Polkadot (DOT) is forming a falling wedge sample on the weekly chart, much like the setup that preceded a 171% breakout in 2024. Nonetheless, the present development continues to be bearish, and affirmation of a breakout has not but emerged.

DOT Trades Beneath $3.60 Amid Weak Momentum

As of June 20, DOT is priced at $3.53, down over 7% previously week. The token has did not maintain good points above the 20-day EMA and now trades under all main transferring averages on the 4-hour and day by day charts. RSI has additionally dropped close to 30, indicating oversold situations, but no reversal has adopted.

Quantity additionally continues to weaken. 24-hour buying and selling quantity declined 17% to $201.7 million, exhibiting decrease spot exercise and a scarcity of conviction amongst patrons. The present construction locations DOT in a consolidative section throughout the wedge, with out affirmation of a breakout.

2024 Sample Projected 171% Rally—is it Repeating?

A weekly fractal shared by analyst @nileshrh73 reveals Polkadot forming an identical falling wedge sample that occurred in Q2 2024. In that occasion, DOT broke above the construction in late Might and rallied from round $3.58 to over $9.70—a rise of greater than 170% inside six weeks.

The present wedge is nearing its apex, with assist at $3.50 and key resistance at $3.91. A breakout above the higher trendline may revive a bullish case, doubtlessly aiming for the $9–$10 zone once more. Nonetheless, the setup stays speculative and not using a clear transfer above resistance backed by quantity. But technical patterns alone are inadequate with out affirmation from derivatives knowledge

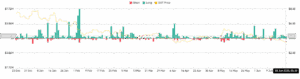

Open curiosity has risen to $458 million, suggesting elevated leveraged buying and selling, however persistent unfavourable funding charges verify dominance of brief positions. Merchants are paying to keep up bearish publicity, anticipating additional draw back.

You Might Additionally Like: 21Shares Seeks SEC Approval for Spot Polkadot ETF

Moreover, lengthy liquidations have picked up, with current spikes in compelled promoting. The dearth of brief squeezes signifies the market nonetheless favors bearish positioning.

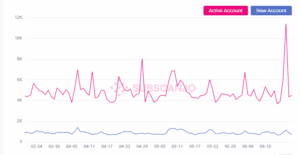

Staking Holds Regular with 53.5% of DOT Locked

Whereas spinoff markets recommend warning, staking and validator participation have remained regular. Round 53.5% of DOT’s whole provide is presently staked. This determine stays simply above the community’s ideally suited staking charge of 52.5%, retaining yields enticing with out growing inflation danger. Present APRs vary between 11% and 14%, incentivizing long-term holding over energetic buying and selling.

Nonetheless, new account creation has remained stagnant. Every day new accounts have hovered under 2,000, whereas energetic accounts common round 4,000 to six,000. This means ongoing participation from current customers however little new person development—limiting short-term demand.