Picture supply: Getty Photographs

easyJet (LSE:EZJ) shares have achieved lift-off in current weeks. At 574p per share, the FTSE 100 flyer has risen 15.7% up to now month alone, boosted by a falling oil price and enhancing hopes for the worldwide financial system.

However airline shares are famously unstable investments. And within the case of easyJet, somebody who invested a lump sum a decade in the past would now be nursing a hefty loss.

Since mid-2015, the price range airline’s dropped 57.6% in worth from £13.55 per share. It implies that £10,000 value of the shares purchased again then would now be value £4,239.

Dividends totalling 223.94p per share have cushioned the blow for long-term traders. However even accounting for this, a £10k funding in easyJet shares 10 years in the past would have delivered a complete return of £5,892, or -41.1%.

Whereas easyJet shares nonetheless commerce effectively beneath pre-pandemic ranges, ought to I contemplate shopping for them in June as they choose up momentum?

Bullish forecasts

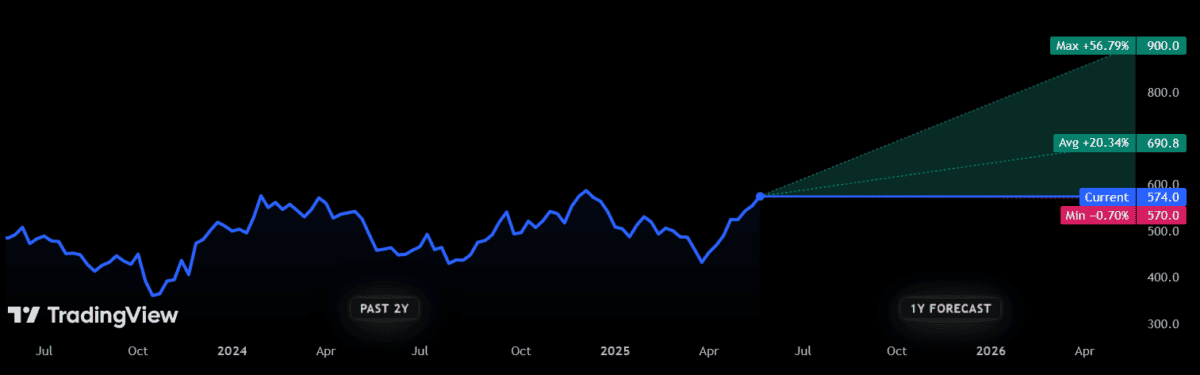

Metropolis analysts, maybe unsurprisingly, haven’t launched price forecasts for the subsequent 10 years. However they’ve supplied estimates for the subsequent 12 months. And, pleasingly, they’re largely upbeat.

As of at this time, 18 analysts presently have scores on easyJet inventory. The consensus amongst them is that the airline will rise round a fifth in worth over the approaching 12 months, to round 691p per share.

Encouragingly, solely one in all these brokers believes costs will reverse through the interval. And the size of the decline is lower than 1%. On the different finish of the size, one particularly bullish forecaster thinks costs will hit 900p, the best stage since Might 2021.

Bear in mind although, that dealer consensus can typically miss its mark, eitherh to the upside or the draw back.

Sunny aspect up

Wanting on the brilliant aspect, buying and selling at easyJet stays largely fairly spectacular. Passenger and ancillary revenues are anticipated to proceed to climb, whereas demand at easyJet Holidays is capturing by the roof (gross sales rose 29% between October and March). Consequently, group income was up 8% 12 months on 12 months.

Ahead bookings have additionally been marching greater — these had been 80% and 42% for quarters three and 4 respectively, up 0.5% and a couple of.2%.

With falling oil costs delivering a gasoline value enhance too, I wouldn’t be shocked to see easyJet shares achieve additional floor.

Dangers stay

But it surely’s not all sunny, and there are important hazards on the horizon for the low-cost service. easyJet’s half-year outcomes had been additionally notable for indicators of price softness in more moderen months. Complete airline income per seat dipped fractionally, to £69.78 from £69.87 within the prior interval.

Whereas the numbers themselves weren’t seismic, they do counsel a cooldown within the journey sector as individuals really feel the pinch. With current commerce tensions hitting shopper confidence since then, it’s attainable easyJet’s subsequent replace gained’t be half as spectacular.

Powerful competitors from price range rivals like Ryanair may be behind that income per seat decline. That is a permanent risk that’s discouraged me from investing earlier than, and — just like the hazard of financial downturns — it’s not the one one.

Sudden oil price spikes, strike motion by airport and air visitors management workers, and geopolitical tensions are evergreen dangers to airline profitability. They usually may proceed to depress easyJet shares, as they’ve at instances over the past decade.

Because of this, all issues thought of, I want different UK shares at this time.