Picture supply: Ocado Group plc

Throughout the pandemic, the Ocado Group (LSE:OCDO) share price peaked at almost £30. With many individuals housebound, the web retailer benefitted from a rise in web procuring and extra demand for house deliveries. On Friday (27 June), I might purchase one of many group’s shares for £2.28.

Nonetheless regardless of this, the group seems to retain the assist of its largest shareholders. It’s believed that over 60% of its inventory is owned by metropolis establishments, a few of which have held positions because the group’s IPO in 2010.

Unlucky timing?

However having checked out Ocado’s latest inventory alternate bulletins, I’m reminded of a well-known Volkswagen TV business from 1985.

The automobile big ran an promoting marketing campaign that includes a forlorn-looking man leaving a on line casino within the early hours of the morning. Sadly for him, he’d simply put “a million on black” when the roulette wheel got here up purple. And to make issues worse, he had earlier “moved into gold just as the clever money moved out”. The underlying message was that regardless of this unfortunate particular person’s woes, he was capable of depend on his good automobile.

And in some respects, this has occurred to Ocado. With impact from April, the group’s relinquished management of its three way partnership with Marks & Spencer, simply because it’s beginning to do higher. Though it retains a 50% shareholding, the choice demonstrates that it doesn’t see promoting groceries as its core enterprise.

However in contrast to the person from the Volkswagen advert, it’s not but able to depend on the opposite elements of its enterprise.

Wanting good

In keeping with Kantar, in the course of the 12 weeks to fifteen June, Ocado Retail was the fastest-growing grocer in Nice Britain. With a 12.2% enhance in gross sales, it now has a 1.9% market share.

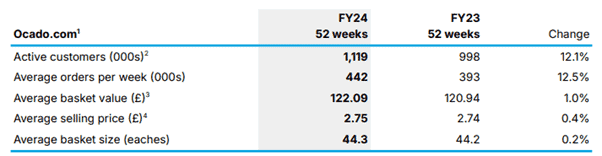

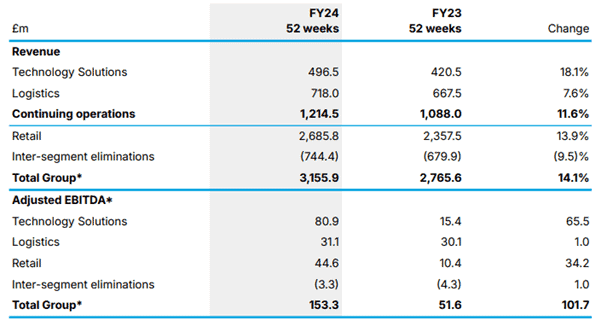

And in the course of the 52 weeks ended 1 December 2024 (FY24), it improved every of its key efficiency indicators in comparison with FY23.

Wanting forward, 10% income progress is predicted in FY25. And analysts expect a doubling of adjusted EBITDA (earnings earlier than curiosity, tax, depreciation and amortisation).

Intelligent options

However the group believes its future lies in licensing its know-how to others. It now has 13 world partnerships and its most up-to-date buying and selling replace stated it’s prone to open one other seven buyer fulfilment centres (warehouses) over the following three years.

And if it may possibly develop, its share price ought to reply positively. Buyers are usually extra affected person with tech shares and, typically talking, they entice the next earnings a number of than, for instance, grocery retailers.

My view

However I nonetheless don’t wish to make investments. The group stays loss-making at a post-tax degree. Its FY24 adjusted loss earlier than tax was £374m.

And it continues to burn money. From 2020-2024, it’s seen an underlying working money outflow of over £2.5bn. The group expects to be money move optimistic throughout FY26 nevertheless it doesn’t disclose when its backside line will transfer into the black.

And whereas I acknowledge that the group has some spectacular know-how, it’s prone to be a number of years (on the earliest) earlier than its Options and Logistics divisions turn out to be worthwhile.

To be sincere, due to these points, I don’t assume Ocado shares will be relied upon to do higher over the following 5 years than they’ve completed over the previous 5. In brief, they’re not for me.