The Israel‑Iran battle escalated decisively between June 13–21, when Israel executed strikes on Iran’s nuclear websites and Tehran retaliated with drones and ballistic missiles. Shortly after, U.S. motion intensified the disaster with airstrikes on Iranian nuclear amenities, pushing markets into a pointy threat‑off stance.

This turmoil impacted crypto instantly. Bitcoin fell under $99 000, its lowest since early Could, whereas Ethereum dropped over 5 p.c in sooner or later. Altcoins like Cardano and AI‑cash plunged equally, briefly erasing about $200 billion from the crypto market.

Why the Battle Hit Crypto Laborious

Geopolitical upheavals drive traders towards protected‑haven property—gold, U.S. Treasuries, and typically Bitcoin. Initially, crypto suffered as panic unfold. Nonetheless, many analysts be aware that crypto’s DNA contains swift rebounds after such volatility.

Moreover, cyber‑battle spilled into the crypto area. Israeli‑linked “Predatory Sparrow” hackers hit Iran’s main crypto change Nobitex, destroying or stealing about $90 million price of cash—together with BTC and ETH—or shutting them into unrecoverable addresses. Iran responded with nationwide web shutdowns to restrict additional cyber‑espionage. These occasions amplified fears round digital‑asset safety in battle zones.

Market Response

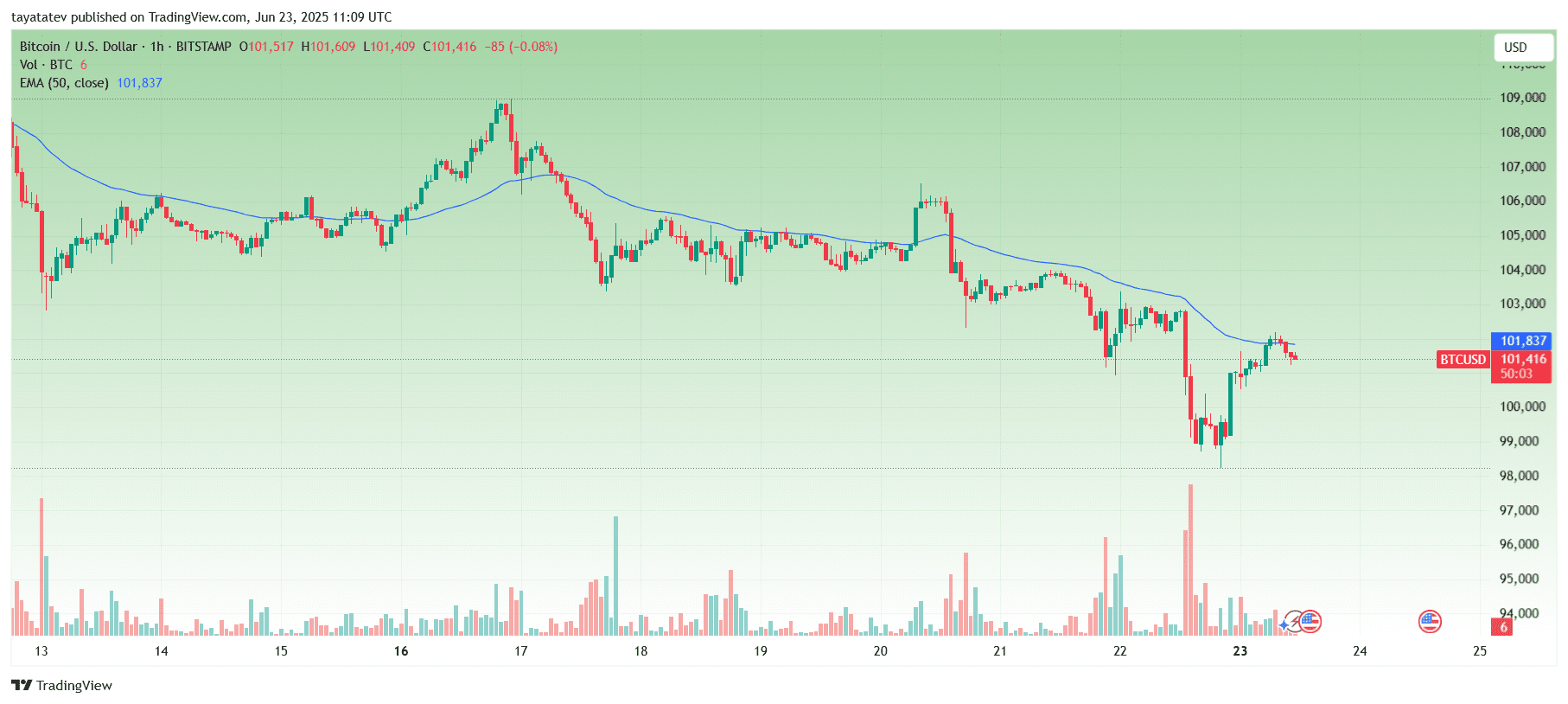

After the preliminary drop, Bitcoin climbed again above $100 000 as hopes grew that the battle would stay contained. In the meantime, Ethereum and XRP additionally recovered modestly. In different phrases, markets appear to price in brief‑time period rigidity and pivot to threat property when escalation stalls.

Technically, Bitcoin has consolidated inside a descending channel. Key ranges to observe embrace help at $100 000 (or probably $92 000) and resistance close to $107 000–112 000.

Will Crypto Rise Once more?

Sure — however with caveats:

-

Macro help stays robust.

-

ETF adoption continues. Bitcoin nonetheless trades effectively under its current peak, however sentiment stays bullish .

-

If the U.S. greenback weakens—attributable to tariffs, inflation, or Fed fee shifts—crypto may gain advantage as capital seeks different shops of worth .

-

-

Geopolitical threat could tighten financial coverage.

-

Rising oil costs (up ~18 p.c since June 10, nearing $80/barrel) and Center‑East unrest may spur inflation.

-

If the Fed delays fee cuts or hikes to tame inflation, threat property may battle—hindering crypto features .

-

-

Cybersecurity turns into a strategic factor.

-

The Nobitex hack alerts that crypto platforms in hotspots are susceptible, undermining confidence.

-

In the meantime, state‑linked hackers could goal Western platforms or crypto infrastructure subsequent.

-

-

Historic context affords perspective.

-

Crypto markets usually fall throughout geopolitical shocks, then get well inside weeks as soon as speedy threat subsides.

-

Following Iran’s 2024 assault on Israel, Bitcoin dropped ~7.7 p.c however rebounded later.

-

Outlook & Technique

Within the quick time period, volatility is more likely to proceed. Bitcoin could revisit the $95,000 to $100,000 vary if the Israel–Iran battle reignites or new cyber-attacks disrupt essential crypto infrastructure. Merchants ought to monitor geopolitical developments carefully, as any escalation may set off quick pullbacks throughout the market.

Over the medium to long run, nevertheless, crypto fundamentals stay supportive. Institutional flows by Bitcoin ETFs, ongoing adoption, and macro hedging in opposition to inflation and forex debasement proceed to offer upward stress. If the Federal Reserve eases financial coverage and the Center East scenario calms, Bitcoin may reclaim $120,000 and better.

Though battle and worry shook the market, crypto as soon as once more reveals indicators of resilience.