Picture supply: Getty Pictures

Pushed by the fast-paced tech revolution, Scottish Mortgage Funding Belief (LSE:SMT) shares have delivered a FTSE 100-beating return over the previous decade.

There’s been bumps alongside the way in which, however the expertise belief’s shares have risen from 267.5p per share in early Might 2015 to 943p at this time. This implies somebody who purchased £10,000 of Scottish Mortgage shares again then would have seen the worth of their funding balloon to £35,248.

Dividend revenue hasn’t been formidable in that point, as you’d possibly anticipate from a belief targeted on development shares.

Nonetheless, including in whole dividends of 33.91p per Scottish Mortgage share, the overall return on a £10k funding improves by greater than £1,000, to £36,515 (or 265%).

To place that into context, the broader FTSE 100 has delivered an annual return nearer to 85% in that point. However can Scottish Mortgage shares proceed to outperform, and will I purchase the belief for my portfolio?

The bull case

With a concentrate on US tech shares, the belief’s been in a position to harness a mess of main tech developments of the final decade. The explosion of social media, e-commerce, cloud computing, smartphones and electrical autos are only a few such phenomena which have pushed returns.

Many of those developments have additional scope to develop over the following 10 years too. Moreover, different early-stage applied sciences like quantum computing, autonomous automobiles, augmented actuality and generative synthetic intelligence (AI) are additionally tipped for take-off.

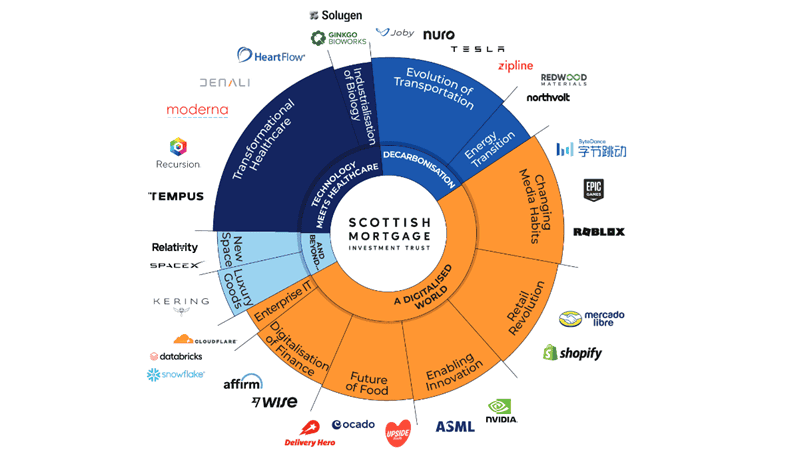

Scottish Mortgage invests in modern market leaders like Nvidia, Amazon, Tesla and Meta for each focused and diversified methods to capitalise on these. However that is solely half the story, because the belief additionally holds a excessive proportion of smaller personal companies which have notably substantial development potential.

Round 27% of the belief is tied up in personal tech firms that buyers might not in any other case be capable to acquire publicity to. These embrace SpaceX, ByteDance, Databricks, Stripe and Epic Video games, which type 10 of the world’s most useful ‘unicorns’ (personal start-ups valued at $1bn or extra).

With greater than 96 holdings, Scottish Mortgage has wonderful development potential whereas concurrently permitting buyers to diversify to unfold dangers.

Ought to buyers take into account the shares?

That stated, investing within the belief isn’t with out its risks. Within the quick time period, returns might disappoint if financial circumstances worsen, prompting buyers to dump tech-based shares and trusts.

Long term threats embrace rising competitors for US tech shares from Chinese language disruptors, and punishing world commerce tariffs that injury gross sales and inflate prices. However in my opinion, the potential advantages of proudly owning Scottish Mortgage shares outweighs these hazards.

What’s extra, at present costs, it trades at a reduction of roughly 8% to its web asset worth (NAV) per share. All issues thought of, I feel this FTSE 100 development share is value critical consideration in Might.