74,638, tarnishing Bitcoin’s popularity. Nakamoto revealed a brand new model of the Bitcoin software program, however by the top of the 12 months, he disappeared from the Bitcoin scene utterly.

2011

One-fourth of the 21 million bitcoin had been mined. By early February, the worth of a bitcoin was equal to the U.S. greenback. Shortly thereafter, McCaleb bought Mt. Gox to Mark Karpelès. And shortly after that, the bitcoin reached parity with the euro and British pound sterling. WikiLeaks began accepting bitcoin donations. Nonetheless, Mt. Gox was hacked and bitcoin have been stolen, inflicting a man-made drop in worth and leading to suspension of buying and selling. Litecoin was launched in October, representing one of many earlier Bitcoin spinoffs and thought of the primary different cryptocurrency.

2012

The curiosity in cryptocurrencies solidified. Bitcoin’s price hovered round $5 for many of the 12 months with a number of fluctuations. Early that 12 months, Mihai Alisie and Ethereum creator Vitalik Buterin launched Bitcoin Journal and revealed their first problem in Might. Just a few months later, the Bitcoin Basis was established to advertise Bitcoin and restore public perceptions of cryptocurrency after a number of scandals. McCaleb and Chris Larsen based OpenCoin, which led to the event of the Ripple transaction protocol for forex transactions and real-time funds. Coinbase raised greater than $600,000 in its crowd-funded seed spherical on its technique to turning into one of many prime Bitcoin exchanges.

2013

Bitcoin’s upward trajectory continued. In February, Coinbase reported promoting $1 million value of bitcoin in a single month at greater than $22 every. By the top of March, with 11 million bitcoin in circulation, the forex’s whole worth exceeded $1 billion. And in October, the primary reported bitcoin ATM launched in a Vancouver, B.C., espresso store.

But it surely wasn’t all excellent news for digital forex. Each Thailand and China banned cryptocurrencies. The U.S. Federal Courtroom seized Mt. Gox’s funds within the U.S. for transmitting cash with no license. And the FBI shut down the darkish internet market Silk Street, confiscating about 144,000 bitcoin value greater than $1 billion and leading to a life jail sentence for proprietor Ross Ulbricht for a litany of crimes, together with drug trafficking, laptop hacking and cash laundering.

2014

Regardless of setbacks, one of many extra essential milestones in blockchain’s historical past occurred when Bitcoin Journal co-founder Buterin revealed a white paper proposing a decentralized software platform, resulting in the creation of Ethereum and the Ethereum Basis. Ethereum paved the best way for blockchain know-how for use for purposes aside from cryptocurrency. It launched good contracts and offered builders with a platform for constructing decentralized purposes.

Monetary establishments and different industries started to acknowledge and discover blockchain’s potential, shifting their focus from digital forex to the event of blockchain applied sciences. However Bitcoin stayed within the highlight — for higher and worse. The Mt. Gox Bitcoin trade filed for chapter. The Bitcoin Basis vice chairperson was arrested for cash laundering. And the U.Ok. tax authority categorized bitcoin as non-public cash. But a number of corporations accepted bitcoin by 12 months’s finish, together with the Chicago Solar-Occasions, Overstock.com, Microsoft, PayPal and Expedia. Bitcoin’s acceptance solely added gas to blockchain’s fireplace.

2015

The Ethereum Frontier community launched, enabling builders to put in writing good contracts and decentralized apps that might be deployed to a dwell community. Ethereum was on its technique to turning into one of many greatest purposes of blockchain know-how. It drew in an energetic developer group that continues to today. As well as, Nasdaq initiated a blockchain trial. The Linux Basis launched the Hyperledger challenge. And 9 main funding banks joined forces to type the R3 consortium, exploring how blockchain may benefit their operations. Inside six months, the consortium grew to greater than 40 monetary establishments.

2016

The time period blockchain gained acceptance as a single phrase, relatively than being handled as two ideas, as they have been in Nakamoto’s unique paper. The Chamber of Digital Commerce and the Hyperledger challenge introduced a partnership to strengthen trade advocacy and training. A bug within the Ethereum decentralized autonomous group code was exploited, leading to a “hard fork” within the Ethereum community. The Bitfinex cryptocurrency trade was hacked and practically 120,000 bitcoin have been stolen — a bounty value about $66 million.

2017

Bitcoin hit a report excessive of practically $20,000. Japan acknowledged bitcoin as authorized forex. Seven European banks shaped the Digital Commerce Chain Consortium to develop a commerce finance platform based mostly on blockchain. The Block.one software program firm launched the EOS blockchain working system, based mostly on the EOS cryptocurrency and designed to help business decentralized purposes. About 15% of worldwide banks used blockchain know-how in some capability.

2018

Getting into its tenth 12 months, bitcoin’s worth continued to drop, ending the 12 months at about $3,800. The web fee agency Stripe stopped accepting bitcoin funds. Google, Twitter and Fb banned cryptocurrency promoting. South Korea banned nameless cryptocurrency buying and selling however introduced it could make investments tens of millions in blockchain initiatives. The European Fee launched the Blockchain Observatory and Discussion board to speed up the event of blockchain. Baidu launched its blockchain-as-a-service platform.

2019

Walmart launched a provide chain system based mostly on the Hyperledger platform. Amazon introduced the final availability of its Amazon Managed Blockchain service on AWS to assist customers construct resilient Net 3.0 purposes on private and non-private blockchains. Ethereum community transactions exceeded a million per day. Blockchain research and improvement took heart stage as organizations embraced blockchain know-how and decentralized purposes for a wide range of use instances.

2020

A Deloitte survey revealed that almost 40% of respondents included blockchain into manufacturing, and 55% seen blockchain as a prime strategic precedence. Ethereum launched the Beacon Chain in preparation for Ethereum 2.0. Stablecoins, whose worth is tied to a different asset class, rose considerably as a result of they promised extra stability than conventional cybercurrencies. Curiosity elevated in combining blockchain with AI to optimize enterprise processes.

2021

Bitcoin reached an all-time excessive of $68,789.63 on Nov. 10, 2021. Throughout its bull run, the bitcoin market cap surpassed $3 trillion. Coinbase went public and was acknowledged because the seventh greatest new itemizing of all time on the U.S. inventory trade. The DeFi market providing providers via good contracts on blockchain grew a whopping 600% from the earlier 12 months, reaching a price of $200 billion. And NFT paintings made headlines, promoting for greater than $69 million in Ethereum on the public sale home Christie’s. Effectively-known entrepreneurs and athletes tried to seize the meteoric rise in bitcoin’s worth, together with Elon Musk initially accepting cryptocurrency as fee on new Tesla autos and Aaron Rogers taking a portion of his multimillion-dollar NFL wage in bitcoin.

Curiosity in utilizing blockchain for purposes aside from cryptocurrency continued as governments and enterprises thought of blockchain for a wide range of use instances, together with voting, actual property, health monitoring, mental rights, IoT and vaccine distribution within the midst of the COVID-19 pandemic. Furthermore, a number of cloud suppliers now supplied blockchain as a service, and the demand for certified blockchain builders was better than ever. The worldwide blockchain know-how market was valued at practically $6 billion in 2021 and seen surpassing a trillion {dollars} by 2030, in line with market researcher Statista.

2022

NFTs continued their ascent, eco-friendly blockchain networks emerged and blockchain purposes elevated amongst corporations. Bitcoin mining crept nearer to Nakamoto’s 21 million coin restrict, reaching 19 million and leaving lower than 10% of bitcoin to be mined.

All-time excessive costs for bitcoin and different cryptocurrencies plummeted within the spring attributable to investor considerations about inflation and the brand new COVID-19 Omicron variant. Some cryptocurrency exchanges went bankrupt. The collapse of the FTX trade and arrest of its CEO Sam Bankman-Fried amplified fears about cryptocurrency’s riskiness. The open supply blockchain platform Terra additionally collapsed. Hypothesis of latest U.S. authorities regulation of cryptocurrency added to the uncertainty however on the similar time was thought to assist legitimize the trade.

Globally, Danish transport firm Maersk introduced the shutdown of the blockchain-based TradeLens digital ledger it co-developed with IBM due to a scarcity of participant participation. And the Australian Inventory Trade scrapped a seven-year plan to maneuver its buying and selling platform to blockchain. Greater than 100 international locations have been concerned within the creation of their very own central financial institution digital currencies, in line with Statista. CBDCs are digital variations of real-world fiat cash to finally assist pace cross-border retail transactions on blockchain in distinction to the slower speeds and price volatility of cryptocurrency.

Blockchain’s vaunted claims of imperviousness got here below assault — and never simply figuratively. Blockchain analysis agency Chainalysis recognized practically 200 cryptocurrency or blockchain hacks, leading to losses of $3.8 billion. Probably the most noteworthy incident occurred when the online game blockchain Ronin Community reported the theft of $625 million value of Ether and USDC stablecoins. The U.S. Treasury Division blamed a North Korean hacker collective for the assault.

2023

The unhealthy information for cryptocurrency continued because the SEC indicted executives on the Coinbase and Binance exchanges and filed fees towards crypto-asset entrepreneur Justin Solar and three of his wholly owned corporations for the unregistered supply and sale of crypto-asset securities.

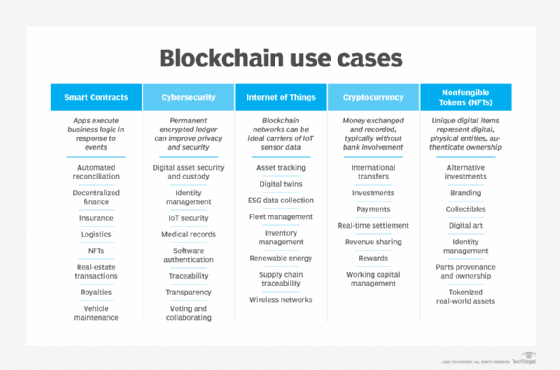

Companies are nonetheless shifting forward with blockchain, however they’re continuing with better warning. Whereas blockchain know-how has been largely relevant to finance providers and banking, different viable purposes embrace gaming, media and leisure, actual property, healthcare, cybersecurity, good contracts, NFTs, IoT, transportation, provide chain administration and the federal government. However the newest iteration of the web, Net 3.0, with its supply of decentralization and information safety, could be the best driver of blockchain know-how.

Bitcoin for now has discovered some comparatively strong footing within the $25,000 to $30,000 vary. Bitcoin mining ought to attain Nakamoto’s 21 million restrict someday round 2140.

Past 2023

Blockchain’s promise of safe and clear transactions with out the necessity for intermediaries will probably change the best way enterprises conduct virtually each side of their day by day enterprise operations for many years to come back. Applied sciences like AI, IoT, NFTs and the metaverse might be considerably impacted by blockchain.

Gartner pegs the enterprise worth of blockchain at greater than $360 billion by 2026 — modest when in comparison with the research agency’s estimate of $3.1 trillion by 2030. Different estimates place the blockchain market at about $1 trillion by the top of the last decade.

Anticipate a number of traits to contribute significantly to blockchain’s eventual trillion-dollar-plus valuation, together with the next:

- Blockchain as a cloud-based know-how is important to digital transformation initiatives and the migration of information and workloads to distributed cloud environments.

- AI and blockchain will merge as they work synergistically to extend blockchain’s effectivity and produce torrents of latest information utilized in constructing extra dependable machine studying fashions.

- NFT use instances will considerably improve, opening new avenues of income to content material producers who tokenize and promote their work with out intermediaries.

- Blockchain IoT will make digital transactions sooner, extra reasonably priced and safer by stopping tampering and rising accountability.

- Sensible contracts encoded on blockchain will allow less complicated, extra automated and extra wide-ranging transactions.

- Blockchain might be foundational to Net 3.0 and important to the event of the metaverse on the most recent iteration of the web.

- DeFi will present lending, borrowing and funding providers on blockchain which can be extra open, clear and inclusive.

- Blockchain as a service will allow corporations and builders to create, implement and administer blockchain purposes with out setting up and sustaining their very own blockchain networks.

- Proof-of-stake protocol, which selects validators in proportion to their amount of holdings to keep away from the computational value of PoW schemes, will acquire additional momentum as a viable different.

- Governments will exchange conventional paper-based techniques with distributed ledger know-how.

- In reply to cyber assaults, scams and indictments, anticipate blockchain to be within the crosshairs of federal, state and native legislative and regulatory efforts.

- Blockchain know-how will encourage new cryptocurrencies and cryptocurrency exchanges.

As universities, governments and personal companies proceed to research and put money into blockchain, the know-how will proceed to enhance and broaden within the areas of safety, privateness, scalability and interoperability. And since blockchain is not suited to each software, companies might want to weigh the dangers, consider the monetary prices and be selective with their blockchain deployments.

Editor’s word: This text was up to date in July 2024 to enhance the reader expertise.

Ron Karjian is an trade editor and author at TechTarget protecting enterprise analytics, synthetic intelligence, information administration, safety and enterprise purposes.

Robert Sheldon is a technical guide and freelance know-how author. He has written quite a few books, articles and coaching supplies associated to Home windows, databases, enterprise intelligence and different areas of know-how.