On June 18, 2025, Dogecoin (DOGE) traded at $0.169 and had already dropped 22% beneath a rising channel it created between April and early June 2025. The construction appeared after DOGE rebounded from its March lows and started forming larger highs and better lows, with parallel trendlines marking the higher and decrease bounds.

A rising channel is a chart sample the place costs transfer upward between two upward-sloping parallel strains, indicating a short lived bullish pattern inside a broader context. Nonetheless, when the price breaks beneath the decrease boundary, it typically alerts a reversal or a pointy downward transfer.

DOGE already examined the channel’s assist line round early June. After failing to carry it, the price fell via and continued to say no. The breakdown is now seen, however affirmation stays unsure. Merchants often look forward to follow-up candles and elevated quantity to validate the breakout course. To this point, DOGE exhibits no sturdy restoration, whereas the 50-day Exponential Transferring Common (EMA) at $0.192 acts as resistance.

If the rising channel confirms a full breakdown, the projected drop from the highest of the sample to the bottom may result in a 138% decline from the present price. This may ship Dogecoin as little as $0.071.

The price already dropped 22% beneath the rising channel’s backside. Quantity spikes in the course of the decline recommend panic promoting. Nonetheless, and not using a confirmed retest or a robust rejection, merchants stay unsure whether or not the breakdown will maintain.

Dogecoin’s subsequent strikes could rely on the way it interacts with the previous channel boundary and the 50-day EMA resistance. If the price fails to reclaim these ranges, the bearish case may strengthen.

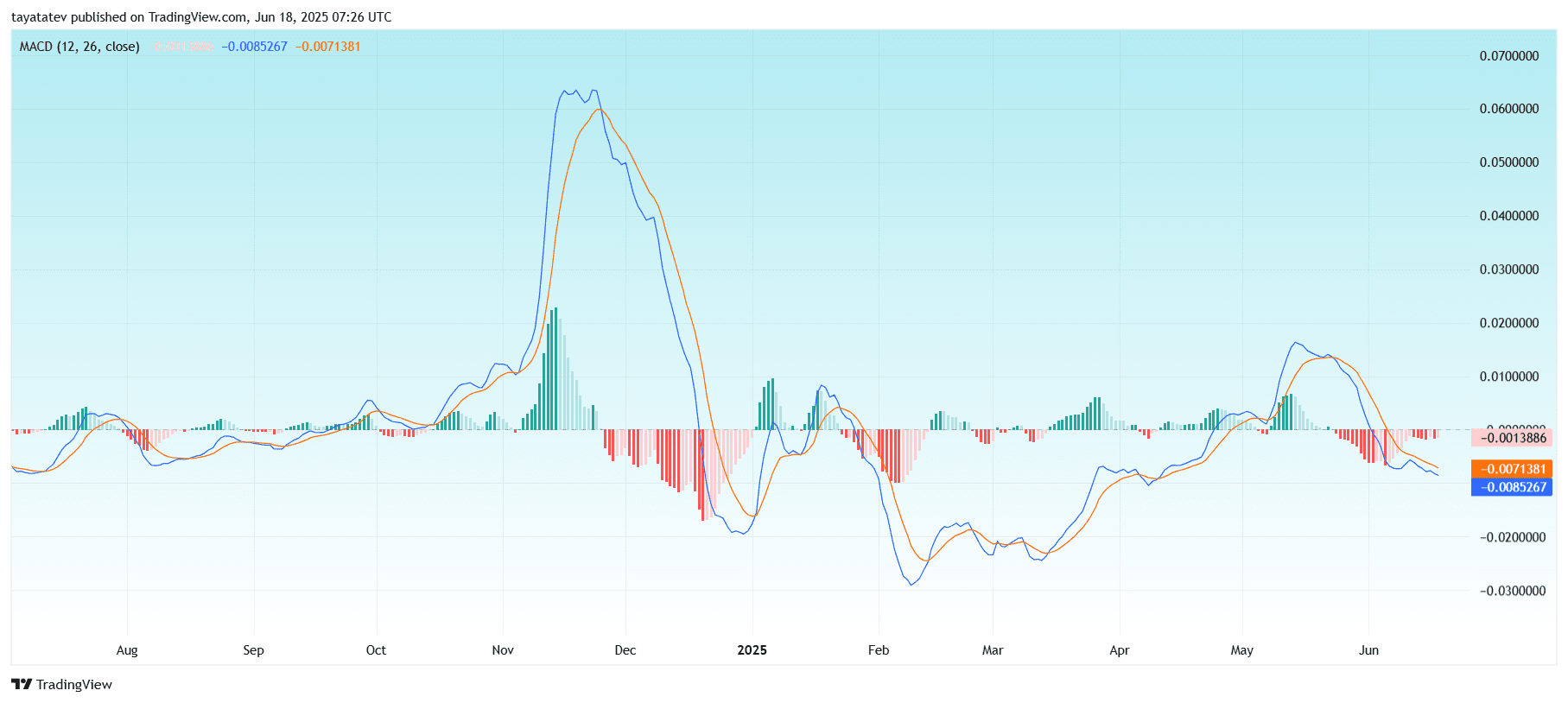

Dogecoin MACD Turns Bearish Once more as Momentum Weakens

This MACD chart, printed on June 18, 2025, exhibits the Transferring Common Convergence Divergence (MACD) indicator for Dogecoin (DOGE), utilizing default settings (12, 26, shut). As of now, the MACD line (blue) reads -0.0085, and the sign line (orange) sits at -0.0071, putting each in destructive territory.

The MACD line has crossed beneath the sign line in early June 2025, which alerts a bearish crossover. This sample typically signifies that draw back momentum is constructing. Since then, the histogram bars have remained crimson and beneath the zero line, confirming sustained bearish stress.

The final bullish crossover occurred in late April 2025, adopted by a short-lived rally. That momentum light by early June, when the bearish crossover occurred once more. This shift coincides with DOGE’s 22% price drop from the rising channel seen on the price chart.

MACD, which measures the connection between two Exponential Transferring Averages (EMAs), alerts momentum power and course. When the MACD line drops beneath the sign line and stays beneath zero, it exhibits that promoting momentum outweighs shopping for curiosity.

Presently, each the histogram and the transferring strains present no indicators of reversal. The downtrend stays energetic, and until the MACD line strikes above the sign line with histogram bars turning inexperienced, the bearish pattern could persist.

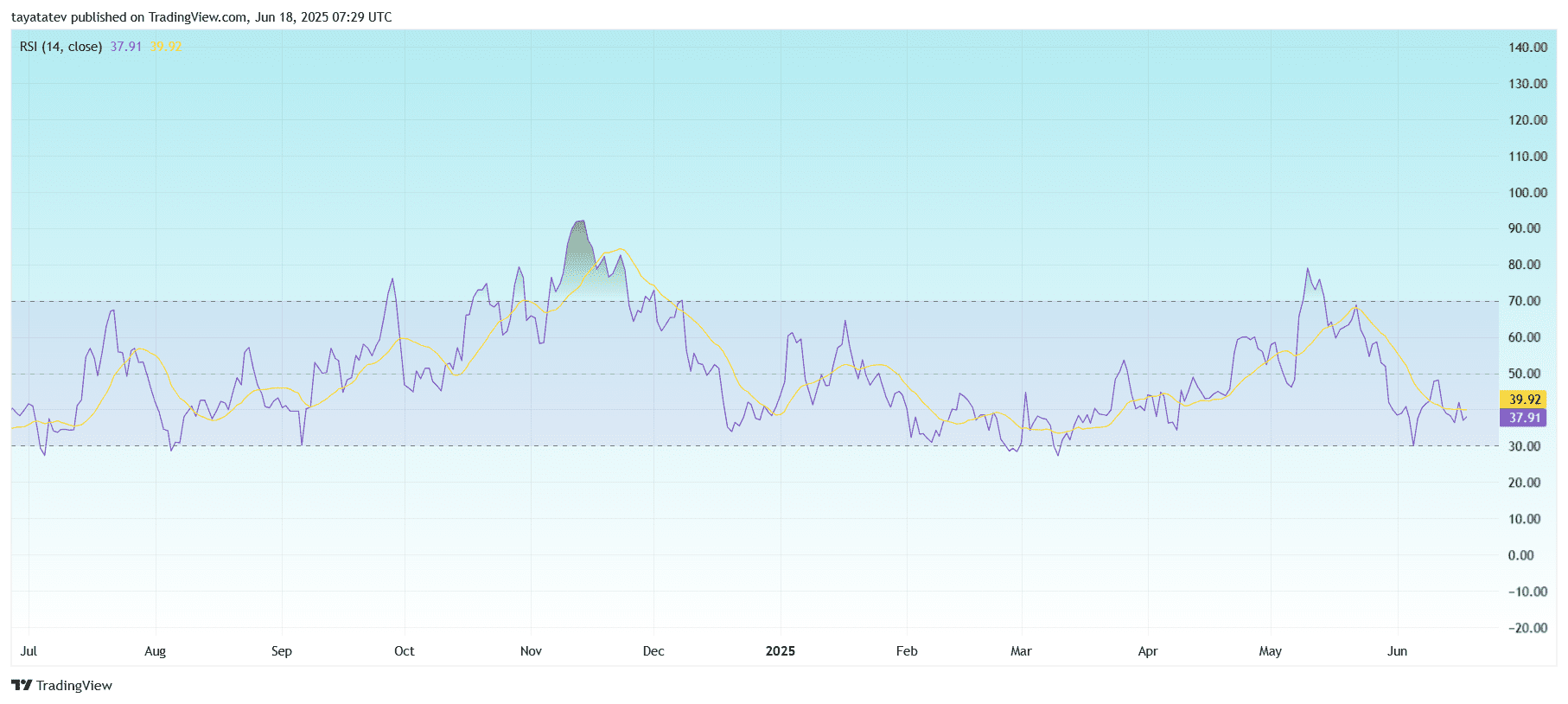

Dogecoin RSI Slides Beneath 40, Alerts Weak Momentum

This Relative Power Index (RSI) chart for Dogecoin (DOGE), printed on June 18, 2025, exhibits the 14-day RSI at 37.91. The RSI measures the pace and alter of price actions on a scale from 0 to 100. It helps determine overbought and oversold situations.

DOGE’s RSI is now beneath the impartial 50 degree and approaching the oversold threshold of 30. The yellow line represents the RSI’s transferring common, at present at 39.92. The purple RSI line crossing beneath this common suggests weakening power and elevated bearish stress.

After peaking close to 70 in early Could 2025, DOGE’s RSI started a gradual decline. The continued drop exhibits momentum has shifted from bullish to bearish. Every RSI bounce since then has didn’t reclaim 50, confirming sellers are in management.

When the RSI strikes beneath 30, it usually alerts that an asset is oversold. Though DOGE just isn’t but within the oversold zone, it stays shut, indicating promoting could proceed. Nonetheless, and not using a confirmed bullish divergence or sturdy reversal sign, there isn’t a clear signal of a restoration.

DOGE’s RSI stays firmly in bearish territory. This helps the downward stress seen in each the price and the MACD.

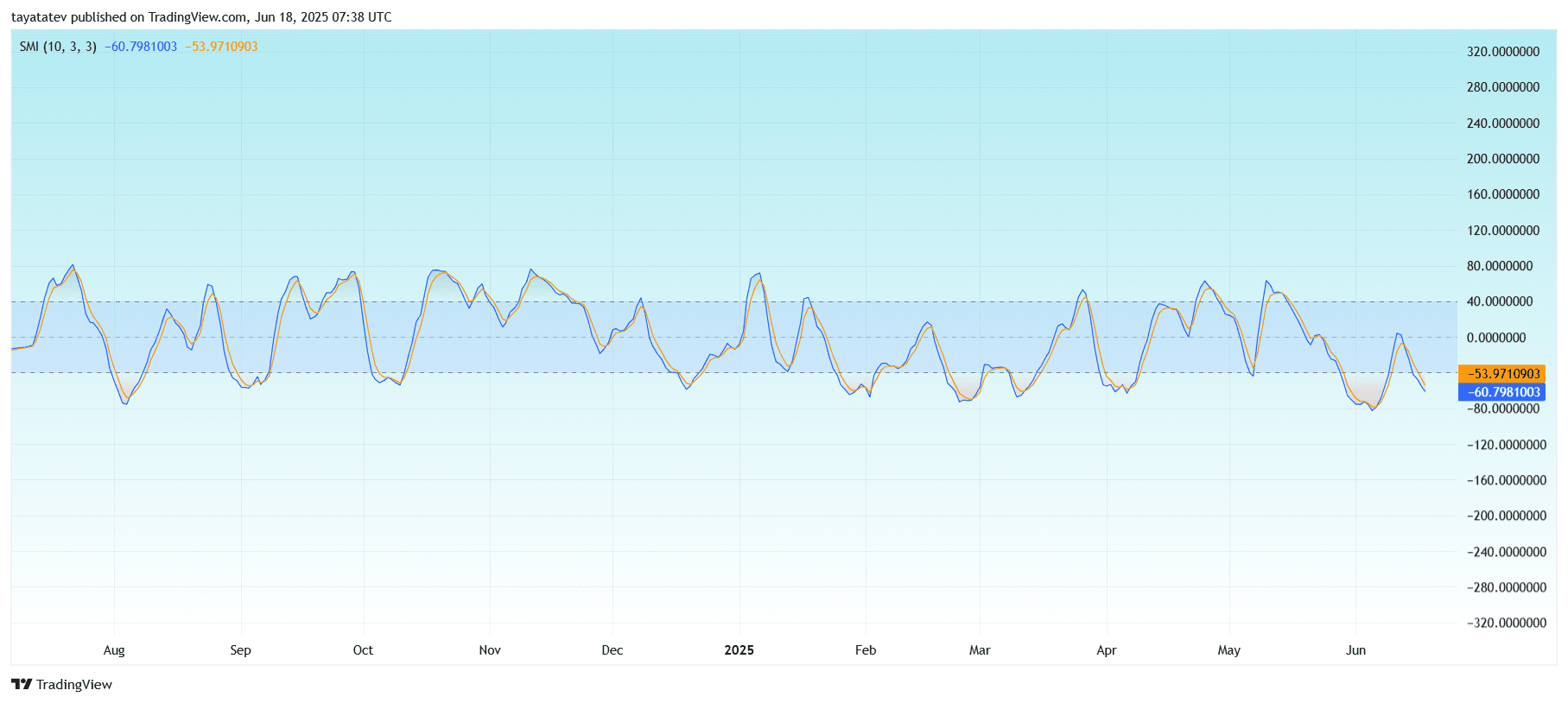

Dogecoin SMI Alerts Bearish Momentum Resumes

In the meantime, the Stochastic Momentum Index (SMI) chart, printed on June 18, 2025, exhibits Dogecoin (DOGE) with each its SMI line (blue) and sign line (orange) transferring downward. The SMI studying stands at -60.79, whereas the sign line is at -53.97. Each strains are beneath the impartial zero degree and diverging, which factors to renewed bearish momentum.

The Stochastic Momentum Index is a refined model of the Stochastic Oscillator. It measures the closing price’s place relative to the midpoint of the latest high-low vary and smooths it over time. Readings above +40 usually recommend sturdy upward momentum, whereas readings beneath -40 point out sturdy downward momentum.

DOGE’s SMI crossed beneath the sign line in early June 2025. That bearish crossover occurred simply after the coin dropped out of its rising price channel. Since then, each strains have accelerated downward, confirming that bearish stress continues to construct.

Every time the SMI stays beneath -40 for an prolonged interval, it signifies that the asset stays in a robust bearish section. On this case, each strains are properly beneath that degree. The continued separation between the SMI and the sign line additionally means that downward momentum has not but weakened.

No indicators of bullish divergence or crossover are seen but. DOGE’s SMI sample helps what’s already evident within the MACD and RSI indicators—a sustained bearish pattern with out reversal affirmation.