The U.S. Senate has handed the GENIUS Act (Guiding and Establishing Nationwide Innovation for U.S. Stablecoins), a invoice that introduces the primary federal guidelines for stablecoins. The invoice handed with a 68-30 vote and now heads to the Home of Representatives for additional debate.

What’s the GENIUS Act?

The GENIUS Act creates a federal framework to supervise the issuance and use of stablecoins—digital tokens which can be pegged to the worth of the U.S. greenback. These cash are sometimes utilized in crypto buying and selling and funds as a result of they provide price stability in comparison with extra risky cryptocurrencies like Bitcoin.

Underneath the brand new legislation, stablecoin issuers can be required to keep up full reserves, endure month-to-month audits, and adjust to anti-money laundering guidelines. The invoice permits banks, fintech corporations, and even main retailers to difficulty their very own stablecoins, so long as they meet regulatory requirements.

The Treasury Division will oversee your complete course of, giving it sweeping authority over the $238 billion stablecoin market.

Why This Invoice Issues

That is the primary time the U.S. has launched federal guidelines for stablecoins, that are already broadly used throughout crypto markets and conventional finance. Supporters of the invoice say it’s going to defend shoppers, forestall fraud, and make the U.S. extra aggressive globally.

Senator Invoice Hagerty, who launched the invoice, warned that with out such regulation, stablecoin innovation may shift abroad. “We must act now,” he stated, “or we risk losing economic leadership in digital finance.”

In response to Deutsche Financial institution, stablecoin transactions reached $28 trillion in 2024—greater than the mixed quantity of Visa and Mastercard. Main platforms like Shopify, Coinbase, and Financial institution of America are already testing or utilizing stablecoins for real-world funds.

Political Tensions Across the Stablecoin Invoice

Regardless of bipartisan help, the invoice was not with out controversy. Some Senate Democrats initially pulled their help after it was revealed {that a} UAE-based fund deliberate to speculate $2 billion in Binance utilizing a stablecoin linked to World Liberty Monetary—a crypto agency tied to Donald Trump’s household.

An earlier model of the invoice included a clause to forestall presidents and their households from cashing in on stablecoins. That clause was later eliminated. Nonetheless, lawmakers saved a provision barring members of Congress and their households from doing so.

Senator Jeff Merkley criticized the ultimate invoice for leaving out key safeguards. He stated it lacks controls to cease elected officers from utilizing crypto ventures for private achieve.

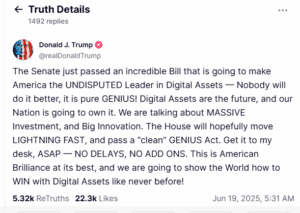

Trump Requires ‘Lightning Fast’ Home Vote With out Amendments

President Donald Trump has urged the Home to move the invoice directly or amendments. He described it as “incredible” and important for making the U.S. “the undisputed leader in digital assets.”

Nonetheless, issues persist. Studies present Trump earned $57 million in token gross sales final 12 months alone. Critics say the invoice may legitimize potential conflicts of curiosity, particularly along with his household’s ongoing involvement in stablecoin ventures.

USD1, a stablecoin issued by Trump’s World Liberty Monetary, is already the eighth-largest stablecoin by market capitalization.

What’s Subsequent?

The GENIUS Act now heads to the Home of Representatives, the place lawmakers might try and merge it with different crypto-related payments just like the STABLE Act or the CLARITY Act. Whereas Senate Republicans need it handed by July 4, Home Republicans are exploring whether or not to connect it to broader crypto laws to enhance its possibilities.

The Home model of the invoice differs considerably. It splits oversight amongst a number of companies, together with the Federal Reserve and the Workplace of the Comptroller of the Forex, whereas the Senate model centralizes energy within the Treasury.

The invoice may additionally influence the broader funds business. Fintechs, banks, and retailers might begin providing stablecoin funds. Some imagine this shift will push networks like Visa and Mastercard to help stablecoin transactions, which may scale back cost processing charges.

The GENIUS Act additionally restricts large tech corporations like Amazon or Meta from straight issuing stablecoins until they associate with regulated monetary establishments. This rule goals to forestall tech monopolies from dominating the digital forex house.